In a remarkable move that has sent shockwaves through the cryptocurrency community, Radiant Capital, one of the emerging players in the decentralized finance (DeFi) sector, has reportedly fallen victim to a hacking incident. Security research firm PeckShield revealed that a substantial amount of Ethereum (ETH), totaling approximately 5,400 ETH, was illicitly transferred to Tornado Cash, a controversial cryptocurrency mixer that has been frequently cited for its role in obfuscating the origins of digital assets.

The Incident Unfolds

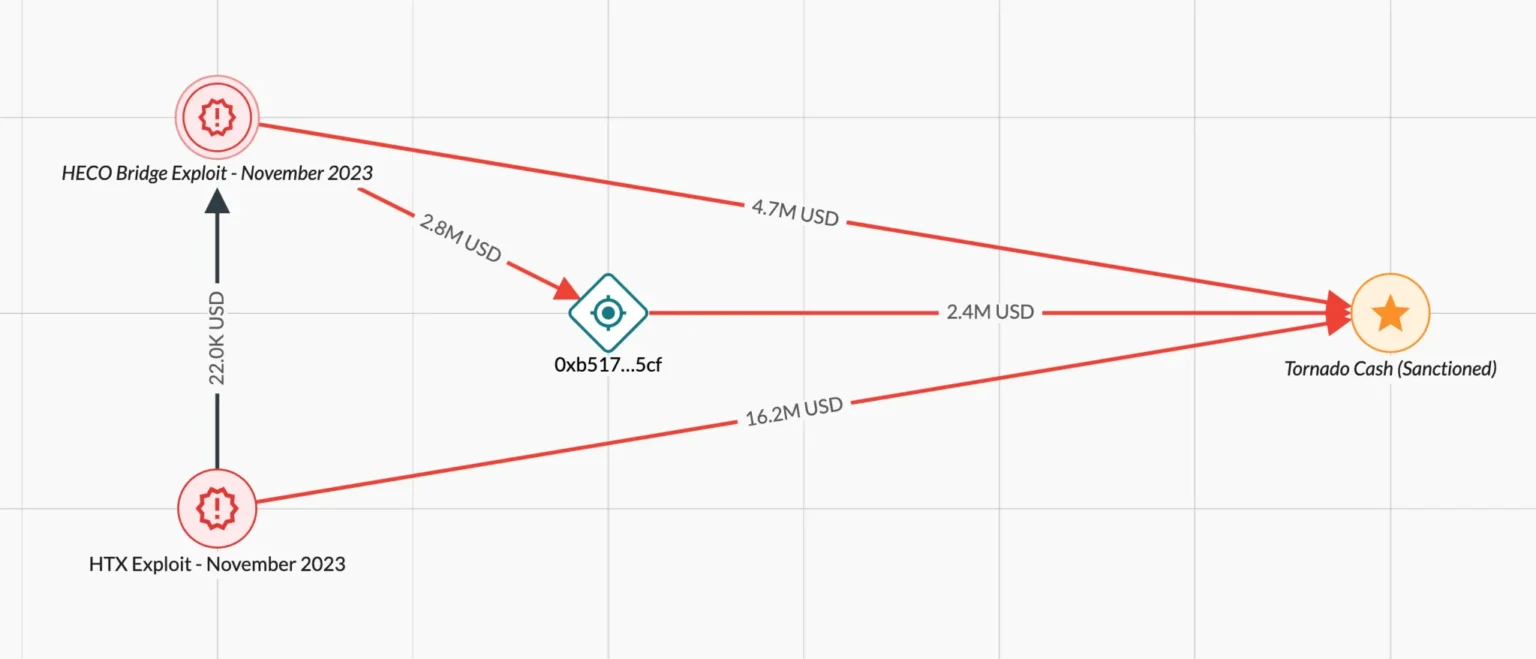

The incident was first flagged by PeckShield when unusual activity was detected in the wallet addresses associated with Radiant Capital. According to the security firm, the hackers were able to exploit a vulnerability in Radiant Capital’s smart contract system, which allowed them unauthorized access to withdraw ETH directly. The stolen funds, worth over $17 million at the time of the transaction, were immediately directed to Tornado Cash, making the tracing of the stolen funds challenging.

Implications for Radiant Capital

This security breach is a significant setback for Radiant Capital, which has been gaining traction in the DeFi space for its innovative approaches to lending and liquidity. The hacking incident not only leads to financial losses but also tarnishes the reputation of Radiant Capital as a secure platform for cryptocurrency transactions and investments. It raises serious questions about the robustness of their security measures and the potential need for more stringent protocols to safeguard user assets.

The Tornado Cash Controversy

The involvement of Tornado Cash in this incident is particularly noteworthy. Tornado Cash has been previously sanctioned by the US Treasury’s Office of Foreign Assets Control (OFAC) due to its role in laundering money for cybercriminals. By mixing large volumes of transactions, Tornado Cash can obscure the origins of stolen funds, complicating efforts by law enforcement and security agencies to track down hackers and recover stolen assets.

Legal and Regulatory Ramifications

This incident comes at a time when the use of cryptocurrency mixers like Tornado Cash is under intense scrutiny. The use of these services to launder ill-gotten gains from hacking activities has drawn criticism and raised calls for tighter regulatory oversight of cryptocurrency transactions. The involvement of a sanctioned entity in a new hacking case could lead to further legal actions and possibly stricter regulations aimed at curbing the misuse of privacy-enhancing technologies in the cryptocurrency space.

Looking Ahead

For Radiant Capital, the immediate focus is on assessing the full impact of the breach and strengthening their security infrastructure to prevent future incidents. The broader cryptocurrency community will also likely be watching closely, as this incident adds to the ongoing discussions about the balance between user privacy and regulatory compliance in DeFi. The challenge lies in implementing effective security measures that can thwart these increasingly sophisticated hacking attempts without stiflying the innovation and privacy that cryptocurrencies offer.

Conclusion

The theft of 5,400 ETH from Radiant Capital and its subsequent transfer to Tornado Cash is a stark reminder of the persistent security challenges in the DeFi sector. As the industry continues to evolve, the need for advanced security protocols and cooperative regulatory frameworks becomes increasingly apparent. Only through collective efforts can trust and security be restored, ensuring the sustainable growth of the cryptocurrency ecosystem.