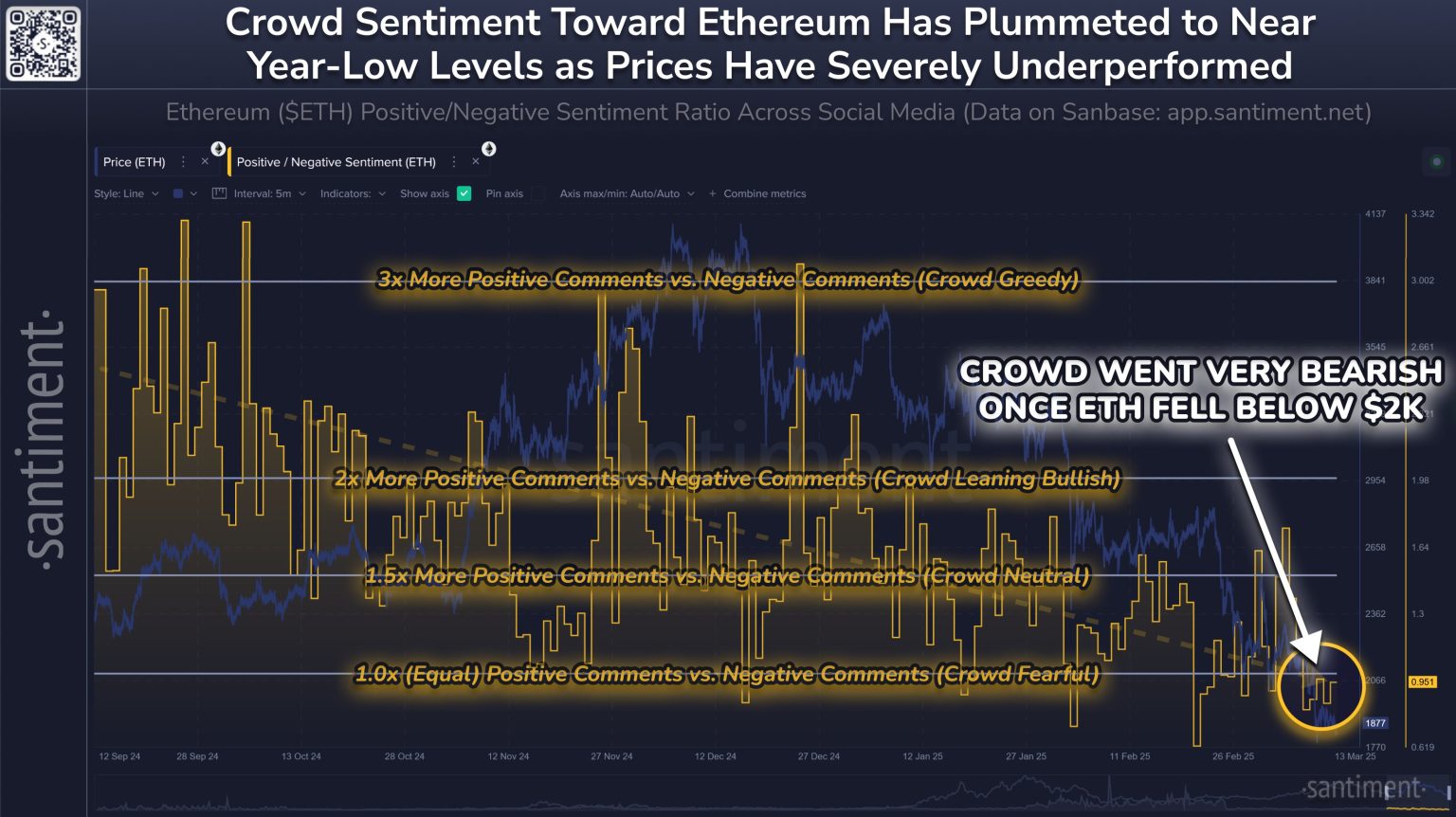

Ethereum social media sentiment has been a topic of keen interest as analysts observe parallels with previous market behaviors prior to significant price increases. Recent data from Santiment indicates that the current decline in social media discussions around Ethereum mirrors sentiments recorded before its 2025 price rally, which propelled the cryptocurrency back to its all-time high from 2021. Brian Quinlivan, a noted crypto sentiment analyst, suggests that this dip in social media activity may signal a bottoming out for Ethereum’s price, implying limited potential for further decline. This aligns with ongoing discussions about Ethereum price analysis and future market trends, as investors remain cautiously optimistic amidst a landscape punctuated by broader market fluctuations. As the landscape develops, crypto enthusiasts are increasingly focusing on Ethereum price predictions, keenly watching how social sentiment correlates with price movements and overall market recovery expectations.

The sentiment surrounding Ethereum’s social media interactions offers fascinating insights into the digital currency’s potential trajectory. Observers have drawn interesting comparisons to previous market cycles, especially in terms of investor behavior and community engagement. Many analysts are delving into crypto sentiment analysis to understand the emotional and psychological factors that influence Ethereum’s market dynamics. As Ethereum continues to navigate through varying economic climates, discussions about its future outlook become more pronounced, providing valuable context for market participants. The evolving landscape of Ethereum market trends showcases not just the immediate price movements, but also the underlying sentiment that drives investor confidence.

