The Ethereum total locked value (TVL) has recently crossed an impressive milestone, surpassing $300 billion in on-chain applications. This remarkable figure underscores the growing importance of DeFi applications, where participants are utilizing their assets to unlock new financial opportunities. Furthermore, stablecoins and Real World Assets (RWA) play a crucial role in bolstering Ethereum liquidity, creating a dynamic ecosystem ripe for innovation. Leon Waidmann’s recent insights highlight Ethereum’s leadership in terms of liquidity depth and a robust developer community, offering a unique composability that sets it apart from competing networks. As the Ethereum TVL continues to expand, it signals not just growth but a transformative shift in how assets are utilized in the financial landscape.

As the value locked within Ethereum’s decentralized finance ecosystem surges, it’s essential to understand the implications of this burgeoning market. The substantial amount of capital held in the Ethereum network showcases the shift towards alternative financial systems, where decentralized platforms are becoming increasingly popular. By integrating various assets, including stablecoins and Real World Assets, these applications are fostering deeper liquidity and operational efficiency. Moreover, Ethereum’s composability enables developers to create innovative financial products and services that cater to a diverse user base. In this evolving landscape, keeping abreast of the trends and developments surrounding Ethereum’s total locked value will be imperative for investors and enthusiasts alike.

Understanding Ethereum Total Locked Value (TVL)

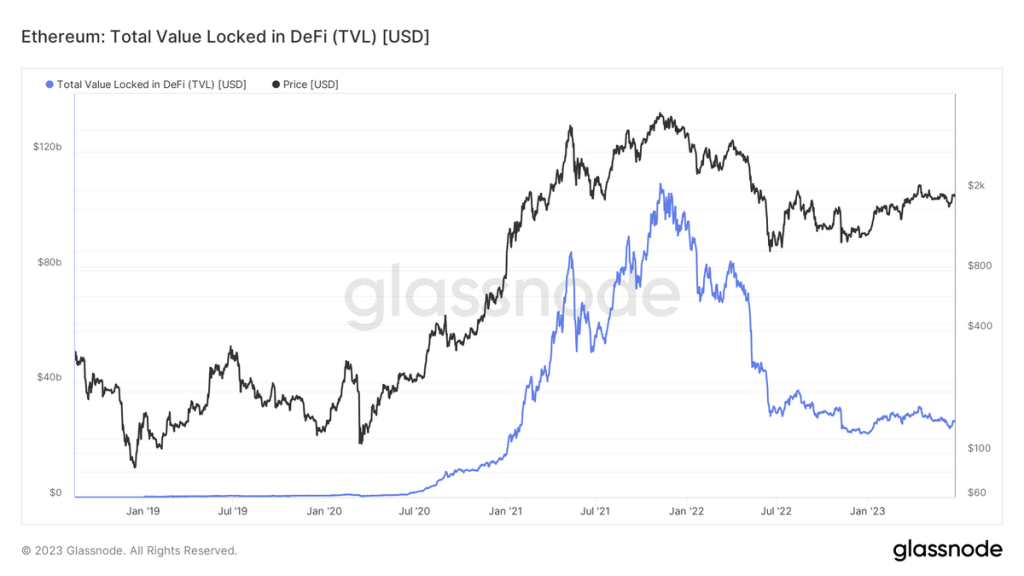

Ethereum total locked value (TVL) is a critical metric that measures the overall assets locked in smart contracts on the Ethereum blockchain. As of January 2026, this number has impressive surpassed $300 billion, highlighting Ethereum’s dominance in the decentralized finance (DeFi) sector. TVL represents the capital that is actively being utilized in various applications, showcasing the trust and reliance users place on Ethereum’s capabilities. This robust figure reflects the growing adoption of DeFi applications that utilize Ethereum for lending, borrowing, and trading assets, as investors look to secure greater returns.

The factors contributing to such a substantial TVL in Ethereum include its advanced smart contract functionalities and the vibrant ecosystem it supports. Many DeFi applications utilize stablecoins for transaction efficiency, while others are exploring partnerships with Real World Assets (RWA) to bolster liquidity. Ethereum’s infrastructure enables developers to create innovative solutions that cater directly to user needs, enhancing the usage of liquidity pools and staking mechanisms that are pivotal in maintaining a healthy blockchain economy.

Ethereum’s Dominance in DeFi Applications

The decentralized finance (DeFi) landscape has been revolutionized largely due to Ethereum’s technological advantages. DeFi applications built on the Ethereum blockchain leverage the extensive liquidity offered by the network, thus attracting a significant volume of transactions. Ethereum’s composability feature allows these applications to integrate seamlessly with one another, creating an interconnected web of financial services that foster innovation and user engagement. As a result, Ethereum continues to set benchmarks in the DeFi sector, leading the pack in both user adoption and capital flow.

