In a groundbreaking move, a prominent trader has established a substantial short position in HYPE, amounting to $2.9 million, by employing a 10x leverage strategy. This bold action highlights the growing trend of whale trading strategy in the cryptocurrency market, particularly for traders looking to capitalize on short selling HYPE. Recently, reports from HyperLiquid news revealed that this whale deposited $2 million USDC to fortify their position, now holding a staggering 84,388 HYPE coins. With orders poised to expand their short bets between the price range of $34.6 to $35, this crypto whale activity could signal significant market movements ahead. As HYPE continues to capture attention, savvy investors are keenly watching these developments in the realm of cryptocurrency leverage and whale interactions.

A remarkable event has unfolded in the cryptocurrency space, where a major player has initiated a significant sale strategy involving HYPE. This investment maneuver reflects a broader trend in short selling within the digital asset landscape, where leveraged bets can lead to substantial gains or losses. Recent insights indicate that this high-stakes trader, now with a heightened focus on HYPE, has channeled considerable resources into their trading strategy, holding a large quantity of HYPE coins. As the market fluctuates, these types of trading pursuits reveal the intricate dynamics of whale maneuvers and their potential impact on overall liquidity. Investors are increasingly analyzing such examples to better understand the forces at play in cryptocurrency movements.

Understanding Whale Trading Strategies

Whale trading refers to the trading activity of individuals or entities that hold large amounts of cryptocurrency. Their actions can significantly influence market trends and prices due to the sheer volume of assets traded. In the cryptocurrency world, whales often employ various strategies to maximize their returns. One common approach is to accumulate assets when prices are low and to sell or short sell when prices spike. This strategy allows them to capitalize on market volatility, making whale trading a key focus for both investors and market analysts.

The relevance of whale trading strategies extends beyond just individual profit. It plays a crucial role in shaping market behavior and liquidity. For instance, when a whale executes a significant transaction, it can trigger a chain reaction of price movements. This is particularly pertinent in a volatile market such as cryptocurrency, where emotions and rapid trades can lead to sudden price changes. Understanding these strategies can help smaller investors anticipate market trends and make informed trading decisions.

