In recent discussions, euro-denominated stablecoins are emerging as a key topic among Eurozone finance ministers, highlighting their potential role in enhancing the stability of the EU’s monetary landscape. As nations navigate the complexities of crypto regulation, these digital currencies are increasingly being viewed as viable alternatives that could align with EU currency policy. The ongoing euro stablecoin discussion reflects a growing interest in how these assets could support financial transactions within Europe, offering a bridge between decentralized finance and traditional economic frameworks. In light of recent stablecoin news, stakeholders are eagerly assessing the implications of these digital currencies for the economy. Therefore, the future of digital currency in Europe could hinge on how effectively euro-denominated stablecoins are integrated into the broader financial system.

As governments and financial institutions explore the benefits of blockchain technology, discussions surrounding euro-backed digital assets are gaining traction. Known for their ability to maintain price stability, these crypto alternatives are capturing attention as a solution to promote economic resilience in the Eurozone. Furthermore, the exploration of central bank digital currencies (CBDCs) reflects a strategic pivot towards innovation in monetary policy. With the EU’s focus on fostering a stable digital currency ecosystem, the conversation surrounding euro-denominated stablecoins becomes increasingly relevant. The implications of these developments may transform how transactions occur, prompting reevaluation of existing frameworks within Europe’s financial landscape.

| Key Points |

|---|

| Eurozone finance ministers will discuss euro-denominated stablecoins issuance. |

| Discussion includes ways to enhance the euro’s status. |

| Potential measures include increasing joint EU debt. |

Summary

Euro-denominated stablecoins are at the forefront of discussions among Eurozone finance ministers, highlighting a significant step towards enhancing the euro’s status in the global market. By considering the issuance of these stablecoins and the increase of joint EU debt, policymakers are aiming to strengthen the euro’s foothold and respond to the evolving financial landscape. This initiative could pave the way for greater stability and acceptance of the euro within the digital economy.

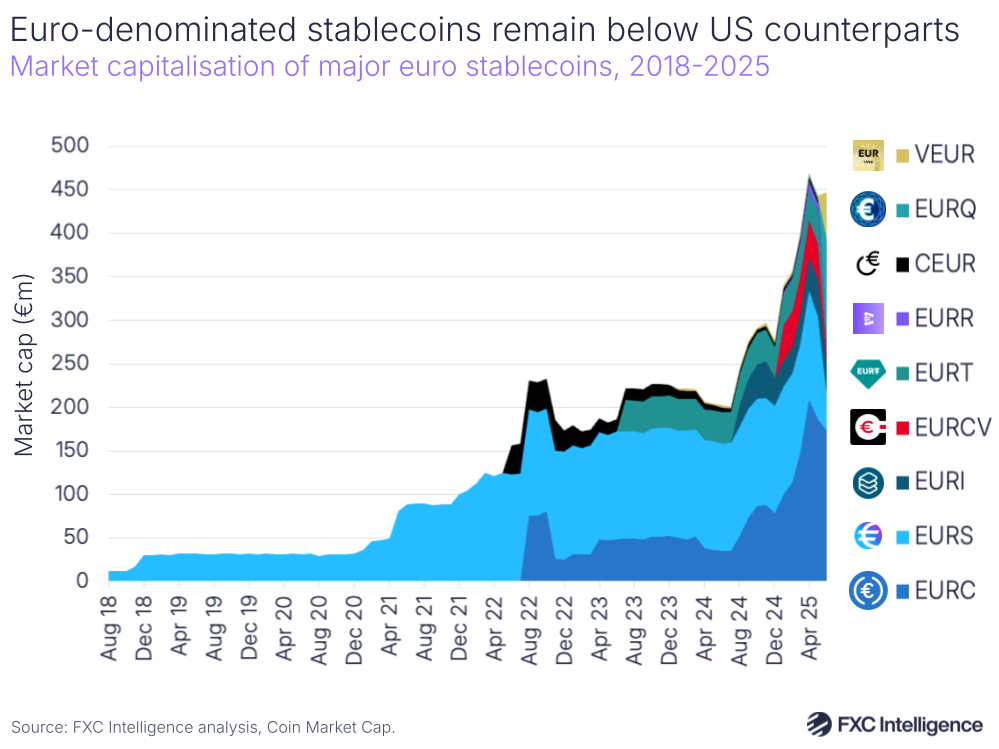

The Rise of Euro-Denominated Stablecoins in Europe

Euro-denominated stablecoins are gaining traction within the European financial landscape, especially as Eurozone finance ministers open discussions on their potential issuance. These digital assets link the stability of the euro currency with the innovations of blockchain technology, appealing to investors and users seeking reliability in a volatile cryptocurrency market. As the demand for robust, fiat-backed digital currencies surges, euro stablecoins emerge as a viable solution that aligns with the EU’s currency policy.

