The recent movements of the Giant Whale ETH Position present a fascinating glimpse into the dynamics of cryptocurrency trading. This whale, known for its substantial influence in the market, currently maintains a short position that has generated a floating profit of $1,139,000. With a strategy that leverages both long and short positions, this trading behemoth exemplifies the intricacies of whale trading in Ethereum (ETH). As the crypto landscape evolves, monitoring such positions is crucial for understanding broader blockchain trading strategies. This case highlights the potential rewards and risks inherent in the volatile world of cryptocurrency, especially for entities wielding immense capital like this giant whale.

In the ecosystem of Ethereum trading, the strategies employed by prominent entities, commonly referred to as cryptocurrency whales, significantly shape market trends. The substantial short position currently held by a prominent whale in ETH is a testament to the strategic maneuvering within this volatile space. This large player continues to capitalize on price movements, illustrating the delicate balance of risk and profit, specifically with a notable floating profit stemming from their trading activities. Observers of ETH trading can glean valuable insights into how these giants navigate the complexities of blockchain investments and the importance of adapting trading strategies in response to market fluctuations. By analyzing such high-stakes positions, traders can better position themselves to anticipate market shifts influenced by these powerful stakeholders.

Understanding the Giant Whale ETH Position

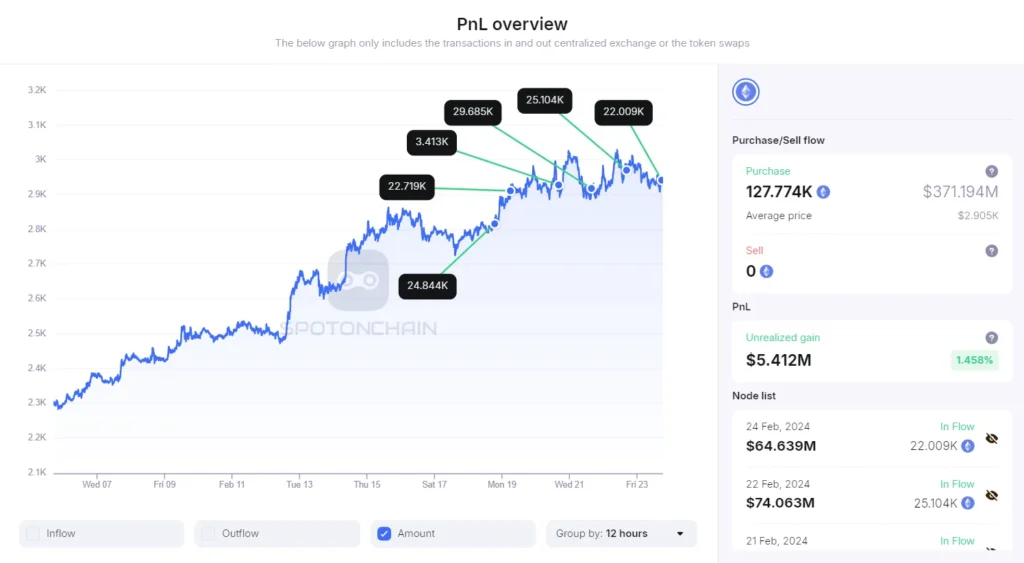

In the world of cryptocurrency trading, the term “whale” refers to individuals or entities that hold significant amounts of cryptocurrency, influencing market dynamics. The giant whale in question holds a short position in Ethereum (ETH), which currently reflects a floating profit of 1,139,000 USD. This impressive figure stems from strategically trading large volumes, demonstrating a masterclass in cryptocurrency whale maneuvering. By monitoring on-chain data, analysts can observe these massive trades and assess their impact on the market, particularly the fluctuation of ETH prices.

This whale’s significant position in ETH serves as a clear indicator of market sentiment. Holding 15,000 ETH at an opening price of 2,945.83 USD, the current marked price has risen to 3,022.2 USD, suggesting a robust trading strategy and a deep understanding of blockchain trading strategies. As the market continues to evolve, the positions held by such whales can lead to considerable ripple effects on liquidity and market price trends, drawing the attention of other traders keen on replicating their strategies.