The Significance of Short Selling in Cryptocurrency Markets

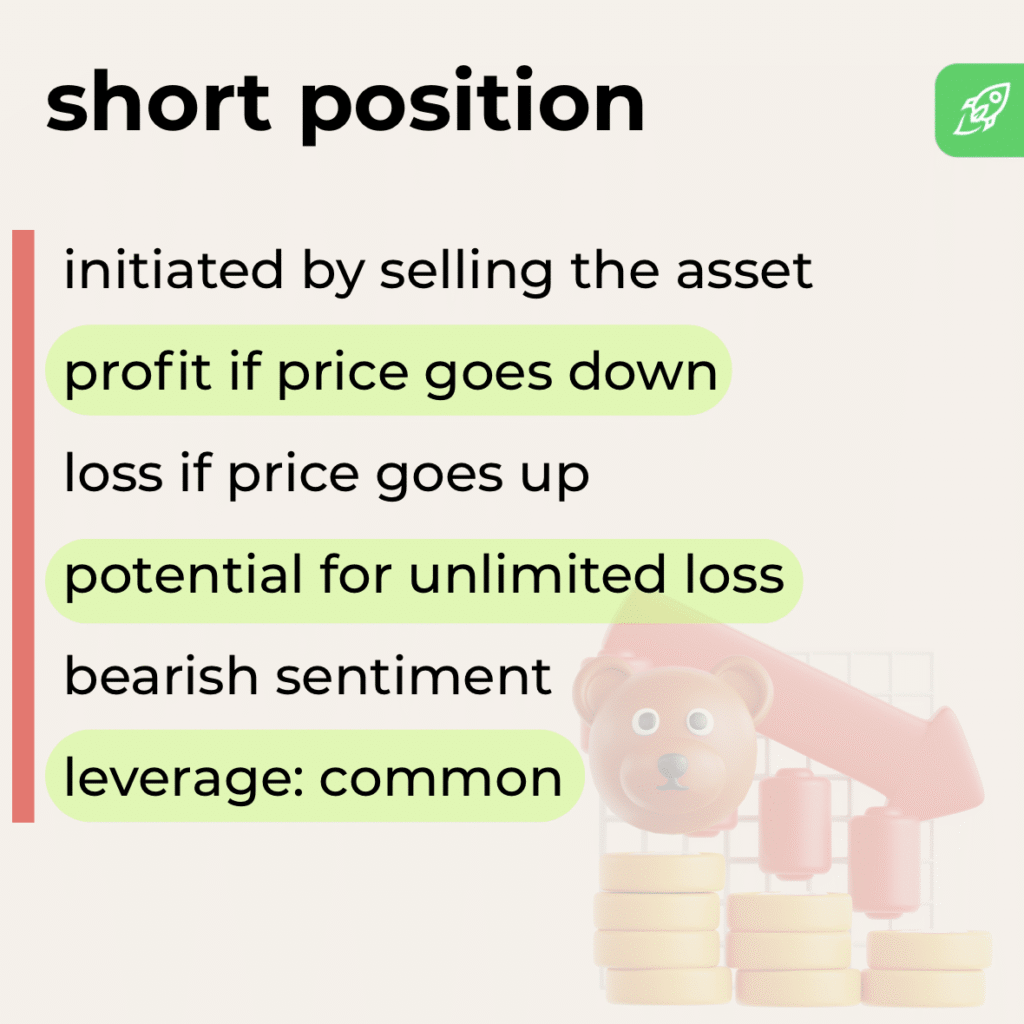

Short selling is a strategy used by traders to profit from the decline in the price of an asset. In the context of cryptocurrency, short selling has gained traction as more sophisticated trading platforms allow high leverage, enabling traders to amplify their positions. For instance, a whale recently established a $2.9 million short position in HYPE using 10x leverage, which illustrates the potential upside of this strategy when applied correctly. By betting against HYPE, the trader aims to profit from downward price movements while managing risk through leveraged positions.

Moreover, the rise of short selling in cryptocurrencies has changed how investors view market opportunities. Investors who employ this strategy can take advantage of overvalued assets or market corrections, thereby contributing to healthy market dynamics. However, it requires a keen understanding of market indicators and trends, as leverage can also amplify losses. For instance, in cases where prices unexpectedly rise, those holding short positions may face significant risks, which emphasizes the importance of continual market analysis in successful trading.

Leveraging Positions in the Cryptocurrency Market

Leverage in cryptocurrency trading refers to borrowing funds to increase one’s position size, which can multiply potential gains as well as potential losses. The recent $2 million USDC deposit into HyperLiquid by a whale to increase a short position in HYPE with 10x leverage exemplifies this concept. Using leverage allows traders to control larger amounts of cryptocurrency than they would be able to with their own funds alone. However, this practice also introduces substantial risk, especially in a volatile market where sudden price swings can lead to liquidation of positions.

The manipulation of leverage can be a double-edged sword for traders. While it enhances profit potential in a favorable market environment, it can also result in devastating losses if the market moves against the trader’s position. Thus, thorough risk management practices, such as setting stop-loss orders and closely monitoring market trends, are essential. As the crypto market evolves, understanding how to effectively utilize leverage combined with whale trading strategies proves vital for both institutional and retail investors alike.

Monitoring Whale Activity: Tools and Techniques

To track whale activity in cryptocurrency, traders and analysts use specialized tools and platforms that monitor large transactions on the blockchain. Platforms like Onchain Lens provide real-time insights into whale movements, which can suggest upcoming market trends or reversals based on significant trades. The ability to monitor deposits such as the recent $2 million USDC transfer to HyperLiquid allows the community to assess potential shifts in market sentiment and trading strategies employed by these large players.

In addition to monitoring transactions, analyzing historical data from whale activity can provide valuable insights into market patterns. By examining how whales react during price fluctuations or major news events, traders can refine their strategies around short selling HYPE or other cryptocurrencies. Continuous engagement with these tools not only enhances trading strategies but also empowers investors to make educated decisions in a complex and ever-changing market landscape.

The Impact of HyperLiquid News on Trading Sentiment

News related to specific trading platforms like HyperLiquid can heavily influence market behavior and trader sentiment. The recent developments of whales establishing substantial short positions are not only significant for their direct financial impact but also for the perception they create among other traders. As news spreads regarding a whale’s $2.9 million short position in HYPE using leverage, it can prompt widespread analysis, speculation, and potential panic among retail investors, creating a ripple effect through the market.

Therefore, keeping abreast of HyperLiquid news and understanding its implications on trader sentiment can help investors make timely decisions. For example, positive news regarding the platform’s security or functionality might encourage more traders to engage, inflating prices. Conversely, any negative reports or substantial whale short selling could lead to bearish sentiment, impacting other cryptocurrencies as well. Hence, news monitoring becomes an essential component of managing a successful trading strategy in the crypto market.

Strategies for Engaging with Whale Activity

For investors looking to engage with whale trading strategies, understanding how to interpret whale activity is crucial. Recognizing patterns in trading volumes, especially during significant price changes, allows traders to align their strategies accordingly. If large positions, like the $2.9 million short in HYPE, are established, it can indicate bearish sentiment from influential market players. This understanding can help smaller investors decide when to enter or exit positions, optimizing their trading strategies.

