Gold prices are experiencing a significant surge this week, catching the attention of investors keenly monitoring the landscape for current gold prices amid rising geopolitical tensions. The recent spike, attributed to the controversy surrounding US President Donald Trump’s ambition to acquire Greenland, has led to a 2% increase in gold futures, now reaching $4,863.50 per ounce. As global uncertainties loom large, savvy investors are turning to gold as a safe-haven asset, shaping emerging gold investment trends as they seek stability. Analysts are closely watching the gold price forecast, which has been leaning toward upward momentum triggered by escalating geopolitical risks. The interplay between politics, economic forecasts, and gold prices is crucial, especially as the implications of Trump’s plans resonate across the market.

The dynamics of precious metal values, particularly those of gold, are heavily influenced by a variety of external factors, including political movements and conflicts. Investors are increasingly gravitating towards these assets, especially in the context of the ongoing crises involving governmental affairs and international relations. Observers note that the decisions made by influential leaders can dramatically affect market predictions and trading behaviors, which in turn influences gold pricing cycles. With rising tensions from events like the proposed Greenland acquisition by former President Trump, the rallying of resources toward gold underscores a growing priority for stability in fluctuating economic times. As investment sentiments evolve, the landscape for alternative values like precious metals continues to thrive, prompting deeper analysis into their market resilience and future projections.

| Aspect | Details |

|---|---|

| Current Gold Price (Futures) | $4,863.50 per ounce |

| Current Spot Gold Price | $4,862.20 per ounce |

| Reason for Price Increase | Escalating tensions over Trump’s acquisition efforts regarding Greenland. |

| Investor Behavior | Increased demand for safe-haven investments amid geopolitical concerns. |

| Analyst Insight | Investors are seeking safer havens that are less dependent on the US economy. |

Summary

Gold prices have been significantly affected by recent geopolitical events, driven primarily by concerns over US President Donald Trump’s ambitions concerning Greenland. The ongoing tensions have led to increased investor interest in gold as a safe-haven asset, resulting in a notable uptick in both futures and spot prices. As investors look for security amid uncertainties, it appears that the gold market may continue moving upward in response to further geopolitical developments.

Current Trends in Gold Prices Amid Geopolitical Uncertainty

Gold prices have been significantly influenced by recent geopolitical events, notably concerning US President Donald Trump’s aspirations to acquire Greenland. As tensions escalate, investors are increasingly drawn to safe-haven assets, propelling gold’s value upward. Recently, gold futures recorded a notable increase of 2%, reaching $4,863.50 per ounce. Similarly, spot gold’s value surged by 2.1%, marking a clear indication of how political stability impacts precious metal markets, with gold emerging as a focal point for investors seeking refuge from uncertainty.

As geopolitical risks mount, the current gold prices reflect a broader trend in investment behaviors that lean towards security in volatile times. Investors have historically turned to gold during periods of political unrest or economic instability, as evidenced by the recent spikes in gold’s value. With Trump’s Greenland acquisition ambitions fueling fears of trade conflicts and economic downturns, many analysts predict a sustained increase in gold prices over the coming months, aligning with the historical tendency for gold to serve as a financial safe haven.

Analyzing Gold Investment Trends in 2023

In 2023, the landscape for gold investments appears robust, driven by a confluence of market factors including inflation, currency fluctuations, and geopolitical crises. The recent interest in gold as a valuable asset class is amplified by current gold prices reflecting increasing investor anxiety about the global economy. Notably, as the US faces pressure from potential tariffs and trade disputes, investors are reevaluating their portfolios and seeking the stability that gold offers, leading to a noticeable uptick in gold purchase activity.

Gold investment trends are also closely tied to inflationary pressures and currency devaluation. With the consumer price index unexpectedly rising in the UK and ongoing discussions regarding interest rates, the demand for gold as a hedge against inflation becomes increasingly relevant. This scenario positions gold not just as a safe haven, but also as a strategic asset for investors looking to navigate through the complex economic terrain of 2023.

The Impact of Geopolitics on Gold Pricing

Geopolitical events have a profound effect on gold pricing, as demonstrated by the recent surge in gold values following heightened tensions associated with Trump’s Greenland acquisition proposal. Political announcements and international relations play critical roles in shaping investor confidence and can lead to fluctuations in gold market dynamics. When individuals perceive a threat to global stability, they often pivot towards gold as a reliable investment, causing prices to rise accordingly.

