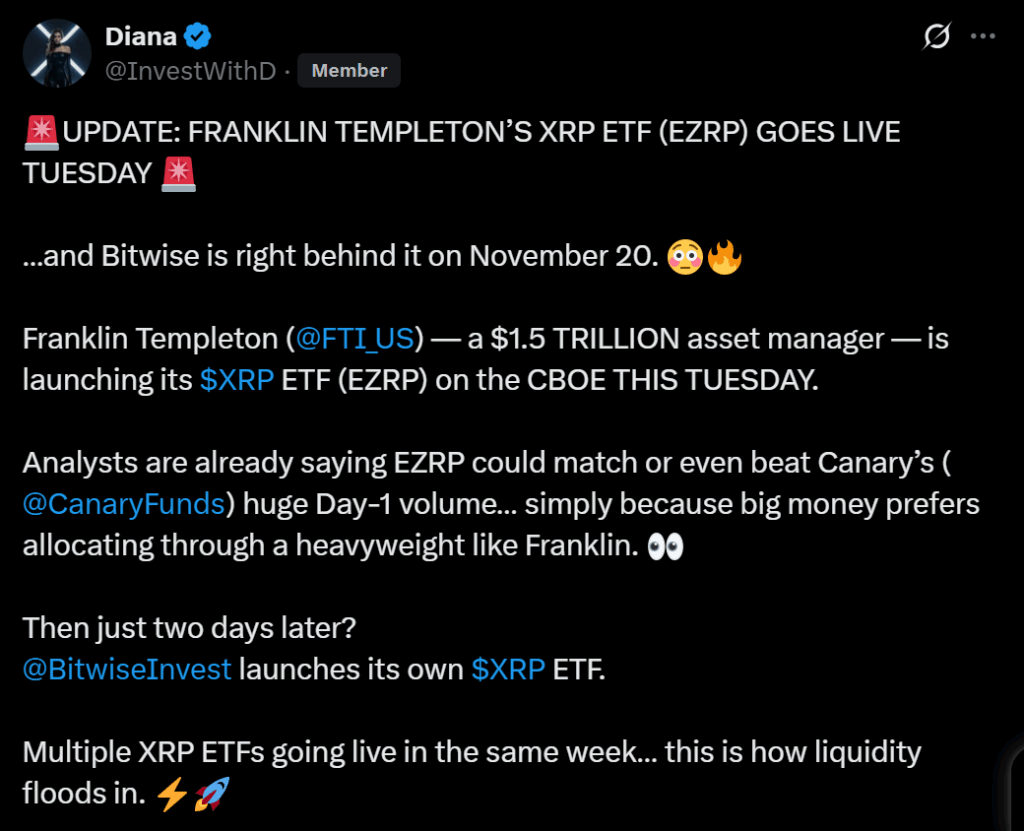

Franklin Templeton XRP ETF has recently garnered buzz in the financial world following its approval for listing on NYSE Arca. This significant milestone paves the way for the Franklin XRP Trust, which has submitted certification to the SEC, ensuring compliance with all required regulations. Enthusiasts can look forward to trading the ETF under the XRPZ code, prominently spotlighting it among cryptocurrency ETFs. Notably, Franklin Templeton has also revealed an attractive fee structure, offering an annual sponsorship rate of just 0.19% of the net asset value, which will be waived on the first $5 billion in assets up to May 31, 2026. As the market for XRP ETF listings grows, investors are eager to see how this innovative fund will perform in the dynamic landscape of digital assets.

In the rapidly evolving sphere of digital finance, the newly approved Franklin Templeton XRP ETF represents a pivotal development for investors keen on cryptocurrency exposure. Under the banner of the Franklin XRP Trust, this fund will take its place on the NYSE Arca exchange, making it accessible to a wide range of investors. The trading symbol XRPZ is set to become synonymous with this landmark ETF, which aims to blend traditional investment strategies with innovative cryptocurrency assets. With a competitive fee framework and an initial waiver for significant assets, this ETF signals Franklin Templeton’s commitment to pioneering investment solutions. As the cryptocurrency ETFs market expands, the emergence of such offerings opens new avenues for diversified portfolios.

Understanding Franklin Templeton’s XRP ETF

Franklin Templeton’s XRP ETF, officially designated as the Franklin XRP Trust, marks a significant milestone in the world of cryptocurrency investments. Approved for listing on NYSE Arca, this ETF brings a unique investment opportunity for both seasoned and novice investors interested in digital assets. With the growing interest in cryptocurrencies, the approval process signifies the increasing acceptance of these investment vehicles by regulatory bodies. Investors can expect the ETF to provide exposure to one of the leading cryptocurrencies, XRP, while also benefiting from the expertise of Franklin Templeton, a trusted name in asset management.

The launch of the Franklin Templeton XRP ETF not only represents a breakthrough for the company but also highlights the potential growth of cryptocurrency ETFs within the financial market. Unlike traditional securities, this ETF allows investors to gain exposure to XRP through a regulated and transparent structure, making it easier for them to navigate the often volatile cryptocurrency landscape. As such, the Franklin XRP Trust is poised to attract a diverse range of investors who are looking to leverage the potential gains in the cryptocurrency market.

