ETF Greenlight: Government Shutdown Deal Could Trigger Massive XRP Rally

In the world of finance and cryptocurrency, few events have as significant an impact on the market as decisions made by governments, particularly those pertaining to financial regulations and oversight. A recent development indicating a potential government shutdown deal could have substantial implications for the cryptocurrency sector, particularly for Ripple’s XRP. The central aspect of this event is the rumored approval or consideration of an Exchange-Traded Fund (ETF) focusing on cryptocurrencies, which has sparked discussions about a greenlight effect triggering a massive rally in XRP’s value.

Understanding The Context: ETFs and Cryptocurrencies

An ETF is an investment fund traded on stock exchanges, much like stocks. An ETF holds assets such as stocks, commodities, or bonds and generally operates with an arbitrage mechanism designed to keep it trading close to its net asset value, albeit the ETF’s price can fluctuate throughout the day. Approval of a cryptocurrency ETF would mean a considerable endorsement of digital currencies as legitimate financial assets by the governing bodies, potentially leading to increased investor confidence.

The interest in a cryptocurrency ETF primarily revolves around its ability to provide investors more direct exposure to digital assets without the complexities of managing individual crypto wallets. It essentially bridges conventional finance and the emerging crypto markets, offering a familiar tool for traditional investors.

The Speculated Government Shutdown Deal

Recent rumors hint at a possible deal in the U.S. government to avert a shutdown. Such deals are typically packed with various legislative measures that could include frameworks for better clarity and regulation over digital currencies. Notably, the crypto community speculates the introduction of crypto-friendly regulations, including the approval of new forms of digital asset ETFs.

Potential Impact on XRP

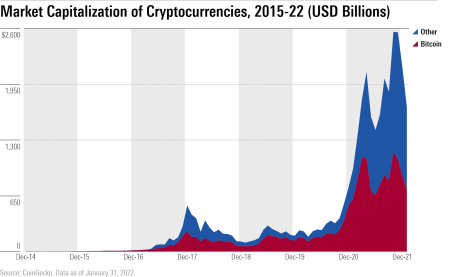

Ripple’s XRP, being one of the top cryptocurrencies by market capitalization and involved in global transaction networks, stands to benefit immensely from such developments. XRP is distinguished by its utility in global money transfers, aiming to facilitate faster and more cost-effective cross-border payments. The greenlighting of an ETF encompassing cryptocurrencies like XRP could potentially increase the asset’s visibility and attractiveness to investors who are still wary of direct crypto investments.

Why a Massive Rally Could Be Triggered

-

Investor Confidence: Formal approval and establishment of a crypto ETF can significantly boost investor confidence in digital assets. It implies a level of security and legitimacy when government bodies validate the asset class through regulated financial instruments.

-

Increased Liquidity: ETFs can inject substantial liquidity into the associated assets. For XRP, being part of such an ETF would increase the liquidity of its market, potentially stabilizing and driving up its price.

-

Broader Market Entry: Many institutional investors remain hesitant about entering the cryptocurrency space due to regulatory uncertainties. An ETF provides a regulated and somewhat more stable entry point, potentially leading to increased buying pressures from big players.

- Positive Sentiment: The mere news and discussions about potential regulatory advancements can spur positive market sentiment, acting as a catalyst for rallies not just in XRP, but across the cryptocurrency spectrum.

Conclusion

While it remains to be seen whether the government shutdown deal will indeed encompass crypto-friendly measures like the approval of a cryptocurrency ETF, the potential impact of such a decision could be transformative for digital assets. For XRP, the implications could be particularly profound, possibly resulting in a massive price rally buoyed by renewed investor interest and increased market participation. In the dynamic and often unpredictable realm of cryptocurrencies, regulatory clarity and advancement are always a beacon for bullish sentiments.