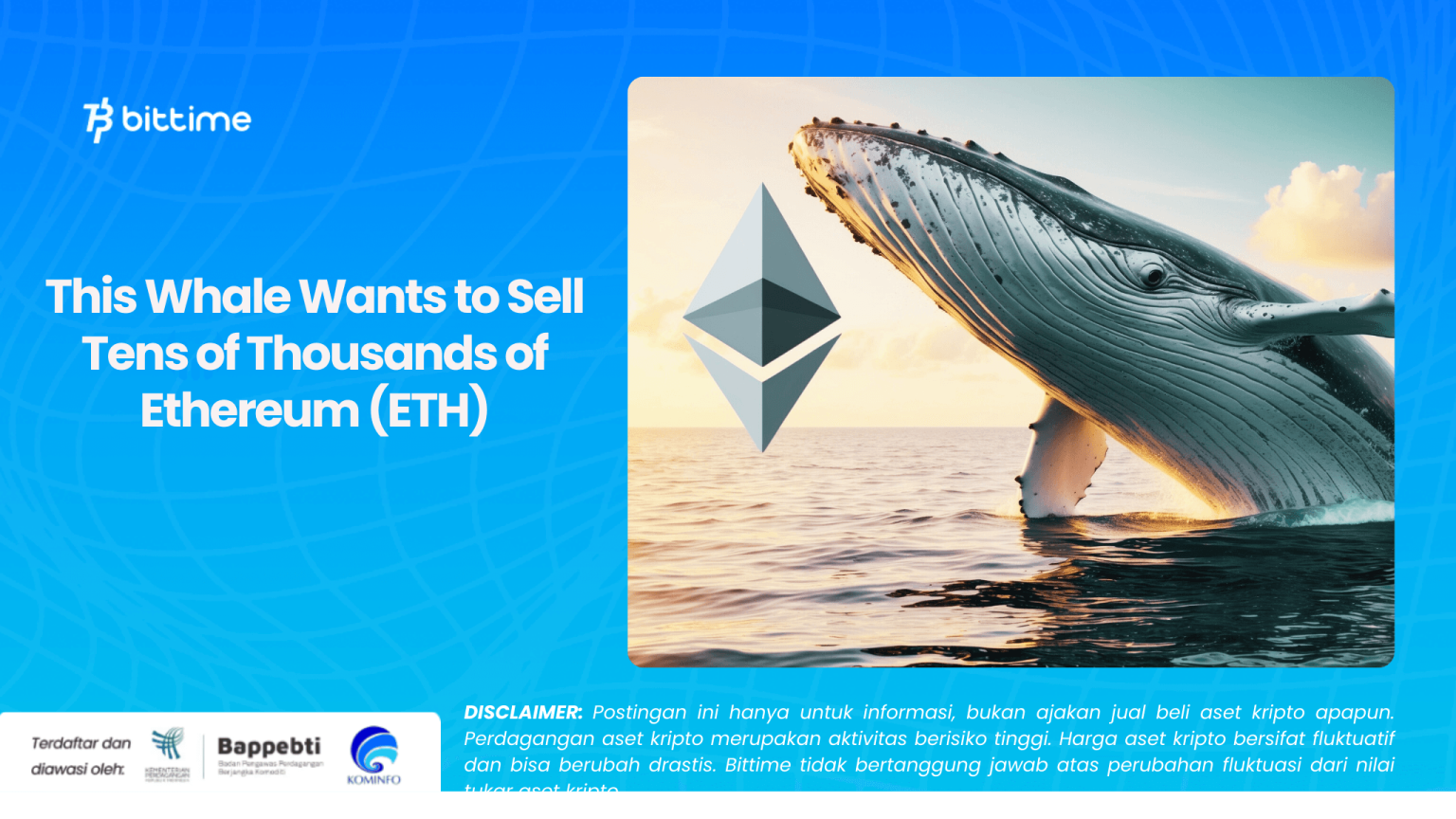

In a notable turn of events, an Ethereum whale sells ETH, parting with a staggering 27,800 ETH to curb potential losses amid the current market fluctuations. This strategic move comes as the price of ETH reached $2050, prompting the whale to take decisive action to protect its assets. By doing so, the whale successfully repaid a loan totaling $44.14 million, reflecting a significant impact on crypto market movements. The ongoing activity of large holders in the Ethereum ecosystem raises questions about future Ethereum price predictions and the overall stability of the market. As the whale still retains a position of 9,810 ETH worth $18.66 million on Spark, this situation continues to be a focal point for investors monitoring the volatile crypto landscape.