As countries grapple with various threats, including trade wars and sanctions, the correlation between geopolitical risks and gold pricing becomes ever more apparent. Analysts suggest that significant geopolitical events will continue to create volatility in financial markets, thereby increasing the allure of gold. Investors are urged to monitor these developments closely to strategize their investments, as the impact of such uncertainties often translates into tangible shifts in gold prices.

Gold Price Forecast: What Lies Ahead?

Looking ahead, gold price forecasts are influenced by a multitude of factors, including economic indicators, geopolitical tensions, and changes in fiscal policy. Analysts suggest that the persistent uncertainties surrounding ongoing trade disputes and tariffs may lead to sustained upward pressure on gold prices, making it an essential consideration for investors. Additionally, with Trump’s focus on acquiring Greenland, there could be further market implications that bolster the case for gold as an investment.

Investment forecasts also indicate that, should inflation continue to rise or if economic conditions deteriorate, gold may very well see a significant price increase. As investors seek refuge, the demand for gold is likely to strengthen, and any disruptions in the geopolitical landscape will only amplify this trend. For investors, understanding the potential fluctuations of gold prices in 2023 will be crucial to making informed decisions.

The Role of Gold in the Face of Economic Volatility

In times of economic volatility, gold has consistently proved its worth as a safeguard against financial turmoil. Current events surrounding Trump’s potential acquisition of Greenland exemplify how quickly market conditions can change and how that influences investor sentiment towards commodities like gold. With safety being imperative during turbulent times, the increased demand for gold is a direct response to the instability looming over economic forecasts.

The role of gold transcends simple investment; it serves as a barometer of financial fear and confidence. As uncertainties shadow global markets, particularly in sectors influenced by geopolitical issues, the precious metal continues to attract attention from a wide array of investors. In this context, those involved in gold investment should remain vigilant, monitoring policy changes and international developments that might directly impact the economic climate.

Investing in Gold: Strategies for 2023

As we move deeper into 2023, devising effective strategies for investing in gold is paramount for investors looking to hedge against potential market downturns. With gold prices surging due to geopolitical tensions, it becomes crucial to assess various factors including current gold prices, market trends, and overall economic conditions. By developing a well-informed investment strategy, investors can successfully navigate through the uncertainties that lie ahead.

Incorporating a diversified approach is essential when considering gold investments. Besides direct purchases of gold bullion, investors may also explore exchange-traded funds (ETFs), mining stocks, or other related assets that can offer leveraged exposure to gold. With current gold prices reflecting a strong market, leveraging these diverse options may yield significant rewards as the geopolitical landscape continues to evolve.

