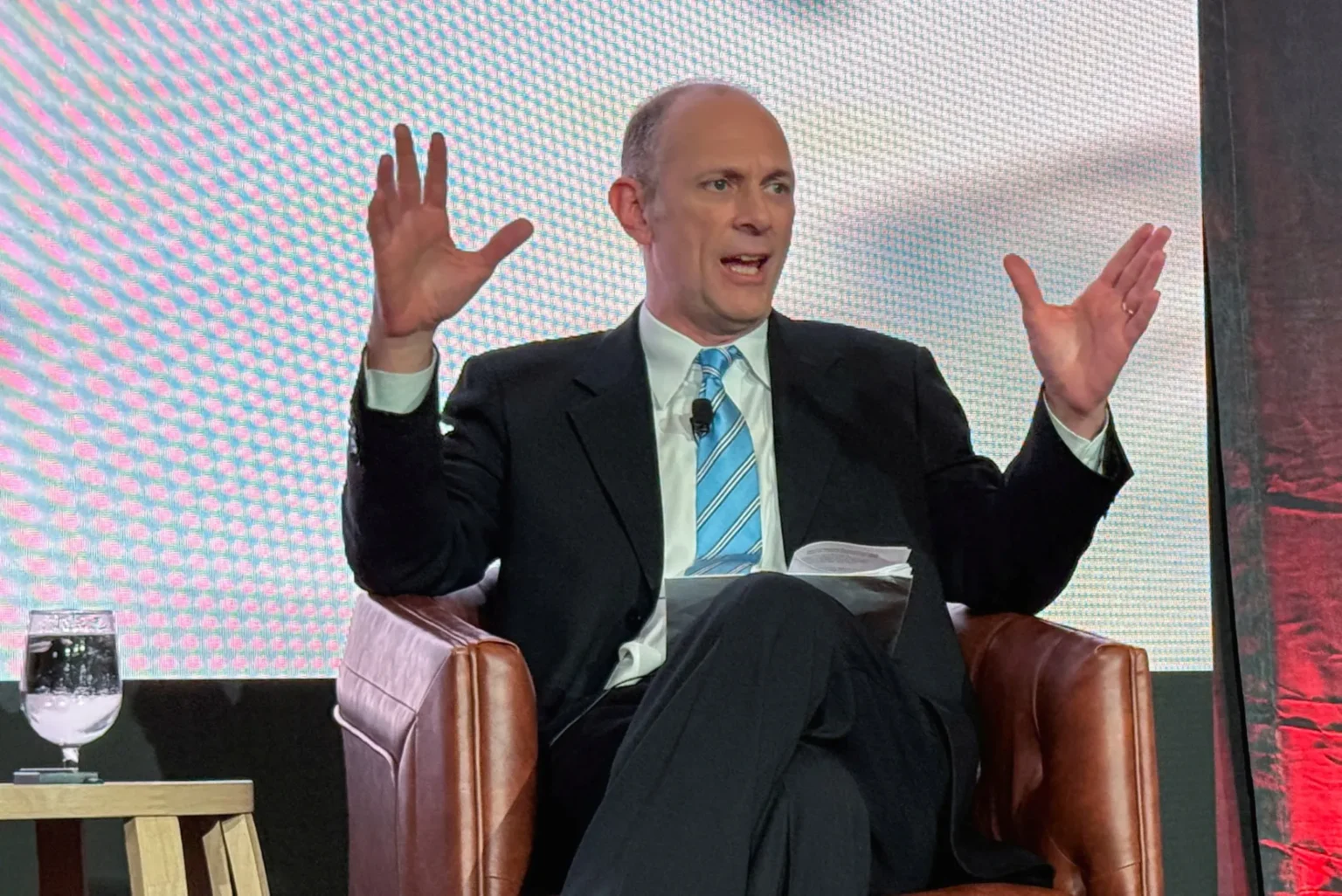

Fed’s Goolsbee: Hesitation on Continuing the Rate-Cutting Cycle

In recent statements, Austan Goolsbee, a key figure at the Federal Reserve, expressed reservations about persisting with the ongoing cycle of interest rate cuts. His cautious stance highlights the intricate balancing act the Federal Reserve faces as it navigates through economic uncertainties and evolving market conditions.

Key Takeaways

Context of Monetary Policy

The Federal Reserve has historically adjusted interest rates as a primary tool to manage economic growth and inflation. Lowering interest rates tends to stimulate economic activity by making borrowing cheaper, hence encouraging spending and investment. However, prolonged low rates can also lead to overheating in the economy, asset bubbles, and inflationary pressures.

Goolsbee’s Perspective

Goolsbee’s reluctance to endorse further rate cuts comes at a critical juncture. As a seasoned economist and the President of the Federal Reserve Bank of Chicago, Goolsbee is well-regarded for his expertise and measured approach to fiscal policy. His current stance may be influenced by several factors, including existing economic data, future inflation expectations, and the overall health of the global economy.

Economic Indicators and Inflation

One of the primary concerns with continuing the rate-cut cycle is the risk of inflating asset prices and potentially triggering an inflation rate that could run above the Fed’s target. Current economic indicators might show mixed signals, with some areas experiencing robust growth while others indicate underlying weaknesses. Goolsbee, in his analysis, might be weighing these factors to determine the potential consequences of further rate reductions.

Global Economic Environment

The global economic landscape also plays a crucial role in shaping the Fed’s policy decisions. With major economies experiencing varying rates of growth and other central banks also adjusting their policies, the decision to alter rates isn’t made in isolation. The strength of the dollar, trade relationships, and international debt levels are all considerations that Goolsbee and his colleagues must evaluate to understand the broader implications of their policies.

Market Reactions

The financial markets react significantly to hints of policy shifts by the Federal Reserve. Goolsbee’s comments on rate cuts can lead to immediate responses from stock, bond, and foreign exchange markets. Investors often look to such insights to gauge future economic conditions and adjust their strategies accordingly. The cautious approach suggested by Goolsbee might be interpreted as a signal to prepare for a potential shift in policy direction in the near future.

Moving Forward

As the economy continues on its path towards recovery and adjustment post-pandemic, the decisions made by the Federal Reserve will be crucial. Goolsbee’s cautious note may herald a more conservative approach towards monetary easing, focusing possibly on monitoring incoming economic data more intensely before committing to further actions. This strategy could be pivotal in safeguarding the economic gains achieved so far while managing inflation risks effectively.

In conclusion, Austan Goolsbee’s current stance on being reluctant to continue the rate-cutting cycle reflects a complex interplay of economic analysis, risk management, and foresight. As the economic landscape evolves, the Federal Reserve’s policies will undoubtedly require adaptability and careful consideration of both domestic and international economic cues. The coming months will be critical in determining the trajectory of monetary policy and its implications for economic stability and growth.