The recent Federal Reserve interest rate cut discussions have ignited significant interest among economists and investors alike. As we approach December 2025, the market is buzzing with an 84.9% probability of a 25 basis point reduction in interest rates, according to CME FedWatch updates. This potential adjustment comes as part of a broader analysis of the 2025 economic outlook, reflecting the Federal Reserve’s careful decisions amid fluctuating economic conditions. Moreover, the landscape suggests a cumulative chance that rates could be cut further, with projections indicating a 66.4% likelihood by January. Such developments raise pivotal questions about the impact on financial markets, consumer spending, and overall economic growth in the coming months.

In light of anticipated monetary policy shifts, discussions around the Federal Reserve’s potential easing of credit conditions are gaining traction. The outlook for interest rates in December 2025 points towards a noteworthy possibility of rate reductions, prompting analysis among financial experts. Observing the updates from CME’s FedWatch reveals compelling trends regarding the probability of interest rate adjustments, as analysts consider the implications for the economy. With a keen focus on the upcoming Federal Reserve meetings and economic indicators, stakeholders are keenly observing how these decisions might shape the financial landscape and influence consumer confidence moving forward.

The Current State of Interest Rates Ahead of December 2025

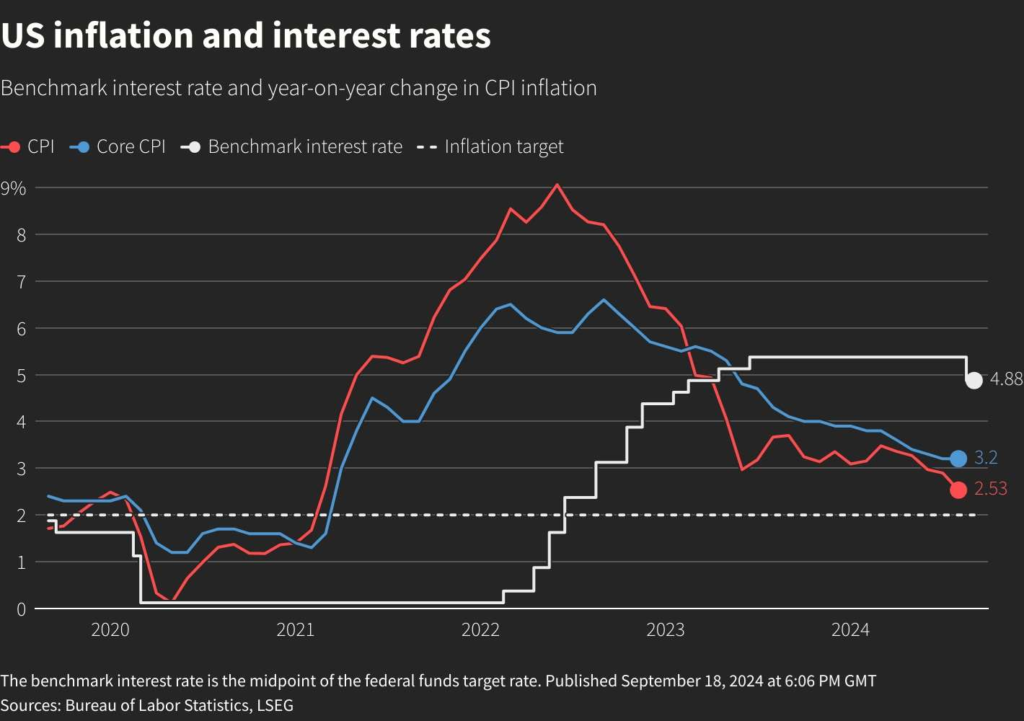

As we approach December 2025, the landscape of interest rates is shaping up to be pivotal for economic stakeholders. Recent data, particularly from the CME FedWatch tool, indicates a significant probability—a striking 84.9%—that the Federal Reserve will implement a 25 basis points interest rate cut. This anticipated decision follows an ongoing assessment of economic conditions, which has shown signs of slowing growth and decreasing inflationary pressures. For borrowers and investors, the implications are twofold: lower interest rates could lead to cheaper loans and boost spending, while also affecting savings yields.

