Ethereum’s validator entry queue has become a focal point in the world of blockchain technology, as it has surged close to 1 million ETH, reflecting a growing interest in Ethereum staking. With institutional players like BitMine Immersion Technologies adding substantial stakes—82,560 Ether valued at approximately $259 million—the validator queue congestion is expected to increase further. This influx of staked Ether results in a projected wait time of around 17 days for new validators eager to join the Ethereum network. As the demand for yield continues to rise, staking Ether has never been more appealing to investors seeking to maximize their returns in the evolving DeFi landscape. The developments in the validator entry queue underscore the dynamic nature of the Ethereum ecosystem and its potential for future growth.

The Ethereum validator entry queue, often referred to as the staking validator backlog, has seen a remarkable rise in Ether deposits, indicative of the broader interest in participating in Ethereum’s decentralized financial ecosystem. As major players like BitMine boost their stakes, the influx intensifies the validator queue congestion, which now holds close to 1 million Ether, leading to significant wait times for new validators wishing to activate. This growing interest in staking and yield generation reflects the potential for profit within the Ethereum network, making it an increasingly attractive option for both individual and institutional investors alike. Moreover, trends in Ethereum staking suggest that the market is becoming more saturated with staked assets, ultimately shaping the future landscape of this blockchain technology. Those looking to stake Ether are finding themselves at the heart of an evolving challenge as the staking ecosystem grows and matures.

Understanding Ethereum Staking and Its Impact on the Validator Entry Queue

Ethereum staking has become a critical aspect of the Ethereum network, allowing participants to lock up their Ether in exchange for rewards. As institutional players like BitMine join the staking ecosystem, they contribute significantly to the validator entry queue. Currently, the queue is nearing 1 million ETH, with new validators facing a wait time of approximately 17 days. This congestion signals a rapid increase in interest in staking, particularly as more entities seek to capitalize on the annualized staking yield of about 2.54%.

The surge in the validator entry queue directly correlates with the growing demand for yield in the cryptocurrency market. This demand has been fueled partly by institutional investments like those from BitMine, which recently staked an additional 82,560 ETH. Such investments not only enhance validator capacity but also signify a bullish sentiment on the future appreciation of Ether, positively influencing the broader Ethereum network’s security and stability.

BitMine’s Strategic Moves and the Rise of Validator Queue Congestion

BitMine Immersion Technologies has made headlines with its aggressive staking strategy, adding over $259 million worth of ETH to the Ethereum network. This move illustrates the increasing participation of institutions in Ethereum staking, contributing to the growing validator entry queue congestion. With BitMine’s total staked Ether reaching 544,064, the firm’s presence in the ecosystem is unmistakable, pushing the wait time for new validators to an estimated 17 days.

The substantial addition of Ether to the staking pool not only impacts the validator entry queue but also showcases the potential for Ethereum’s scalability and security enhancements. As more participants stake Ether, the network benefits from improved resilience against attacks and greater decentralization. BitMine’s plans to pilot its internal Made-in-America Validator Network (MAVAN) further highlight the evolving landscape of Ethereum staking, suggesting that institutional engagement could lead to significant changes in how stakeholders interact with the Ethereum network.

