The recent HBAR surge has captured the attention of cryptocurrency enthusiasts as it soars 15%, paralleling the positive momentum seen with XLM, which has gained 10%. This sudden leap in Hedera’s price comes as the broader market looks for signs of a cryptocurrency recovery following a tumultuous decline that wiped out over $2.6 billion in leveraged positions. With Bitcoin making a significant comeback by reclaiming the $70K mark, altcoins like HBAR and Stellar are reflecting this bullish sentiment, signaling a possible shift in market dynamics. Traders are now optimistic about the Hedera price increase as buyers target the critical $0.10 level, a threshold lost earlier this week. In a landscape where Bitcoin price movements heavily influence altcoins, the gains in HBAR and XLM highlight the interconnected nature of these digital assets amid evolving investor confidence.

As the crypto market experiences notable shifts, the recent uptick in HBAR and XLM prices suggests an emerging trend of recovery in the digital asset ecosystem. Following a sharp downturn, these altcoins have rebounded significantly, igniting excitement among investors eager for opportunities in the aftermath of heavy losses. With Bitcoin’s resurgence to above $70,000 acting as a catalyst, the performance of Hedera and Stellar represents not only their individual recovery but also the overall health of the cryptocurrency sector. The substantial spikes in trading volumes indicate a renewed interest, promising a potentially bullish phase for cryptocurrencies. Consequently, keeping an eye on further developments in the market could lead to more substantial growth in the weeks ahead.

| Cryptocurrency | Price Change (%) | Current Price | Trading Volume (24h) |

|---|---|---|---|

| HBAR | +15% | $0.093 | $420 million |

| XLM | +10% | $0.17 | $426 million |

| BTC | > +10% (at time of writing) | $71,190 | N/A |

Summary

The recent HBAR surge of 15% reflects the positive market sentiment that has followed Bitcoin’s recovery back above $70,000. As cryptocurrencies rebound after a significant dip, the performance of Hedera and Stellar highlights the resilience of altcoins in a volatile market. With increasing trading volumes and strong bullish indicators, the ongoing HBAR surge suggests potential for further growth, particularly if Bitcoin maintains its upward trajectory.

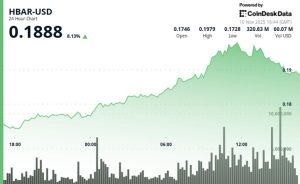

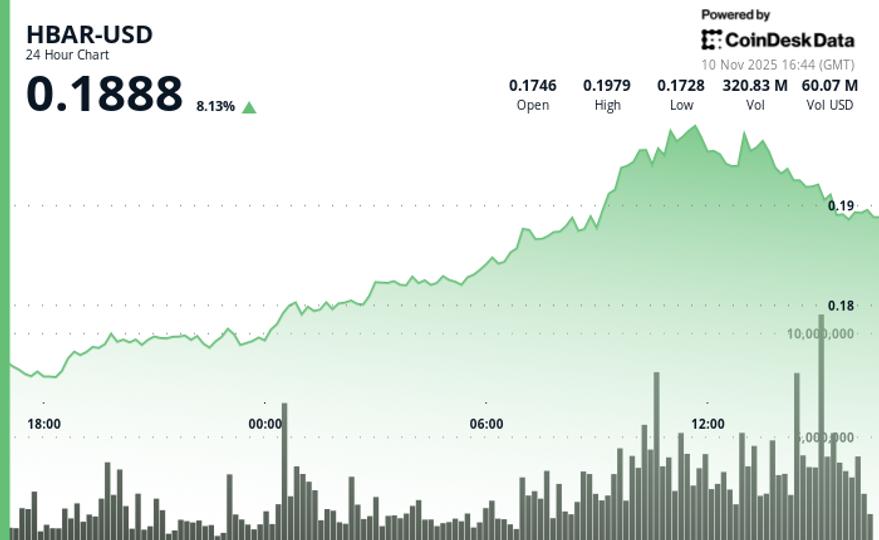

Recent Surge in HBAR Prices

HBAR has rebounded impressively, surging over 15% in a short span, indicating a robust recovery following the adverse market movements last week. This dramatic resurgence comes after the token plummeted to lows of $0.073 amidst a broader cryptocurrency crash, impacting many altcoins. Investors are now looking at HBAR with renewed interest as it stabilizes above $0.093, drawing attention to potential target levels around $0.10—a significant threshold previously lost.

