The anticipation surrounding a Federal Reserve interest rate cut has become a central theme in recent economic discussions. As Bank of America highlights, many analysts are aligning their outlooks with the market’s growing expectations for a potential January interest rate cut. This pivotal moment could significantly influence interest rate predictions and market stability moving forward. With the latest Federal Reserve news circulating, investors and consumers alike are keenly aware of the implications this may hold for borrowing costs and economic growth. Understanding the factors at play will be crucial for those looking to navigate the financial landscape in 2023.

In the context of monetary policy, the concept of slashing interest rates by the Federal Reserve is garnering considerable attention. As speculations increase regarding shifts in lending rates, many financial institutions, including Bank of America, are analyzing upcoming trends and predictions. The forthcoming adjustments, which may unfold as early as January, are pivotal in shaping market sentiment and investment strategies. Keeping an eye on these developments is essential for those who seek to capitalize on potential opportunities or safeguard their assets against economic fluctuations. Moreover, discussions surrounding the central bank’s strategies are more pertinent than ever for informed decision-making.

Understanding the Federal Reserve Interest Rate Cut

The Federal Reserve interest rate cut is anticipated to have significant impacts on both the economy and the markets. Bank of America has highlighted that the financial markets are preparing for this potential shift as they evaluate the implications of lowered borrowing costs on economic growth. This interest rate cut could stimulate increased consumer spending and investment, which are critical components of economic expansion.

Interest rate predictions surrounding the Federal Reserve’s decisions are closely monitored by economists and investors alike. As speculation builds regarding a January interest rate cut, it becomes essential to analyze how such changes historically affect market trends and investor sentiment. Lower interest rates typically correlate with increased market activity as businesses and consumers gain access to cheaper loans.

Bank of America Outlook on Interest Rates

Bank of America’s outlook suggests that a Federal Reserve interest rate cut could be viewed as a proactive measure to support an economy facing potential challenges. Analysts at Bank of America are closely watching indicators such as inflation rates and employment figures to gauge the optimal timing for this anticipated cut. Such a strategic move could align with the overall economic conditions, allowing the Fed to navigate potential downturns more effectively.

The bank’s analysis of upcoming Federal Reserve news indicates that market expectations are shifting as investors adjust their strategies in response to the possibility of rate changes. Should the Fed announce an interest rate cut in January, it would likely validate the market’s anticipations and could lead to a surge in stock prices as companies begin to capitalize on lower financing costs.

Market Expectations Countered by Federal Reserve Actions

Market expectations regarding interest rates are ever-changing, and often reflect broader economic sentiment. As Bank of America provides insights into potential shifts in monetary policy, investors remain cautious yet optimistic about the prospects of a January interest rate cut. Economic forecasts and market analyses help shape these expectations, guiding investment strategies across various sectors.

The response to Federal Reserve actions is typically immediate and multifaceted. If an interest rate cut is announced, it may boost stock markets but could also raise concerns about long-term inflation or financial stability. Hence, understanding the balance between market expectations and the Federal Reserve’s policy decisions is crucial for stakeholders aiming to make informed investments.

Implications of a January Interest Rate Cut

A January interest rate cut by the Federal Reserve could have wide-ranging implications for consumers and businesses alike. For consumers, lower interest rates might translate into cheaper mortgages and loans, encouraging spending in other areas of the economy. This uptick in consumer confidence can lead to a more vibrant economic environment, propelling growth in various sectors.

Businesses may also benefit from reduced borrowing costs, paving the way for increased capital investment and hiring. Bank of America estimates that an economic uptick resulting from a successful interest rate cut could lead to a more robust job market, enhancing overall economic indicators that investors watch closely.

Analyzing Interest Rate Predictions for 2024

Interest rate predictions for 2024 will play a crucial role in shaping the economic landscape for the coming year. As the Federal Reserve prepares to make decisions that could influence the trajectory of the economy, the market is keenly attuned to these forecasts. Bank of America emphasizes the importance of staying informed about potential rate adjustments and their anticipated effects on various financial instruments.

In light of recent economic data, analysts are evaluating how the Federal Reserve’s policy decisions will unfold next year. Investors are advised to remain agile and prepared for shifts in interest rate predictions that may arise, potentially recalibrating their portfolios in response to the Federal Reserve’s evolving stance.

The Role of the Federal Reserve in Economic Stability

The Federal Reserve plays a critical role in maintaining economic stability through its monetary policy decisions, including interest rate adjustments. As Bank of America outlines, the anticipation of an interest rate cut can signal the Fed’s responsiveness to changing economic conditions. Such proactive measures are aimed at fostering sustainable growth and preventing economic downturns.

Understanding the Federal Reserve’s influence on interest rates helps consumers and investors appreciate the broader economic context. In the face of uncertainty, the Fed’s ability to manage interest rates can provide the necessary support for economic stability, ensuring that growth remains steady amid fluctuating market conditions.

