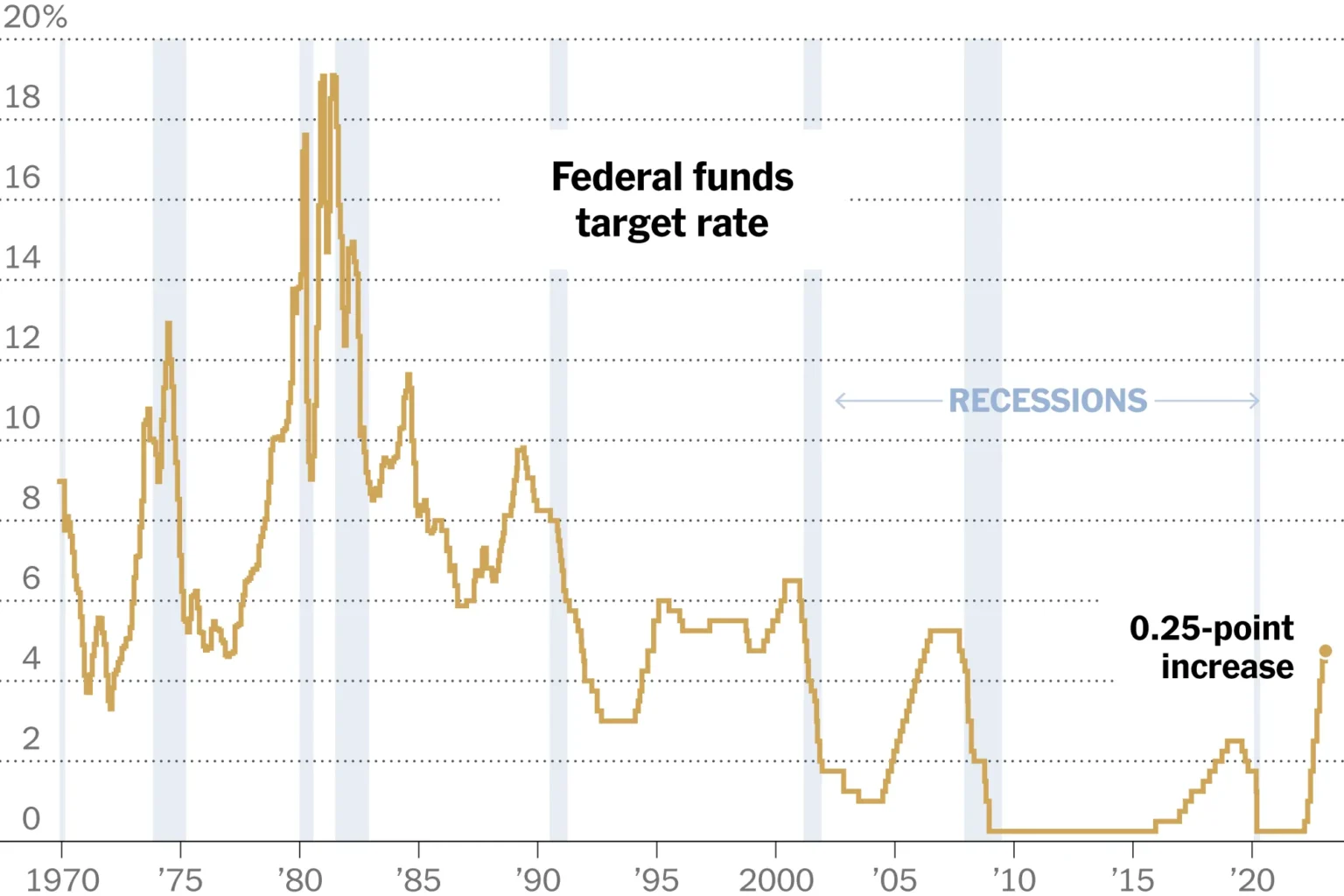

The likelihood of the Federal Reserve implementing a reduction in interest rates by 25 basis points during the month of October has significantly increased, now standing at an impressive 96.7%. This notable rise in probability reflects growing market expectations regarding the Fed’s potential monetary policy adjustments. As economic indicators continue to evolve, investors and analysts are closely monitoring the Fed’s decisions, particularly in light of the current economic climate. A cut in interest rates could have far-reaching implications for borrowing costs, consumer spending, and overall economic growth. The anticipation surrounding this potential decision underscores the importance of the Fed’s role in shaping financial conditions and influencing the broader economy.