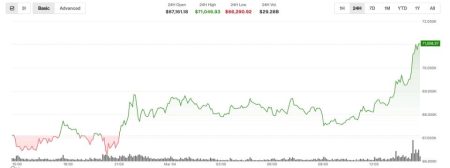

Giant whale BTC profits have made headlines as they reveal the intricate strategies employed by large-scale investors in the cryptocurrency market. Just recently, this particular whale executed a successful trade by reducing its position by 20 BTC, netting a substantial profit of $501,000 in a matter of minutes. According to BTC trading news from Odaily Planet Daily, the whale has strategically shorted BTC on four occasions since March 2025, accumulating an impressive profit of over $57.58 million this year alone. On-chain analysts closely monitor these whale movements, shedding light on potential trends and shifts in market dynamics. The giant whale currently holds 1,081.98 BTC in profitable short positions, with further limit buy orders placed at advantageous price points, indicating a keen interest in capitalizing on future market fluctuations.

In the world of cryptocurrency, large investors, often referred to as ‘whales,’ play a pivotal role in market movements, exemplified by the recent profits garnered from giant whale BTC transactions. This significant player in the Bitcoin market continues to implement strategic short positions, demonstrating effective risk management and market timing. As these whales engage in BTC trading, their activities are closely analyzed by on-chain specialists who seek to decode the signals behind their moves. Such analyses not only inform individual investors but also contribute to broader BTC market analysis and sentiment. The dynamic nature of whale trading and their resulting cryptocurrency profits underscores the need to stay informed about market trends and opportunities.

The Behavior of Giant Whales in BTC Trading

In recent months, the activity of giant whales in the BTC market has drawn significant attention from both traders and analysts. A notable example is a giant whale that has strategically capitalized on market movements by shorting BTC multiple times. Their recent position reduction by 20 BTC yielded an impressive profit of $501,000, showcasing the whale’s ability to navigate the volatile cryptocurrency landscape effectively. Monitoring such trades provides traders with valuable insights into market trends and potential patterns in BTC trading news, which are crucial for informed decision-making.

Whales often represent a substantial portion of cryptocurrency trading volume, and their decisions can significantly affect market dynamics. The on-chain analysis of prominent traders reveals that this whale has executed four successful short positions, accumulating profits exceeding $57.58 million this year alone. This emphasis on observing whale movements not only sheds light on individual trader behaviors but also highlights broader market trends. As more traders keep an eye on whale short positions, it’s important to understand how these activities influence overall BTC market sentiment.

Analyzing BTC Market Trends with On-Chain Analytics

On-chain analytics has become a vital tool for cryptocurrency investors seeking to decode the complexities of BTC trading. By examining transaction data, analysts can uncover patterns and potential opportunities for profit. In the case of the giant whale noted earlier, on-chain analysts like Ai Yi have been instrumental in tracking the fluctuating profits and strategies employed by large holders in the market. Such insights not only inform individual trading strategies but also guide market predictions and long-term investment decisions.

The landscape of BTC trading is ever-changing, with price movements often tied to large transactions from whales. These entities can significantly shift the market by either buying or selling substantial amounts of BTC, which can lead to fluctuations in price. With over $26.83 million still in profit from their short positions, this particular whale’s activities serve as a case study in strategic investment decisions. Traders looking to enhance their cryptocurrency profits should pay close attention to on-chain data and trends, which can provide foresight into potential market changes.

Whale Strategies: Limit Buy Orders and Their Implications

The recent actions of the giant whale, who has placed limit buy orders for 1,300 BTC in the price range of $67,244 to $67,844, indicate a tactical approach to market dynamics. Such strategies can reveal the whale’s sentiment regarding future price movements and signal potential support levels for BTC. Engaging in limit buy orders allows whales to accumulate positions at favorable prices while also indicating their confidence in a price rebound. These strategies contribute to the broader narrative of market psychology and can influence the trading behaviors of smaller investors.

Understanding the rationale behind large limit buy orders helps traders gauge market sentiments and anticipate movements in BTC prices. Whales often have access to advanced market insights, which enables them to make calculated decisions in their trading endeavors. By balancing short and long positions, such whales maintain a robust strategy that can maximize their gains while minimizing risks. As the market continues to evolve, smaller traders should monitor these strategies closely to refine their own approaches to navigating BTC trading.