How Economic Indicators Influence Interest Rate Decisions

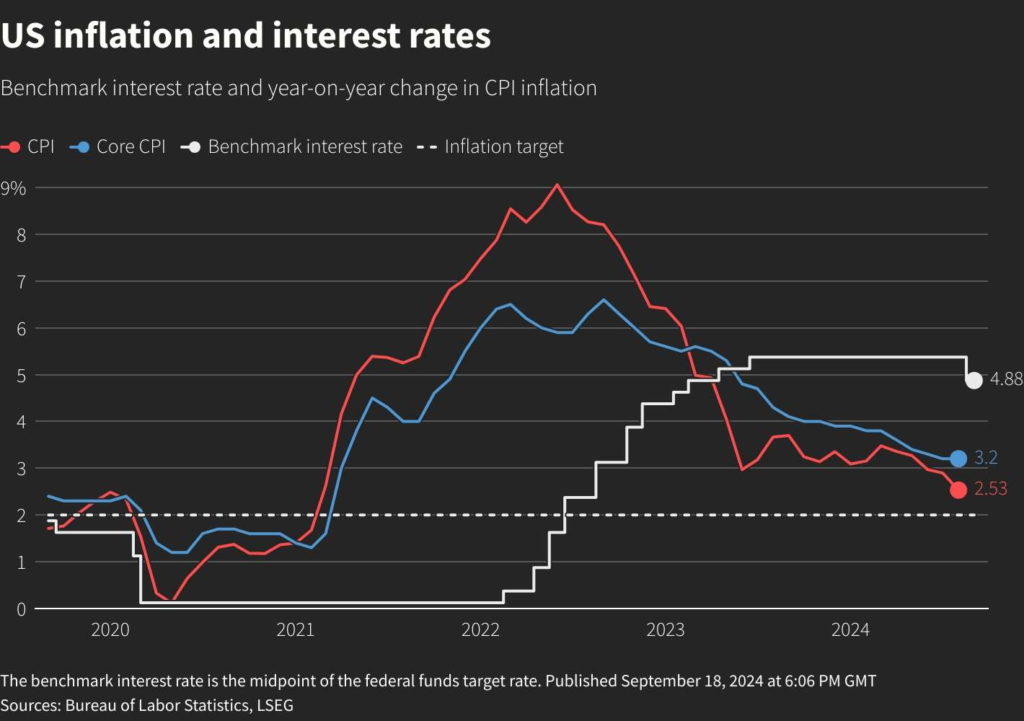

Economic indicators play a pivotal role in the Federal Reserve’s decision-making process regarding interest rates. Key metrics such as inflation, unemployment, and GDP growth are closely monitored by the Fed when considering potential interest rate changes. As highlighted in Bank of America’s analysis, these indicators can lead to varied predictions about future interest rate movements.

The interconnectedness of these indicators and their impact on monetary policy underscores the complexity of economic forecasting. Investors, therefore, must remain vigilant in assessing how changes in these indicators could influence the Federal Reserve’s actions, particularly as January approaches with its speculative environment surrounding interest rate cuts.

The Relationship Between Interest Rates and Market Reactions

The relationship between interest rates and market reactions is often pronounced, especially in the context of the Federal Reserve’s decisions. When the Fed cuts interest rates, markets typically respond favorably as borrowing costs decrease, allowing for increased investment and consumer spending. Bank of America emphasizes this direct correlation, illustrating how changes in interest rates can lead to shifts in market dynamics.

Conversely, the anticipation of a rate cut can create a preemptive rally in the markets as investors position themselves for potential gains. Understanding this phenomenon is crucial for those looking to navigate the intricacies of market fluctuations resulting from Federal Reserve news and interest rate predictions.

Financial Strategies in Anticipation of Interest Rate Changes

As the market gears up for the potential impact of a Federal Reserve interest rate cut, investors are urged to adopt strategic financial approaches. Bank of America advises integrating flexibility into investment strategies, given the uncertainty surrounding market reactions to interest rate changes. Forms of investment such as bonds may become more attractive as rates drop, suggesting a shift in allocation might be warranted.

Furthermore, diversification remains key in navigating these changes effectively. Investors should consider a wide array of asset classes to guard against volatility and prepare for the economic shifts that a January interest rate cut could usher in. Awareness and preparedness allow investors to respond swiftly and capitalize on potential opportunities presented by changing interest rates.

Frequently Asked Questions

What is the current outlook from Bank of America regarding the Federal Reserve interest rate cut?

Bank of America has indicated that market expectations are aligning with a potential Federal Reserve interest rate cut in January. This outlook reflects a broader sentiment among analysts and investors considering the economic conditions.

How do interest rate predictions influence market expectations for the Federal Reserve interest rate cut?

Interest rate predictions are crucial as they shape market expectations surrounding the Federal Reserve interest rate cut. If analysts forecast a decrease, market participants may react by adjusting their investment strategies and anticipating changes in monetary policy.

What recent Federal Reserve news suggests a possible interest rate cut in January?

Recent Federal Reserve news has highlighted economic indicators that support the hypothesis of an interest rate cut in January. Analysts are monitoring inflation rates and employment figures, which may prompt the Federal Reserve to lower rates to stimulate economic growth.

When is the expected timing for the January interest rate cut by the Federal Reserve?

The January interest rate cut by the Federal Reserve is anticipated based on current economic indicators and Bank of America’s outlook. While the exact timing will depend on forthcoming economic data, analysts believe the cut could happen early in the month.

How do market expectations change with news about the Federal Reserve interest rate cut?

Market expectations can shift significantly with news regarding the Federal Reserve interest rate cut. Positive data that suggests an imminent cut can lead to increased market confidence, resulting in rising stock prices as investors anticipate lower borrowing costs.

| Key Points |

|---|

| Bank of America anticipates an adjustment in market expectations regarding the Federal Reserve’s interest rate. |

Summary

The Federal Reserve interest rate cut is expected to be a significant market mover, as analysts like Bank of America suggest that the market will soon adapt to these new expectations. This potential cut in interest rates may influence economic activities and investment decisions, making it a crucial topic for investors and economists alike.