How XRP Whales are Maneuvering Following the Cryptocurrency Market Downturn

In times of unstable economic markets, cryptocurrency investors often find themselves facing both unprecedented opportunities and daunting challenges. The recent downturn in the cryptocurrency market is no exception, prompting drastic strategic shifts by large stakeholders commonly referred to as “whales”. One cryptocurrency, in particular, that has seen significant activity from these large holders is Ripple’s XRP. As the dust settles post-downturn, the maneuvers of XRP whales are marked by their enhanced strategies to mitigate risk and capitalize on potential market rebounds.

Understanding XRP and Its Ecosystem

XRP, developed by Ripple Labs, is a digital asset built for payments, intended to enable fast, direct, and secure cross-border transactions, which makes it particularly appealing for financial institutions globally. Unlike many cryptocurrencies that depend on traditional blockchain mining, XRP uses a consensus protocol through a network of validating servers. Despite facing an ongoing lawsuit with the SEC over its legal status, XRP remains popular and widely used, making its movements a topic of keen interest among cryptocurrency enthusiasts.

Whale Movements Amid the Downturn

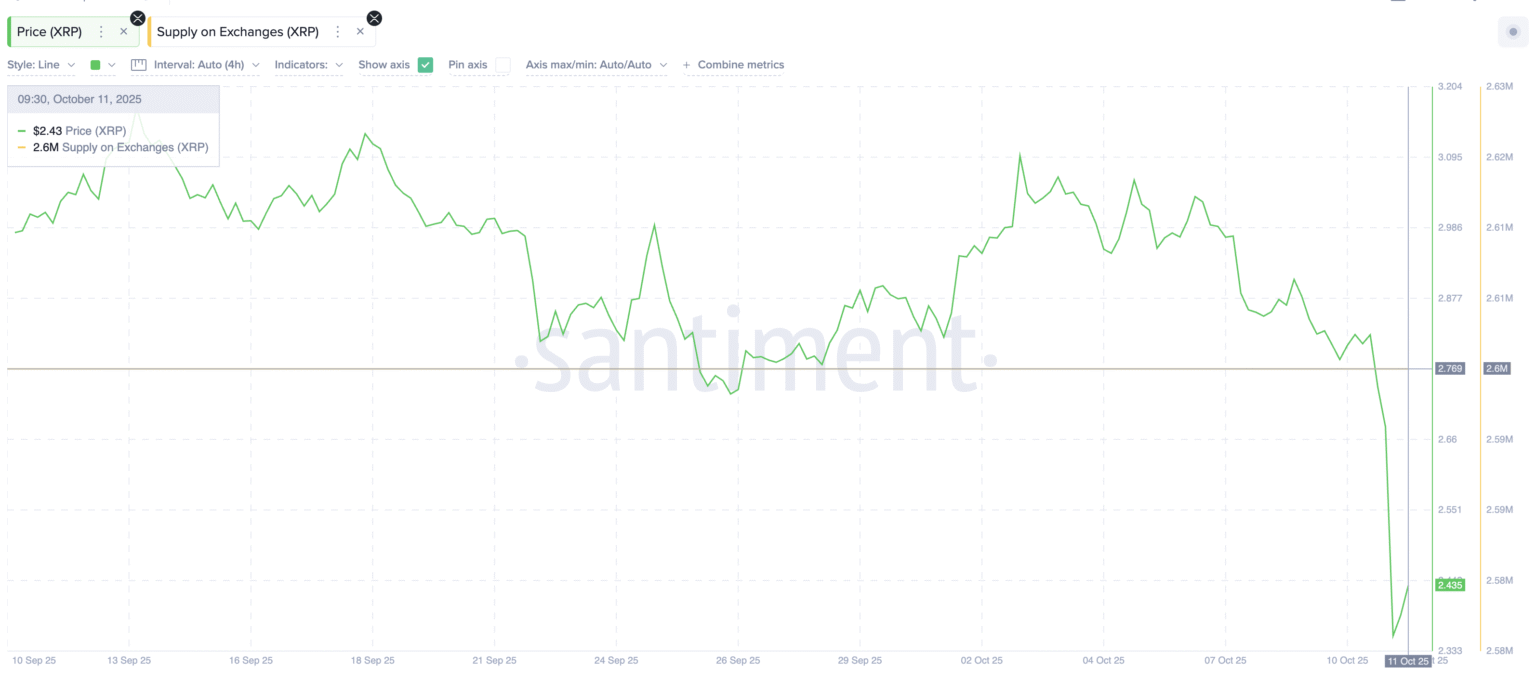

The market downturn has seen many smaller investors exit their positions, often at a loss, due to panic selling, high volatility, and a gloomy market outlook. However, XRP whales have demonstrated a different trend – accumulation and strategic transfers. Based on data from blockchain analytics platforms such as Whale Alert, there has been a notable increase in the volume of XRP held by large addresses, indicating a phase of accumulation. This strategy is typically undertaken when whales believe that the market is undervalued and likely to recover in the long term.

Whales also engage in rebalancing their portfolios, reducing exposure to riskier assets and increasing holdings in assets deemed safer or likely to appreciate as markets recover. For XRP, this means strategic shifts in their holdings can swing liquidity and trading volume significantly, occasionally sparking rapid price movements.

Market Impact and Speculative Trading

The actions of XRP whales have considerable implications for the average retail investor. Large transactions and accumulated movements can lead to increased volatility in the XRP market. For speculative traders, these swings represent both potential profits and potential risks. Market participants often monitor these transactions closely as they can precede price movements.

Whale-Driven Liquidity Pools and Exchanges

Beyond speculative trading, XRP whales play a critical role in liquidity provision. Large holders often contribute vast amounts of XRP to liquidity pools, impacting the overall liquidity and hence the stability of this cryptocurrency. In decentralized finance (DeFi), XRP is gaining traction where these liquidity pools are fundamental to the ecosystem’s operations.

Moreover, the choice of exchanges and platforms for trading and holding large amounts of XRP can also underscore the whales’ confidence in these platforms’ security and operational efficacy. These choices can sway public perception and influence the influx of smaller investors towards or away from certain platforms.

Regulatory Watch and Future Outlook

Given the ongoing legal scrutinies, notably the SEC lawsuit, the movements and strategies adopted by XRP whales are also likely under regulatory watch. The outcome of such legal engagements could significantly influence the strategies of these large-scale holders.

What lies ahead for XRP and its community of investors, especially the whales, will hugely depend on broader market conditions, regulatory advancements, and technological developments within the Ripple ecosystem. Although the path remains unclear amid these market dynamics and regulatory uncertainties, one thing is certain: the maneuvers of XRP whales will be crucial in shaping the future trajectory of XRP’s market standing.

Hence, keeping an eye on the strategic shifts of these substantial holders provides not just a glimpse into their market outlook but also serves as a bellwether for the cryptocurrency’s resilience and potential in navigating through turbulent times.