The deliberations on euro-denominated stablecoins highlight the European Union’s commitment to adapting its financial frameworks to accommodate digital currencies. Policymakers are keen on formulating a regulatory framework that fosters innovation while ensuring consumer protection and market integrity. By establishing standards for euro stablecoins, the EU can potentially enhance the euro’s status globally, solidifying its role in the growing landscape of digital currencies in Europe.

Impacts of Crypto Regulation on Eurozone Stablecoins

As discussions around euro-denominated stablecoins unfold, the subject of crypto regulation inevitably comes to the forefront. Effective regulation in the cryptocurrency space is paramount to establish trust and security among users. These regulations can help mitigate risks associated with price volatility and ensure that issuers of euro stablecoins adhere to stringent financial standards, aligning them with traditional financial systems.

Moreover, robust crypto regulation enhances the European Union’s stature as a leader in digital currency discussions. By implementing frameworks that govern euro-denominated stablecoins, the EU can safeguard its economy while encouraging innovation. Such policies can potentially attract investment into the region, serving as a catalyst for further growth in the digital currency landscape across Europe.

EU Currency Policy and Its Interaction with Digital Currencies

The alignment of EU currency policy with the emergence of digital currencies is a pivotal topic within the discussions surrounding euro-denominated stablecoins. As finance ministers weigh the impacts of increasing joint EU debt to bolster the euro, it’s crucial to consider how digital currencies can complement these fiscal strategies. The integration of stablecoins into the existing framework of EU currency policy could provide innovative ways to enhance monetary flow and economic stability in the region.

Additionally, incorporating euro stablecoins within the EU’s currency strategy offers opportunities for cross-border transactions and financial inclusion. By standardizing regulations around digital currencies, the EU can facilitate smoother operations for businesses and consumers alike, fostering an environment where euro stablecoins serve as a bridge between traditional finance and the digital economy.

Current Trends in Stablecoin News and Eurozone Discussions

The financial media is abuzz with stablecoin news, particularly focusing on the ongoing discussions among Eurozone finance ministers about euro-denominated stablecoins. This heightened interest stems from the broader implications for the European economy and the potential to reshape how financial transactions occur. Stakeholders are closely monitoring these developments to understand their impact on both the cryptocurrency market and traditional financial institutions.

As euro-denominated stablecoins come into play, it’s essential to keep an eye on the evolving dynamics within the realm of stablecoins. Innovations in technology and policy can alter the trajectory of these digital assets, affecting everything from market liquidity to investor confidence. Continuous coverage of these topics ensures that individuals and businesses are well-informed about the potential changes in the regulatory environment surrounding stablecoins in Europe.

Exploring Digital Currencies in Europe: Challenges and Opportunities

The discussion surrounding euro-denominated stablecoins poses both challenges and opportunities for digital currencies in Europe. While creating a framework to incorporate these assets into the existing financial system, there is a need to address concerns about consumer protection and market volatility. Policymakers must tread carefully to foster a supportive environment for innovation without compromising financial stability.

On the flip side, the rise of digital currencies presents an unprecedented opportunity for economic growth and technological advancement in Europe. Embracing euro stablecoins can lead to the development of a more efficient payment ecosystem, driving competition and reducing costs for consumers. By navigating the challenges with a strategic approach, the EU can position itself at the forefront of the global digital currency movement.

The Role of Euro Stablecoins in the Future of Finance

Euro stablecoins are poised to play a transformative role in the future of finance, as European institutions explore their potential applications. Leveraging the stability of the euro, these digital currencies offer a reliable means of value transfer that could revolutionize cross-border payments and remittances. As the EU continues to push for digital inclusion, euro-denominated stablecoins could serve as a critical tool for integrating unbanked populations into the financial system.

The future of finance also hinges on the collaboration between traditional financial systems and emerging digital currencies. Euro stablecoins can complement existing financial products, enhancing user experiences and expanding the scope of financial services. As Europe embraces technological advancements, the effective integration of stablecoins into mainstream finance could pave the way for a digital economy characterized by efficiency and inclusivity.

Navigating the Regulatory Landscape for Euro Stablecoins

The regulatory landscape surrounding euro-denominated stablecoins is complex and ever-evolving, prompting discussions among European policymakers to ensure appropriate frameworks are established. Understanding the nuances of crypto regulation will be key for financial institutions looking to engage with these innovative digital assets. Clear guidelines will not only protect investors but also provide clarity to businesses exploring euro stablecoins as a viable financial solution.