The Importance of Following BTC Trading News

Staying updated with BTC trading news is crucial for anyone involved in the cryptocurrency market. Information regarding whale activities, market trends, and regulatory changes can significantly impact market conditions. Recent reports highlighting the giant whale’s profit-making strategies exemplify the value of timely news in shaping trading decisions. By analyzing such news, traders can adapt their strategies to align with prevailing market conditions, thus enhancing their potential for realizing profits.

Furthermore, promptly accessing BTC trading news equips investors with insights that can assist in timing their entries and exits in a volatile market. The ability to catch early signs of price movements, like those influenced by whale behaviors, can be the difference between a profitable trade and a loss. Therefore, incorporating reliable news sources into trading routines plays a fundamental role in achieving success in cryptocurrency trading.

Utilizing On-Chain Data for Better Trading Decisions

On-chain data analysis has emerged as an essential method for understanding the cryptocurrency market, particularly with respect to BTC trading. By examining transaction histories, volume changes, and the movements of large holders, traders gain critical insights into market signals. This approach helps identify potential entry points and the behavior of significant market players like whales. For instance, the recent analysis of the giant whale’s transactions has illuminated how strategic decisions can yield substantial profits, thereby offering a roadmap for aspiring traders.

The meticulous examination of on-chain data encourages a more empirical approach to trading, moving beyond mere speculation. Traders can use insights gained from analyzing whale activities to develop informed strategies that account for real-time market shifts. This level of awareness can lead to enhanced decision-making and increased profitability, highlighting the necessity of integrating on-chain analytics into trading systems.

Navigating Cryptocurrency Profits Through Strategic Trading

In the fast-paced world of cryptocurrency, attaining profitability often requires strategic trading informed by comprehensive market analysis. The case of the giant whale that was able to realize a profit of $501,000 serves as a focal point for understanding how calculated risks can lead to significant rewards. For traders aiming to increase their cryptocurrency profits, adopting a strategy that involves both on-chain analysis and attention to whale movements can prove beneficial. By studying these patterns, traders can develop strategies that mirror successful tactics employed by larger market players.

Moreover, managing one’s investment portfolio through diversification and monitoring various market signals is paramount in today’s trading environment. As demonstrated by the whale’s actions, maintaining a mix of long and short positions, while leveraging on-chain data analytics, can optimize trading outcomes. This holistic approach to cryptocurrency trading not only helps in achieving profitability but also fosters resilience in navigating the unpredictable pathways of the BTC market.

The Role of Whales in Influencing BTC Market Sentiment

It cannot be overstated how whales significantly influence BTC market sentiment. Their large-scale trading activities often trigger waves of reactions across the market, leading to rapid price changes. Traders closely observe these movements, understanding that a whale deciding to sell or buy can lead to a domino effect impacting the wider cryptocurrency ecosystem. The giant whale we discussed, with its sizable limits on both short and long positions, encapsulates the importance of whale actions in shaping overall market behavior.

Consequently, for smaller investors and traders, comprehending the motives behind whale transactions can be crucial for making informed trading calls. By following the strategies of major players, such as entering the market when accumulation signals are evident, traders can position themselves advantageously. Awareness of how whale actions affect sentiment enables traders to navigate the BTC market more effectively, ensuring they remain receptive to the fluctuations imposed by these powerful entities.

Key Insights from On-Chain Analysts on Whale Trading Patterns

On-chain analysts play a pivotal role in deciphering the complex trading patterns exhibited by whales in the BTC market. Through meticulous data assessment, they reveal the underlying strategies large holders employ to maximize their profits. Analysts like Ai Yi provide insights into the trading sequences of whales, effectively translating raw data into actionable intelligence for smaller traders. This transparency fosters a deeper understanding of market mechanics, empowering traders to make decisions based on empirical evidence rather than speculation.

