HBAR’s Price Faces Potential Decline with Emerging Death Cross: Analyzing Implications for Investors

In the dynamic and often unpredictable realm of cryptocurrency, Hedera Hashgraph (HBAR) has recently shown signs that could concern investors, particularly with the emergence of a technical pattern known as the “death cross.” This article delves into the potential impact of this pattern on HBAR’s pricing and what it might mean for the cryptocurrency’s future.

Understanding the Death Cross

A death cross is a technical chart pattern indicating a potential bearish (downward) turn in a security’s price. It occurs when a security’s short-term moving average (such as the 50-day moving average) crosses below its long-term moving average (like the 200-day moving average). This phenomenon is often regarded by technical analysts as a signal that the current downtrend could persist, possibly resulting in lower prices ahead.

HBAR’s Market Position

Hedera Hashgraph has carved out a niche in the blockchain arena with its innovative approach to digital transactions, focusing on high throughput, low fees, and finality speeds that set it apart from traditional blockchains. However, despite these significant technological strides, HBAR’s price has not been immune to the widespread volatility that characterizes the crypto markets.

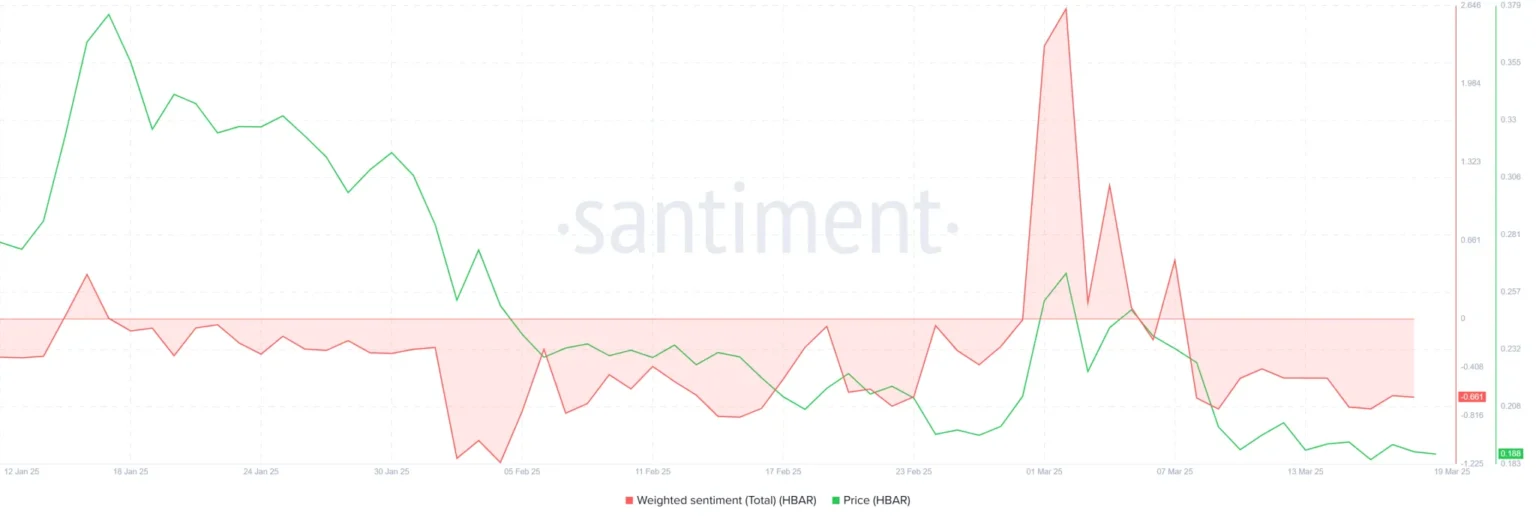

Until the emergence of the death cross, HBAR had shown some resilience in maintaining a stabilized price movement. Nonetheless, as the bearish pattern takes shape, the sentiment among traders and investors has visibly shifted.

Market Reactions to the Death Cross

Historically, the appearance of a death cross has led to bearish market sentiments, as it confirms a weakening momentum in the asset’s price trajectory. For HBAR, this pattern could result in a further 17% price drop, affecting both short-term trading and potentially deterring long-term investment until a recovery pattern, like a golden cross (where the short-term moving average crosses above the long-term moving average), emerges.

Impact on HBAR Investors

For current investors, the appearance of a death cross might lead to reevaluation of their holding strategies. Traditional responses could range from tightening stop-loss orders to mitigate potential losses to strategically selling off HBAR assets before anticipated drops in price.

Conversely, potential investors might see this as an unfavorable time to enter the market, preferring to wait for signs of a more robust reversal in price trends. However, for contrarian investors, such downturns may present unique buying opportunities to purchase HBAR at a low price in anticipation of future gains.

Looking Forward

The emergence of a death cross on HBAR’s price chart serves as a critical reminder of the volatile and unpredictable nature of cryptocurrency investments. Investors and traders should always conduct comprehensive market analysis, stay informed about global economic indicators, and consider other external factors that could influence crypto markets.

Moreover, adopting a diversified investment strategy and applying prudent risk management measures can help mitigate adverse impacts during unpredictable market downturns.

Conclusion

As HBAR’s death cross signals potential challenges ahead, both short-term traders and long-term investors must navigate this bearish indicator with strategic caution and informed decision-making. Observing subsequent market movements, especially any signs of a potential golden cross, will be essential for those looking to capitalize on future HBAR price movements.

In conclusion, while the death cross is a daunting development for HBAR, it also underscores the importance of resilience and adaptability in the ever-evolving landscape of cryptocurrency investing.