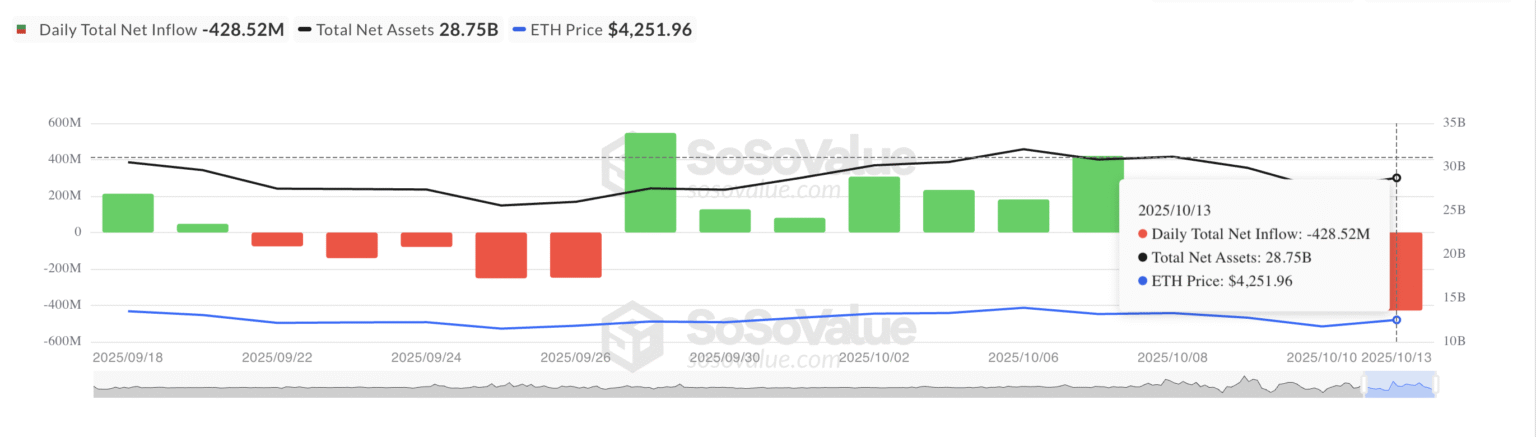

How Soon Will ETH Prices Bounce Back as $428 Million Withdrawn from ETFs?

The recent withdrawal of $428 million from Ethereum-based Exchange Traded Funds (ETFs) has sent ripples through the cryptocurrency market, prompting discussions among investors and analysts about the future of Ethereum (ETH) prices. This significant movement of funds raises questions about investor confidence, market stability, and the potential timeline for a price rebound in one of the world’s leading cryptocurrencies.

Understanding the Withdrawal Impact

Exchange-Traded Funds that focus on Ethereum offer a critical gateway for institutional and retail investors seeking exposure to cryptocurrency without the direct risks of handling the tokens themselves. Such ETF withdrawals can indicate several market sentiments. The immediate effect of this substantial withdrawal might be negative, signaling a bearish outlook from investors or a response to broader economic indicators or regulatory news that could affect the cryptocurrency market.

When large sums are withdrawn from ETFs, the selling pressure on ETH can increase, potentially leading to a decrease in its price. It’s essential to analyze not only the scale of the withdrawals but the broader context in which they occur. For instance, if these withdrawals are part of a larger trend of decreasing interest in crypto assets or triggered by specific geopolitical events, the impact can be more pronounced and prolonged.

Factors Influencing ETH’s Price Recovery

Multiple factors will dictate how soon and effectively Ethereum’s prices might recover from such a jolt. These include market sentiment, technological advancements within the Ethereum network, and macroeconomic factors affecting the investment landscape.

-

Market Sentiment: Cryptocurrency markets are particularly sensitive to sentiment and speculative activity. If the withdrawal is perceived as a lack of faith in Ethereum’s prospects, it may lead to a bearish sentiment. Conversely, if the market views these withdrawals as temporary or strategic reallocations by ETFs, the negative impact might be short-lived.

-

Network Upgrades: Ethereum has been undergoing significant changes, with upgrades aimed at improving scalability, security, and efficiency – such as the move from proof-of-work to proof-of-stake in Ethereum 2.0. Positive developments regarding these upgrades could restore faith in Ethereum’s long-term value, aiding in price recovery.

-

Regulatory Environment: Regulatory news significantly impacts crypto markets. Clarification of regulations, particularly in large markets such as the U.S., can either bolster or hinder Ethereum’s recovery, depending on whether these regulations are perceived as supportive or restrictive of the growth of cryptocurrencies.

- Macroeconomic Factors: Broader economic considerations, including inflation rates, interest rates, and the performance of traditional financial markets, also play a role. For instance, in environments where traditional assets are seen as unstable, cryptocurrencies can appeal as alternative investments, potentially boosting ETH prices.

Historical Insights and Recovery Patterns

Historically, the cryptocurrency market has proven resilient, with prices bouncing back after sharp declines, although the timeline varies greatly from one incident to another. For instance, after significant pullbacks, recovery has sometimes been swift, driven by strong investor interest and positive news, while at other times, it has required more extended periods of consolidation.

Conclusion

While the recent $428 million withdrawal from Ethereum ETFs poses a challenge, the future of ETH prices will depend on a complex interplay of market dynamics, investor behavior, and broader economic factors. Investors should keep a close eye on related developments, maintaining a diversified portfolio to hedge against such volatility.

Only time will reveal how quickly Ethereum can recover from this recent upheaval. However, with ongoing network improvements and increasing clarity in regulatory frameworks, there remains cautious optimism about Ethereum’s capacity to bounce back and continue playing a prominent role in the broader cryptocurrency landscape.