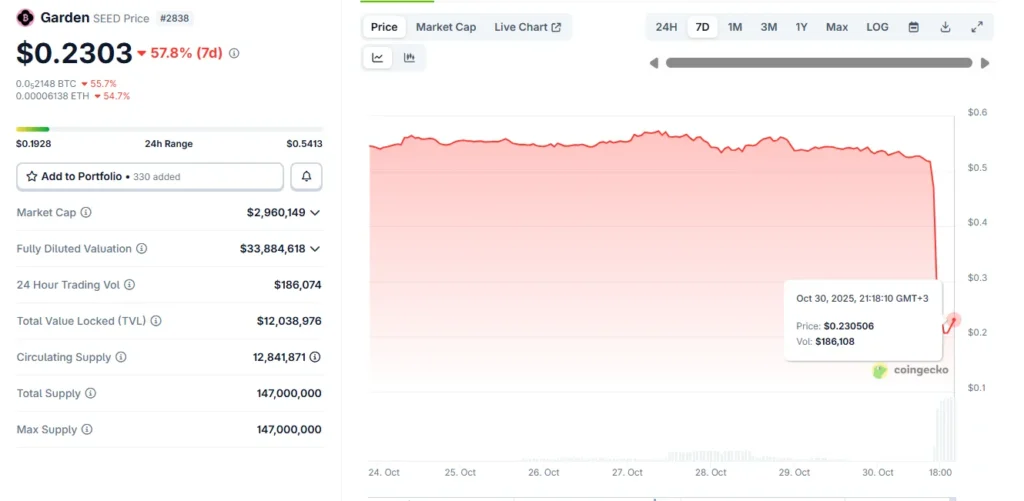

Garden Finance Exploit: Over $5.5M Stolen, 10% White Hat Bounty Announced

In a significant security breach, the decentralized finance (DeFi) platform Garden Finance was exploited, resulting in the loss of over $5.5 million. Following the incident, the platform’s response included the announcement of a 10% white hat bounty, an effort to recover the stolen funds and patch the system vulnerabilities.

What Happened?

The exploit, which occurred earlier this week, involved a complex attack on Garden Finance’s smart contract architecture. Reportedly, the attacker(s) managed to exploit loopholes in the smart contract code that handles the logic for token exchanges within the platform. As a result, they could illicitly withdraw funds repeatedly without the usual verification checks catching these unauthorized transactions.

Details of the Exploit

The exact technical specifics of the exploit have yet to be fully disclosed as investigations are ongoing. However, initial analyses suggest that the exploit was related to a reentrancy attack—a common attack vector in the DeFi space where a function can be forced to call an external, untrusted contract, which then calls back into the original function to execute it again before it finishes.

The Immediate Response

Garden Finance took immediate action upon discovering the breach. Their first steps were to pause affected contracts and disable certain functionalities to prevent further losses. They have since been conducting a detailed audit of their contract code and security protocols.

Implementing the White Hat Bounty

In a bid to rectify the situation and improve platform security, Garden Finance has announced a 10% white hat bounty. This bounty is aimed at ethical hackers who can help by identifying any further vulnerabilities in the system and aiding in the recovery of the stolen funds. The bounty, calculated from the total amount of funds exploited, reaches up to $550,000—a substantial incentive for white hat hackers to come forward and assist.

Industry Repercussions

The exploit at Garden Finance adds to a series of high-profile thefts in the cryptocurrency ecosystem, renewing concerns about the security of DeFi platforms. These platforms often run on open-source code that, while transparent and flexible, can also be vulnerable to sophisticated cyberattacks.

Future Steps for Garden Finance and DeFi Security

To prevent such incidents in the future, Garden Finance and other DeFi platforms may need to consider more rigorous security measures. These could include thorough audits by multiple independent security firms, fostering a more robust security culture, and setting up more substantial bug bounty programs to detect vulnerabilities before they are exploited maliciously.

Additionally, there is a pressing call within the community for improved standards and practices that can bolster trust and safety in DeFi investments. Enhanced user education about potential risks and the importance of security practices is also deemed crucial.

Conclusion

The exploit of Garden Finance is a stark reminder of the vulnerabilities in DeFi platforms and the continuous need for advancements in cybersecurity measures within the sector. The response with a white hat bounty is a step toward not only recovering the lost funds but also strengthening the overall security posture of the platform. As the DeFi landscape grows, it will undoubtedly face more such challenges, underscoring the importance of security, transparency, and user vigilance in protecting investments in this innovative, yet vulnerable digital finance frontier.