Gold steadies near US$4,210 as traders eye delayed PCE and Fed cut next week

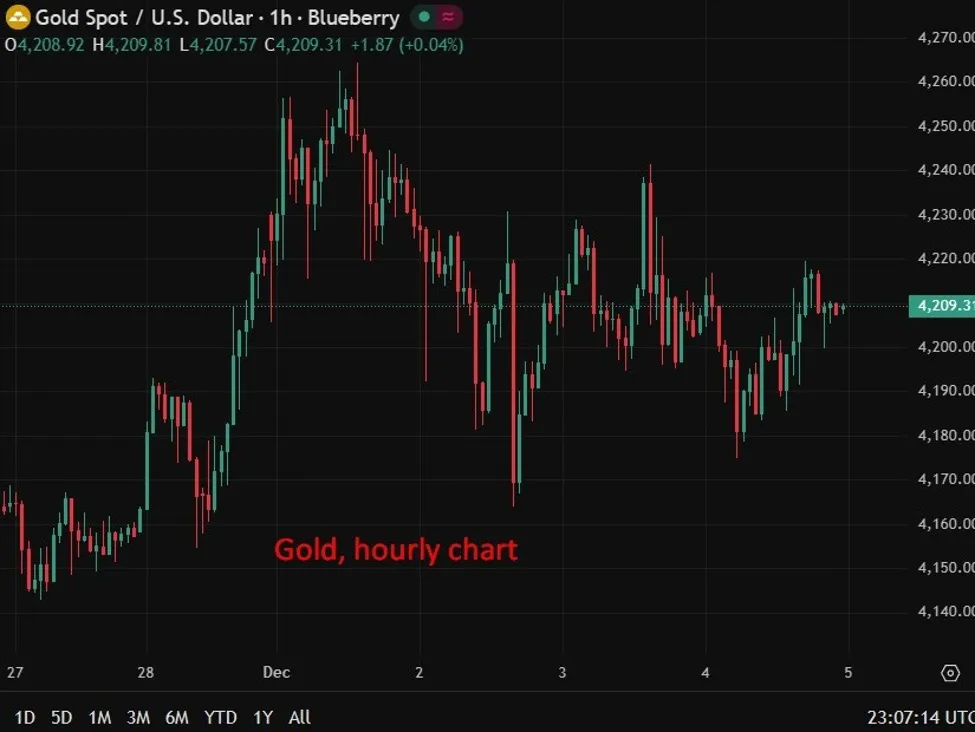

Gold hovered just below US$4,210/oz in early Asia trade Friday, with investors trimming risk ahead of long-delayed U.S. inflation data and a closely watched Federal Reserve meeting where a rate cut is widely expected.

Traders position for PCE, Fed and a data-heavy December

Spot bullion slipped about 0.5% overnight to roughly US$4,180 before recovering, as the dollar and U.S. real yields guided intraday flows. The immediate catalyst is the U.S. Personal Income and Outlays report due Friday at 13:30 GMT (08:30 ET), which will finally deliver the September PCE and core PCE inflation prints following shutdown-related delays. Consensus points to core PCE running near 2.9% year-on-year.

With liquidity thinning into year-end and positioning long after 2025’s powerful rally, price action may sharpen around surprises. A softer PCE print that nudges real yields lower would typically bolster non-yielding gold; a stickier inflation reading could revive the dollar and spark profit-taking.

What traders are watching

- U.S. Personal Income & Outlays (Friday, 13:30 GMT/08:30 ET): September core PCE expected around 2.9% y/y after shutdown delays.

- FOMC meeting (Dec 9–10): Markets broadly price a 25bp rate cut, with guidance on 2026 path in focus.

- U.S. November Employment Situation (Dec 16): First clean labor-market read since the shutdown.

- U.S. CPI (Dec 18, 2025): Key input for the trajectory and pace of rate cuts into 2026.

- Cross-asset cues: Dollar and U.S. real yields remain the primary near-term anchors for bullion.

Market context and strategy

Gold’s near-term correlation to U.S. real yields remains tight. A downside surprise in today’s PCE—or later in CPI and payrolls—that pressures yields and the greenback should underpin bullion and keep momentum buyers engaged above the US$4,200 handle. Conversely, a hawkish turn from the Fed or stronger-than-expected jobs data may test the rally as stretched longs lighten exposure.

Volatility is subdued ahead of the event cluster, but thinner year-end liquidity could amplify moves once data land. For FX, a PCE miss would likely soften the dollar and support higher-beta G10, adding tailwinds to gold; a beat would favor the dollar bid and weigh on precious metals. As always, risk management around release windows is paramount, particularly given the unusual cadence of rescheduled U.S. data.

Key Points

- Gold trades just under US$4,210/oz in Asia after an overnight dip toward US$4,180.

- All eyes on delayed U.S. PCE; core PCE seen near 2.9% y/y at 13:30 GMT/08:30 ET.

- Markets brace for a 25bp Fed cut on Dec 9–10; guidance critical for 2026 rate path.

- Rescheduled U.S. November jobs report arrives Dec 16; CPI set for Dec 18, 2025.

- Gold remains tethered to U.S. real yields and the dollar; surprises could trigger outsized moves in thin liquidity.

FAQ

Why is gold consolidating near US$4,210?

Investors are reducing risk ahead of delayed U.S. inflation data and the Fed’s policy decision next week. With the dollar and real yields steady, gold is marking time around a key round number.

How important is today’s PCE release for gold?

Very. Core PCE near 2.9% y/y is expected; a softer print could push real yields lower and lift bullion, while a firmer reading risks a dollar bid and gold pullback.

What is the market expecting from the Fed?

Traders broadly anticipate a 25bp cut on Dec 9–10. The forward guidance on the pace of easing into 2026 will likely drive the dollar, yields, and gold’s next leg.

Why were some U.S. data releases delayed?

Government shutdown-related disruptions pushed back key reports, including PCE and nonfarm payrolls, concentrating market-moving events into December.

What could trigger profit-taking in gold?

A hawkish Fed tone or a stronger-than-expected labor print could firm the dollar and real yields, prompting investors—already long after 2025’s big move—to lock in gains.

How should traders think about liquidity now?

Year-end conditions are thinner, which can magnify price reactions to data surprises. Consider tighter risk controls around release times, as BPayNews notes in its market coverage.