The Importance of ETF Listings on NYSE Arca

The NYSE Arca has emerged as a leading platform for listing exchange-traded funds (ETFs), including Franklin Templeton’s XRP ETF. The exchange provides a reliable trading environment, which is crucial for investors looking to engage in the fast-paced cryptocurrency market. By listing on NYSE Arca, the Franklin XRP Trust is positioned to benefit from enhanced visibility and liquidity, potentially attracting more investors who may have previously been hesitant to explore crypto-based ETFs. The listing further bolsters the ETF’s credibility, streamlining the regulatory oversight process to ensure compliance with high operational standards.

Furthermore, the establishment of cryptocurrency ETFs, such as the one by Franklin Templeton, signals a broader acceptance of digital currencies in traditional finance. The NYSE Arca’s support in listing these funds is a step toward integrating cryptocurrency into mainstream investment portfolios, allowing retail and institutional investors alike to diversify their holdings without the complexities of direct crypto trading. This strategic move by Franklin Templeton not only showcases their innovative approach but also reinforces the trend of major financial institutions recognizing the potential of cryptocurrency investments.

Key Features of the Franklin XRP Trust ETF

The Franklin XRP Trust, designated under the trading code XRPZ, offers several attractive features for investors. One of the most notable aspects is the annual sponsorship fee of only 0.19% based on net asset value, which positions it competitively in the growing ETF market. Additionally, for the first $5 billion in assets, Franklin Templeton plans to waive this fee entirely until May 31, 2026, making it an appealing choice for early adopters looking to enter the cryptocurrency ETF space.

This fee structure not only incentivizes initial investment into the Franklin XRP Trust but also reflects the company’s commitment to fostering broad market participation in cryptocurrency. The accessibility and affordability of this ETF could significantly influence investor behavior by lowering the barriers to entry, ultimately driving interest and growth in the entire cryptocurrency ETF segment. With the potential for strong market performance complemented by lower costs, the Franklin XRP Trust stands to capture significant investor attention.

Navigating the SEC Certification Process for ETFs

Any ETF initiative, including Franklin Templeton’s XRP ETF, must undergo a rigorous certification process with the Securities and Exchange Commission (SEC) before launch. This process is crucial in ensuring that the fund meets strict regulatory standards that help protect investors’ interests. For Franklin Templeton, gaining SEC approval not only validates the integrity of the Franklin XRP Trust but also exemplifies the trustworthiness of the company as a responsible fund manager in the volatile cryptocurrency market.

Moreover, the SEC’s approval of the Franklin XRP Trust highlights the increasing acceptance of cryptocurrency-focused investment products in regulated marketplaces. As more ETFs gain certification, it signals a shift in the regulatory landscape towards embracing digital currencies. This development encourages other financial institutions to explore similar offerings, fostering competition and innovation within the industry. With the SEC’s endorsement, Franklin Templeton is well-positioned to take advantage of this momentum.

The Rise of Cryptocurrency ETFs

The emergence of cryptocurrency ETFs, like Franklin Templeton’s XRP Trust, marks a pivotal trend in the evolution of investment strategies. As digital currencies gain traction, investors are increasingly looking for convenient ways to gain exposure to this asset class without the complexities of direct cryptocurrency ownership. ETFs offer a vehicle that combines the simplicity of trading equities with the dynamic growth potential of cryptocurrencies, thus appealing to a wider investor base.

Furthermore, the ongoing development of cryptocurrency ETFs is indicative of a broader institutional shift toward acknowledging the role of digital assets in diversified portfolios. With the introduction of Franklin Templeton’s XRP ETF, which is set to be listed on NYSE Arca, investors can now consider an asset-backed approach to investing in cryptocurrencies. This trend is expected to continue growing, driven by the increasing public interest and institutional investment in digital currency markets.

The Future of Franklin Templeton XRP ETF

The future of the Franklin Templeton XRP ETF looks promising, as it opens up new paths for investors interested in entering the cryptocurrency market. As the fund gains traction and potentially reaches significant asset levels, Franklin Templeton’s ETF could become a benchmark for other cryptocurrency ETFs entering the market. With competitive fees and strong management backing, the ETF is positioned for substantial growth, benefiting from the ongoing adoption of cryptocurrencies in various investment strategies.

As institutional investors begin to further integrate digital assets into their portfolios, Franklin Templeton’s ETF may attract significant inflows. The combination of established trust in the Franklin Templeton brand, alongside the innovative nature of cryptocurrency investments, sets a precedent for future ETF offerings in this market. By continuously adapting to the evolving landscape of cryptocurrencies, the Franklin XRP Trust can remain relevant and appealing to both retail and institutional investors alike.

Impact of the Franklin XRP Trust on Market Sentiment

The introduction of the Franklin XRP Trust is likely to impact market sentiment surrounding not only XRP but the cryptocurrency sector as a whole. When a reputable financial institution like Franklin Templeton embraces digital assets through an ETF, it lends a level of credibility that can sway public perception and encourage more cautious investors to consider cryptocurrency options. This positive sentiment can lead to increased demand for XRP, reflecting on its market price as well.

