HBAR Futures Face Challenges as Prospects of $200 Million Recovery Dim

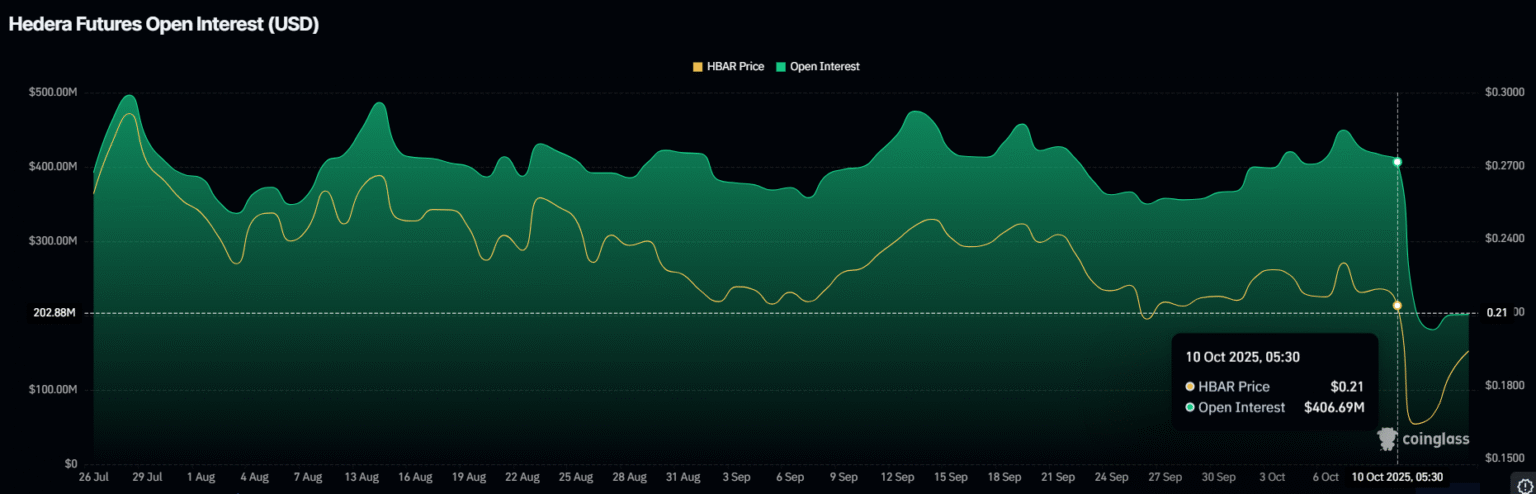

The futures of Hedera’s native cryptocurrency, HBAR, are currently facing significant challenges as predictions about a $200 million market recovery appear less probable. This has sparked a wave of concern among investors and stakeholders within the Hedera ecosystem.

The Current State of HBAR

HBAR, the cryptocurrency built on the Hedera Hashgraph, a public network that prides itself on high-speed and secure transactions, has experienced considerable volatility in recent months. Traditionally viewed as a dark horse with strong potential within decentralized financial systems, HBAR has struggled recently to regain its upward momentum amidst a turbulent global cryptocurrency market.

Factors Impacting HBAR’s Performance

Several factors contribute to the challenges HBAR futures currently face. The broader market condition is one, with global economic uncertainties influencing investor behavior heavily towards safer assets. Another factor is the diminishing hopes of a quick recovery from a $200 million market capitalization loss. This loss was primarily fueled by a mixture of market sell-offs and reduced transaction volumes on the Hedera network.

The competition is also a significant factor, with many other cryptocurrencies and blockchain platforms introducing newer, more innovative solutions that cater to the needs of developers and enterprises, making the market even tighter for HBAR.

Technical and Development Stagnations

One issue that analysts point to is a phase of perceived stagnation in Hedera’s development and technical advancement. While Hedera has boasted superior technology in terms of throughput and transaction fees, the pace of innovation and new partnerships appears to have slowed, causing concerns about long-term viability and competitiveness.

Moreover, issues related to governance and transparency in decision-making processes within the Hedera network might have also led investors to reconsider their stakes. As with any decentralized network, investor confidence heavily relies on clear, democratic processes and visible advancements, which seem to be lagging with Hedera.

Market Recovery Prospects

The initial optimism about a $200 million recovery was based on strategic plans laid down by Hedera’s governing council earlier this year, which included expanding its enterprise solutions and fostering a richer developer ecosystem. However, the impact of these initiatives has been less than anticipated, casting doubts on the rapid recovery previously expected by investors.

Economists and cryptocurrency experts suggest that recovery for HBAR could still be on the horizon, but it would likely be a more prolonged and arduous journey than initially projected. For the short term, gaining back the lost $200 million in market capital seems a dim prospect, primarily due to slower market dynamics and lesser investor confidence.

Conclusion

As we move forward, the future of HBAR futures seems tethered not just to market activities but significantly to Hedera’s ability to innovate and keep pace with its competitors. The Hedera team needs to reinvigorate its platform with cutting-edge solutions that not only cater to current investor and user needs but also pave the way for future blockchain needs.

For now, stakeholders might need to buckle up for a bumpy ride and focus on long-term strategies that could realign HBAR with the path to recovery and growth. The road ahead is uncertain and demands robust strategic realignment to recapture the lost ground and reach new heights.