As regulation develops, stakeholders must remain vigilant and adaptive to the changes that impact euro-based stablecoins. Engaging in continuous dialogue with regulators will be essential to foster a constructive relationship between the crypto industry and traditional finance. By working together, a balanced approach to regulation can be achieved, setting the stage for a thriving environment for euro stablecoins in Europe.

Future Outlook for Euro-Denominated Stablecoins in the Cryptocurrency Market

The future outlook for euro-denominated stablecoins appears promising as they become more integrated into the broader cryptocurrency market. With increasing interest from investors and users alike, these digital assets could lead to heightened adoption rates. Coupled with proactive regulatory measures from the EU, the potential for euro stablecoins to function effectively alongside existing cryptocurrencies is significant.

As financial technology continues to evolve, the integration of euro-denominated stablecoins may not only influence the EU’s monetary policies but could also redefine the landscape of digital currencies in Europe. The foundational strength of the euro, combined with innovative financial solutions, sets the stage for euro stablecoins to play a pivotal role in shaping the future of the financial ecosystem.

Impact of Increased EU Debt on Euro Stablecoins

The discussions among Eurozone finance ministers about increasing joint EU debt have far-reaching implications for euro-denominated stablecoins. As the euro seeks to strengthen its presence in the global market, stablecoins tied to the euro’s value might become more attractive to investors, enhancing their utility and popularity. The correlation between increased EU debt and stablecoins could provide a safety net for investors looking for stability in the unpredictable cryptocurrency landscape.

Furthermore, this interconnection may lead to euro stablecoins playing a more prominent role in international trade and finance. As Eurozone countries explore strategies to boost economic resilience, euro-denominated stablecoins could facilitate seamless trade settlements, offering advantages to businesses operating within and beyond the EU. By embracing this synergy, both the euro and stablecoins can thrive in an interconnected global economy.

Frequently Asked Questions

What are euro-denominated stablecoins and why are they significant in crypto regulation?

Euro-denominated stablecoins are digital currencies pegged to the euro, designed to minimize volatility typically associated with cryptocurrencies. Their significance in crypto regulation stems from their potential to simplify transactions and enhance financial stability in the EU, aligning with European currency policies.

How might the European Union’s currency policy impact the adoption of euro stablecoins?

The European Union’s currency policy plays a crucial role in the adoption of euro stablecoins by providing a regulatory framework that ensures compliance and promotes confidence among users. As finance ministers discuss the issuance of these stablecoins, favorable policies could drive their acceptance in the digital currency landscape in Europe.

What discussions are taking place around euro stablecoin issuance by Eurozone finance ministers?

Eurozone finance ministers are currently discussing the issuance of euro stablecoins, focusing on their potential to enhance the euro’s status and the overall stability of the financial system. This discussion encompasses the regulatory measures needed to support these digital assets and their integration into the broader economic framework.

What impact could euro-denominated stablecoins have on digital currency initiatives in Europe?

Euro-denominated stablecoins could significantly boost digital currency initiatives in Europe by providing a stable and regulated form of digital payment. This would not only facilitate cross-border transactions but also position the euro as a viable digital currency competitor against other cryptocurrencies, enhancing its global standing.

What are the potential benefits of adopting euro-denominated stablecoins for businesses in the EU?

The adoption of euro-denominated stablecoins can benefit EU businesses by enabling faster, cheaper, and more efficient transactions. With reduced volatility, businesses can better manage financial risks, improve cash flow, and explore new digital payment strategies aligned with European currency policies.

How do euro-denominated stablecoins relate to the current crypto landscape in Europe?

Euro-denominated stablecoins represent an emerging trend in the European crypto landscape, reflecting a growing interest in digital currencies tied to traditional fiat. They highlight the need for effective regulation and the potential for innovation in European financial systems, especially amid discussions on crypto regulation.

What challenges might euro-denominated stablecoins face in terms of regulation?

Euro-denominated stablecoins could face several regulatory challenges, including compliance with EU financial regulations and ensuring consumer protection. As discussions progress among Eurozone finance ministers, establishing a clear regulatory framework will be essential for easing these challenges and fostering innovation in digital currency.

How do euro stablecoin discussions align with broader financial strategies in the EU?

The discussions surrounding euro stablecoins align with broader financial strategies in the EU by aiming to enhance the euro’s global position, promote financial inclusion, and leverage digital innovation. By exploring the issuance of these stablecoins, the EU seeks to strengthen its financial landscape and adapt to the evolving digital economy.