The Federal Reserve interest rate prediction has garnered significant attention as analysts anticipate a pivotal monetary policy meeting this week. Barclays foresees a reduction in interest rates by 25 basis points, setting the new range between 3.5% and 3.75%. This adjustment is part of a broader trend, with projections indicating that further rate cuts are on the horizon, particularly in March and June of 2024. Investors and economists alike will be keenly observing the post-meeting statement for hawkish language, hinting at a pause in the cutting cycle early next year. As the Federal Reserve reveals its updated economic projections summary, the dot plot predictions will provide critical insight into long-term interest rate trends, suggesting cuts could occur in 2026 and 2027 as well, maintaining a median forecast of 3% for years to come.

Predicting the trajectory of interest rates set by the central bank is crucial for understanding future economic conditions. Market analysts are closely watching the upcoming monetary decision, where experts from Barclays foresee a slight dip in rates, moving toward a more favorable lending environment. This shift could pave the way for potential interest rate reductions next year, particularly as new economic forecasts emerge from the Fed. As discussions around monetary tightening or loosening continue, the implications of the Fed’s dot plot projections will be significant for long-term borrowing rates. Investors and stakeholders are also interested in how the summary of economic projections will shape the financial landscape in the coming years.

Federal Reserve Interest Rate Prediction for 2024

The Federal Reserve interest rate prediction for 2024 is a focal point for economists and investors alike, especially with Barclays’ recent forecast suggesting a decrease of 25 basis points. This potential shift, bringing rates to about 3.5% to 3.75%, marks a significant move in the ongoing economic landscape. Given that the Fed’s decision-making is influenced by various macroeconomic factors, including inflation and employment levels, many financial analysts are closely monitoring these developments in anticipation of their implications for the broader market.

The economic projections summary revealed during the Federal Reserve’s upcoming monetary policy meeting will be critical. Investors will pay close attention to any indications of the Fed’s future interest rate trajectory. Barclays anticipates that this meeting will include hawkish language in its post-meeting statement, which may suggest a pause in any further rate cuts until January next year. This aligns with expectations for further reductions later in 2024, particularly in March and June, hinting at a cautious approach by the Fed in response to evolving economic conditions.

Barclays Rate Forecast and Interest Rate Cuts

Barclays has projected a cautious outlook for interest rate cuts in the coming months, aligning with the broader narratives in the financial sector. As the Fed prepares for its latest monetary policy meeting, the bank’s forecast indicates that a 25 basis point cut is highly probable. This proactive stance reflects Barclays’ confidence in the Fed’s ability to navigate the complexities of the current economic climate while aiming to stimulate growth without triggering excessive inflation.

As macroeconomic conditions continue to fluctuate, the potential for interest rate cuts in 2024 could be influenced by various factors, such as employment rates and consumer spending. Barclays expects the Fed may announce further cuts later in the year, specifically in March and June, as part of its strategy to maintain economic stability. The anticipation surrounding these cuts is bolstered by the hope that the economic projections summary will yield favorable insights into the overall health of the economy.

Economic Projections Summary Insights

The economic projections summary from the Federal Reserve is set to play a crucial role in shaping market expectations for 2024. As Barclays prepares for a 25 basis point cut this week, many are looking to how the Fed’s economic forecasts might evolve in light of current monetary trends. This summary provides crucial insights into the Fed’s outlook on unemployment, inflation, and GDP growth, which are essential for making informed investment decisions and adjusting monetary policy effectively.

