Hong Kong’s economy growth has become a focal point for both local and international observers, especially as recent developments indicate a promising trajectory. With a reported expansion of 3.2% last year, stakeholders are keen to understand how trends in virtual currencies and financial innovation are shaping this dynamic landscape. Financial Secretary Paul Chan highlighted the importance of embracing virtual currencies while being mindful of the associated risks, particularly regarding investor protection and anti-money laundering initiatives tied to blockchain technology. As discussions unfold about introducing a stablecoin linked to stable assets like gold, there is a clear call for a thoughtful regulatory framework to guide this evolution. This strategic approach is deemed essential for fostering sustainable economic development amid rapid technological changes.

The economic advancement of Hong Kong has garnered significant attention, particularly in light of its recent growth figures. With innovative financial instruments like digital currencies and blockchain applications reshaping the market, local authorities are exploring their potential to enhance economic stability. Paul Chan, the Financial Secretary, is advocating for a robust assessment of these technologies, pointing out the dual need to promote financial innovation while safeguarding investor interests. Conversations are now turning towards the feasibility of adopting a gold-backed digital currency, marking a noteworthy step in integrating traditional assets with modern technology. This blend of innovation and caution could well define Hong Kong’s future economic strategy.

Hong Kong Economy Growth: A Positive Outlook

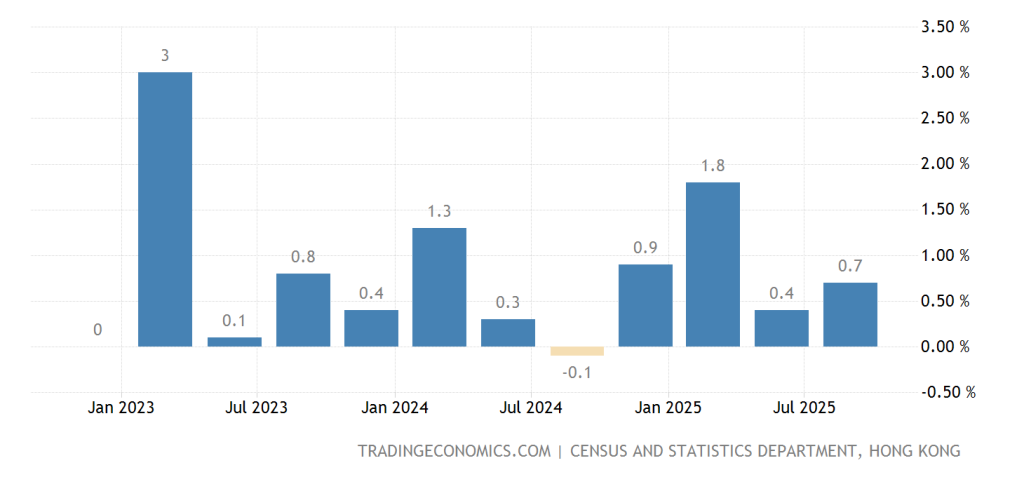

In a recent announcement, Financial Secretary Paul Chan revealed that Hong Kong’s economy witnessed a commendable growth of 3.2% last year. This growth trajectory showcases the resilience of the financial sector amidst global uncertainties and reflects the government’s efforts to stimulate economic activity. As sectors adapt to changes in technology and consumer behavior, the government is poised to foster an environment conducive to sustained economic growth and financial innovation.

With a foundation built upon robust economic policies and strategic planning, Hong Kong’s economy is increasingly diversifying. The government’s recognition of emerging trends, particularly in technology and virtual currencies, exemplifies its commitment to pushing forward while maintaining fiscal responsibility. The growth figures serve not only as a benchmark for evaluation but also as an impetus for further innovation in financial markets.

The Role of Financial Innovation in Economic Growth

The embrace of financial innovation is critical for Hong Kong’s ongoing economic success. Chan emphasized the importance of virtual currencies as part of this innovation wave, advocating for a proactive approach to integrating these technologies into the financial framework. Such acceptance paves the way for advancements that can potentially enhance transaction efficiency and lower costs for consumers and businesses alike.

However, with the rise of financial innovation comes the responsibility to safeguard the market. The challenges posed by blockchain technology, including concerns over investor protection and anti-money laundering efforts, require careful navigation. The Hong Kong government aims to establish regulations that not only support innovation but also ensure compliance with international standards, thereby fostering a secure financial environment.

