When it comes to maximizing your digital asset portfolio, the decision to exchange WBTC for ETH has never been easier, especially in light of Yi Lihua’s compelling WLFI analysis. As highlighted by WLFI co-founder Chase Herro, stablecoins are emerging as the crucial medium of exchange in today’s digital economy. This perspective not only underscores the value of WBTC and ETH but also encourages investors to consider the strategic advantages of engaging in a digital assets exchange. By understanding the current crypto asset value dynamics, traders can navigate the complexities of stablecoins exchange with more confidence. With the trend moving towards significant growth, the insights from Yi Lihua promise a strong foundation for those looking to enter this evolving market segment.

In the realm of cryptocurrency trading, the notion of swapping WBTC for ETH is gaining traction as enthusiasts explore diverse methods to enhance their investments. This shift represents a broader tradition of exchanging crypto assets, where investors assess the performance of different tokens based on technical analyses and market trends. The recent discussions around WLFI and the potential for stablecoins to foster a more robust trading environment have invigorated interest in this topic. As analysts and crypto strategists delve into predictive models and future pathways, the re-evaluation of asset types in digital finance is ongoing. Overall, the crypto landscape is ripe for innovation, encouraging users to stay abreast of developments in asset valuation and exchange opportunities.

Understanding the Decision to Exchange WBTC for ETH

The decision to exchange Wrapped Bitcoin (WBTC) for Ethereum (ETH) can significantly influence an investor’s portfolio, especially in the dynamic world of cryptocurrencies. According to WLFI co-founder Chase Herro, this decision is not just a complex calculation but an intuitive choice shaped by current market analysis. Yi Lihua’s insights into WLFI’s potential demonstrate a profound understanding of the cryptocurrency landscape, suggesting that as stablecoins fortify their role as mediums of exchange, such decisions become easier to navigate. For instance, recognizing the strategic value of WBTC in comparison to ETH can align with the growth trajectories often discussed in WLFI analysis.

Additionally, investing in WBTC is often seen as a bridge to ETH, as many crypto enthusiasts view Ethereum as a foundational asset for the digital economy. The liquidity and market capitalization of ETH compare favorably against WBTC, especially when considering trends toward decentralized applications and smart contracts. Therefore, exchanging WBTC for ETH is not just a transactional maneuver but a proactive step towards securing one’s position in digital asset exchanges that are expected to evolve alongside emerging technological infrastructures.

The Role of Stablecoins in Digital Asset Exchanges

Stablecoins have gained prominence as a reliable means of exchange in the digital asset space, primarily due to their ability to maintain stable value relative to traditional fiat currencies. This aspect is crucial for investors looking to reduce volatility while taking part in the ever-fluctuating cryptocurrency markets. As Yi Lihua highlights, achieving a targeted market cap for USD1 could place WLFI among the leading infrastructures in the crypto ecosystem. With predictions of USD1 collaborating with established Web2 companies, it is evident that stablecoins will play an integral role in advancing the infrastructure required for seamless digital transactions.

Moreover, the reliance on stablecoins in decentralized finance (DeFi) platforms ensures that users can engage in trading and asset exchanges without the fear of dramatic value drops characteristic of more volatile cryptocurrencies. The stablecoin’s role as a hedge during uncertain market conditions highlights their significance in maintaining balance and increasing trust within digital assets. As stablecoins, like USD1, flourish, they could redefine the parameters of digital assets exchange by making it accessible and user-friendly.

Analyzing the Future Pathways of WLFI

The future pathways outlined by Yi Lihua for WLFI suggest a bold vision for the project within the cryptocurrency landscape. The projected growth trajectory that anticipates USD1 surpassing $10 billion soon and aiming for $100 billion in the medium term presents a strategic framework for stakeholders in the crypto domain. This ambitious plan not only positions WLFI as a key player in the stablecoin market but also emphasizes the importance of aligning with market needs and technological advancements. Investors involved in WLFI can take solace in the analysis provided, simplifying the decision to exchange WBTC for ETH in light of these promising developments.

Furthermore, the collaboration with Web2 companies can drastically enhance WLFI’s adoption rate, bringing in millions of active users and establishing a solid foundation for its utility and value as a stablecoin. This strategy underscores the importance of community engagement and partnerships in driving growth within the digital assets exchange landscape. The economic forecasts discussed by Yi Lihua aid in cementing the notion that smartly navigating between assets, such as WBTC and ETH, is not merely speculative but rather a calculated approach that could yield significant returns.

Chase Herro’s Take on Digital Assets and Stablecoins

Chase Herro, as a co-founder of WLFI, emphasizes the strategic advantages of utilizing stablecoins, particularly in relation to their exchange functionalities. He notes that the evolving landscape of digital assets necessitates a clear understanding and judgement on when to switch between coins like WBTC and ETH. With synthetic assets gaining traction, placing emphasis on stablecoins allows investors to hedge against crypto volatility while maintaining a foothold in the market. This insight demonstrates why many are considering the shift from WBTC to ETH as a method of optimizing their digital asset portfolios.