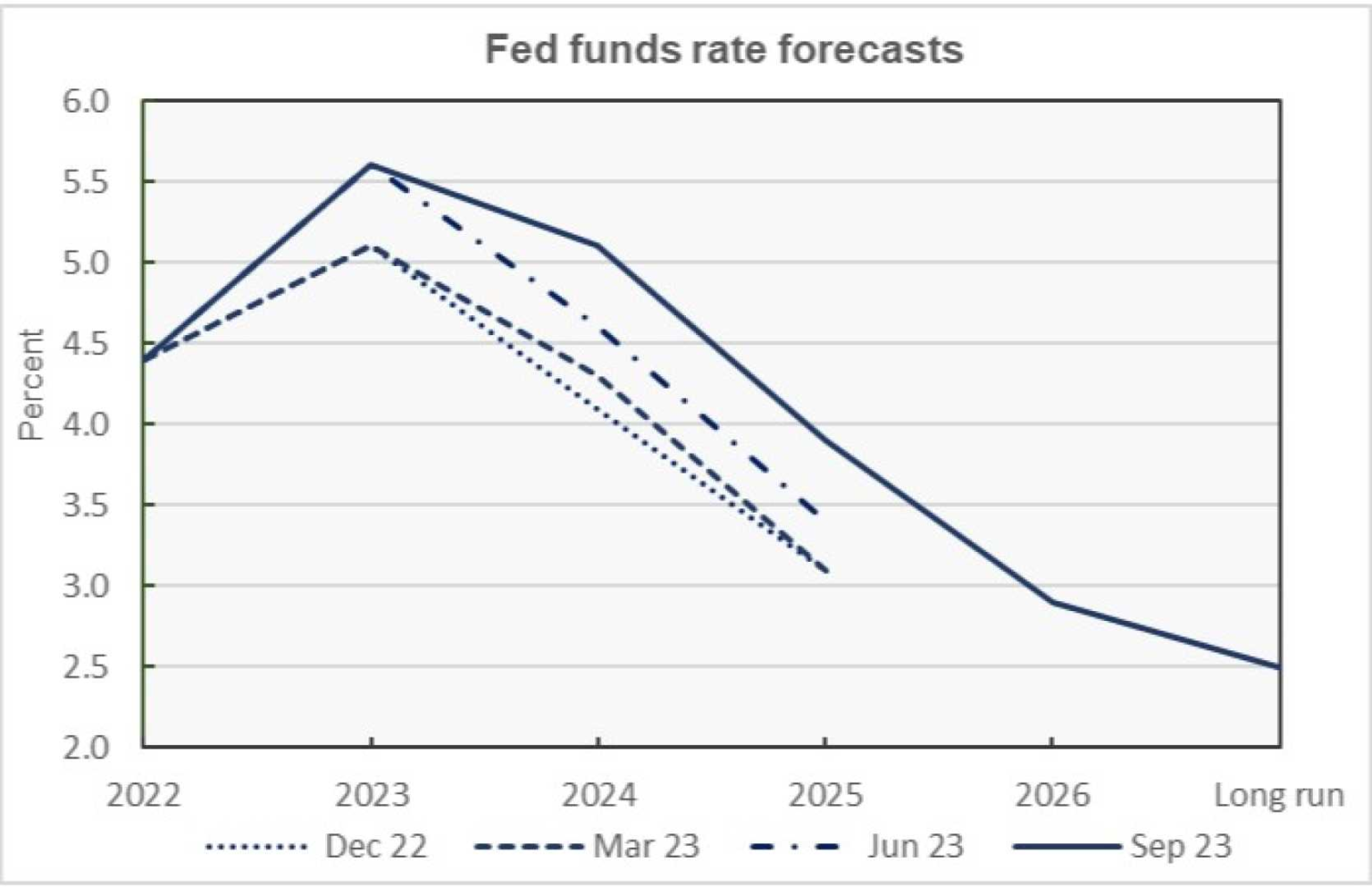

Analysts believe that the economic projections may show little change compared to previous announcements, indicating a stable outlook for the coming years. This stability can lead to greater confidence among investors, as a consistent economic forecast allows for easier planning and growth strategies. Furthermore, the Fed’s dot plot predictions, which suggest gradual rate cuts in 2026 and 2027, offer a long-term perspective that could impact investment strategies significantly.