The widespread acceptance of DeFi on Ethereum is also fueled by the presence of stablecoins, which act as a stable medium of exchange within the volatile crypto market. Users can interact with DeFi applications by minting and using stablecoins, reducing the risks associated with price fluctuations and increasing overall participation in the ecosystem. This stability not only attracts retail investors but also institutional players, further enhancing Ethereum’s TVL as more participants seek the benefits of decentralized finance.

The Role of Stablecoins in Ethereum’s Ecosystem

Stablecoins play a crucial role in Ethereum’s economic landscape by providing liquidity and stability. They bridge the gap between traditional fiat currencies and the cryptocurrency world, allowing users to transact without the inherent volatility associated with cryptocurrencies. On Ethereum, popular stablecoins like USDC and DAI enable users to trade, lend, and borrow with confidence, effectively driving up Ethereum’s total locked value (TVL). As these stablecoins gain traction, they significantly contribute to the liquidity depth of the Ethereum network.

Moreover, the integration of stablecoins in DeFi applications on Ethereum opens up a multitude of use cases, from yield farming to liquidity provider incentives. Users can leverage their stablecoin holdings to earn interest or engage in arbitrage opportunities across different applications. This continuous inflow and outflow of stablecoins not only enhances the overall liquidity within the Ethereum network but also solidifies its position as the leading blockchain for financial innovation.

Real World Assets (RWA) on Ethereum

The concept of Real World Assets (RWA) being tokenized on the Ethereum blockchain represents a significant step toward bridging the gap between traditional finance and the digital assets space. By converting tangible assets like real estate and commodities into digital tokens, Ethereum enables a new way for investors to access these markets. This movement not only increases the total locked value (TVL) of Ethereum but also introduces a broader audience to blockchain technology, appealing to both seasoned investors and newcomers.

Furthermore, incorporating RWAs into the Ethereum ecosystem enhances its utility, making it possible to collateralize these assets in DeFi applications. This shift in thinking encourages liquidity by providing assurances and tangible backing for decentralized financial transactions. As more RWAs are integrated into Ethereum’s framework, the benefits extend beyond just increased TVL; it paves the way for increased adoption and a more diverse range of financial products and services.

Ethereum’s Liquidity Depth and Its Implications

Ethereum’s liquidity depth is unparalleled, setting it apart from other blockchain networks. Liquidity is the lifeblood of any financial ecosystem, allowing users to enter and exit positions with minimal price impact. This feature is especially crucial for traders and investors, as it diminishes the risks associated with volatility in asset prices. As reported, the total locked value (TVL) on Ethereum underscores not only the sheer volume of assets available but also the solidity of its infrastructure, thereby attracting even more capital and users.

The implications of Ethereum’s liquidity depth are profound, as it creates a self-reinforcing cycle of growth. The more liquidity available, the more applications can thrive and innovate, which in turn attracts more users and capital. This ecosystem feedback loop is vital in driving forward Ethereum’s position as the leading blockchain technology. With continuous upgrades and enhancements, Ethereum is poised to further capitalize on its liquidity advantages, ensuring sustained growth in its total locked value (TVL).

The Development of Ethereum’s Ecosystem

The development of Ethereum’s ecosystem has been marked by consistent innovation and updates that enhance its overall functionality. Developers are constantly releasing new DeFi applications that push the boundaries of what is possible on the blockchain. This includes protocols that enable more efficient trading and lending, which not only attracts users but also enhances the total locked value (TVL) on the platform. Such continuous development demonstrates Ethereum’s commitment to addressing the evolving needs of its user base.

Moreover, the collaborative nature of the developer ecosystem fosters a culture of innovation, where ideas can be rapidly prototyped and deployed. With each new application or enhancement, the Ethereum network becomes more robust, increasing its appeal both for individual users looking to leverage DeFi products and for institutions seeking stability and reliability in their investments. This multifaceted approach to development ensures that Ethereum remains at the forefront of blockchain technology and financial services.

Institutional Investment in Ethereum: A Growing Trend

Institutional investment in Ethereum has surged in recent years, propelling its total locked value (TVL) to record highs. These institutions recognize the immense potential that Ethereum holds, particularly in the realms of DeFi and stablecoins. By pouring capital into Ethereum, they are not only diversifying their portfolios but also legitimizing the blockchain ecosystem in the eyes of mainstream investors. The influx of institutional money translates into greater liquidity and stability for Ethereum’s market.

The interest from institutional investors has also spurred advancements in Ethereum’s infrastructure. With increased demand, there are continuous improvements in scalability, security, and overall functionality of the network. Additionally, this trend encourages the launch of new financial products and services tailored for institutional needs, further embedding Ethereum into the traditional finance framework. As this movement progresses, it solidifies Ethereum’s position as a cornerstone of the global crypto economy.