Herro’s insights also reflect a broader understanding of the mechanics at play in crypto exchanges. As some traders lean heavily on stablecoins as a safety net amidst price fluctuations, the decision to exchange assets must be rooted in an awareness of market sentiment. By advocating for a simplified decision-making process, Herro positions WLFI as a guiding force in financial strategies, encouraging investors to make informed choices that align with the overarching trends in the cryptocurrency market.

Decrypting Yi Lihua’s Insights on WLFI’s Potential

Yi Lihua’s insights into WLFI’s market potential provide a clearer picture of the strategic pathways the project aims to navigate. His analysis suggests that WLFI has the capacity to redefine its position within the stablecoin market, enabling it to become a mainstay in digital transactions. By focusing on achieving substantial market capitalization and collaborating with high-traffic user platforms, WLFI isn’t just an ordinary stablecoin; it’s paving a pathway towards becoming a dominant player. Such insights lend strong validity to the decision-making process for investors contemplating whether to exchange WBTC for ETH, as they highlight the emerging relevance of a stablecoin like USD1.

Additionally, Lihua’s emphasis on the infrastructure aspect of the crypto ecosystem brings to light the increasing need for innovators to work closely with established companies. This collaboration can enhance the user experience and further integrate stablecoins into everyday transactions, thereby elevating their status in the competitive crypto space. Consequently, as WLFI continuously analyzes market opportunities through frameworks established by thought leaders, investors can better gauge the timing and reasoning behind their trading decisions.

Strategies for Engaging in the Crypto Asset Exchange Market

Engaging in the crypto asset exchange market requires a multifaceted strategy that takes network effects and market conditions into consideration. With the rising popularity of WBTC as a Bitcoin representation on the Ethereum blockchain, investors looking to exchange WBTC for ETH must analyze the liquidity, market capitalization, and future projections for both assets. Creating a diverse portfolio that includes stablecoins not only adds stability but also opens avenues for potential gains as market conditions shift. The analysis provided by WLFI co-founder Chase Herro suggests that understanding current trends can substantially influence trading strategies.

Moreover, market analysis tools and resources will aid investors in navigating the complexities of digital asset exchanges. Understanding LSI terms such as crypto asset value, stablecoins exchange, and digital assets infrastructure becomes crucial. By leveraging the available data, investors can refine their strategies and enhance their decision-making when considering exchanges. As the financial landscape continues to evolve, those equipped with knowledge and analytical tools are more likely to capitalize on profitable opportunities in the ever-changing world of cryptocurrencies.

The Impact of Compliance and Infrastructure on Stablecoins

The implications of compliance in the stablecoin market, such as those tethered to projects like WLFI, cannot be overstated. Achieving regulatory compliance not only enhances trust among users but also positions stablecoins to scale in an environment that is increasingly sensitive to regulations. Yi Lihua points to the importance of leveraging compliance as a competitive advantage when discussing the envisioned growth of USD1. Engaging past trends suggests that cryptocurrency projects that prioritize compliance are more likely to gain traction and sustained usage in digital assets exchange.

In addition, building a sound infrastructure involves not only compliance but also a robust technological backbone supporting stablecoins. A strong infrastructure ensures seamless transactions and provides a higher standard of usability for users, which directly reflects in volume and user retention rates. Investors are more inclined to engage with stablecoins that exhibit a trustworthy infrastructure as it alleviates concerns regarding transaction stability and security. Thus, the development of such foundations is vital for the sustained growth and acceptance of stablecoins like USD1 and alters the decision-making framework for future exchanges.

Collaborations with Web2 Companies: A New Frontier for Stablecoins

Collaborations with established Web2 companies present a significant growth opportunity for stablecoins. As highlighted by Yi Lihua’s analysis, engaging with well-known platforms could dramatically increase adoption rates by providing stablecoin users with familiar interfaces and trusted ecosystems. These partnerships can also bring increased liquidity, allowing users to exchange their stablecoins for various assets, including ETH. The strategy to collaborate reflects a broader trend in the cryptocurrency market where integration with traditional tech giants paves the way for mainstream acceptance.

Such partnerships could ultimately change the landscape for digital assets exchange by bringing stablecoins into everyday use cases, from payments to remittances. Linking stablecoins to established platforms can offer a seamless user experience, encouraging both crypto novices and veterans to engage with digital asset exchanges. For investors, this means that the decision to exchange WBTC for ETH may be influenced not only by market analysis but also by the growing ubiquity of stablecoins in regular financial transactions.

Navigating the Future: Predictions and Analysis for WLFI and Beyond

The future of WLFI and similar projects will depend heavily on market dynamics and the overall sentiment surrounding stablecoins. As Yi Lihua forecasted, if the foundation laid out currently leads to successful partnerships and user engagement strategies, WLFI could eclipse traditional stablecoins within the next few years. This trajectory aligns with the broader acceptance of cryptocurrencies as viable assets, compelling users to consider their investment choices carefully, such as the decision to swap WBTC for ETH.