Understanding Dot Plot Predictions

The dot plot predictions provide a visual representation of Federal Reserve officials’ forecasts regarding future interest rate trajectories. This tool has gained popularity for its straightforward depiction of where committee members believe rates will head in the coming years. Barclays acknowledges that understanding these predictions can lend insight into the dynamics shaping monetary policy. In the upcoming meetings, the dot plot is expected to reflect one rate cut each in 2026 and 2027, reinforcing the notion of a gradual easing of monetary policy.

Market participants will closely examine the dot plot as it provides clarity on the Fed’s long-term monetary policy intentions. While some investors may see this gradual approach as a sign of economic caution, others might interpret it as an opportunity to adjust their portfolios in anticipation of future rate cuts. In this context, Barclays’ insights are invaluable for investors looking to navigate the complexities of interest rate fluctuations and their implications for economic growth.

The Impact of Monetary Policy Meetings

Monetary policy meetings like the one expected this week are pivotal events for financial markets. Analysts and investors eagerly await the outcome and accompanying statements from the Federal Reserve, which can significantly influence investment strategies and market trends. Barclays’ forecast suggests that these meetings will increasingly play a role in overall market sentiment as the Fed navigates economic uncertainties and potential interest rate cuts.

These meetings also serve as an opportunity for the Fed to communicate its economic outlook and rationale behind interest rate decisions. The hawkish language anticipated in this week’s statement indicates a careful balancing act, as the Fed seeks to maintain confidence in economic growth while being responsive to inflationary pressures. How the Fed articulates its strategy during monetary policy meetings could determine market reactions and shape investor expectations for the year ahead.

The Future of Interest Rates and Economic Growth

As analysts envision the future of interest rates, attention turns to the relationship between monetary policy and economic growth. A reduction in interest rates can stimulate economic activity by encouraging borrowing and spending. Barclays’ expectation of rate cuts in early 2024 is positioned as a strategy to promote growth amid uncertainties in the economy. The prospect of lower rates is particularly appealing as it may spur investments across various sectors.

The ability of the Fed to balance rate cuts with economic growth is critical. If successful, these moves could pave the way for increased consumer confidence and spending. Conversely, failure to manage these cuts effectively could lead to inflationary pressures that might stifle growth. Therefore, the upcoming economic projections summary will be pivotal in assessing how the Fed plans to navigate these challenges and foster a stable economic environment in the years to come.

Investment Strategies Amid Changing Rates

In today’s dynamic economic environment, developing effective investment strategies is crucial as interest rates shift. With Barclays predicting rate cuts beginning in early 2024, investors must evaluate their portfolios and consider how these changes will influence different asset classes. Equities, fixed income, and alternative investments may react uniquely to adjustments in interest rates, making it essential to strategize accordingly.

Investors should also be wary of the potential short-term volatility that can arise from significant monetary policy changes. The anticipated cuts in March and June could lead to sporadic market movements as investors recalibrate their expectations. Evaluating economic indicators and the Fed’s communications—especially post-monetary policy meetings—will be critical for making informed decisions. By staying informed and adaptable, investors can leverage the opportunities that come with shifting rates.

Navigating Economic Uncertainties

The current economic landscape is marked by uncertainties, with factors such as inflation, labor market dynamics, and global economic pressures at play. Navigating these challenges requires a nuanced understanding of how monetary policy, particularly decisions made by the Federal Reserve, integrates into the broader economic context. Barclays’ insights into expected interest rate cuts provide a framework for anticipating shifts that could impact the economy and market performance.

In such an environment, businesses and investors alike must remain adaptable. Strategic planning that incorporates potential changes in monetary policy can mitigate risks associated with economic fluctuations. Engaging with consistent updates from the Fed—especially during monetary policy meetings—can offer invaluable data that inform strategic decisions moving forward. Understanding how these shifts align with long-term economic projections is key to maintaining resilience in times of uncertainty.

The Role of Interest Rates in Economic Stability

Interest rates play a fundamental role in maintaining economic stability by influencing borrowing costs, consumer spending, and investment decisions. With Barclays forecasting interest rate cuts, the implications for economic stability are significant. Lower interest rates typically encourage spending and borrowing, which can, in turn, stimulate economic growth. Understanding this dynamic is essential for policymakers and investors alike.