Additionally, the Franklin XRP Trust’s entry into the market could act as a catalyst for other institutions to explore similar listings or investments in cryptocurrency funds, further enhancing overall investor confidence in the sector. As more regulated products come to the market, it paves the way for a more structured investment landscape, which can stabilize price fluctuations and contribute to the long-term growth of cryptocurrency investments.

How to Invest in the Franklin Templeton XRP ETF

Investing in the Franklin Templeton XRP ETF will be an accessible option for many investors looking to enter the cryptocurrency market through regulated channels. Given that the fund will be listed on NYSE Arca under the trading code XRPZ, investors can purchase shares through their brokerage accounts, similar to how they would with traditional stocks or ETFs. Understanding the mechanics of ETF trading is crucial for new investors, and they can easily find resources and guides online to assist them in making informed decisions.

Before investing, it’s essential for potential investors to conduct thorough research on the fund’s performance metrics, fees, and historical data related to XRP. Assessing individual risk tolerance and investment goals will also play a significant role in determining the right approach for including the Franklin XRP Trust in their portfolios. By leveraging this unique investment opportunity, investors can balance their overall strategy with exposure to one of the world’s leading cryptocurrencies.

Comparing the Franklin XRP Trust with Other Cryptocurrency ETFs

When considering ETF options in the cryptocurrency space, comparing the Franklin XRP Trust with other available products is crucial. While several cryptocurrency ETFs exist, each has distinct features and fee structures that may appeal to different investor profiles. The Franklin XRP Trust, with its low management fee and the temporary waiver on asset fees, presents an appealing option against competitors who may have higher cost structures or limited assets under management.

Investors must weigh factors such as fund performance, liquidity, and the underlying assets when comparing ETFs. The Franklin Templeton XRP ETF offers direct exposure to XRP, making it a distinct choice among crypto funds that may focus on broader cryptocurrency indices or different digital assets. Understanding these nuances can empower investors to make well-informed decisions that align with their financial objectives and risk tolerance.

Frequently Asked Questions

What is the Franklin Templeton XRP ETF?

The Franklin Templeton XRP ETF, officially named the Franklin XRP Trust, is a newly approved exchange-traded fund that focuses on XRP cryptocurrency. It will be listed on NYSE Arca, providing investors with a regulated way to gain exposure to XRP.

When will the Franklin XRP Trust be listed on NYSE Arca?

The Franklin XRP Trust is set to launch after receiving listing approval from NYSE Arca. The fund has submitted all necessary certification to the SEC, indicating a continuous progress towards its trading debut.

What is the trading code for the Franklin Templeton XRP ETF?

The Franklin Templeton XRP ETF will trade under the trading code XRPZ on NYSE Arca, allowing investors to easily identify and access this cryptocurrency ETF.

What are the management fees for the Franklin XRP Trust?

The Franklin XRP Trust will charge an annual sponsorship fee of 0.19% based on net asset value. However, Franklin Templeton has announced plans to waive this fee entirely for the first $5 billion in assets until May 31, 2026.

How does the approval of the Franklin Templeton XRP ETF impact cryptocurrency ETFs?

The approval of the Franklin Templeton XRP ETF signifies a pivotal moment for cryptocurrency ETFs, as it enhances legitimacy within the financial markets and opens doors for more institutional investment in cryptocurrencies like XRP.

What are the benefits of investing in the Franklin XRP Trust?

Investing in the Franklin XRP Trust allows investors to gain exposure to XRP within a regulated framework, supported by Franklin Templeton’s reputation. Additionally, the initial waiver of management fees adds to its appeal for early investors.

Where can I find more information about the Franklin Templeton XRP ETF listing?

More information about the Franklin Templeton XRP ETF can be found on official financial news websites, the NYSE Arca website, or directly from Franklin Templeton’s investor relations pages, which will provide updates regarding the ETF’s launch and performance.

What makes the Franklin Templeton XRP ETF different from other cryptocurrency ETFs?

The Franklin Templeton XRP ETF, or Franklin XRP Trust, distinguishes itself through its established management by Franklin Templeton, its competitive fee structure, and its regulatory approval, which enhances transparency and investor confidence compared to many other cryptocurrency ETFs.

| Key Point | Details |

|---|---|

| Approval Status | Received listing approval from NYSE Arca and submitted certification to the SEC. |

| ETF Name | Franklin XRP Trust |

| Trading Code | XRPZ |

| Annual Fee | 0.19% based on net asset value, waived for the first $5 billion in assets until May 31, 2026. |

Summary

Franklin Templeton XRP ETF has made significant strides in the financial market by securing listing approval from NYSE Arca. As the fund prepares for its launch, it offers investors an innovative opportunity through the Franklin XRP Trust, trading under the code XRPZ, with a competitive annual fee structure. This development positions the Franklin Templeton XRP ETF as a compelling option for those looking to invest in cutting-edge financial products.

Related: More from Altcoin News | ETH, SOL, XRP Surge 10%, Recovering War Losses in Altcoin | XRP Drops 10%, Ripple Tokens Future Uncertain in Altcoin