Looking ahead, analysis of market indicators, technological advancements, and user behavior will be critical to understanding the future impact of WLFI in the stablecoin landscape. Investors who remain informed and agile in their strategies, considering both opportunities and risks, are bound to navigate this space effectively. The progression of WLFI integrates lessons learned in the volatile markets, illustrating the necessity for sophisticated analyses that include both LSI topics and broader market narratives.

Frequently Asked Questions

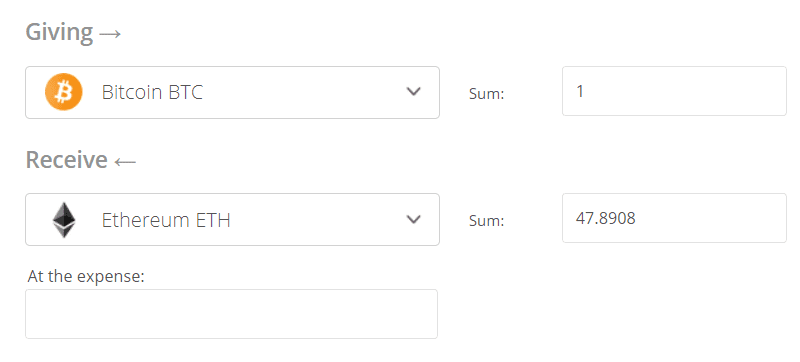

How can I exchange WBTC for ETH easily?

Exchanging WBTC for ETH is straightforward, especially when considering insights like those from Yi Lihua’s WLFI analysis. By using a trusted digital assets exchange, you can seamlessly convert your Wrapped Bitcoin (WBTC) into Ether (ETH) with just a few clicks.

What are the benefits of exchanging WBTC for ETH in the current market?

The benefits of exchanging WBTC for ETH include the potential for greater liquidity and taking advantage of price movements in the Ethereum market. With stablecoins gaining traction, many users prefer to exchange their crypto asset value into ETH to engage with decentralized finance (DeFi) platforms.

Which platforms allow the exchange of WBTC for ETH?

Numerous digital assets exchanges facilitate the exchange of WBTC for ETH, including popular options like Binance, Coinbase, and Uniswap. These platforms provide user-friendly interfaces and competitive rates for your transactions.

What factors should I consider before deciding to exchange WBTC for ETH?

Before exchanging WBTC for ETH, consider factors such as market conditions, transaction fees on the exchange, and your investment goals. Analyzing market trends, like those outlined in WLFI and Yi Lihua’s insights, can also help you make informed decisions.

Is it a good time to exchange WBTC for ETH based on WLFI insights?

According to WLFI co-founder Yi Lihua, as stablecoins evolve as primary media of exchange, now could be an opportune time to exchange WBTC for ETH. If the outlined goals of WLFI are met, the value of ETH may increase significantly, making this exchange favorable.

What are the stablecoin market trends related to exchanging WBTC for ETH?

Recent trends in the stablecoin market indicate that the demand for cryptocurrencies, including ETH, is rising, driven by integrations with Web2 companies and increased adoption. This dynamic supports a robust environment for users looking to exchange WBTC for ETH.

How does the WLFI analysis influence the decision to exchange WBTC for ETH?

The WLFI analysis, particularly Yi Lihua’s perspective, emphasizes that as WLFI achieves its goals, it could signal a strengthening market for ETH, influencing users to consider exchanging WBTC for ETH to capitalize on future growth.

Can I get good exchange rates when trading WBTC for ETH?

Yes, many digital assets exchanges offer competitive exchange rates for WBTC to ETH trades. It’s advisable to compare rates across platforms before executing your trade to ensure you receive the best value for your crypto asset.

| Key Points | Details |

|---|---|

| Agreement on WBTC to ETH Exchange | Chase Herro supports Yi Lihua’s analysis that exchanging WBTC for ETH is a simple decision. |

| Role of Stablecoins | Stablecoins are essential as a medium of exchange in the digital economy. |

| Three Future Paths for WLFI | 1. USD1 aims to expand from 10 billion to 100 billion, targeting a trillion share in the stablecoin market. 2. Collaboration with Web2 companies having over a million users. 3. Leveraging brand and compliance for B2B and user relations. |

Summary

Exchanging WBTC for ETH is a straightforward decision according to the insights shared by WLFI co-founder Chase Herro, supported by Yi Lihua’s positive outlook on WLFI’s future. With the growing acceptance of stablecoins and WLFI’s strategic plans to capture a significant market share, the potential for valuable returns on such exchanges could be significant. Therefore, for investors considering their cryptocurrency options, exchanging WBTC for ETH could be a wise decision in light of the promising developments in the WLFI project.