Moreover, the relationship between interest rates and economic stability is complex. While cuts can foster growth, they can also raise concerns about potential inflation if the economy overheats. Therefore, the Fed’s approach—especially in light of the upcoming monetary policy meetings and economic projections summary—will be critical in balancing these opposing forces. Keeping a pulse on interest rate strategies will help stakeholders navigate potential impacts on economic stability.

Conclusion: Future Directions in Monetary Policy

As we approach pivotal monetary policy meetings, the future directions in monetary policy remain a topic of discussion among economists and investors. With Barclays predicting interest rate cuts, understanding the implications of these changes is vital for anticipating economic trends. The Fed’s decisions can shape not just immediate market reactions, but also long-term economic outcomes, making these meetings crucial.

Ultimately, staying informed on developments from the Federal Reserve, particularly its economic projections summary and dot plot predictions, will equip stakeholders with the insights necessary to navigate the evolving landscape. By analyzing these factors, businesses and investors can better position themselves to adapt to shifts in monetary policy and capitalize on potential opportunities for growth.

Frequently Asked Questions

What is the latest Federal Reserve interest rate prediction according to Barclays?

Barclays predicts that the Federal Reserve will lower interest rates by 25 basis points to a range of 3.5% to 3.75% during this week’s monetary policy meeting.

How will the Federal Reserve’s monetary policy meeting affect interest rate cuts in 2024?

The upcoming monetary policy meeting is expected to set the stage for interest rate cuts in 2024, with Barclays forecasting rate reductions of 25 basis points in March and June of next year.

What does the economic projections summary indicate about future Federal Reserve interest rate predictions?

The economic projections summary may show minimal changes in economic forecasts; however, Barclays expects the dot plot predictions to reveal one rate cut each in 2026 and 2027.

What are the implications of the dot plot predictions regarding Federal Reserve interest rates?

The dot plot predictions indicate that the Federal Reserve is anticipated to implement one rate cut in both 2026 and 2027, with each cut expected to be 25 basis points.

Will the Federal Reserve’s statement after the interest rate decision be hawkish or dovish?

Barclays suggests that the post-meeting statement will likely include hawkish language, indicating a pause in rate cuts may occur in January next year.

What is Barclays’ forecast for long-term interest rates from the Federal Reserve?

Barclays maintains a median forecast for long-term interest rates to stay stable at 3%, reflecting ongoing conditions in the market.

What are the expectations for the Federal Reserve interest rate cuts in the near future?

In the near future, Barclays anticipates that the Federal Reserve will enact interest rate cuts of 25 basis points in March and June of 2024.

How do recent economic projections affect Federal Reserve interest rate predictions?

Recent economic projections are expected to have little impact on the overall forecast; however, they will provide context for future Federal Reserve interest rate predictions.

| Key Point | Details |

|---|---|

| Interest Rate Cut | Barclays predicts a 25 basis points reduction to a range of 3.5% to 3.75%. |

| Post-Meeting Statement | Expectations of hawkish language indicating a pause in rate cuts for January 2024. |

| Future Rate Cuts | Forecasts include additional cuts of 25 basis points in both March and June 2024. |

| Economic Projections | Little change anticipated in the economic forecasts within the new projections summary. |

| Dot Plot Projections | Indicates one rate cut each in 2026 and 2027, each being 25 basis points. |

| Long-term Interest Rates | The median forecast for long-term interest rates expected to remain at 3%. |

Summary

The Federal Reserve interest rate prediction indicates that a decrease in rates is expected this week, as Barclays forecasts a cut by 25 basis points to a range of 3.5% to 3.75%. This decision is expected to be coupled with a statement that may suggest a pause in further rate reductions in the upcoming months, particularly in January. Furthermore, forecasts point to additional cuts in the middle of next year, with stable long-term interest rates anticipated. Overall, the outlook presented by Barclays reflects a cautious approach to monetary policy while considering prevalent economic conditions.