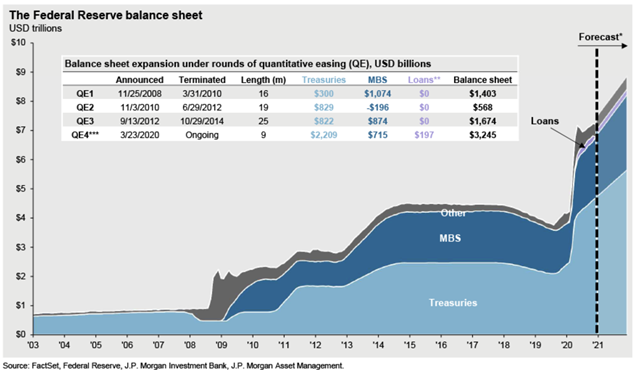

In recent discussions surrounding the Federal Reserve balance sheet expansion, market participants are closely monitoring potential shifts in the central bank’s monetary policy. With assets currently surging to a staggering $6.5 trillion, the Federal Reserve’s strategy is set to become a focal point, particularly as Bank of America predicts a monthly increase of $45 billion starting January 2026. This anticipated balance sheet increase not only aims to support economic growth but also reflects evolving liquidity conditions in response to market demands. Financial analysts are aligning their economic forecasts with these developments, discussing how the Federal Reserve interest rates may be impacted by such a significant balance sheet expansion. As we delve into the effects of this monetary strategy, it will be crucial to consider how it shapes future financial landscapes and investment opportunities across various asset classes.

As we explore the implications of the Federal Reserve’s decision to enlarge its balance sheet, it’s essential to consider this in terms of monetary liquidity adjustments and fiscal stimulus measures. The ongoing discussions about the balance sheet growth signal a response to prevailing economic conditions and reflect a proactive approach to managing inflationary pressures. Various experts, including those from Bank of America, are sounding alarms over potential interest rate adjustments linked to this increased asset acquisition. This pivotal moment in economic policy may well dictate the trajectory of financial markets, particularly as we approach the convergence of these significant monetary interventions in 2026. Understanding these mechanisms will provide valuable insights into the broader economic environment and investment strategies moving forward.

Bank of America Predictions on Federal Reserve Balance Sheet Expansion

Bank of America has been at the forefront of predicting the Federal Reserve’s monetary policy movements, particularly regarding its balance sheet expansion strategy. Recent reports from the bank suggest that starting January 2026, the Fed is poised to increase its assets by $45 billion monthly. This increase stems from both a necessary $20 billion in purchases to sustain the natural growth of the balance sheet and an additional $25 billion aimed at reversing the excess consumption of reserves. These insights highlight a key strategy that may shape liquidity conditions in the financial markets moving forward.

The implications of such predictions are significant for both investors and the economy as a whole. If the Federal Reserve proceeds with this expansion, it could influence various economic forecasts, from interest rates to inflation targets. Market analysts are closely monitoring the impact of this potential balance sheet increase on the broader financial landscape, considering that any changes could lead to adjustments in Federal Reserve interest rates throughout 2026 and beyond.

Impact of Federal Reserve’s Balance Sheet on Economic Forecasts

The Federal Reserve’s balance sheet plays a critical role in shaping economic forecasts and overall market sentiment. As the Fed expands its assets, there is a possibility that liquidity conditions will improve, which can foster consumer spending and investment. A more robust balance sheet may allow for greater flexibility in monetary policy, impacting Federal Reserve interest rates in the near future. Bank of America, through its predictive models, suggests that sustained balance sheet increases will enhance financial stability and contribute positively to economic growth.

Furthermore, the anticipation of a balance sheet expansion sends ripples through the investment community. Investors are evaluating how these liquidity conditions will affect asset pricing, including equities and alternative assets like cryptocurrencies. As banks and financial institutions prepare for the ramifications of the Fed’s moves, forecasts indicating resilience in the U.S. economy reinforce confidence for strategic planning in portfolios that may include growth-oriented assets.

Frequently Asked Questions

What is the Federal Reserve balance sheet expansion and why is it important?

Federal Reserve balance sheet expansion refers to the increase in the total assets held by the Federal Reserve, which currently stands at $6.5 trillion. This expansion is significant because it impacts Federal Reserve interest rates and liquidity in the economy, influencing financial conditions and lending.

How does Bank of America predict the Federal Reserve balance sheet expansion will unfold in 2026?

Bank of America predicts that starting January 2026, the Federal Reserve will expand its balance sheet by $45 billion monthly, with $20 billion allocated for natural growth and $25 billion to counteract excessive reserve consumption.

What are the implications of the Federal Reserve balance sheet expansion on interest rates?

The Federal Reserve balance sheet expansion may lead to lower Federal Reserve interest rates as the increased liquidity conditions provide more capital for banks to lend, potentially stimulating economic growth.

What factors contribute to the Federal Reserve’s decision to expand its balance sheet?

Factors influencing the decision to expand the Federal Reserve’s balance sheet include economic forecasts, demand for reserves, and prevailing liquidity conditions, which impact monetary policy effectiveness.

How might the Federal Reserve balance sheet expansion affect the economy in 2026?

The expected balance sheet expansion in 2026 is likely to enhance liquidity conditions in the economy, support growth, and affect asset prices. This could be crucial for maintaining economic stability amid changing interest rates.

What are some related predictions regarding the Federal Reserve’s liquidity conditions?

Experts like Cathie Wood have suggested that easing liquidity conditions from the Federal Reserve, tied to balance sheet expansion initiatives, could significantly influence markets, including predictions for cryptocurrencies like Bitcoin.

When are the Federal Reserve’s new balance sheet expansion measures expected to begin?

The Federal Reserve’s new measures for balance sheet expansion are anticipated to commence in January 2026, as outlined by Bank of America’s predictions concerning ongoing economic conditions.

How does the balance sheet increase impact banks and lending?

A Federal Reserve balance sheet increase can enhance banks’ liquidity, making it easier for them to lend, which supports economic activity and can contribute to growth by enabling borrowing for consumers and businesses.

| Key Point | Details |

|---|---|

| Federal Reserve’s Balance Sheet | Currently at $6.5 trillion, expected to expand. |

| Monthly Asset Increase | Predicted increase of $45 billion per month starting January 2026. |

| Components of Expansion | Includes $20 billion for natural growth and $25 billion to reverse reserve consumption. |

| Duration of Expansion | Expected to continue until at least the first half of 2026. |

| Market Reaction | Traders closely monitoring the Fed’s actions and impact on liquidity conditions. |

| Long-term Predictions | Potential for increased demand for reserves, impacting interest rates and asset prices. |

Summary

The Federal Reserve balance sheet expansion is a crucial topic in today’s economic climate. According to recent predictions from Bank of America, the Federal Reserve is set to increase its assets by $45 billion monthly, effectively expanding its $6.5 trillion balance sheet starting in January 2026. This decision is driven by both the necessity to support the natural growth of the balance sheet and to address excess consumption of reserves in the economy. With expectations that this expansion will persist at least through the first half of 2026, market participants are keenly observing the Fed’s moves. Increasing liquidity in the financial system could lead to significant changes in market dynamics, emphasizing the importance of the Federal Reserve balance sheet expansion in shaping financial markets and economic conditions.