The GENIUS Stablecoin Yield Rules are at the forefront of a significant debate within the cryptocurrency space, particularly as bipartisan senators work to reshape them under the advancing CLARITY Act. With the influence of banking lobbyists growing, proposed adjustments could redefine how yield is calculated for stablecoins, a critical aspect for many investors in this rapidly evolving market. The discussion has sparked controversy, especially among decentralized finance (DeFi) advocates who argue that stricter regulations may stifle innovation. In this climate of uncertainty surrounding crypto legislation, the delicate balance between fostering growth and ensuring consumer protection is crucial. As these developments unfold, the implications of the GENIUS Stablecoin Yield Rules will undoubtedly reverberate throughout the financial landscape, impacting everything from stablecoin regulations to investor confidence.

The ongoing review of the yield regulations for stablecurrency, particularly around the GENIUS framework, highlights the complexities facing lawmakers today. As the regulatory landscape shifts, particularly influenced by bipartisan cooperation, critical decisions are on the horizon that will affect the entire cryptocurrency ecosystem. Alternative structures focused on yield calculation are emerging, as senators evaluate proposals that could significantly alter the balance of power in the market. The advances in the CLARITY Act represent a pivotal moment in crypto governance, with stakeholders from various sectors keenly watching for adjustments that could either hinder or enhance the sector’s growth. Exploring the implications of such regulatory measures will help us understand the evolving nature of crypto and its future within the realm of finance.

Understanding the GENIUS Stablecoin Yield Rules

The GENIUS Stablecoin Yield Rules are critical in shaping how stablecoins operate within the financial ecosystem. These proposed regulations are currently being influenced by bipartisan discussions among senators who are weighing the banking lobby’s demands against the interests of decentralized finance (DeFi) advocates. As adjustments are being made to these rules, it remains essential to understand their implications for investors and the broader cryptocurrency market, particularly as they relate to yield generation through stablecoin investment.

By limiting stablecoin yields to certain phases, as proposed by Senator Alsobrooks, senators hope to address concerns surrounding the sustainability of these yields while also maintaining oversight. This could create a more stable environment for investors, but it might also deter innovation within DeFi, where yield offerings bring a much higher risk-reward ratio. As the legislative process unfolds, the final shape of the GENIUS Stablecoin Yield Rules will likely reflect a compromise between security and innovation.

Frequently Asked Questions

What changes are being proposed to the GENIUS Stablecoin Yield Rules under the CLARITY Act?

Bipartisan senators are proposing changes to the GENIUS Stablecoin Yield Rules, influenced by the banking lobby. These adjustments may include limiting stablecoin yields to specific trading phases or making it mandatory for only licensed institutions to offer such yields, aligning with the ongoing stablecoin regulations in the CLARITY Act.

How does the CLARITY Act impact GENIUS Stablecoin Yield Rules?

The CLARITY Act, currently under consideration, aims to provide a framework for stablecoin regulations that could directly affect the GENIUS Stablecoin Yield Rules. By defining yield parameters and licensing requirements, it seeks to stabilize the environment for stablecoins in the crypto market.

What is the DeFi controversy regarding the GENIUS Stablecoin Yield Rules?

The DeFi controversy surrounding the GENIUS Stablecoin Yield Rules stems from proposed regulations that may favor traditional banking institutions, restricting decentralized finance platforms from offering competitive yields, which could limit innovation in the DeFi sector.

Are the GENIUS Stablecoin Yield Rules likely to change before the CLARITY Act passes?

While discussions are ongoing, the potential for changes to the GENIUS Stablecoin Yield Rules exists, especially as bipartisan senators push to accommodate various interests before the CLARITY Act is finalized.

What role do bipartisan senators play in shaping GENIUS Stablecoin Yield Rules?

Bipartisan senators are crucial in shaping GENIUS Stablecoin Yield Rules as they work to balance the demands of the banking lobby with the needs of the crypto community, influencing the legislative process regarding stablecoin regulations.

How are institutions involved in the proposed adjustments to GENIUS Stablecoin Yield Rules?

Proposed adjustments to GENIUS Stablecoin Yield Rules suggest that only institutions with a bank license from the Office of the Comptroller of the Currency (OCC) may offer stablecoin yields, which could centralize control in the hands of traditional financial entities.

What impact will the proposed yield rules have on the future of stablecoins and crypto legislation?

The proposed adjustments to the GENIUS Stablecoin Yield Rules could significantly impact the future of stablecoins by creating a more regulated environment in crypto legislation, potentially enhancing consumer protection but also stifling innovation.

What can we expect from the forthcoming analysis of the GENIUS Stablecoin Yield Rules?

As the CLARITY Act is expected to advance, stakeholders can anticipate a thorough analysis of the GENIUS Stablecoin Yield Rules, which will provide more clarity on regulatory expectations and future stability in the crypto market.

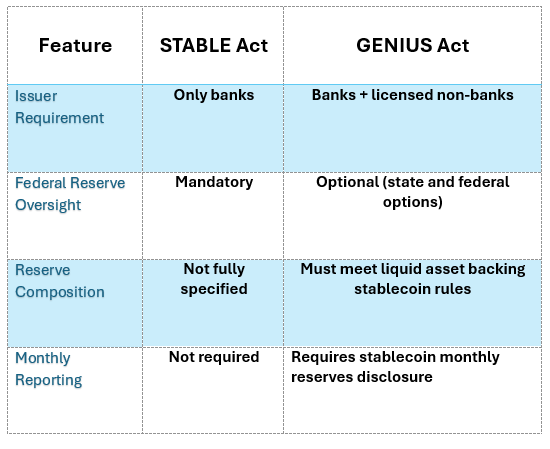

| Key Point | Details |

|---|---|

| Senate Adjustments | Bipartisan senators are considering changes to GENIUS Stablecoin Yield Rules. |

| Yield Limitation Proposal | A proposal from Senator Alsobrooks may limit yields to the trading phase. |

| Institutional Banking Requirement | Stablecoin yields may only be available to banks licensed by the OCC. |

| CLARITY Act Progress | Scott plans to submit a House version of the CLARITY Act to begin review. |

| Optimism on Bill Passage | Participants view the comments about bill passage as lighthearted rather than cynical. |

Summary

The GENIUS Stablecoin Yield Rules are currently under review by bipartisan senators who are leaning towards making adjustments based on industry lobbying. The potential modifications to these rules aim to either limit yields during the trading phase or require that only bank-licensed institutions can offer them, reflecting a split perspective within the crypto market. As the legislative process unfolds, particularly with the impending introduction of the CLARITY Act, the future of these yield rules appears dynamic and worth monitoring closely.

Related: More from DeFi & Stablecoins | Aixovia Burns 90,357,968 AIXDROP Tokens On-Chain Proof | Arthur Hayes Liquidates DeFi Tokens: A $3.48 Million Loss You Should See