Moreover, the insights from on-chain analytics extend beyond individual whales to encompass broader market trends. By aggregating data from multiple large holders, analysts can identify correlations and emerging patterns that reflect the overall sentiment in the market. Understanding these trends, especially in the context of recent whale short positions and their resultant profits, allows traders to cultivate robust strategies aimed at boosting their own cryptocurrency profits, demonstrating the intersecting impacts of on-chain analysis and market navigation.

Long-Term Implications of Whale Trading on BTC Markets

The actions of giant whales have long-term implications for the BTC markets that extend beyond immediate profit realizations. Their decisions to take short positions or to accumulate BTC can shape market psychology, influencing the decisions of other traders in both bullish and bearish circumstances. The recent movements of our highlighted whale, who has successfully garnered substantial profits, exemplify how the confidence displayed by a minority can dictate the broader market narrative.

Understanding these long-term behaviors is essential for strategizing within the cryptocurrency landscape. As whales continue to flex their influence, trailing their actions can provide traders with additional context for interpreting market shifts. By considering the longer game and acknowledging the weight of whale trading on BTC prices, traders can better prepare for potential shifts and prepare more resilient strategies for market participation.

Frequently Asked Questions

What are giant whale BTC profits and how are they realized?

Giant whale BTC profits refer to the substantial earnings made by large cryptocurrency investors, often by taking significant positions in Bitcoin. For example, a giant whale recently realized profits of $501,000 by reducing its position by 20 BTC. Such profits are achieved through strategic trading, including short positions and market analysis.

How do whale short positions impact BTC trading news?

Whale short positions are critical in BTC trading news as they can indicate market sentiment and potential price movements. A giant whale has shorted BTC multiple times, which can signal bearish trends. When such whales reduce their positions, it often leads to notable shifts in BTC prices and trading volumes, influencing overall market dynamics.

What insights can on-chain analysts provide about giant whale BTC profits?

On-chain analysts, like Ai Yi, offer valuable insights into giant whale BTC profits by tracking trading behavior and position changes. Their analysis shows how many profits a whale has accumulated; for instance, one whale amassed over $57.58 million in profits this year, providing context for market trends and trader strategies.

Why is BTC market analysis essential when assessing giant whale BTC profits?

BTC market analysis is essential for understanding the broader implications of giant whale BTC profits. By evaluating factors such as trading volume, price trends, and whale positioning, analysts can gauge potential market movements. The recent activities of whales, including a giant whale’s limit buy orders and current positions, significantly influence BTC’s market landscape.

How do cryptocurrency profits vary with whale trading strategies?

Cryptocurrency profits can vary widely based on the trading strategies employed by giant whales. For instance, a whale that has successfully reduced its BTC position while accumulating profits—over $26.83 million on current short positions—demonstrates a strategic approach that maximizes profits through market fluctuations and long-term analysis. Understanding these strategies is key for both small and large investors.

| Key Point | Details |

|---|---|

| Giant Whale BTC Position Reduction | The whale reduced its position by 20 BTC. |

| Realized Profit | The reduction resulted in a profit of $501,000. |

| Cumulative Profits since March 2025 | Total profits accumulated have exceeded $57.58 million. |

| Remaining BTC in Short Positions | The whale still has 1,081.98 BTC in short positions. |

| Profit from Remaining Short Positions | These positions remain profitable by $26.83 million. |

| Opening Price of Short Positions | The positions had an opening price of $111,499.3. |

| Financing Costs | Financing costs for the whale exceed $9.425 million. |

| Current Limit Buy Orders | Currently, the whale has placed limit buy orders for 1,300 BTC at $67,244 to $67,844. |

Summary

Giant whale BTC profits have reached extraordinary levels, showcasing the potential gains from strategic trading maneuvers in the cryptocurrency market. The recent activities of a giant whale, including a 20 BTC position reduction for a significant profit, illustrate not only the whale’s market influence but also serve as a case study for other investors. With cumulative profits exceeding $57.58 million and additional profitable short positions, this whale exemplifies the power of informed investment strategies in the volatile world of Bitcoin.

Related: More from Bitcoin News | JPMorgan: New Legis. Could Spark Bitcoin Growth | Bitcoin Fork Proposal Fails to Gain Support