As Halloween approaches, not only are people gearing up for spooky festivities, but the cryptocurrency market is also bracing for its own kind of excitement. This October 31st is set to witness a monumental event in the crypto world: Bitcoin options contracts worth a staggering $31 billion are due to expire, marking it as the largest expiration in the history of Bitcoin options. This event, occurring amidst the playful eeriness of Halloween, has been aptly dubbed by traders and market enthusiasts as a part of the “Spooky Szn.”

What are Bitcoin Options?

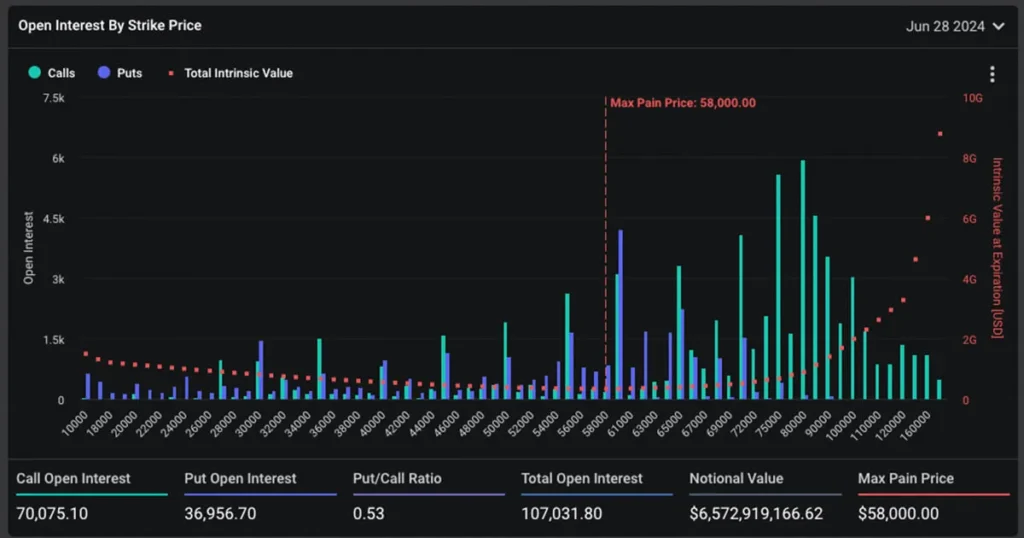

Bitcoin options are financial derivatives that give investors the right, but not the obligation, to buy or sell Bitcoin at a specified price, known as the strike price, before a certain expiration date. Unlike futures, where the holder has an obligation to buy or sell the asset at the set price upon the contract’s expiration, options provide investors with a hedge against price volatility, thereby reducing risk, or the opportunity to speculate, based on their market predictions.

A Record-Breaking Expiration

The $31 billion worth of Bitcoin options set to expire on October 31, 2023, far surpasses any previous records. It represents a significant indicator of the growing interest and activity in cryptocurrency derivatives. This surge could be attributed to increasing institutional participation and a more nuanced understanding of digital asset management within traditional financial circles.

Market analysts speculate that such a large scale expiration could lead to increased volatility in the Bitcoin market. As options near their expiration, many traders might adjust their positions, either by rolling over their options to a later date or by liquidating them, depending on their market outlook and risk exposure.

Implications of the Massive Expiration

The immediate implication of this massive options expiry could be heightened volatility in Bitcoin’s price. The anticipation of the expiry might drive some preemptive trading strategies in the days leading up to Halloween, with traders aiming to hedge their portfolios against potential price movements or to capitalize on the fluctuations.

Furthermore, the crypto market might also see increased liquidity as numerous contracts approach their maturity, followed by a possible liquidity crunch post-expiration. This situation can lead to unpredictable market dynamics, especially for retail investors who might find the market conditions more challenging to navigate.

Strategic Moves by Investors

Investors with expiring options face several strategic choices: they can either choose to roll over their options, securing a similar position for a future date, or they can close their positions, which might involve buying or selling the underlying asset, thereby directly influencing Bitcoin’s market price. Each strategy carries its own set of risks and benefits, deeply influenced by the prevailing market sentiment and economic indicators.

Market Sentiment and External Influences

The geopolitical landscape, regulatory news, and technological advancements within the blockchain ecosystem can also sway the market’s direction. Positive news might encourage holding or expanding positions, while adverse news could lead to a sell-off. Therefore, staying updated with comprehensive market analysis becomes crucial for traders around such critical periods.

Conclusion

The upcoming Halloween marks not just a day of trick-or-treat but also casts a spotlight on a significant event in the cryptocurrency segment. Whether this “Spooky Szn” for Bitcoin will turn out to be a trick or a treat for investors remains to be seen. However, one thing is certain: the market is in for some pulsating action as investors and traders across the globe maneuver through this historic options expiry. As always, in the high-stakes arena of cryptocurrency trading, the blend of sharp strategy and timely decision-making will dictate who reaps the rewards and who braces for the scares.