The Mechanics Behind Short Positions in ETH

A short position in Ethereum or any cryptocurrency involves borrowing ETH and selling it with the expectation that its price will decrease, allowing the trader to buy back at a lower price. In the case of the giant whale’s 1011 short position, the strategy appears successful as it currently holds a floating profit. Understanding the nuances of short selling is essential for any trader looking to emulate this approach, especially within the volatile crypto market where prices can change drastically in short periods.

Traders engaging in short positions must be mindful of market trends and the broader cryptocurrency ecosystem. With ETH showing fluctuations, the potential for profit also carries inherent risks, particularly underlining the importance of strategic planning. By utilizing advanced tools and analytics, traders can mitigate risks associated with short selling, ultimately leading to more informed decisions when navigating the complex world of cryptocurrency.

Risk Management in Whale Trading

When dealing with large cryptocurrency positions, risk management becomes a crucial aspect of a trader’s strategy. The giant whale’s significant holding in ETH not only reflects an aggressive trading approach but also highlights the necessity of implementing robust risk management protocols. This ensures that even if market conditions turn unfavorable, the impact on their position is minimized. By strategically setting stop-loss orders and diversifying their portfolios, traders can safeguard their investments against sudden market downturns.

In the realm of whale trading, understanding market sentiment among cryptocurrency whales is essential, as these entities often set the tone for broader market trends. Observing their behaviors, such as the giant whale’s current floating profit position, can provide insights into potential market movements. Therefore, effective risk management intertwined with the observation of whale activity can guide more strategic trading decisions, minimizing potential losses while maximizing profit opportunities.

Analyzing ETH Floating Profit Trends

The concept of floating profits in cryptocurrency trading, particularly with Ethereum, refers to unrealized gains based on current market prices versus the price at which assets were acquired. The giant whale’s floating profit of 1,139,000 USD illustrates the volatility and opportunity present in crypto markets. Such profits can fluctuate significantly in short periods, influenced by market developments, trade volumes, and news related to blockchain technology and regulations.

As ETH markets evolve, observing trends in floating profits can provide traders valuable insights into market behavior. Monitoring whales, like the one holding a substantial short position, allows analysts and traders to predict potential upward or downward movements based on prevailing market conditions. Recognizing patterns in these floating profits can inform trading strategies, helping traders align their actions with market trends and possibly replicate successful trades.

The Impact of Whale Trades on Market Dynamics

Whale trading can significantly impact the dynamics of the cryptocurrency market. When a giant whale makes a move—such as holding a substantial short position in Ethereum—it can ripple across the market, influencing prices and trading volumes. Other traders often react to these movements, leading to shifts in supply and demand for ETH and contributing to its price volatility. By analyzing these trades, market participants can better predict potential fluctuations and adjust their trading strategies accordingly.

Moreover, the collective behavior of cryptocurrency whales provides insights into broader market sentiment. If multiple whales engage in short positions while the market shows bullish signs, it might indicate underlying risks that could lead to price corrections. This interplay between whale actions and market responses exemplifies the need for ongoing analysis and awareness of whale trading patterns, making it an indispensable part of cryptocurrency investment strategies.

Blockchain Trading Strategies for Long-Term Gains

Successful trading in Ethereum often relies on a combination of short-term insights and long-term strategies. Blockchain trading strategies emphasize not only capitalizing on immediate price movements but also developing a foundation for sustained investment growth. Traders can learn from whale strategies by observing established positions and their outcomes, particularly concerning floating profits and market timing. Informed decisions, based on thorough market analysis, can lead to more sustainable investment gains.

Diversifying trading strategies to include both short and long positions can provide investors with a buffer against market volatility. By leveraging insights gained from observing giant whale positions and engaging with various trading methodologies, cryptocurrency traders can augment their potential for long-term success. Continual education in emerging blockchain trends, analytical tools, and community engagement can support traders in making informed decisions that enhance their investment portfolios.

Identifying Key Players in Cryptocurrency Markets

Identifying key players, such as whales within cryptocurrency markets, is essential for any trader aiming to understand market movements. Whales often lead trends and influence pricing by executing large trades. The giant whale showcased in this analysis possesses a significant short position in ETH, marking its presence prominently in the crypto landscape. Recognizing these participants and their trading behaviors allows other traders to align their strategies accordingly.

By observing the ongoing strategies of influential players in the market, like the one holding a significant floating profit in Ethereum, traders can gain insights into market psychology. This knowledge can inform entry and exit points, ultimately guiding more strategic investments. Hence, the focus on identifying and analyzing key players is pivotal for developing insightful trading tactics within the dynamic landscape of cryptocurrency.

