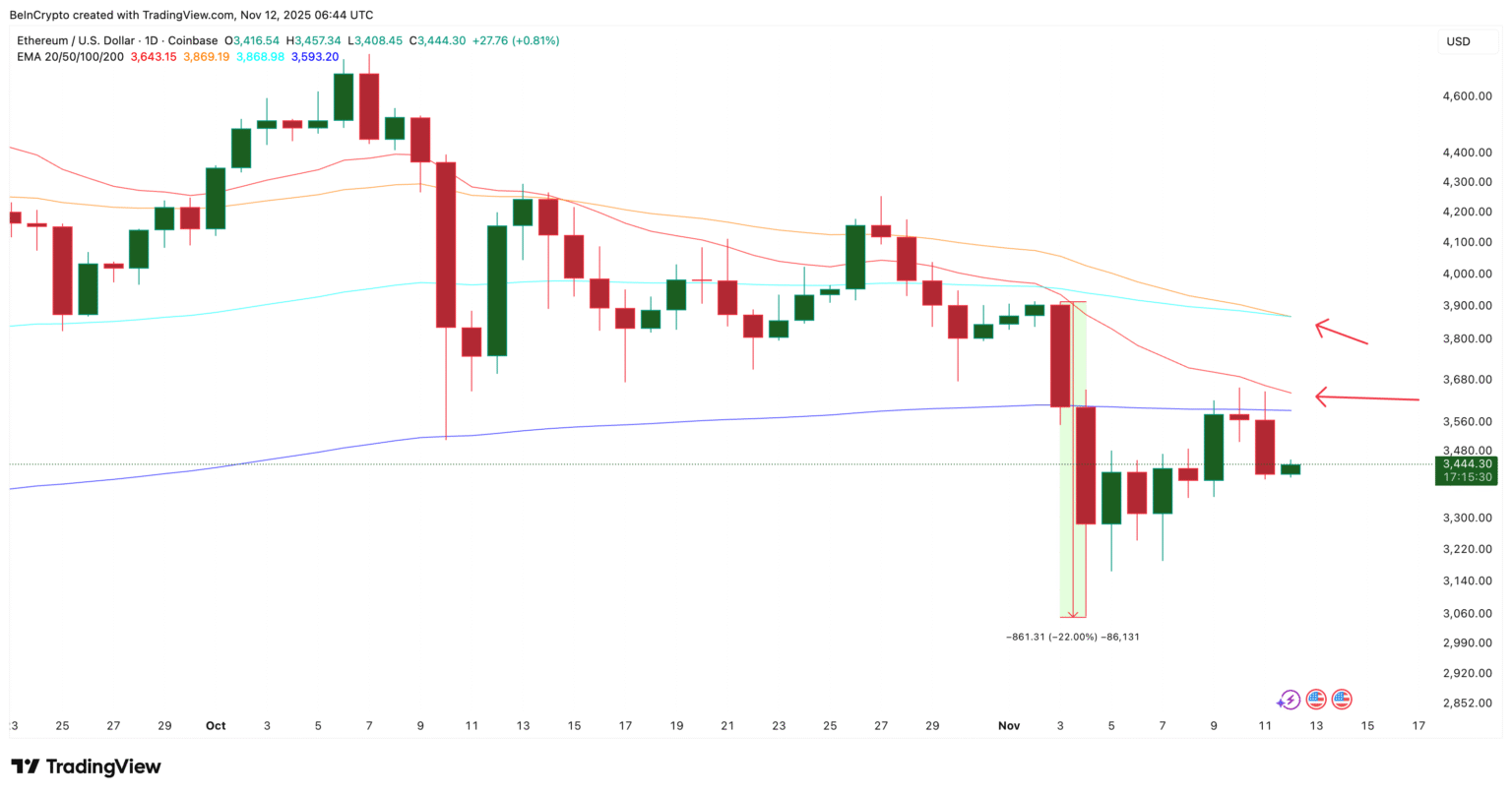

In a display of significant market confidence during unsettled times, Ethereum whales have collectively poured approximately $900 million into Ethereum amidst lingering bearish signals, marking a potentially transformative moment for the cryptocurrency landscape.

