Crypto Sell-Off Shocks Market — Hidden Signal Suggests It’s Not Over

The recent weeks have witnessed a tumultuous sell-off in the cryptocurrency markets, wobbling the confidence of even the staunchest crypto enthusiasts and investors. Several popular digital currencies, including Bitcoin, Ethereum, and others, have seen significant declines in their values, sparking widespread concern about the future stability of the crypto market. Deeper analysis reveals that this might not just be a typical market correction, but rather the beginning of a more extended bearish trend.

Unpacking the Crypto Market’s Recent Turmoil

Initially, the crypto market’s volatility can be attributed to various geopolitical factors and changes in the regulatory environment. The announcement of stricter regulations in major markets such as the United States and China has historically led to significant fluctuations in crypto prices. Moreover, the impact of macroeconomic factors, such as inflation rates and changes in monetary policies by central banks, cannot be understated. These factors come together to create an environment of uncertainty and rapid changes in crypto asset valuations.

The Hidden Signal in the Noise

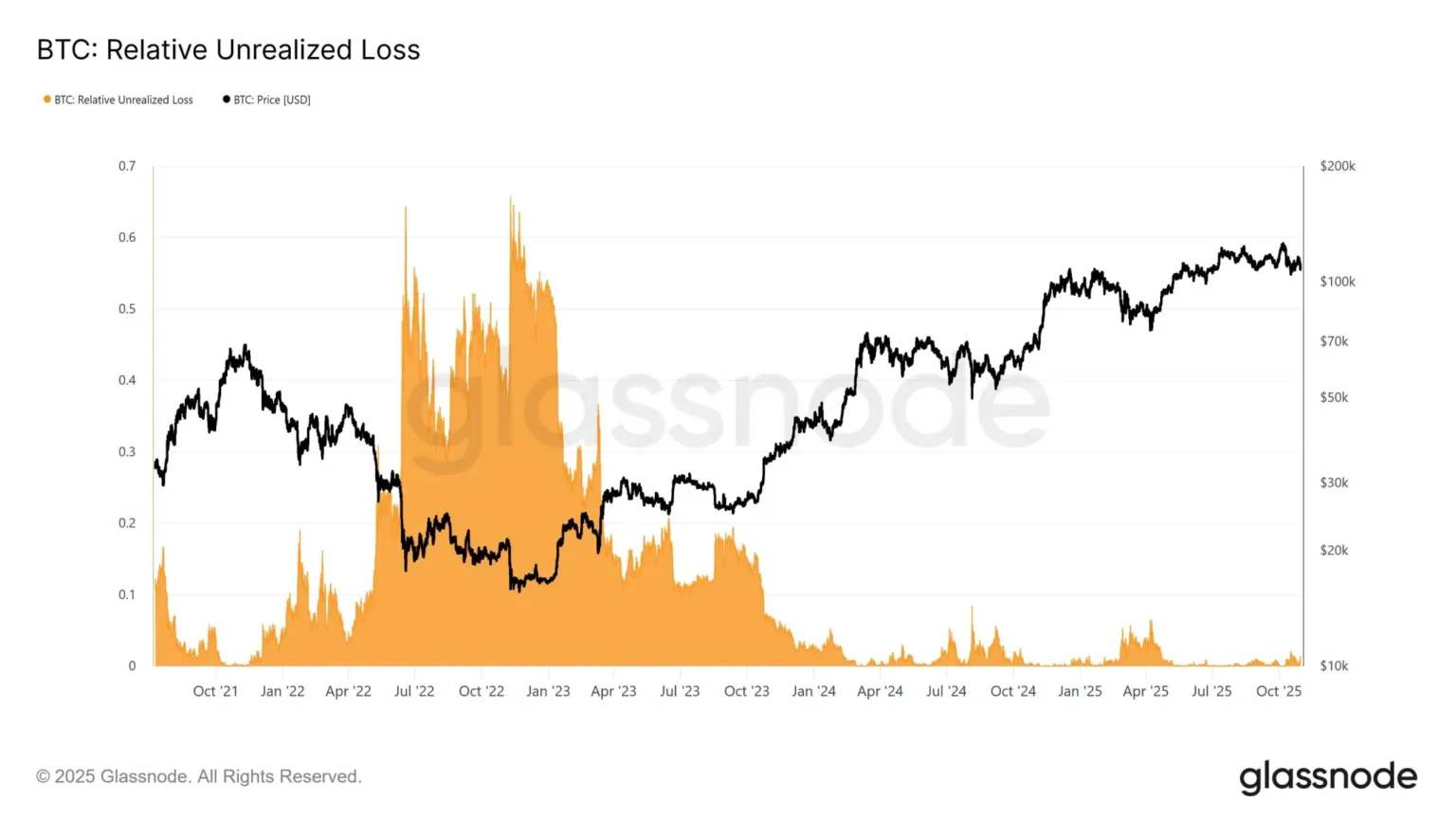

What is intriguing in this scenario is not just the visible market corrections, but also the underlying signals that suggest a prolonged bear market. Analysts have highlighted a specific trend in the trading volumes and the movement of cryptocurrencies to and from exchanges.

A key indicator, the exchange net flow, has shown large quantities of Bitcoin and other cryptocurrencies being moved onto exchanges. Traditionally, this is an indication that large holders of cryptocurrencies, often referred to as ‘whales’, are preparing to sell off their holdings, increasing the supply of cryptocurrencies available for trading and putting downward pressure on prices.

Additionally, an often overlooked metric is the “sell/buy ratio,” which has shown an unusually high number of sell orders compared to buy orders, further confirming the bearish sentiment among major investors.

Technical Indicators Support Bearish Outlook

Technical analysis further supports the view that the crypto sell-off might not be over. Price charts for top cryptocurrencies show a sustained break below key support levels, which typically signals further drops in price. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) metrics, widely regarded in trading, suggest that the market remains in an oversold territory with potential for further decline before any recovery can be expected.

Potential Implications and Investor Strategies

If the market continues its downward trend, investors might need to brace themselves for more short-term losses. However, this scenario also provides a potential buying opportunity for those who have been waiting on the sidelines for a more favorable entry point. Long-term investors might see these declines as cyclical setbacks within a larger bullish context for cryptocurrencies.

Seasoned traders could exploit the high volatility using strategies like short-selling or options to manage risks while newcomers should be exceedingly cautious, prioritizing education on market dynamics before participating actively.

Conclusion

The crypto market is currently under a significant test with the recent sell-off raising flags not just for immediate price movements but for potentially more fundamental shifts in market dynamics. Investors are advised to keep an eye on key financial indicators and market movements, and possibly prepare for more turbulence ahead. Whether this marks a temporary correction or the start of a lengthier winter in crypto markets, remains to be seen. However, the hidden signals are strongly suggesting that the storm isn’t over yet.