Gold and silver prices have recently experienced a significant downturn, capturing the attention of investors and analysts alike. The current state of the precious metals market raises concerns about ongoing volatility, fueled by low market liquidity that has made prices more prone to wild fluctuations. Just last week, a surprising surge in silver was halted abruptly as a dramatic silver price drop occurred, highlighting the unpredictable nature of these investments. Investors are now closely monitoring gold price analysis as they navigate through uncertain market conditions brought on by aggressive profit-taking. With hedge funds cautious amid rising volatility, understanding the dynamics of gold and silver prices becomes increasingly crucial for those looking to make informed investment decisions.

In recent discussions surrounding the value of valuable metals, attention has shifted towards the notable fluctuations in gold and silver’s worth. The recent trends showcase a troubled landscape marked by unexpected drops in silver and a consequent reevaluation of gold’s stability. Speculation and sentiment play lofty roles in this arena, as investors react to shifts in market dynamics that affect these assets’ appeal. Financial analysts note that the current environment, characterized by limited liquidity, creates opportunities for unforeseen price swings. Additionally, the hesitance of investment firms to mitigate these trends further amplifies the need for comprehensive market insights.

Understanding Gold and Silver Prices in 2025

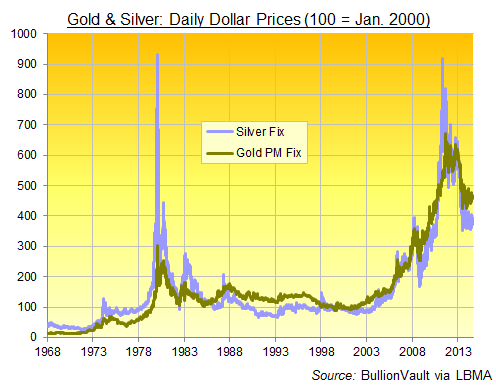

In 2025, the dynamics of gold and silver prices continue to captivate investors and analysts alike. As the precious metals market adjusts to various external factors, fluctuations in these prices have become more pronounced. Recent reports indicated that gold prices have seen significant drops, driven by a combination of profit-taking and low market liquidity. This scenario invites investors to delve deeper into gold price analysis and understand how macroeconomic elements impact these essential assets.

Notably, silver has recently made headlines with a dramatic price surge which ultimately faced a steep decline. The silver price drop of over $7 in a single day signifies not just a momentary setback but raises questions about the underlying market conditions. Investors must maintain vigilance, as the precious metals market remains susceptible to rapid changes, necessitating informed strategic decisions moving forward.

Frequently Asked Questions

What factors are currently influencing gold and silver prices in the market?

Gold and silver prices are heavily influenced by market liquidity and sentiment. Currently, low market liquidity is contributing to increased volatility in the precious metals market, causing significant price fluctuations. Analysts are noting that profit-taking and speculation around hedge funds managing their positions are also impacting these prices.

Why did silver prices experience a significant drop recently?

Silver prices dropped sharply due to a combination of profit-taking by investors and a sudden shift in market sentiment. The precious metals market experienced heightened volatility, and the sudden decline of over $7 in a single day was attributed to reduced investor confidence and low liquidity.

How does low market liquidity affect gold and silver prices?

Low market liquidity can lead to unusually large price swings for gold and silver as there are fewer buyers and sellers. This lack of participation increases the risk of volatility in the precious metals market, creating opportunities for sharp price changes during trading sessions.

What is the impact of hedge funds on gold and silver price volatility?

Hedge funds typically add liquidity to the market, but in times of high volatility, they may hesitate to enter trades that go against prevailing trends. This reluctance can exacerbate price movements in the gold and silver markets, leading to larger fluctuations and price instability when market conditions are uncertain.

Is it advisable to invest in gold and silver during periods of high volatility?

Investing in gold and silver during volatile periods can offer opportunities, but it also comes with increased risk. Market dynamics can lead to rapid price changes, so it’s essential for investors to conduct thorough gold price analysis and consider their risk tolerance before buying into the precious metals market.

| Key Points | Details |

|---|---|

| Market Retreat | Gold and silver prices have significantly retreated. |

| Low Liquidity Concerns | Low market liquidity raises concerns about ongoing volatility. |

| Silver’s Performance | Silver saw a strong performance last week but has dropped sharply. |

| Major Price Drops | Silver prices dropped over $7 in a single day, marking the largest nominal drop recorded. |

| Profit-Taking Pressure | Gold faced pressure today from profit-taking, decreasing about 4%. |

| Market Sentiment | The precious metals market is significantly driven by sentiment. |

| Trading Environment | Analysts note the current trading environment is tricky with low liquidity. |

| Hedge Funds Strategy | Hedge funds are reluctant to hedge against excessive market movements. |

Summary

Gold and silver prices are currently experiencing notable volatility amidst a complex trading environment. As the market reacts to low liquidity and profit-taking from recent highs, both metals face unpredictable fluctuations. Investors are advised to proceed with caution as sentiment continues to drive price movements in the precious metals market.