The Federal Reserve’s decisions on interest rates are central to the economy’s health, directly influencing everything from mortgage rates to business investment. As outlined in various economic forecasts, the projected interest rates in December 2025 will not only impact immediate financial decisions but also the 2025 economic outlook as a whole. If the Fed cuts rates as anticipated, it may create a stimulating environment for economic growth—one that could counteract recessionary fears and encourage consumer confidence.

CME FedWatch Updates Point to Potential Rate Cuts

The CME FedWatch tool has been closely monitored by market analysts as it provides valuable insights into the likelihood of future rate changes by the Federal Reserve. The current data suggests a robust 84.9% probability of a 25 basis point cut in December 2025, aligning with broad market expectations that consider various economic indicators. This metric reflects not just the collective sentiment of traders regarding monetary policy but also serves as a forecasting tool for assessing economists’ projections around interest rates moving forward.

As we analyze the broader implications of these predictions, it’s essential to consider the potential ripple effects on the economy. With a cumulative probability of 66.4% indicating further cuts might occur by January of the following year, the landscape for interest rates appears dynamic. Stakeholders must stay informed on these CME updates, as shifts in Federal Reserve policy can significantly alter both the investment landscape and consumer financial planning.

Impact of Federal Reserve Decisions on the Economy

Federal Reserve decisions regarding interest rates play a fundamental role in shaping economic conditions. The probability of rate cuts as suggested by current forecasts reflects underlying economic challenges. With the Fed likely to cut rates by 25 basis points in December, a supportive monetary policy stance could facilitate borrowing and spending, essential for stimulating economic growth. Analysts are keenly observing these developments, given the Fed’s historical tendency to adjust rates in response to inflation and unemployment levels.

Looking ahead to the 2025 economic outlook, the anticipated rate cuts could spur significant changes in consumer behavior and business investments. Lower interest rates typically lead to increased spending by households and companies alike, potentially resulting in a revitalized economy compared to the sluggish trends observed in recent months. However, the effectiveness of these cuts will ultimately depend on various external factors, including global economic conditions and domestic confidence levels.

Understanding the Probability of Rate Cuts in Late 2025

As we gauge the future of interest rates, understanding the probability factors surrounding Federal Reserve cuts is crucial. With an 84.9% likelihood of a 25 basis point reduction this December, it’s clear that market sentiment is leaning towards easing monetary policy. Such probabilities are not mere speculation; they are grounded in economic data and trends. As the months progress, these probabilities evolve, reflecting the Fed’s assessments of economic stability and growth prospects.

Market participants—ranging from individual investors to large financial institutions—are closely observing these probabilities as they prepare for upcoming financial opportunities. If the Federal Reserve does proceed with the anticipated cuts, it may not only alleviate some financial burdens on consumers but also pave the way for a resurgence in economic growth. Therefore, keeping an eye on the shifting probabilities surrounding rate cuts is essential for making informed financial decisions.

The 2025 Economic Outlook: What Comes Next?

The outlook for the economy in 2025 is fraught with both challenges and opportunities as anticipated Federal Reserve rate cuts loom on the horizon. Following recent patterns, a 25 basis points reduction could signal a shift in monetary policy aimed at spurring economic activity. The interplay between interest rates and inflation is a key concern for economists, and the decisions made by the Federal Reserve will be instrumental in shaping the economic landscape for the coming year.

With the current probability trends forecasting substantial cuts, businesses and consumers alike should prepare for a potential economic revival. Cheaper borrowing costs could encourage spending, enhancing demand across several sectors. However, stakeholders must also remain vigilant about inflation, as a delicate balance will need to be maintained to ensure sustainable economic growth in 2025.

Decoding Federal Reserve’s Approach to Interest Rates

The Federal Reserve’s approach to managing interest rates involves careful consideration and foresight, particularly as we approach late 2025. A 25 basis points cut in December seems probable, driven by the need to combat slowing economic growth and mitigate pressures on consumers. The Fed’s nuanced strategy focuses on adapting to current economic conditions, aiming to foster a stable financial environment while ensuring inflation remains under control.

As the market reacts to these anticipated cuts, it is essential for individuals and businesses to understand the Federal Reserve’s rationale. Decisions made by the Fed are not taken lightly; extensive analysis of economic indicators informs their strategy. As economic conditions evolve, so too will the decisions surrounding interest rates, underscoring the importance of staying informed about the Federal Reserve’s outlook and its implications for future monetary policy.

