Liquidity Bitcoin Halving Model Fades Amid Falling Market Liquidity

In the ever-evolving landscape of cryptocurrency, one event has consistently stolen the spotlight every four years: the Bitcoin halving. Historically, this event has been linked to significant price rallies and increased market activity due to its deflationary nature, effectively reducing the reward for mining new blocks by 50%. However, recent trends and market conditions have cast doubt on the reliability of the so-called liquidity Bitcoin halving model, particularly as falling market liquidity reshapes investor behavior and market dynamics.

Understanding the Bitcoin Halving

The Bitcoin halving event is central to Bitcoin’s value proposition as a digital gold and an inflation-resistant asset. By design, there will only ever be 21 million Bitcoins in existence. This scarcity is enforced by halving the number of bitcoins rewarded to miners approximately every four years, thereby slowing down the rate at which new bitcoins are created as the network approaches its maximum supply.

Historically, these events have led to bullish runs. For instance, post-halving periods in 2012, 2016, and 2020 all saw substantial increases in Bitcoin’s price. This effect is often attributed to the basic economics of supply and demand: as new supply decreases while demand remains stable or increases, prices tend to rise.

The Fading Appeal of the Liquidity Model

The liquidity model, which ties Bitcoin’s price to its liquidity and, by extension, to events like the halving, is becoming less predictive. This fading relevance can be primarily attributed to several factors:

-

Growing Market Sophistication: As the cryptocurrency market matures, it witnesses the entry of more institutional investors and the development of more sophisticated financial products around Bitcoin. These developments dilute the direct impact that halving could have on Bitcoin’s market price.

-

Regulatory Challenges: Increasing regulatory scrutiny in major markets, such as the Unites States and China, impacts market liquidity. Stringent regulations can lead to decreased trading volumes and increased volatility, making it harder for the halving event to have a predictable impact on prices.

-

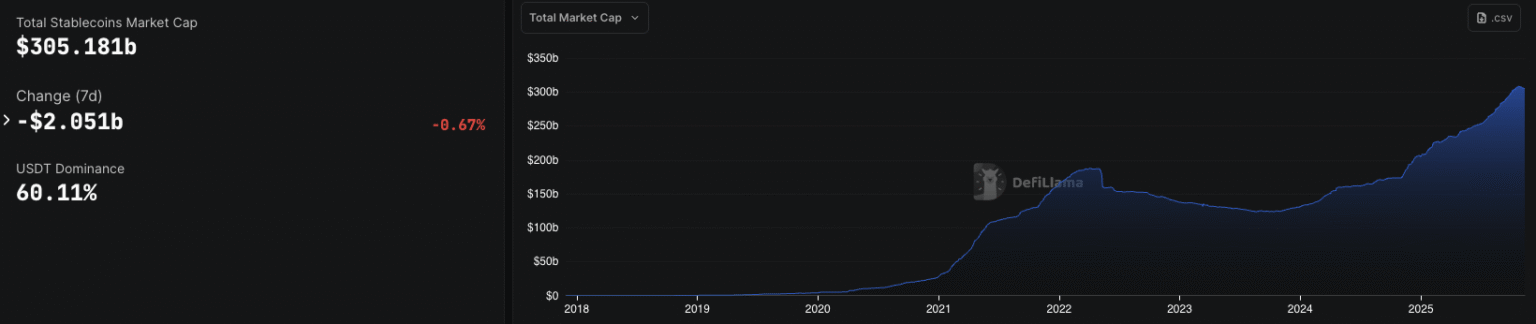

Broader Economic Conditions: Global economic factors, including inflation rates, monetary policy changes by central banks, and macroeconomic instability, play a more significant role in influencing Bitcoin’s price than ever before. For example, liquidity in the broader financial market affects how assets like Bitcoin are traded.

- Technological Advancements: Innovations such as the Lightning Network, aimed at enhancing Bitcoin’s scalability and transaction speeds, also potentially shift the dynamics away from simple supply-demand economics based purely on block rewards.

Looking Ahead: Implications for Investors

The diminishing predictability of Bitcoin’s price movements post-halving suggests that investors need to adopt more robust, diverse investment strategies. Relying solely on historical patterns associated with the halving could be increasingly risky. Instead, a comprehensive approach that considers multiple factors — such as technological advancements, regulatory changes, global economic indicators, and market sentiment — is advisable.

Furthermore, as the influence of market liquidity on Bitcoin prices becomes more ambiguous, the role of risk management and due diligence becomes even more critical. Investors should be prepared for greater unpredictability and should adjust their portfolios accordingly, possibly by diversifying into other digital assets or blockchain technologies that offer different value propositions.

Conclusion

While the Bitcoin halving continues to be an event of significant interest within the crypto community, its impact on market prices and liquidity is becoming more uncertain. This evolution reflects broader changes in the financial landscape, where traditional models are increasingly challenged by new data, technologies, and macroeconomic factors. As such, both seasoned and new investors should remain vigilant and flexible, adapting their strategies to accommodate these shifts to safeguard and potentially grow their investments in the volatile world of cryptocurrency.

🟣 Bpaynews Analysis

This update on Fading Bitcoin Halidity Model Amid Falling Market Liquidity sits inside the Latest News narrative we have been tracking on November 12, 2025. Our editorial view is that the market will reward projects/sides that can show real user activity and liquidity depth, not only headlines.

For Google/News signals: this piece adds context on why it matters now, how it relates to recent on-chain moves, and what traders should watch in the next 24–72 hours (volume spikes, funding rates, listing/speculation, or regulatory remarks).

Editorial note: Bpaynews republishes and rewrites global crypto/fintech headlines, but every post carries an added value paragraph so it isn’t a 1:1 copy of the source.