Additionally, employing risk management techniques and staying informed about major whale moves can provide traders with an edge. By anticipating possible market reactions based on whale activity, investors can adjust their positions proactively rather than reactively. Engaging with data from platforms that analyze whale behavior can facilitate this awareness, allowing more informed decisions that align with overall market sentiment.

Short Selling HYPE: Risks and Rewards

Short selling HYPE, as demonstrated by the whale’s recent actions, presents both substantial reward potential and inherent risks. The strategy relies on predicting a decline in price, and while it might yield significant profits when done accurately, it can lead to substantial losses if the market moves unfavorably. Understanding market trends, like fluctuations in demand for HYPE or overall market sentiment towards cryptocurrency, is key for success in short selling.

Moreover, timing is critical in short selling; markets can shift rapidly. The use of tools like technical analysis and fundamental analysis, in conjunction with insights from whale activity, can help traders time their short positions more effectively. By keeping an eye on significant price levels, such as the $34.6 to $35 range mentioned in the whale’s strategy, traders can make educated decisions that maximize their profit potential while minimizing risks.

Cryptocurrency Leverage: Understanding Its Role

Cryptocurrency leverage allows traders to borrow money to increase the size of their trading positions, amplifying profits. This mechanism is especially prevalent in the context of highly volatile assets like HYPE. When a whale utilizes 10x leverage to short sell, they effectively invest a much larger amount than their initial capital would allow. This strategy can yield high returns if the trade is successful, but it equally raises the stakes, as losses can mount quickly if the market trends upward.

Understanding the mechanics of cryptocurrency leverage is crucial for all traders. It is not just about magnifying potential profits; it also involves a deep comprehension of risk management. Investors need to be aware of their liquidation levels and utilize stop-loss orders to safeguard against market volatility. With the market’s unpredictable nature, especially in light of whale trades and significant positions, mastering leverage can be both an opportunity and a rigged game, where knowledge and strategy define the ultimate outcome.

Interpreting Crypto Whale Activity for Market Trends

The activity of crypto whales can serve as a valuable indicator of broader market trends. Whales, due to their significant holdings and trading capacity, often make moves that reflect not only their personal strategies but also inform the market sentiment at large. Tracking how whales, like the one establishing a large short position in HYPE, respond to market conditions can provide critical insights for smaller traders looking to forecast future market movements.

By analyzing transaction data and assessing the timing and scale of whale transactions, traders can develop a nuanced understanding of market dynamics. For example, if a significant number of whales are opting to short sell, it may indicate a general bearish trend, prompting retail investors to reconsider their positions. Conversely, if whales are acquiring large quantities, this could signal increased confidence in a particular asset, potentially leading to price rallies. Therefore, interpreting whale activity not only informs individual trading strategies but also enhances overall market analysis.

Frequently Asked Questions

What is a short position in HYPE and how does it relate to whale trading strategy?

A short position in HYPE refers to a trading strategy where investors borrow HYPE coins to sell them, anticipating a price decline. This is part of a whale trading strategy, where large traders (‘whales’) capitalize on market movements, like the recent setup where a whale took a $2.9 million short position using 10x leverage.

How does short selling HYPE impact the price of the cryptocurrency?

Short selling HYPE can put downward pressure on its price, especially when significant positions are established like the $2.9 million short position seen recently. If enough traders follow suit, it can lead to increased market volatility and a potential price drop for HYPE.

What does cryptocurrency leverage mean in the context of HYPE?

Cryptocurrency leverage allows traders to control larger positions than their initial investment. In the context of HYPE, the whale’s use of 10x leverage on its short position means that for every dollar invested, they can trade with ten dollars, amplifying both potential gains and risks.

What do HyperLiquid news updates indicate about current whale activity in HYPE?

HyperLiquid news updates reveal significant whale activity, including the recent $2 million USDC deposit aimed at increasing a short position in HYPE. This signals growing interest from major traders and could affect market sentiment around HYPE.

How can investors monitor crypto whale activity for potential HYPE trading strategies?

Investors can monitor crypto whale activity through platforms like Onchain Lens that track large transactions and positions in cryptocurrencies such as HYPE. Analyzing these movements can offer insights into market trends and inform trading strategies.

| Date | Whale Investment | Position Value | Leverage | HYPE Coins Held | Short Position Target Range |

|---|---|---|---|---|---|

| 2025-11-26 02:55 | $2 million USDC deposited into HyperLiquid | $2.9 million | 10x | 84,388 HYPE | $34.6 to $35 |

Summary

The HYPE short position has seen significant movement with a whale establishing a $2.9 million stake, utilizing 10x leverage. This strategic move highlights a strong bet against HYPE’s current price levels, particularly as the whale aims to expand its holdings of 84,388 HYPE coins. The target price range of $34.6 to $35 indicates a calculated approach to benefit from potential market fluctuations. As market participants observe these developments, the implications for HYPE’s price trajectory remain critical in the broader trading narrative.