Anticipated Economic Changes Following Rate Cuts

In anticipation of the forthcoming Federal Reserve interest rate cuts, analysts are forecasting significant shifts in the economic landscape. With an 84.9% probability of a 25 basis points cut in December, the implications for consumer behavior and business investments are profound. Lower interest rates typically encourage borrowing, leading to higher consumer spending, which can rejuvenate sluggish sectors of the economy.

As we look towards January 2026, where the cumulative probability of further cuts reaches 66.4%, the potential for transformative economic conditions becomes increasingly apparent. The resulting environment may not only ease financial pressures on households but could stimulate business confidence and investment—a vital part of the economic recovery. Therefore, monitoring these changes will provide insights into how the 2025 economic outlook evolves post-rate adjustments.

Key Considerations for Investors in a Changing Rate Environment

For investors, the potential of a Federal Reserve interest rate cut invites strategic recalibrations in portfolios. With a projected 84.9% chance of a 25 basis points cut, understanding how this shift impacts investment choices is critical. Lower interest rates typically correlate with increased stock market activity, as borrowing becomes cheaper for companies looking to expand or innovate. As the January deadline approaches, investors should be vigilant in their analysis of interest rate trends.

Moreover, with a cumulative cut probability heightening at 66.4%, the market dynamics could pivot accordingly. Investors may want to consider sectors that historically benefit from lower interest rates, such as real estate or consumer goods, which frequently respond positively to increased consumer spending power. Careful assessment of the broader economic indicators, in line with Federal Reserve decisions, will guide investors in making strategic decisions moving forward.

Staying Informed with CME FedWatch and Economic Predictions

As we navigate the complexities of economic forecasts, tools like CME FedWatch are invaluable for understanding Federal Reserve interest rate predictions. The platform not only depicts probabilities of upcoming rate cuts but also offers insights into market sentiment based on expectations for future economic conditions. As of now, with an 84.9% likelihood of a 25 basis point cut in December, staying updated on these metrics is crucial for stakeholders at all levels.

The evolving probabilities reflected in CME updates serve as indicators of how markets may respond to changes in monetary policy. Investors and borrowers should recognize the importance of being proactive rather than reactive. By staying informed about potential shifts in interest rates, individuals and organizations can better prepare for the implications on their financial strategies and overall economic decisions.

Frequently Asked Questions

What is the current probability of a Federal Reserve interest rate cut in December 2025?

As of November 26, 2025, there is an 84.9% probability that the Federal Reserve will cut interest rates by 25 basis points in December 2025, according to CME FedWatch updates.

How do CME FedWatch updates influence expectations for Federal Reserve interest rate cuts?

CME FedWatch updates reflect market expectations for the Federal Reserve’s interest rate decisions. For December 2025, the updates show an 84.9% probability of a 25 basis point rate cut, guiding investors and economists in their assessments of the 2025 economic outlook.

What does a 66.4% probability of rate cuts by January indicate about the Federal Reserve’s future decisions?

The 66.4% probability of the Federal Reserve cutting interest rates by 25 basis points by January indicates a strong market expectation for easing monetary policy, which may reflect economic conditions influencing the Federal Reserve’s decisions.

How might the Federal Reserve’s interest rate cuts affect the 2025 economic outlook?

The anticipated Federal Reserve interest rate cuts are likely to stimulate economic growth by lowering borrowing costs, which can enhance consumer spending and investment, thereby positively affecting the 2025 economic outlook.

What should I know about the chance of the Federal Reserve maintaining interest rates through December 2025?

Currently, there is a 15.1% chance that the Federal Reserve will maintain interest rates at their current level in December 2025, highlighting a significant expectation for a rate cut in the financial markets.

| Rate Change | Probability |

|---|---|

| Cut by 25 basis points | 84.9% |

| Keeping rates unchanged | 15.1% |

| Cumulative cut by 25 basis points by January | 66.4% |

| Maintaining current rate | 11.1% |

| Cumulative cut of 50 basis points | 22.6% |

Summary

The Federal Reserve interest rate cut is likely, with an 84.9% chance of a 25 basis points reduction in December. Recent data indicates that there is a significant probability of further rate adjustments in the first few months of the next year, highlighting the Fed’s adaptability to economic conditions. Investors and market watchers should stay tuned to subsequent announcements as these can greatly influence economic stability.