What’s Driving Bitcoin’s Dip Below $100,000? – An Analysis

In the ever-tumultuous world of cryptocurrency, Bitcoin’s recent slip below the $100,000 mark has sent waves of concern, speculation, and analysis throughout the financial community. This descent is particularly striking given the virtual currency’s meteoric rise over the past few years, where it seemed poised to maintain a six-figure threshold. Here, we delve into the multifaceted dynamics behind Bitcoin’s latest valuation dip, exploring economic, regulatory, and market-driven factors.

Key Takeaways

1. Economic Factors: Interest Rates and Inflation Concerns

One of the primary drivers behind Bitcoin’s recent price fluctuations is the broader economic environment, particularly in relation to interest rates and inflation. Central banks around the globe, notably the Federal Reserve in the United States, have begun tightening monetary policies to combat inflation, which has been at peak levels not seen in decades. Higher interest rates make riskier assets like Bitcoin less attractive compared to safer, yield-generating investments. As such, investors might be reallocating assets towards more stable opportunities, thus dampening the demand for Bitcoin.

2. Regulatory Pressures

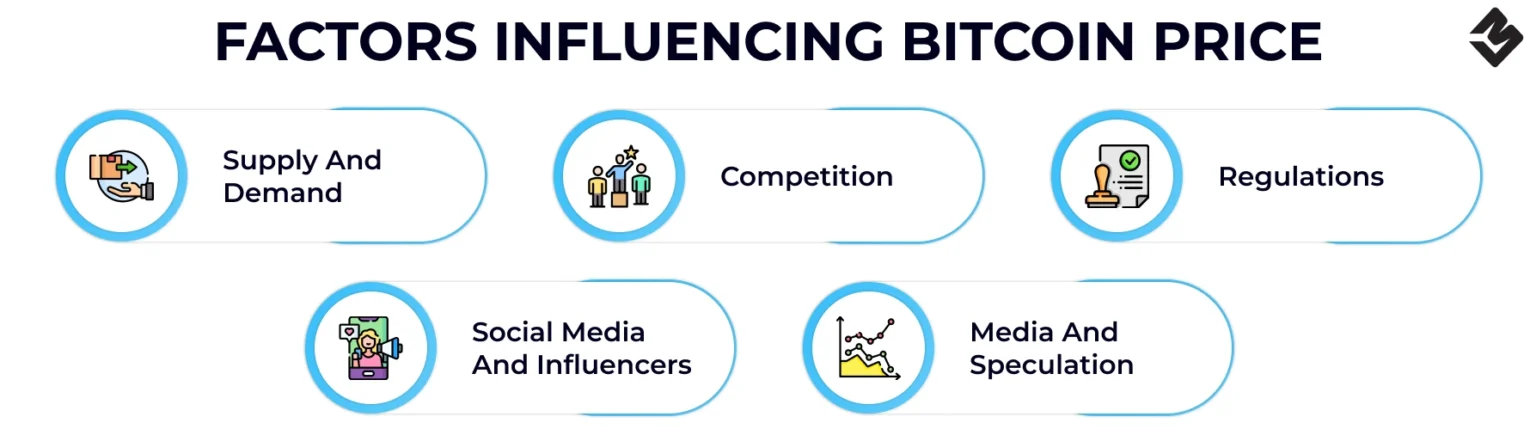

Regulatory changes and uncertainty can significantly impact Bitcoin’s market price. Governments and financial regulators worldwide have been scrutinizing cryptocurrencies with an eye towards more stringent control. From talks of banning crypto transactions to implementing strict regulatory frameworks, these potential changes have prompted investor caution. The mere suggestion of regulatory crackdowns tends to stir fear amongst the crypto community, leading to sell-offs and reduced buying activity which, in turn, lowers Bitcoin’s price.

3. The Technical Sell-Offs and Price Corrections

Another factor at play is the technical nature of Bitcoin trading itself. Bitcoin, like many other cryptocurrencies, is subject to high volatility and speculative trading. After reaching an all-time high, it is not uncommon for Bitcoin to undergo significant price corrections. Many investors might have set automatic sell-offs to take profits at certain thresholds, which can exacerbate the decline as these preset sell orders trigger further sell-offs from other traders reacting to the price drops.

4. Market Sentiment and Competing Cryptocurrencies

Market sentiment, often swayed by news and social media, plays a considerable role in the high amplitude swings seen in Bitcoin prices. Negative news cycles, such as those discussing bans or hacks, can lead to panics that precipitate sharp decreases in value. Furthermore, the rise of other cryptocurrencies offering different or perceived superior technological advancements can also divert investment away from Bitcoin, affecting its overall market dominance and value.

5. MacroEnvironmental Influences

Global events such as geopolitical tensions, economic crises in significant markets (like the US or China), or even pandemics can lead to fluctuations in Bitcoin’s price. Investors often flock to Bitcoin as a “digital gold” in times of uncertainty, but this can be a double-edged sword. For instance, if a crisis prompts a rush for liquid assets, Bitcoin may be sold off along with other investments, leading to price dips.

Conclusion

Bitcoin’s dip below the $100,000 mark is not due to a single, isolated cause but rather a confluence of factors ranging from regulatory anxieties to broad economic indicators and market dynamics. As the cryptocurrency landscape continues to evolve, these influencing factors may also shift, presenting new challenges and opportunities for Bitcoin and its investors. Understanding the driving forces behind such dips is crucial for anyone engaged in the crypto space, whether for daily trading or long-term investment. As always, the volatile nature of Bitcoin demands a robust strategy encompassing thorough research and risk management to navigate its turbulent waters.