Future of Ethereum: Predictions and Trends

The future of Ethereum looks promising, with analysts predicting continued growth in its total locked value (TVL) as more users embrace decentralized finance and the benefits it offers. Innovations in the Ethereum network, such as the transition to proof-of-stake (PoS), aim to improve scalability and efficiency, potentially attracting even more participants to the ecosystem. As developers dream up new applications and use cases, Ethereum is poised for exponential growth.

Moreover, as traditional financial institutions begin to explore how to leverage blockchain technology, Ethereum stands to benefit significantly. The focus on Real World Assets (RWA) tokenization, coupled with the increasing reliance on DeFi applications, enhances Ethereum’s appeal as the go-to blockchain for developers and users alike. In summary, as the Ethereum ecosystem evolves, its total locked value will reflect the growing adoption and integration of its services into daily financial activities.

Ethereum: A Leader in Blockchain Technology

Ethereum has established itself as a leader in the blockchain landscape with its robust ecosystem and innovative approach to decentralized applications. The total locked value (TVL) on Ethereum is a testament to its success, as it consistently outpaces other blockchains in terms of user engagement and capital utilization. This leadership is driven by Ethereum’s pioneering work in smart contracts and DeFi, pushing the boundaries of how traditional financial transactions can be executed in a decentralized manner.

As Ethereum continues to innovate, its position as the cornerstone of blockchain technology will likely solidify. The continuous growth in TVL not only reflects current user trust but also indicates future potential as the network adapts to emerging trends like digital assets and new types of financial products. With ongoing improvements in scalability and functionality, Ethereum is well on its way to leading the new frontier in finance and technology.

Frequently Asked Questions

What is Ethereum total locked value (TVL) and why is it important?

Ethereum total locked value (TVL) reflects the total assets staked or locked in DeFi applications on the Ethereum network. It is important as it indicates the liquidity and health of the ecosystem, with over $300 billion currently locked in various projects. A high TVL suggests robust economic activity and confidence in Ethereum-based protocols.

How does Ethereum TVL impact the DeFi ecosystem?

Ethereum TVL significantly impacts the DeFi ecosystem as it showcases the amount of capital available for lending, borrowing, and trading. The more assets locked, the greater the liquidity, which enhances the efficiency of DeFi applications and attracts users and investors to Ethereum.

What role do stablecoins play in Ethereum’s total locked value?

Stablecoins are crucial in Ethereum’s total locked value as they provide a stable means of transaction and collateral in the DeFi space. They contribute to the TVL by being locked in smart contracts for trading, lending, and yield farming, ensuring greater price stability and liquidity within the Ethereum ecosystem.

What are Real World Assets (RWAs) and their significance in Ethereum TVL?

Real World Assets (RWAs) refer to tangible assets represented on-chain via tokenization. Their significance in Ethereum’s TVL lies in their ability to bridge traditional finance with DeFi applications, allowing Ethereum holders to unlock new liquidity and diversify their asset portfolios, further adding to the overall locked value.

How does Ethereum achieve higher liquidity depth compared to other networks?

Ethereum achieves higher liquidity depth compared to other networks due to its extensive DeFi applications and a vast ecosystem of developers. This composability creates synergistic effects, enabling users to quickly move capital across different applications, thereby increasing the overall total locked value and attracting more participants to the network.

What is the current total locked value of Ethereum and its future projections?

As of January 2026, the Ethereum total locked value stands at over $300 billion. Future projections suggest that this figure may continue to grow as more users and developers engage with innovative DeFi applications, stablecoin offerings, and Real World Assets, enhancing Ethereum’s position in the blockchain ecosystem.

| Key Points |

|---|

| The total locked value (TVL) of Ethereum has exceeded $300 billion as of January 8, 2026. |

| Ethereum’s TVL is used in various sectors including DeFi, stablecoins, Real World Assets (RWA), and staking. |

| Ethereum outperforms other networks in terms of liquidity depth and the composability of its developer ecosystem. |

| There is a significant historical precedent for institutional predictions regarding Ethereum’s future. |

| Ethereum has substantial reserves of users and capital, highlighting strong network effects. |

Summary

The Ethereum total locked value (TVL) highlights the significant engagement and activity occurring within the Ethereum ecosystem. With its TVL surpassing $300 billion, it indicates robust user participation in decentralized finance (DeFi), stablecoins, and more, showcasing Ethereum’s dominance in the blockchain space. The leading liquidity depth, combined with the composable ecosystem, positions Ethereum favorably against competitors. The sustained interest from institutions further reinforces confidence in Ethereum’s long-term viability and growth.