Understanding Historical Gold Price Trends

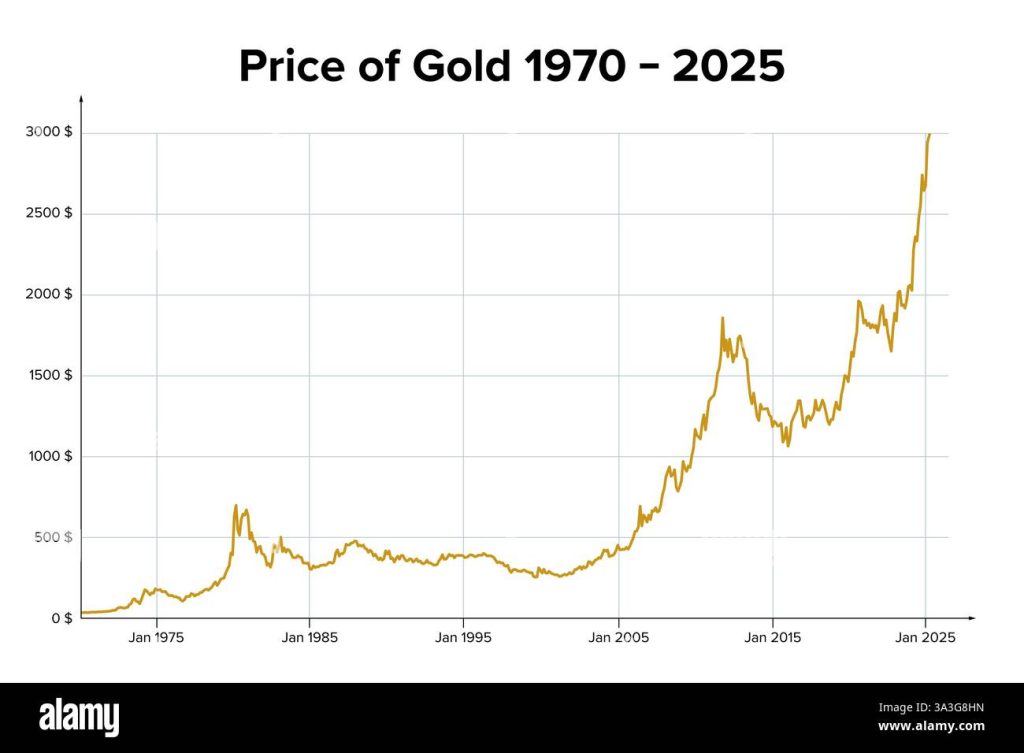

Examining historical trends in gold prices provides valuable insights into how current market conditions may unfold. Over the decades, gold has demonstrated resilience when faced with periods of economic instability, particularly during geopolitical crises. Recent price movements in response to Trump’s Greenland acquisition highlight the recurring patterns that link international relations and gold pricing, establishing a framework for predicting future behaviors.

The historical context also suggests that gold often performs robustly during inflationary periods, making it a critical asset to consider for long-term financial strategy. Investors looking to understand the potential paths of gold prices should analyze past events that resulted in substantial price fluctuations, applying these lessons to current geopolitical narratives and market sentiment.

The Intersection of Gold and Global Trade Dynamics

As global trade dynamics evolve, the interplay between international relations and gold pricing becomes increasingly pertinent. Tensions arising from Trump’s tariff threats against European countries signal a shift in trade paradigms that could have far-reaching consequences on gold markets. In this context, gold prices often react swiftly to trade-related news, reflecting the commodity’s status as a safe haven amidst uncertainty.

Observing the patterns of investment in gold relative to global trade developments allows investors to anticipate potential market shifts. With ongoing international negotiations and trade disputes, the demand for gold is likely to remain strong, providing a hedge against the unpredictable landscape of global commerce. Staying attuned to these changes is crucial for those looking to capitalize on gold’s enduring value during turbulent times.

Future Trade Relations and Their Effects on Gold Prices

Future trade relations between the US and other countries will play a critical role in influencing gold prices. As uncertainties surrounding tariffs and trade agreements unfold, investors are expected to respond by seeking the perceived safety of gold. As demonstrated by Trump’s Greenland ambitions, unresolved trade conflicts often escalate expectations of turbulence in market conditions, which typically correlates with increased gold prices.

The anticipation of trade changes unleashes investor sentiment that can lead to rapid shifts in gold demand. As companies and nations evaluate the repercussions of potential policies, the gold market stands to benefit from the movements of capital seeking security. Consequently, understanding these dynamics will be beneficial for investors aiming to navigate the intricate relationship between gold prices and future trade relations.

Frequently Asked Questions

What are the current gold prices impacted by geopolitical tensions?

Current gold prices have surged due to escalating geopolitical tensions, particularly related to US President Donald Trump’s acquisition efforts for Greenland. As of now, gold futures are trading at approximately $4,863.50 per ounce and spot gold at $4,862.20, highlighting the metal’s status as a safe-haven investment during uncertain times.

How do gold investment trends respond to global political events?

Gold investment trends tend to rise in response to global political events that create uncertainty, such as the recent heightened tensions surrounding Trump’s Greenland acquisition. Investors often seek gold as a safe haven, driving up prices amidst concerns about economic stability.

What is the gold price forecast considering current geopolitical issues?

Given the ongoing geopolitical issues, particularly surrounding Trump’s proposed acquisition of Greenland, the gold price forecast appears bullish. Analysts suggest that as fears of trade wars escalate, demand for gold as a secure investment is likely to increase, potentially pushing prices higher.

What is the impact of geopolitics on gold prices?

The impact of geopolitics on gold prices is significant; current events such as Trump’s threats regarding Greenland acquisition are causing fluctuations. Gold often rises in value when political instability arises, as investors seek to mitigate risk by investing in safe assets.

How have Trump’s Greenland acquisition efforts affected gold prices?

Trump’s efforts to acquire Greenland have created uncertainty in the market, contributing to a rise in gold prices. Increased demand for gold as a safe-haven investment has driven prices up by around 2% recently, reflecting investor sentiment amidst geopolitical tensions.