Despite prevailing market uncertainties and a series of bearish indicators in the crypto world, a set of Ethereum’s largest investors, often referred to as ‘whales’, have seemingly disregarded the broader sentiment to significantly increase their holdings. This surprising accumulation of Ethereum assets totaling around $900 million sends a resounding message about their long-term perspective and belief in Ethereum’s potential.

Analyzing the Bullish Move by Ethereum Whales

The crypto market has been marred by volatility, influenced by a range of factors including geopolitical tensions, regulatory news, and macroeconomic shifts such as interest rate hikes. Usually, such conditions would lead to a bearish outlook on high-volatility assets like cryptocurrencies. However, Ethereum whales appear unfettered by the prevailing gloom that has overshadowed the market.

The substantial investment by these large-scale holders is particularly noteworthy given the scale of the buy-ins, which seem to starkly contrast the market’s slow momentum. This trend was spotted through blockchain analytics tools, which highlighted unusual spikes in wallet activities and transfers, indicating that the whales were accumulating more Ethereum tokens despite the market being in a downturn phase.

What Drives the Whales’ Confidence?

Their motivations, while not entirely transparent, could be multifaceted:

-

Anticipation of Ethereum’s Upgrades: Ethereum is undergoing significant upgrades to its network, with Ethereum 2.0 set to enhance its scalability, security, and sustainability. Such technological enhancements could be a driving factor behind the whales’ decision, as they might expect these upgrades to boost Ethereum’s adoption and utility, thereby increasing its value.

-

Institutional Adoption: Recent trends indicate a growing interest from institutional investors and corporations in incorporating blockchain technology and adopting Ethereum for various applications—ranging from supply chain enhancements to financial services platforms. This institutional endorsement could validate the whales’ optimistic stance on Ethereum’s future.

-

Market Cycle Theories: Some investors operate on historical market cycle theories which suggest that after significant pullbacks, leading cryptocurrencies like Ethereum will not only recover but will also hit new highs. Large investors might be positioning themselves for what they believe could be an impending market upturn.

- Diversification and Hedging: In a broader economic context, diversifying into cryptocurrencies might be seen as a hedge against inflation or potential weaknesses in conventional financial systems. With central banks around the world exploring digital currencies, the inherent value of decentralized alternatives becomes more pronounced.

Potential Impacts of the Whales’ Actions

The aggressive accumulation by Ethereum whales could have several implications:

- Market Stabilization: By buying in large volumes during a downtrend, whales can help put a floor under prices, potentially stabilizing the market or even setting the stage for a rebound.

- Investor Sentiment: This kind of bullish behavior from significant investors could also serve to bolster general market sentiment, potentially attracting other investors to follow suit.

- Price Volatility: While large purchases can stabilize, they can also lead to price swings that can impact smaller investors. The actions of whales will therefore continue to be a critical area to watch.

This bold move by Ethereum whales, amidst a broader context of uncertainty, underscores the nuanced and dynamic nature of cryptocurrency markets. It serves as a reminder that in the crypto arena, strategic moves by major players can sometimes defy prevailing market sentiment and chart a course toward unanticipated outcomes. Their actions provide indispensable insights into market dynamics and future trends in the evolving digital asset landscape.

🟣 Bpaynews Analysis

This update on Ethereum Whales Disregard Bearish Indicators with $900 Million Investment sits inside the Latest News narrative we have been tracking on November 12, 2025. Our editorial view is that the market will reward projects/sides that can show real user activity and liquidity depth, not only headlines.

For Google/News signals: this piece adds context on why it matters now, how it relates to recent on-chain moves, and what traders should watch in the next 24–72 hours (volume spikes, funding rates, listing/speculation, or regulatory remarks).

Editorial note: Bpaynews republishes and rewrites global crypto/fintech headlines, but every post carries an added value paragraph so it isn’t a 1:1 copy of the source.