The trading volume for HBAR has also experienced a remarkable increase, soaring by 65% to over $420 million. This uptick signifies a strong buying interest, hinting that market sentiments may be shifting positively towards Hedera. Analysts suggest that if bulls manage to seize the momentum, we could see prices test last year’s high of $0.13. Monitoring the market closely, investors remain optimistic about HBAR’s price trajectory, especially if Bitcoin continues its bullish climb.

XLM Gains Amid Market Rebound

Stellar (XLM) is significantly benefiting from the recent uptick in the cryptocurrency market, gaining roughly 10% as Bitcoin surpasses the pivotal $70,000 mark. This rise reflects a broader trend where altcoins are responding favorably to Bitcoin’s resurgence, which in turn boosts overall investor confidence. Currently trading around $0.17, XLM’s jump comes in tandem with a notable increase in market volume, with reports indicating it has hit a 24-hour high of $426 million.

The correlation between XLM and Bitcoin’s movements is further emphasized by Ripple’s (XRP) own 18% surge that has historically influenced Stellar’s performance. As XLM prices climb, market analysts are intrigued by the potential for further gains, especially if sentiment shifts from extreme fear to a more bullish outlook. With predictions hinting at a possible breakout above $0.20, the future seems promising for those invested in XLM.

The Role of Bitcoin in Cryptocurrency Recovery

The recent recovery in Bitcoin prices is pivotal for the entire cryptocurrency market, acting as a bellwether for other assets like HBAR and XLM. After a tumultuous drop to $60,000, Bitcoin’s rebound above the $70,000 level signifies a critical turning point. Analysts point out that as long as Bitcoin maintains this support, it could herald further gains throughout the altcoin markets, fostering an environment conducive to recovery across the board.

However, market experts remain cautious; historical trends indicate that while there may be immediate bullish movements, Bitcoin can potentially face resistance that could trigger additional downturns. According to Rekt Capital, fluctuations in open interest and bullish divergences in the daily Relative Strength Index add layers of complexity to Bitcoin’s price prediction. Traders are advised to stay vigilant for signs of bearish acceleration, which can significantly affect the broader cryptocurrency market.

Market Dynamics Post-Crash

The recent crash that erased over $2.6 billion from the crypto market has led to a significant re-evaluation of asset prices. As HBAR and XLM gain momentum, the shift from fear to cautious optimism is evident among traders and investors. This transformative period exemplifies how quickly the market can change, transitioning from drastic sell-offs to potential recovery phases, driven primarily by Bitcoin’s positive trajectory.

Moreover, the market dynamics are not merely speculative; they hinge on fundamental aspects such as trading volume and investor sentiment. With HBAR and XLM showing increased volumes and bullish behavior, this reflects broader market sentiment that tends to seek recovery post-correction. Observing these trends, analysts are monitoring key resistance levels that could serve as pivotal breakout points in the upcoming days.

Impact of Bitcoin’s Performance on Altcoin Market

Bitcoin’s performance remains intrinsically linked to the health of the altcoin market, influencing price movements and investor behavior across numerous platforms. As Bitcoin eclipses the $70,000 mark, many altcoins, including HBAR and XLM, are likely to follow suit. This co-movement is driven by a collective market sentiment that often gravitates towards Bitcoin as a leading indicator, encouraging investments in altcoins during bullish phases.

Additionally, the surge in Bitcoin typically initiates buy signals across altcoins, where traders seek to capitalize on the momentum generated by the king coin. However, past trends indicate that while initial bursts of altcoin gains may occur, they are often tempered by corrections. Investors should remain aware of these cycles and adjust their strategies accordingly, particularly focusing on how Bitcoin’s price stability impacts altcoin recovery efforts.

Analyzing HBAR in the Current Market Context

Hedera’s recent price surge marks an important event in its market timeline, showing resilience against broader market instabilities. Amidst significant volatility, HBAR’s ability to recover to around $0.093 showcases a strengthening narrative for the cryptocurrency. Traders and analysts are increasingly optimistic about HBAR’s potential, particularly with price targets being set at critical levels like $0.10 and beyond.

The undercurrents driving HBAR’s price recovery include increased trading volumes, which indicate heightened investor interest. As sentiment shifts post-crash and investors look for reliable assets, Hedera stands out due to its unique positioning within the blockchain landscape. By leveraging its network and partnerships, HBAR could continue to gain traction, suggesting further bullish potential in this environment of recovery.

