Global Money Supply Soars to a Record $142 Trillion in September

Key Takeaways

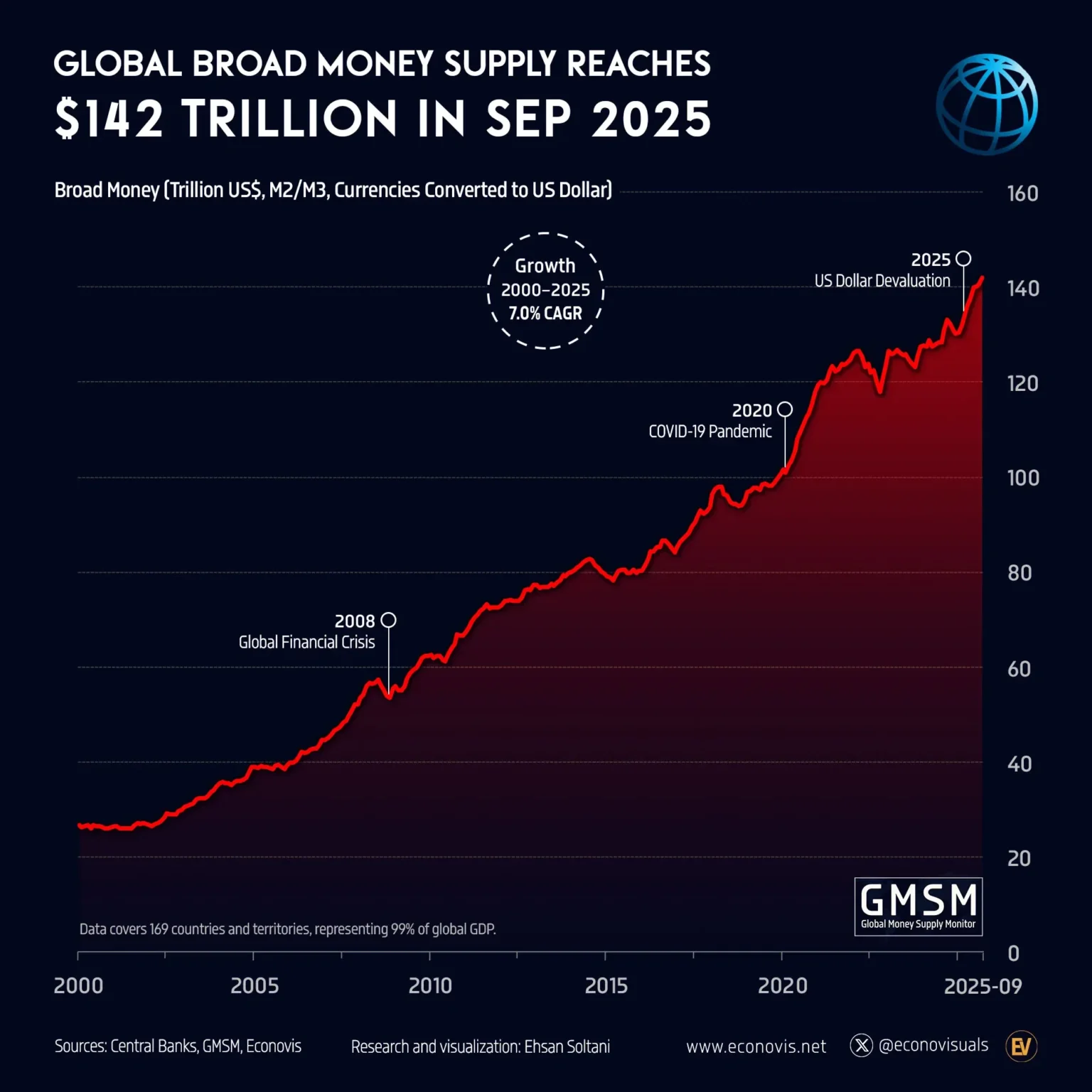

In a remarkable financial milestone, the global money supply surged to an unprecedented $142 trillion in September, according to the latest data from the International Monetary Fund (IMF). This surge reflects a significant increase from previous figures, marking a substantial impact on economies worldwide.

Understanding the Surge

The term “money supply” refers to the total amount of monetary assets available within an economy at any given time, which includes various forms of money like cash, coins, and accessible bank balances. Economists monitor changes in the money supply due to its potential influence on price levels, inflation, and economic stability.

The recent spike can be attributed to various central banks globally adopting expansive monetary policies in response to economic uncertainty. Techniques such as lowering interest rates and quantitative easing have been widespread, pushing more money into circulation to stimulate economic activity.

Implications of an Expanding Money Supply

While an increase in money supply can initially boost economic activity, its effects can variably shift over time, particularly concerning inflation. This influx of capital can decrease the value of money, leading to prices rising across a broad array of goods and services—a phenomenon that several countries are presently grappling with.

Inflation rates are soaring at levels unseen in recent decades, pressing central banks to reconsider their strategies. These conditions demand a delicate balance between fostering growth and controlling inflation.

Global Response and Economic Outlooks

Different countries have responded uniquely to the rise in money supply. In developed nations, such as the United States and those within the European Union, central banks are slowly beginning to increase interest rates as a countermeasure against inflation. Developing countries, facing different economic dynamics, struggle with these adjustments amid concerns about stifling their economic growth.

Experts predict that if money supply continues to rise unchecked, global economies could enter a phase of “stagflation,” where the growth stagnates amidst rising inflation. This scenario puts additional pressure on global economic recovery, especially in the wake of challenges posed by the COVID-19 pandemic.

Policy Makers at a Crossroads

As world economies navigate this complex financial landscape, policymakers face critical decisions about adjusting monetary policies and curbing potential long-term inflation without undermining the economic recovery.

Central banks must also consider the implications of new financial technologies and cryptocurrencies, which are gradually becoming integrated into the broader financial system and can also affect the overall money supply.

Conclusion

The record surge in global money supply to $142 trillion is a watershed moment that highlights the complexities of managing modern economic systems. As governments and central banks pivot their strategies to mitigate the risks associated with high inflation, the global economy stands at a crucial juncture that will define the economic stability and growth patterns for the coming years. The world watches and waits to see how these economic giants will handle the delicate balance of money supply with the pressing needs of their economies.