The Future of Ethereum Staking: Predictions and Market Dynamics,

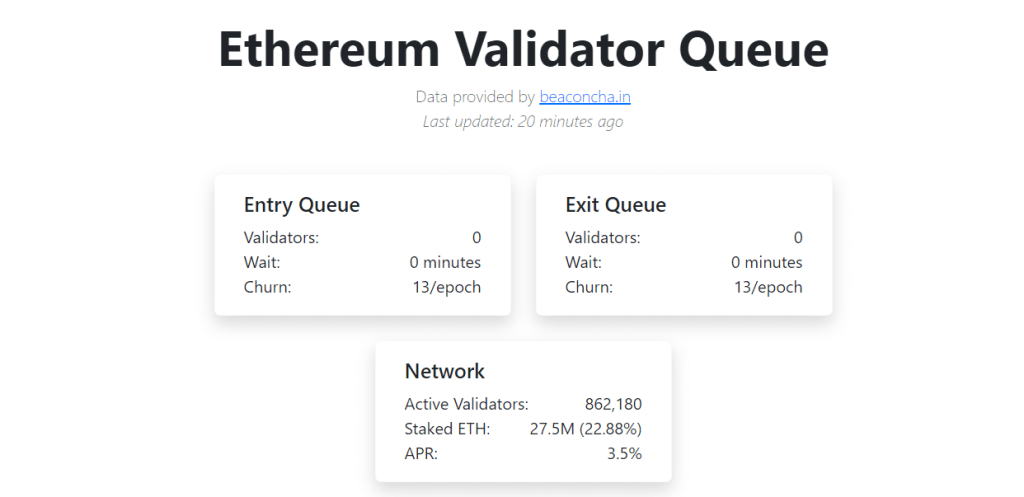

As the Ethereum network continues to evolve and attract more stakers, analysts like Abdul from Monad are reflecting on the potential future dynamics of the staking landscape. With over 35.5 million ETH currently staked, the implications for Ethereum’s market dynamics are profound. Both entry and exit activities in the validator queue are essential indicators of market sentiment; the quick influx of new stakeholders may signal optimism and price appreciation.

Abdul’s correlation of historical events such as the price doubling of ETH following shifts in the entry and exit queues suggests that market movements may be closely tied to validator activities. As we approach 2026, a year some consider pivotal for Ethereum, shifts in the validator queue may continue to play a crucial role in defining the price trajectory of Ether and influence investment strategies for stakeholders.

The Role of Institutional Investors in Ethereum Staking

Institutional investors have been increasingly flocking to the Ethereum staking ecosystem as highlighted by the recent activities of BitMine. This trend marks a significant shift in the perception of Ethereum from mere speculative asset to a viable long-term investment avenue. By stabling substantial amounts of Ether, institutions not only help reduce the overall supply circulating in the market but also enhance the network’s security overall through their long-term commitment.

The influx of capital from institutional players like BitMine elevates the legitimacy of Ethereum staking and introduces a new level of professionalism to the sector. As large stakeholders enter, they often demand more robust infrastructure, which can propel innovations within the Ethereum network. This symbiotic relationship suggests that the growth of the validator entry queue may not just reflect the participation levels, but also instigate advancements that could benefit all stakeholders in the Ethereum ecosystem.

The Future of Ethereum: An Upsurge in Validator Activity

As Ethereum’s validator entry queue expands, it serves as a barometer for the network’s health and future. The ongoing activity reflects not just participation levels but potential future price movements for Ether. Observations from industry experts suggest that periods of high validator entry tend to coincide with increased confidence in Ethereum’s price stability and growth, making it a critical aspect to monitor.

Looking ahead, the potential for Ethereum to achieve significant milestones hinges on how effectively the validator entry queue can accommodate new users without overwhelming network resources. Successful management of this influx will be essential in ensuring that Ethereum remains a competitive player in the crypto market while also fostering an environment conducive to both individual and institutional staking.

Analyzing the Market Dynamics of ETH Staking Yields

With Ethereum staking yields hovering around 2.54%, many market participants are keen to understand the dynamics influencing these returns. As more Ether is staked, the staking rewards are distributed among stakers, which can create fluctuations in yield based on the volume of ETH locked in the system. Given the current level of engagement and the significant amount of ETH in the validator queue, many investors are finding this an appealing opportunity to stake their Ether.

Yield implications are particularly important as we consider broader macroeconomic conditions and their effects on cryptocurrency markets. Should the demand for staking increase further, it’s plausible that yields may adjust accordingly, providing an even greater incentive for individuals and institutions to stake their Ether, thereby expanding the validator entry queue and solidifying Ethereum’s staking ecosystem.

Frequently Asked Questions

What is the current status of the Ethereum validator entry queue?

