How to Read Tokenomics Like a Pro | BPAYNEWS Learn

How to Read Tokenomics Like a Pro

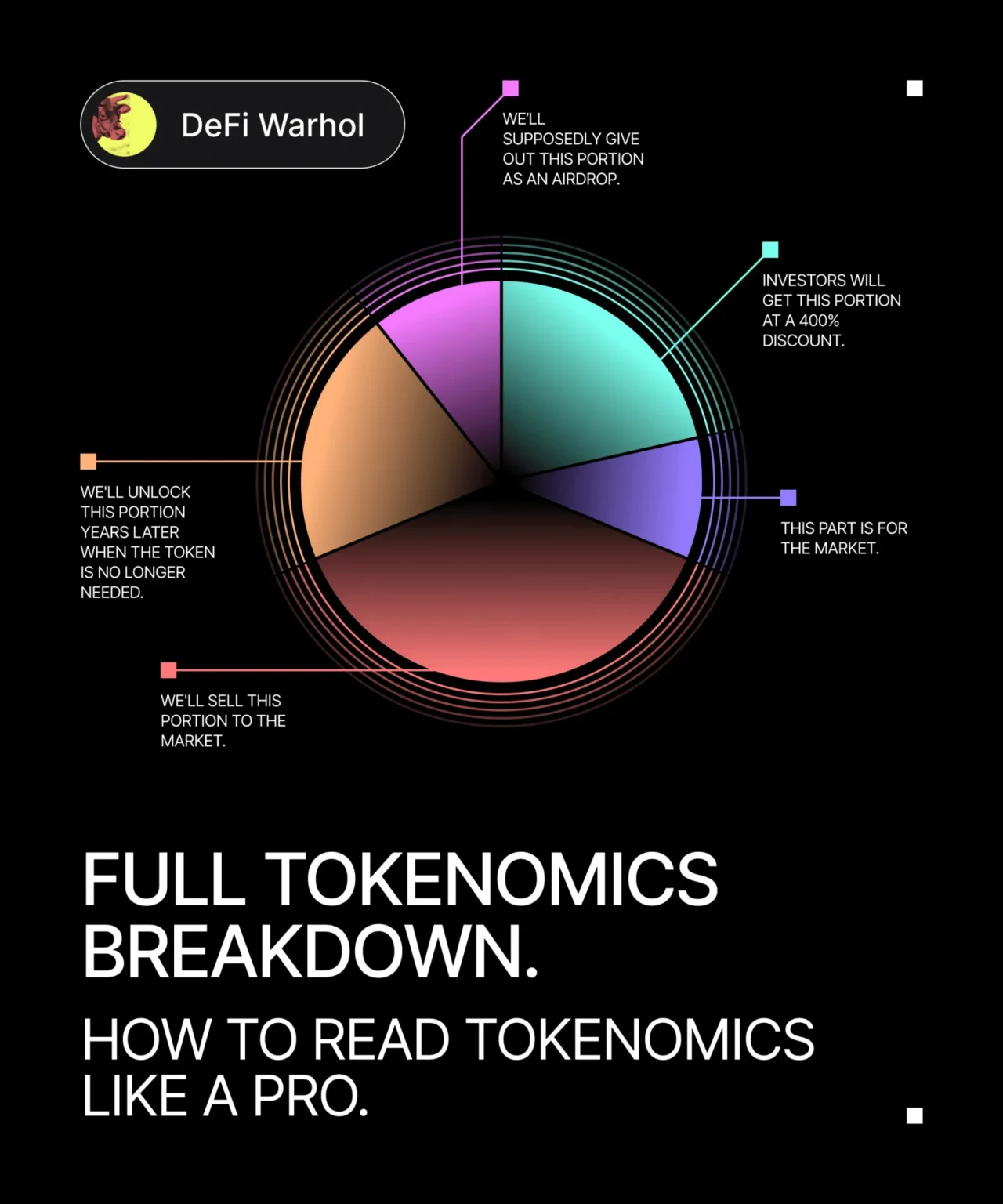

Tokenomics defines value capture and long-term sustainability. This guide teaches you how to decode supply schedules, distributions, and incentives.

Supply & Emissions

- Circulating vs total vs max: Know what’s tradable today and what unlocks later.

- Inflation/deflation: Emissions, burns, buybacks, fees, and staking rewards.

Distribution & Vesting

- Team/investor allocations, cliffs, unlock calendars.

- Community, ecosystem, and liquidity allocations.

Utility & Value Accrual

- Governance, staking, access, collateral, fee sharing.

- Real sinks: burns, upgrades, or required spend.

Liquidity Design

- Depth across DEX/CEX, lock status, market making.

- Bridged liquidity and cross-chain fragmentation risks.

Quick Evaluation Flow

- Map unlocks for the next 3–12 months.

- Stress-test demand vs emissions.

- Check treasury transparency and runway.

You May Also Like

Written by BPAYNEWS Learn | Category: Research / How-To