In recent trading news, a prominent figure in the Ethereum community has executed a sizeable sell-off, indicating a shift in strategy amidst changing market conditions. This high-stakes transaction involved the liquidation of 27,800 ETH, primarily aimed at managing risks connected to a substantial ETH loan repayment. As market enthusiasts analyze the implications of such significant liquidity events, conversations surrounding Ethereum value forecasting and the role of large-scale asset holders, often referred to as whales, become increasingly pertinent. Notably, the transaction also highlights the critical dynamics of ETH on Spark and its influence on ongoing financial decisions. As each maneuver by these influential traders shapes the overall landscape, investors are keenly observing the potential ripple effects on the broader cryptocurrency markets.

| Detail | Value |

|---|---|

| Whale Address | 0xfdd…6a92 |

| ETH Sold | 27,800 ETH |

| Loan Repaid | $44.14 million |

| Current Ether Holdings | 9,810 ETH |

| Value of Remaining ETH | $18.66 million |

| Current Loan Amount | 12.83 million DAI |

| Liquidation Price | $1,560 |

Summary

Ethereum whale sells ETH due to market pressures, as evidenced by a recent transaction where a significant entity liquidated 27,800 ETH to avert losses. This sale followed a decline in ETH price to $2050, compelling the whale to repay a substantial loan of $44.14 million. Despite this move, the whale still retains a hefty balance of 9,810 ETH valued at approximately $18.66 million. With a liquidation price now set at $1,560, it highlights the volatility and strategic maneuvers that large holders make to safeguard their investments in the ever-changing crypto landscape.

Ethereum Whale Sells ETH to Mitigate Losses

In a notable move within the crypto market, an Ethereum whale has sold a staggering 27,800 ETH on the Spark platform. The decision to unload such a significant amount of Ethereum comes as a strategic response aimed at mitigating potential losses amidst fluctuating market conditions. The whale, who had taken a lending position on Spark, saw the price of ETH reach $2050, prompting the urgent need to execute a sell-off to stop losses before they escalated further.

This sale was not just a routine market transaction; it was a calculated decision to protect assets and manage risk effectively. With the Ethereum price prediction showing volatility, the whale repaid approximately $44.14 million in loans, showcasing the impact of crypto market movements on individual investment strategies. Presently, the whale retains 9,810 ETH on Spark, which continues to hold substantial value—approximately $18.66 million despite the recent sell-off.

Impact of ETH Loan Repayment on Market Dynamics

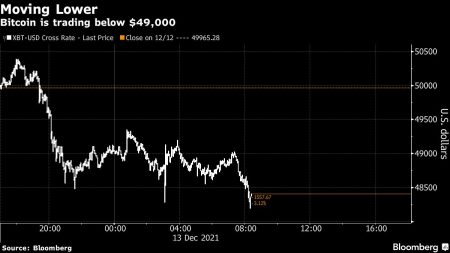

The repayment of a staggering $44.14 million loan by the Ethereum whale significantly impacts market dynamics. Such actions can influence ETH’s market behavior, as large sell-offs often lead to increased volatility and affect overall investor sentiment. The crypto market is particularly sensitive to the actions of whales, who hold substantial amounts of cryptocurrency and can sway prices with their trading choices.

As liquidity shifts in the market, traders and analysts are keen to monitor such movements closely. Given the current economic climate, effective loan repayment strategies like this incident on Spark can also set precedence for how other investors might approach their ETH holdings. This strategic move by the whale could become a pivotal case study in ETH trading and loan management.

Frequently Asked Questions

Why did the Ethereum whale sell 27,800 ETH?

The Ethereum whale sold 27,800 ETH to stop losses as the price of ETH approached $2050. This strategic move aimed to manage risks in the volatile crypto market.

What implications does the Ethereum whale sale have for ETH price prediction?

The sale by the Ethereum whale may influence market sentiment and potentially affect Ethereum price prediction. Large sell-offs can lead to increased volatility and downward pressure on ETH prices.

How does the whale’s sale affect the crypto market movements?

The whale’s sale of 27,800 ETH may trigger notable crypto market movements, as significant transactions can lead to shifts in supply and demand dynamics, affecting prices across the market.

What is the significance of the ETH loan repayment by the whale?

The ETH loan repayment of $44.14 million by the whale signifies a strategic financial maneuver to reduce debt and mitigate liquidation risks in the current market conditions.

How does holding ETH on Spark impact the whale’s position?

Holding ETH on Spark provides the whale the ability to utilize ETH for lending while managing loans. The current position includes 9,810 ETH, valued at $18.66 million, which can influence future trading strategies.

What does the liquidation price drop to $1,560 mean for the whale?

The liquidation price dropping to $1,560 means that if ETH falls below this threshold, the whale’s remaining position could be liquidated to cover the outstanding loan, making risk management crucial.