In a recent announcement, the Federal Reserve Vice Chair indicated that the central bank’s balance sheet is set to continue shrinking in an orderly manner. This statement comes at a pivotal time as the Federal Reserve navigates through a post-pandemic economic landscape characterized by rising inflation and shifting monetary policies.

The Federal Reserve, which plays a crucial role in managing the U.S. economy, significantly expanded its balance sheet during the pandemic by purchasing large amounts of government securities and mortgage-backed assets to stabilize the financial system. This increase in assets was aimed at promoting economic recovery and ensuring liquidity. However, as the economy shows signs of recovery, the focus is shifting towards reducing these asset holdings to combat inflationary pressures.

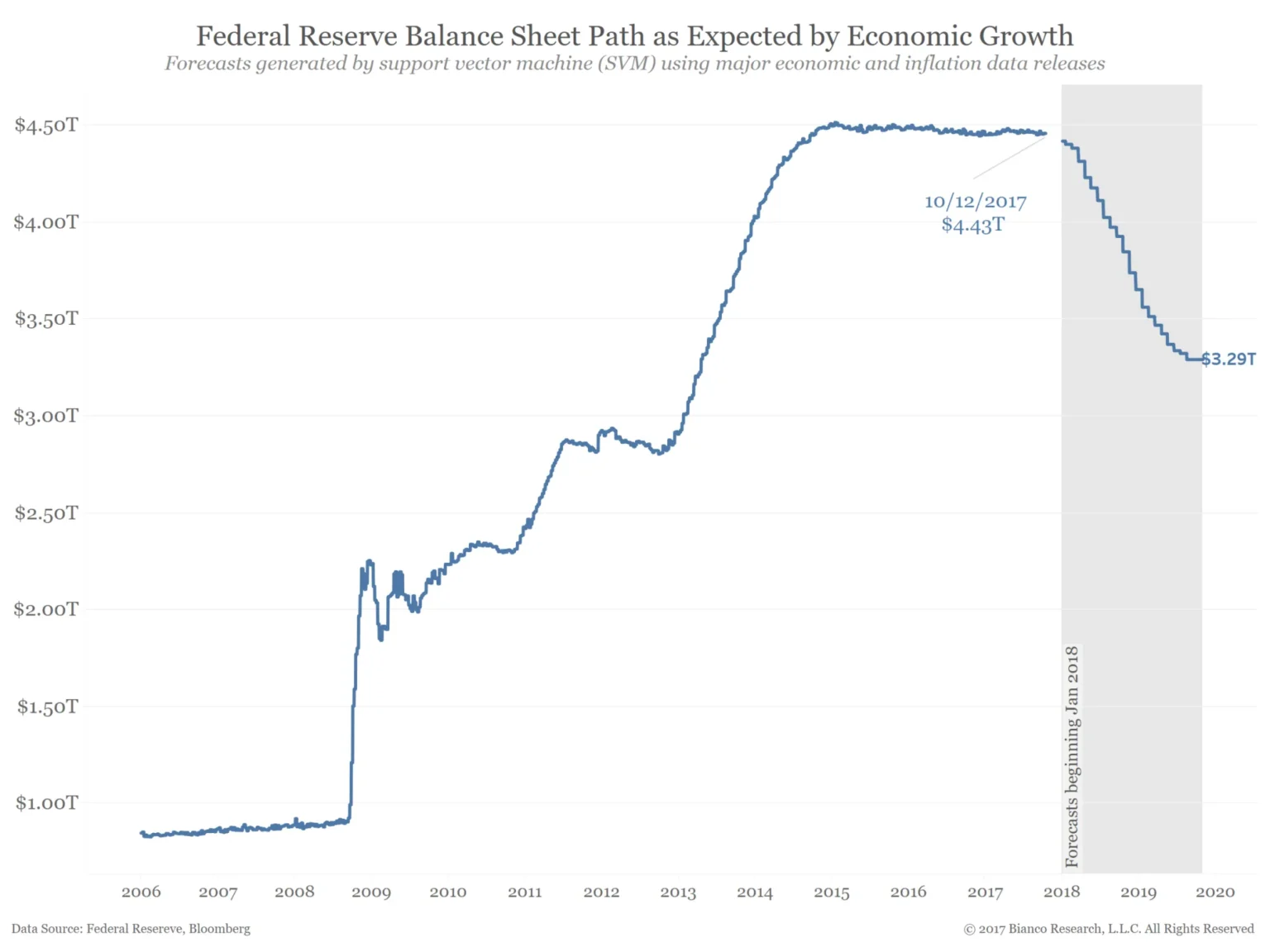

The Vice Chair emphasized that the reduction process will be gradual and systematic, allowing markets to adapt without causing undue disruptions. This measured approach reflects the Fed’s commitment to balancing its dual mandate of fostering maximum employment while maintaining price stability. By carefully shrinking its balance sheet, the Fed aims to unwind the extraordinary support it provided during the crisis while ensuring that economic growth remains on track.

Investors and analysts will be closely monitoring these developments, as the Fed’s actions have significant implications for interest rates and overall market conditions. As the balance sheet reduces, it is expected to influence borrowing costs and investment decisions across various sectors, ultimately shaping the economic outlook for the United States.