Stellar’s Performance in the Shadow of Bitcoin

Stellar (XLM) has been making noticeable strides following Bitcoin’s recovery. The recent performance of XLM highlights not only its potential but also its connection to Bitcoin’s price action — as the market leader, Bitcoin’s movement directly impacts the trajectories of major altcoins, including Stellar. With XLM climbing over 10%, the asset’s resilience amidst Bitcoin fluctuations speaks volumes about its adaptable market strategy.

As traders flocked toward altcoins during Bitcoin’s rally, XLM’s affinity for following Ripple’s price trends has illustrated its potential as a safe bet among altcoins. Its competitive pricing and purchase volume surge mark a critical resurgence aimed at breaking through structural resistance levels. Market analyses going forward will focus on XLM’s ability to maintain this upward trend while Bitcoin solidifies its gains.

Understanding Market Sentiments After Major Fluctuations

Market sentiment plays a crucial role in the performance of cryptocurrencies, especially after pivotal price swings. Following Bitcoin’s dive and its subsequent rebound, emotions across the cryptocurrency spectrum are running high. For HBAR and XLM, increased volume and price escalation are fueled by a wave of optimism, highlighting a stark contrast to the market sentiment experienced during the crash.

Investors are urged to remain vigilant as sentiment can shift rapidly, leading to potential volatility. However, the current trend suggests a breathing space for altcoins as they align themselves with Bitcoin’s recovery narrative. Educational aspects around market fluctuations and cryptocurrency fundamentals are essential for understanding forthcoming price movements in this ever-evolving market landscape.

Predictions for Future HBAR and XLM Movements

Looking ahead, the trajectory for HBAR and XLM will depend heavily on Bitcoin’s performance and overall market conditions. With each showing signs of recovery and renewed interest, traders are closely monitoring potential price targets and support levels. For HBAR, successfully reclaiming the $0.10 mark may encourage a retest of higher price ceilings, making it an asset to watch.

Similarly, XLM’s climb towards resistance points, backed by sustained volume, could lead to further bullish entrenchment within the market. Market analysts are increasingly positive about both cryptocurrencies, suggesting that if current trends persist, we could witness substantial upward movements. Ultimately, the interdependence of Bitcoin with altcoins such as HBAR and XLM will be crucial for shaping their future price action.

Frequently Asked Questions

What factors contributed to the recent HBAR surge amid the cryptocurrency recovery?

The recent HBAR surge, which saw an increase of over 15%, was mainly influenced by Bitcoin’s recovery above $70,000 following a substantial crash. This rebound, coupled with strong buying interest after HBAR hit lows of $0.073, indicated a significant cryptocurrency recovery. The surge in trading volume to over $420 million further supported this momentum.

How does the HBAR surge compare to XLM gains in the current market?

As of the recent market surge, HBAR’s 15% increase outperformed XLM’s 10% gain. Both cryptocurrencies are experiencing upward momentum, largely driven by the Bitcoin price reclaiming the $70K mark, which has positively influenced the market dynamics for altcoins like HBAR and Stellar.

What price level is Hedera (HBAR) targeting after its surge?

Following the recent HBAR surge, buyers are targeting the crucial resistance level of $0.10. This target is particularly relevant as HBAR attempts to recover from lows of $0.073, aiming for year-to-date highs of $0.13 if positive market sentiment continues.

How is the overall cryptocurrency market reacting to Bitcoin’s price increase in relation to HBAR and XLM?

Bitcoin’s substantial rebound to over $70,000 has created a ripple effect through the cryptocurrency market, resulting in significant price increases for several altcoins, including HBAR and XLM. This correlation illustrates how the performance of Bitcoin can directly influence other cryptocurrencies, fostering recovery in the digital assets sector.

What role does trading volume play in the recent HBAR and XLM price increases?

The recent price increases of HBAR and XLM have been bolstered by a surge in trading volume. HBAR experienced a 65% increase in volume, reaching over $420 million, while XLM’s trading volume rose by more than 56%. High trading volumes often indicate increased investor interest and can lead to sustained upward momentum in cryptocurrency prices.

Can the HBAR surge be sustained amid market volatility?

While the recent HBAR surge demonstrates strong momentum, its sustainability will depend on broader market conditions and investor sentiment. Analysts suggest that if Bitcoin maintains its position above $70K, further gains could be realized for HBAR. However, market volatility remains a concern, and potential downturns could affect the bullish outlook.