Virtual Currencies: Challenges and Opportunities

Virtual currencies represent a dual-edged sword in the context of modern finance. While they offer promising opportunities for innovation, they also bring inherent risks that cannot be overlooked. Chan highlighted the need for a cautious approach, particularly in shaping policies around these digital assets. The government’s stance is clear: while embracing financial innovation, they must also prioritize investor safety and market integrity.

As Hong Kong navigates the complexities of virtual currencies, the importance of public education on these topics cannot be overstated. Chan’s skepticism about fully promoting virtual currency investments stems from the need to ensure that the public is well-informed before diving into such speculative assets. This focus on education aims to empower consumers to make educated decisions in a rapidly changing financial landscape.

Stablecoins: A Secure Financial Future?

The concept of stablecoins has gained traction as a potential solution to the volatility commonly associated with cryptocurrencies. Chan’s interest in the gradual development of stablecoins reflects a desire to anchor these digital assets to stable commodities, with suggestions of linking them to gold. Such a move could enhance public trust and encourage broader adoption of stablecoins as a reliable medium of exchange.

However, the implementation of stablecoins must be approached with meticulous planning and regulatory oversight. Chan acknowledged the historical stability of gold, which could provide a solid foundation for a stablecoin, but stressed the need for a thoughtful approach to the integration of this concept. As Hong Kong explores stablecoins, the government aims to ensure that their deployment is secure, sustainable, and beneficial for the economy.

Blockchain Technology: Balancing Innovation and Regulation

Blockchain technology has emerged as a transformative force within the financial sector, promising increased transparency and efficiency. Despite its potential benefits, Paul Chan has raised concerns regarding the confidentiality aspects of blockchain, which may hinder investor protection and complicate anti-money laundering efforts. The challenge for Hong Kong will be to strike a balance between reaping the benefits of this technology while simultaneously safeguarding its financial ecosystem.

The government’s cautious approach to blockchain regulation underscores a commitment to innovation that is rooted in investor protection and risk management. As Hong Kong moves forward, it is essential that regulatory frameworks evolve in tandem with technological advancements, ensuring that both innovation and security are prioritized. This balanced methodology will help position Hong Kong as a leader in integrating cutting-edge technologies within its financial landscape.

Public Education: The Key to Responsible Investment

Given the complexities and risks associated with virtual currencies and financial innovation, public education is crucial in building a responsible investment culture. Chan emphasizes that transparency and knowledge dissemination should be prioritized, allowing potential investors to comprehend the intricacies of new financial instruments. It’s imperative for the government to provide resources and guidance that empower citizens to make informed decisions regarding their investments.

Moreover, an informed public can significantly contribute to the overall stability of the financial market. Through educational initiatives, the government can help demystify virtual currencies and blockchain technology, alleviating fears and misconceptions. This proactive educational stance will cultivate a more knowledgeable populace and ultimately lead to a healthier financial ecosystem as citizens engage with innovative financial products.

Anticipating Future Economic Landscapes in Hong Kong

The financial landscape of Hong Kong is at a crossroads, and the decisions made today will profoundly impact its future. The government’s focus on integrating financial innovation, like virtual currencies and blockchain technology, is indicative of a forward-thinking approach. Chan’s remarks reflect a broader vision to evolve the economy, making it adaptive to global changes while remaining firmly anchored to regulatory principles that protect investors.

Moreover, as emerging technologies continue to reshape market dynamics, Hong Kong must remain vigilant and adaptable. The exploration of stablecoins and the increasing popularity of digital assets signal a shift that will require ongoing assessment and policy adaptation. By embracing innovation while harnessing the lessons of the past, the city can solidify its status as a leading global financial hub.

Maintaining Financial Stability Amidst Technological Advancements

The rapid advancement of technology in the financial sector presents both opportunities and challenges. As Paul Chan noted, while embracing innovations such as virtual currencies is essential for growth, it is equally important to maintain financial stability. This dual focus will require a meticulous and dynamic approach to regulation, ensuring that as financial products evolve, so too do the safeguards designed to protect investors and maintain market integrity.

To achieve this balance, Hong Kong will need to engage with various stakeholders, including financial institutions, regulators, and the public, to develop comprehensive strategies. These strategies should address the risks associated with new technologies while capitalizing on their benefits. By fostering collaboration among key players in the financial ecosystem, Hong Kong can better position itself to navigate the complexities introduced by technological advancements and sustain its economic growth.