The Role of On-Chain Analytics in Trading

On-chain analytics play an increasingly vital role in cryptocurrency trading, providing traders the tools to understand market behaviors better. By monitoring transaction data and whale activities, such as those conducted by the giant whale in their ETH short position, analysts can gauge market sentiment. This access to real-time information enables traders to make swift decisions based on verifiable events rather than speculation.

Through on-chain analytics, market participants can uncover trends related to short positions, floating profits, and overall trading volumes in Ethereum. These insights foster a deeper understanding of how large transactions affect cryptocurrency prices and what strategies might yield the best results. Thus, utilizing on-chain analytics emerges as a powerful tool for traders seeking to navigate the complexities of blockchain trading.

Navigating Risks Associated with Cryptocurrency Investments

Investing in cryptocurrency inherently involves a degree of risk, highlighted by the fluctuating nature of assets like Ethereum. The giant whale’s position reminds investors of the potential for both substantial profits and equally significant losses. Understanding these risks is crucial for developing effective trading strategies. Traders must be prepared for swift market changes, employing risk management tactics to protect their investments.

Additionally, awareness of external factors influencing the cryptocurrency market, such as regulatory changes and technological developments, is critical for mitigating risks. By staying informed about the broader economic environment and engaging with market analyses, traders can make more strategic decisions. Recognizing the nuances of the market, as demonstrated by successful whale trading strategies, can ultimately contribute to more successful and balanced investing in the ever-evolving landscape of cryptocurrency.

Frequently Asked Questions

What is the current status of the Giant Whale ETH Position?

The Giant Whale currently holds a short position on ETH that has generated a floating profit of 1,139,000 USD. This position is significant in the blockchain trading strategies utilized by large investors in the cryptocurrency market.

How much is the Giant Whale’s ETH short position worth?

The Giant Whale’s short position in ETH is approximately valued at 15,000 ETH, which translates to around 45.32 million USD based on the current market price.

What does a floating profit mean in the context of the Giant Whale ETH Position?

A floating profit in the context of the Giant Whale ETH Position indicates that the unrealized gains from their short position amount to 1,139,000 USD. This reflects potential profit that could be realized based on market changes.

What role do cryptocurrency whales play in ETH trading?

Cryptocurrency whales, such as the Giant Whale referenced, have a substantial influence in the market, often employing complex blockchain trading strategies like short positions to leverage price movements and generate profits.

What is the significance of a 5x long position held by the Giant Whale in ETH?

The 5x long position signifies that the Giant Whale is significantly leveraged in the market. This strategy can amplify both profits and risks, as minor fluctuations in ETH prices will have a magnified impact on their overall position.

What strategies might a Giant Whale use to optimize profits in ETH trading?

A Giant Whale may employ a variety of blockchain trading strategies, including short selling, hedging, and diversifying their portfolio to manage risks while capitalizing on floating profits in assets like ETH.

What are the risks associated with the Giant Whale ETH Position?

Given the volatile nature of cryptocurrency markets, the Giant Whale ETH Position faces risks such as market fluctuations, regulatory changes, and the potential for substantial losses if the market moves against the short position.

How can investors learn from the Giant Whale’s trading approach in ETH?

Investors can study the Giant Whale’s approach, such as their use of short positions and market timing, to enhance their own trading strategies, while also remaining aware of the inherent risks in cryptocurrency trading.

| Key Point | Details |

|---|---|

| Giant Whale’s Short Position | 1011 short position in ETH. |

| Floating Profit | 1,139,000 USD. |

| Position Size | 15,000 ETH. |

| Position Value | 45.32 million USD. |

| Opening Price | 2,945.83 USD. |

| Current Marked Price | 3,022.2 USD. |

Summary

The Giant Whale ETH Position indicates a strategic play within the Ethereum market, featuring a significant 1011 short position that is currently reaping a floating profit of 1,139,000 USD. This robust position highlights the whale’s confidence in the market trajectory as they maintain a pronounced 15,000 ETH stake, valued at approximately 45.32 million USD. As the cryptocurrency environment evolves, the whale’s strategic moves may influence broader market trends, presenting both opportunities and risks to other traders.

Related: More from Market Analysis | Polymarket: Traders Bet $500M on US in Crypto Market | Related Box Test