Franklin Templeton Eyes $700B Tokenization by 2030: A Gargantuan Shift in Asset Management

Franklin Templeton, a global leader in asset management, has set its sights on an ambitious goal to tokenize $700 billion of assets by 2030. This revolutionary move promises to redefine the landscape of financial investments, pushing the envelope on how assets ranging from real estate to intellectual property are managed and traded. Tokenization, in this context, refers to the conversion of ownership rights in a particular asset into a digital token on a blockchain.

Demystifying Tokenization

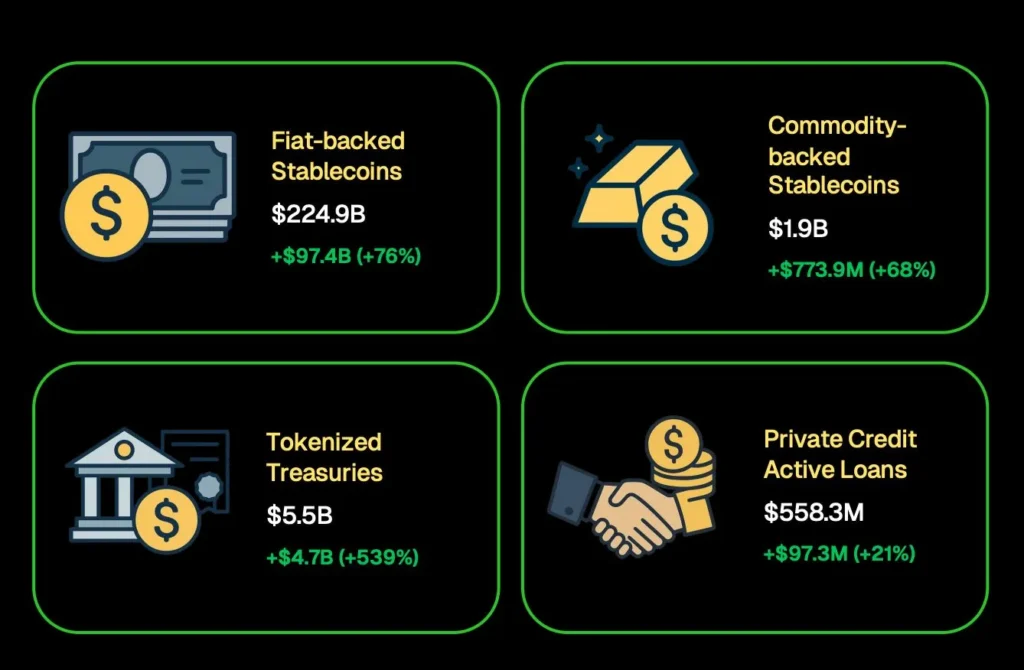

At its core, tokenization is about converting the value of tangible and intangible assets into tokens that can be traded on a blockchain platform. These tokens represent shares or ownership stakes in the assets, making it possible to buy and sell fractions of assets quickly and without the cumbersome paperwork traditionally involved. For investors, this means heightened access to previously illiquid assets, like fine art or private real estate, and the ability to adjust their investment portfolios in real time.

Why Franklin Templeton Is Betting Big on Tokenization

Franklin Templeton’s massive $700 billion tokenization forecast is not just a shot in the dark but a calculated move reflecting broader industry trends. With blockchain technology seeing increased adoption across various sectors, financial services are ripe for disruption. Tokenization offers a way to streamline processes, enhance transparency, and increase liquidity, all of which are key advantages in attractive investment management.

Financial regulators globally are beginning to warm up to the idea of tokenized assets as they start to understand how regulations can be applied to digital assets. Clearer guidelines from regulatory bodies like the SEC in the United States or the FCA in the UK are making it feasible for traditional finance institutions like Franklin Templeton to plan substantial investments into tokenized assets.

Implications for Investors and the Market

For retail and institutional investors, Franklin Templeton’s move could spell a new era of accessibility and opportunities. Small investors could benefit from being able to invest in high-value assets with smaller amounts of money, effectively democratizing more elite markets. On the other hand, institutional investors might find value in the enhanced liquidity and portfolio diversification options offered by digital tokens.

Furthermore, this initiative is likely to spur similar actions from other leading asset managers, potentially leading to a more inclusive and extensively digitized financial market.

Challenges Ahead

Despite the rosy picture, the road to $700 billion in tokenized assets is fraught with challenges. Chief among these is the need for a robust technological infrastructure capable of supporting massive, frequent trading volumes without compromising security or compliance. Additionally, while regulatory frameworks are evolving, there is still significant progress required for clear, universal guidelines concerning tokenized assets.

Conclusion

Franklin Templeton’s strategic push towards tokenizing a substantial portion of its managed assets by 2030 not only highlights the firm’s commitment to innovation but also signals a broader shift in the asset management industry. As technology and regulatory environments continue to evolve, the rise of tokenized assets could very well shape the future of investment, making it more accessible, efficient, and transparent. The success of this initiative will largely depend on collaborative efforts between regulators, technology providers, and traditional financial institutions continuing over the next decade.