The Future of Virtual Currencies in Hong Kong’s Economy

The future of virtual currencies in Hong Kong appears to be one of cautious optimism. As the Financial Secretary elaborates on the growth of the economy and the importance of innovation, the integration of virtual currencies could play a crucial role in revitalizing the market. Chan’s approach suggests that a well-regulated environment can facilitate the evolution of this sector while ensuring investor confidence and market sustainability.

As Hong Kong continues to explore the potential of virtual currencies and their implications, the emphasis on regulatory measures and public awareness will be pivotal. With stablecoins on the horizon and the collective expertise within the financial community, Hong Kong seems poised to create an ecosystem that not only embraces change but also prioritizes the welfare of its investors and the stability of its economy.

Frequently Asked Questions

How is Hong Kong’s economy growth influenced by virtual currencies?

Hong Kong’s economy growth is increasingly influenced by virtual currencies, with the Financial Secretary Paul Chan noting a 3.2% growth last year. He highlighted that virtual currencies are a key aspect of financial innovation, suggesting that embracing this technology could further enhance the economic landscape of Hong Kong.

What role does blockchain technology play in Hong Kong’s economy growth?

Blockchain technology contributes to Hong Kong’s economy growth by facilitating financial innovation. However, Paul Chan cautioned that its confidentiality aspects may pose challenges such as insufficient investor protection and risks to financial stability, necessitating a balanced regulatory approach.

What measures is Hong Kong taking regarding the regulation of stablecoins?

Hong Kong is gradually exploring the development of stablecoins as part of its economic growth strategy. Financial Secretary Paul Chan mentioned the possibility of linking stablecoins to stable assets like gold, emphasizing the importance of a cautious and well-structured regulatory framework for this innovation.

How does financial innovation contribute to Hong Kong’s economic development?

Financial innovation, including the rise of virtual currencies and blockchain technology, plays a critical role in Hong Kong’s economic development. Paul Chan advocates for embracing these innovations while ensuring adequate investor protections and regulatory oversight to foster a stable economic environment.

What challenges does Hong Kong face with the rise of virtual currencies in terms of economic growth?

Hong Kong faces challenges from the rise of virtual currencies, particularly concerning investors’ protection and compliance with anti-money laundering regulations. Financial Secretary Paul Chan stressed the need for responsible management and regulatory frameworks to mitigate risks while still promoting economic growth.

What is the significance of Paul Chan’s stance on virtual currencies for Hong Kong’s economy growth?

Paul Chan’s supportive yet cautious stance on virtual currencies indicates a strategic approach to harnessing financial innovation in driving Hong Kong’s economy growth. His emphasis on public education and regulation suggests an effort to balance growth opportunities with investor safety.

How do virtual currencies impact financial stability in Hong Kong’s economy growth?

Virtual currencies can potentially disrupt financial stability in Hong Kong, as highlighted by Financial Secretary Paul Chan. He warned that while they could spur economic growth, their inherent risks necessitate careful consideration and proactive regulatory measures to ensure overall financial security.

What suggestions have been made for stablecoin development in Hong Kong?

Suggestions for stablecoin development in Hong Kong include linking these currencies to gold, as proposed by a viewer. Financial Secretary Paul Chan indicated a cautious approach to exploring these ideas, ensuring that any adoption aligns with Hong Kong’s broader economic growth objectives.

| Key Points | Details |

|---|---|

| Economic Growth | Hong Kong’s economy grew by 3.2% last year. |

| Virtual Currencies | Financial Secretary Paul Chan emphasized that virtual currencies are part of financial innovation. |

| Regulatory Concerns | Blockchain technology may lead to insufficient investor protection and risks to financial stability. |

| Caution in Handling | The government must ensure a cautious approach and appropriate regulatory framework. |

| Public Education | Chan advocates for stronger public education on virtual currency investments. |

| Stablecoins Suggestion | A viewer suggested a stablecoin linked to gold, which Chan noted would be developed gradually. |

Summary

Hong Kong economy growth has shown a promising increase of 3.2% last year. As the Financial Secretary, Paul Chan, noted, while the opportunity surrounding virtual currencies presents innovative potential, it is essential to approach this rapidly evolving landscape with caution, especially given the associated risks. The need for a solid regulatory framework and public education is paramount to foster a secure environment for investments. Additionally, the idea of stablecoins linked to gold may provide a way to stabilize virtual currency markets amidst financial uncertainties.