The Ethereum validator entry queue has recently surged to nearly 1 million ETH, with a projected activation wait time of about 17 days for new validators. This increase is partly due to the significant volume of Ether being staked, particularly from institutional investors like BitMine Immersion Technologies.

How does BitMine’s staking impact the Ethereum validator entry queue?

BitMine’s aggressive staking strategy has contributed to the congestion in the Ethereum validator entry queue. Recently, they staked an additional 82,560 Ether, bringing their total staked ETH to 544,064, which has heightened demand and delays in the validator activation process.

What does it mean for new validators to join the Ethereum staking network?

For new validators looking to join the Ethereum staking network, joining the validator entry queue is necessary. Currently, the queue has around 977,000 ETH, meaning new validators must wait approximately 17 days before they can activate their staking operation and start earning rewards.

What are the implications of a backlog in the Ethereum validator entry queue?

A backlog in the Ethereum validator entry queue can lead to longer wait times for new validators wanting to stake Ether, potentially discouraging new participants from entering the staking ecosystem and negatively affecting Ethereum’s overall network health and efficiency.

How does validator queue congestion affect Ethereum staking yields?

Validator queue congestion may influence Ethereum staking yields, as a high volume of staked ETH can lead to a more stable network but could also impact the annualized yield, which is currently around 2.54%. As demand grows, it might affect rewards distribution among validators.

What are the future expectations for the Ethereum validator entry queue?

Given the current trends, including increased institutional participation and BitMine’s staking activities, the Ethereum validator entry queue is expected to remain congested. Experts speculate that as the market evolves, the wait times could potentially decrease or alter significantly by 2026.

Why is it beneficial to stake Ether in the Ethereum network?

Staking Ether in the Ethereum network provides several benefits, including earning rewards from transaction validations and contributing to network security. Moreover, with the validator entry queue growing, staking offers a way to participate in Ethereum’s upcoming phases, especially as institutional investments rise.

What role does BitMine play in the Ethereum staking landscape?

BitMine plays a significant role in the Ethereum staking landscape as one of the largest institutional stakeholders, having staked a substantial amount of ETH. Their actions influence validator queue dynamics and overall market sentiment toward Ethereum staking.

What can new investors in Ether expect regarding validator activation?

New investors in Ether looking to become validators should expect some delays for activation due to the current validator entry queue congestion. With the wait time estimated at about 17 days, investors should plan accordingly for these activation periods.

| Key Points |

|---|

| Ethereum validator entry queue nears 1 million ETH (around 977,000 ETH currently), with an estimated activation wait time of 17 days. |

| BitMine Immersion Technologies has staked an additional 82,560 ETH, valued at $259 million, contributing to increased congestion in the queue. |

| BitMine’s total staked ETH has reached 544,064 Ether, which is approximately $1.62 billion based on current prices. |

| The company began staking ETH on December 26 and has a strategy that includes using the Made-in-America Validator Network for future stakes. |

| Only 113,000 ETH are in exit activity, indicating that most stakers are committed to the network and are not withdrawing. |

| About 35.5 million ETH, or around 29% of total supply, is staked across the network, with an annualized staking yield of approximately 2.54%. |

| Predictions indicate that if the entry-exit queue flips, ETH’s price could significantly increase, with speculation around major price points for Ether and BitMine’s shares in the future. |

Summary

The Ethereum validator entry queue has seen a substantial increase, nearing 1 million ETH, primarily driven by the institutional interest represented by BitMine’s recent staking actions. This influx of capital is indicative of a broader trend in the Ethereum network, where the demand for staking continues to outpace exit activities. As a result, prospective validators face an estimated 17-day wait period to activate, highlighting the growing interest and commitment to Ethereum’s staking ecosystem. Overall, the Ethereum validator entry queue reflects a vibrant and actively engaged staking community that anticipates significant developments in the near future.

Related: More from Ethereum News | World Liberty Financial Links Staking to Voting: USD1 Supply Exceeds $4.7B | Ethereum Transforms into High