Eurostoxx Futures Dip Slightly in Early European Trading

In early trading sessions today, the Eurostoxx futures marked a modest decline of 0.1%, signaling a cautious stance among European investors. This slight dip comes amid a medley of economic uncertainties and market variables that continue to sway investor sentiment across the continent.

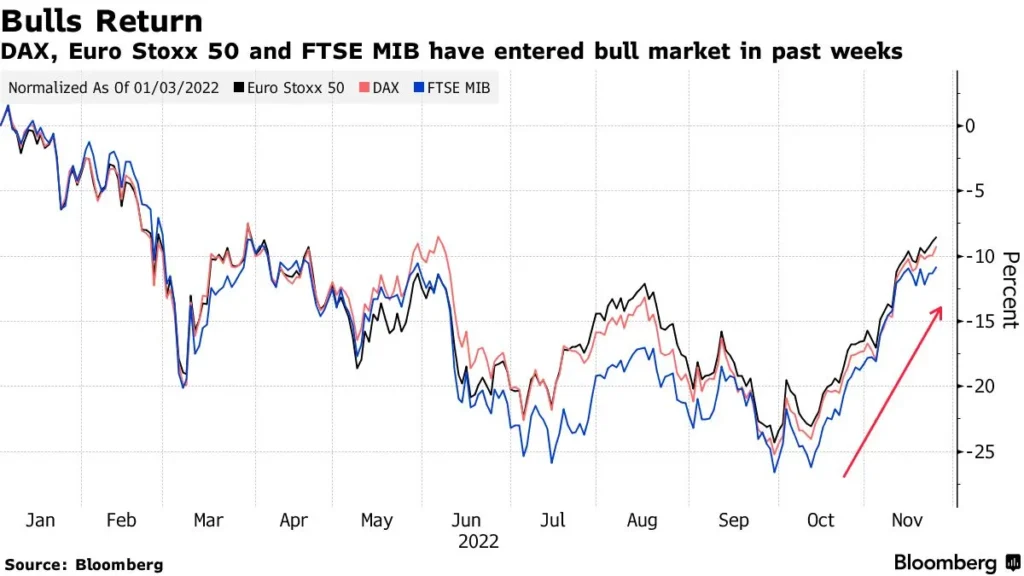

The Eurostoxx, a future index that aggregates the performances of Eurozone stocks, often serves as a barometer for European economic health and investor confidence. Today’s decrement, albeit small, points to an array of factors that market participants are currently grappling with.

Economic Signals and Investor Sentiment

Firstly, the economic climate in Europe has been mixed. Recent reports on GDP growth, unemployment rates, and manufacturing outputs present a tableau of recovery that is both uneven and tentative. While some nations within the Eurozone are witnessing a resurgence in consumer demand and industrial activity, others are lagging, burdened by debt and inefficiencies.

In response to this, the European Central Bank (ECB) has maintained a cautious approach towards monetary policy. Interest rates have been held low to encourage borrowing and spending but the prospect of inflation and its subsequent management remains a key concern for the future.

Impact of Global Markets

Global market dynamics also significantly influence the Eurostoxx futures. The U.S. market, just closing after a contrasting session of gains amidst tech stocks and declines in the energy sector, sets a complex stage for European markets to react. Similarly, Asian markets have shown volatility, largely driven by regulatory changes in China and pandemic recovery patterns.

In addition, geopolitical tensions and trade relations continue to foster an environment of uncertainty. The ongoing complexities of Brexit negotiations, coupled with the EU’s stance on trade with Russia and China, also add layers of diplomatic and economic considerations that investors need to watch closely.

Sector-Specific Movements

Drilling down into sector-specific performances within the Eurostoxx index reveals further nuances. Technology and healthcare sectors are showing resilience, possibly due to the accelerated digital transformation and healthcare demands driven by the pandemic. On the other hand, traditional sectors such as energy and utilities are experiencing the weight of regulatory changes and the global push towards sustainable energy sources.

Market Outlook

Moving forward, the trajectory for Eurostoxx futures could hinge on several upcoming economic data releases and policy announcements from the ECB. Investors will be keenly watching for signs of sustained economic recovery, inflation rates, and any shifts in monetary policy.

Additionally, the outcome of political elections within key European nations, scheduled over the next few months, could introduce new fiscal policies that might affect market dynamics significantly.

Conclusion

In conclusion, while today’s 0.1% dip in Eurostoxx futures is minimal, it underscores a broader landscape of cautious investor sentiment and a complex interplay of economic and political factors. As European markets continue to navigate through these turbulent times, the agility and foresight of investors will be crucial in maneuvering through uncertainties and capitalizing on emergent opportunities.