How a Bangkok Arrest Cracked Open the $31 Million FINTOCH Crypto Fraud

In the bustling city of Bangkok, a significant breakthrough has occurred in one of the most notable cryptocurrency scams in recent years—the FINTOCH crypto fraud, involving a staggering $31 million. The arrest of a key suspect in Bangkok has revealed the complex layers and global reach of this sophisticated scheme, drawing attention to the vulnerabilities within the digital currency market.

The Investigation Begins

The FINTOCH scandal first came to light when numerous investors reported sudden discrepancies in their digital wallets, with substantial sums of money vanishing overnight. FINTOCH, a platform that promised high returns on cryptocurrency investments, suddenly became incommunicado, leading to panic and uncertainty among its investors. Regulatory bodies and law enforcement agencies started to piece together the evidence, and all trails led to an elaborate fraud scheme spread across multiple countries.

The Bangkok Breakthrough

The turning point in the investigation was the arrest of Alexander Jacobs, a key operative in the FINTOCH organization, in Bangkok. Jacobs was apprehended in a coordinated operation involving Interpol and Thai authorities as he attempted to flee to a non-extradition country. His capture was crucial; not only did he possess extensive knowledge about the inner workings of FINTOCH, but he also held data that could potentially reveal the identities of others involved in the scheme.

Digital Footprints and Deception

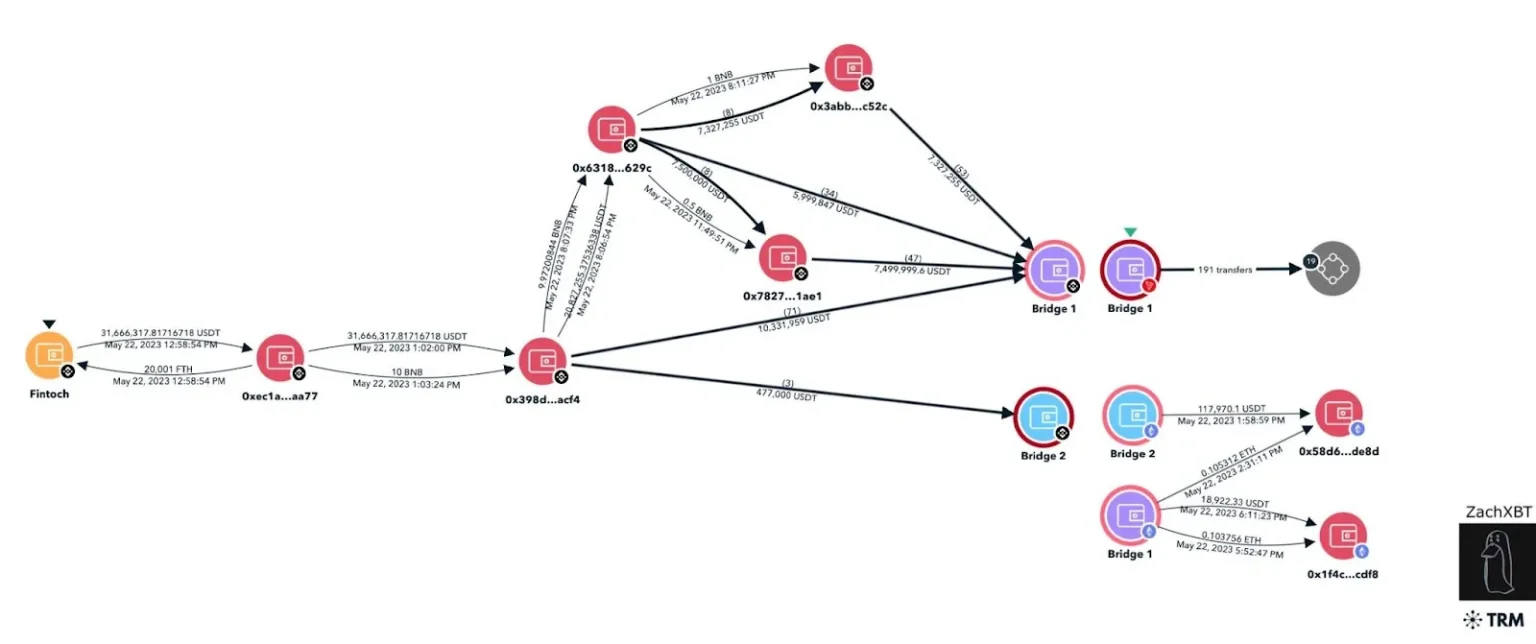

Preliminary interrogation and analysis of Jacobs’ digital devices unveiled a complex network of fake identities, shell companies, and encrypted digital footprints spread across the blockchain. It became evident that FINTOCH’s operations were largely based on a classic Ponzi scheme, albeit utilizing sophisticated cryptocurrency techniques. Investors were lured with promises of exorbitant returns, and new investments were used to pay earlier investors, creating an illusion of profitability.

International Ramifications

The ramifications of Jacobs’ arrest were immediate and widespread. Authorities in the United States, Europe, and parts of Asia have begun tightening their scrutiny of cryptocurrency platforms. The FINTOCH case has also intensified calls for better regulatory frameworks to govern the burgeoning digital currency markets. Countries are now collaborating more closely, sharing information and resources to prevent such large-scale frauds from occurring in the future.

Push for Greater Transparency

The FINTOCH fraud has emphasized the need for greater transparency and accountability in the cryptocurrency sector. Experts argue that while digital currencies offer a new frontier for finance, without robust regulatory oversight, they remain susceptible to fraud and misuse. There is now a stronger push for implementing Know Your Customer (KYC) and Anti-Money Laundering (AML) policies in cryptocurrency exchanges and platforms.

Lessons Learned

The collapse of FINTOCH serves as a critical lesson for both investors and regulators. It has highlighted the perils of high-return promises in the volatile crypto market and the importance of conducting due diligence. For regulators, it is a call to action to accelerate the creation of frameworks that can safeguard investments and maintain the integrity of the digital finance landscape.

Looking Ahead

With Jacobs now cooperating with authorities and additional arrests on the horizon, the full scope of the FINTOCH fraud is expected to unfold in the coming months. The crypto community is hopeful that this unfortunate incident will lead to stronger and more resilient practices, making the digital finance world a safer place for all.

The arrest in Bangkok is just the beginning of what looks to be a lengthy and revealing journey into the dark side of cryptocurrency operations. Investors and market observers alike watch closely, hoping that justice will restore faith in the systems that hold much promise for the future of global finance.