Understanding Ethereum Social Media Sentiment

The current trend in Ethereum social media sentiment signals an intriguing correlation with its past performance, particularly seen prior to significant price movements. According to Santiment’s analysis, Ethereum’s declining social media sentiment echoes the patterns observed ahead of its dramatic rally in 2025. This perception among crypto enthusiasts and market analysts suggests a potential turnaround for Ethereum, as social media platforms play a critical role in shaping market interpretations and forecasted movements. The sentiment can heavily influence investor confidence, setting the stage for momentum shifts that are often pivotal in trading decisions.

Brian Quinlivan from Santiment highlights a critical observation: Ethereum’s current price level suggests limited downside risk, reinforcing that the market sentiment is similar to conditions preceding its past highs. Historically, periods of declining sentiment on social media have often precedented reversals in price momentum, indicating that investor attitudes can swing quickly from negativity to optimism. As traders increasingly discuss Ethereum in a context reminiscent of previous bullish phases, we may witness a revival of interest and potential buying pressure that could propel Ethereum towards its previous resistance levels.

Ethereum Price Analysis and Market Trends

Ethereum’s price analysis reveals a complex interplay of market forces at current levels. Following a surge to its all-time high of $4,878, Ether has faced a recalibration, now trading at approximately $3,089 after a 36% decline. Market analysts attribute this recent downturn to a sweeping liquidation event within the cryptocurrency ecosystem, contributing to the overarching volatility across altcoins. Understanding these dynamics is essential for investors seeking to navigate Ethereum’s price movement amid fluctuating market conditions and to develop informed strategies based on past performance trends.

The future of Ethereum’s price hinges on various factors, including market sentiment and broader economic conditions that influence crypto trading. With hints of recovery emerging from social media sentiment, traders are keenly analyzing potential signals of a rebound that could re-establish Ethereum’s market footing. As the historical context offers insights into future possibilities, the importance of tracking Ethereum market trends becomes increasingly evident for both long-term investors and short-term traders.

Ethereum Price Prediction: Future Outlook

Ethereum’s future price outlook continues to generate speculation among analysts and investors alike. Given the recovery witnessed after the previous lows, many experts are cautiously optimistic about Ethereum’s potential to reclaim new highs. The recent price stabilization and increased staking activity signal that investor sentiment may be shifting favorably, allowing for potential upward momentum in the coming months. Critical considerations such as market sentiment analysis and the performance of other major cryptocurrencies, especially Bitcoin, will be key in forecasting Ethereum’s future price trajectory.

Analysts are also reflecting on Ethereum’s fundamental growth, including network upgrades and increasing transaction activity, which are pivotal for long-term price stability. Predictions may vary, but the collective sentiment remains that Ethereum could find itself in an advantageous position if it manages to capture the interest of both retail and institutional investors. As discussions around Ethereum gain traction within social media and investment forums, keeping an eye on these sentiments could provide essential clues about the crypto’s potential responsiveness to market changes and upcoming price forecasts.

Crypto Sentiment Analysis in the Ethereum Ecosystem

Crypto sentiment analysis is an indispensable tool for understanding how market dynamics affect Ethereum’s price movements. As the broader market continues to exhibit signs of ‘Fear’ and ‘Extreme Fear’, it is essential for investors to gauge how sentiment impacts behavioral patterns associated with Ethereum. The Altcoin Season Index, which indicates competitive positioning among leading cryptocurrencies, reveals that Ethereum’s standing is vital in the landscape of digital assets. As sentiment shifts, analyzing these trends can inform strategic decision-making and bolster trading confidence.

Furthermore, the interplay of social media sentiment and actual market movements plays a critical role in shaping perceptions surrounding Ethereum. Investors should remain vigilant about the positive or negative discourses emerging online as they often preface significant market events. With crypto sentiment oscillating between fear and optimism, engaging in a comprehensive crypto sentiment analysis offers valuable insights that may forecast potential shifts in Ethereum’s trading patterns.

Ethereum Network Growth and its Impact

The unprecedented growth of the Ethereum network is central to understanding its price dynamics and market perceptions. With mounting interest in staking and decentralized finance (DeFi) applications, Ethereum continues to expand its footprint within the crypto ecosystem. This network growth represents an essential pillar in Ethereum’s future outlook, particularly when juxtaposed against the broader trend of sentiment in the market. Analysts point out that as long as the fundamentals of the network remain robust, an uptick in price action could follow, especially if the market sentiment shifts to more favorable conditions.

As Quinlivan indicates, Ethereum’s flourishing network activities, including a surge in staking engagements, indicate a healthy ecosystem that is becoming increasingly attractive to investors. The diversification within the Ethereum landscape enhances investor confidence that the fundamentals support potential price increases. This trend of network expansion and positive sentiment within the community could set the stage for future bullish scenarios, allowing Ethereum to reclaim its previous highs and solidify its position as a leading cryptocurrency.

Market Behavior and Risk Aversion in Ethereum Trading

The behavior of the market surrounding Ethereum indicates a notable degree of risk aversion among investors amidst the prevailing market conditions. The extreme fluctuations and price corrections have led many traders to favor Bitcoin over altcoins, as indicated by the lower Altcoin Season Index score. This shift underscores a cautious approach, where investors are opting for the perceived safety of larger, more established crypto assets, while questions linger regarding Ethereum’s potential for short-term growth. The hesitation among traders exemplifies how market sentiment can profoundly affect investment decisions.

In light of the prevailing risk aversion, it is critical for investors to develop strategies that accommodate uncertainty while remaining aware of potential opportunities within the market. As Ethereum continues to navigate through these challenges, drawing insights from market behavior can empower traders to position themselves advantageously as conditions evolve. Keeping abreast of market sentiment and understanding the history of Ethereum’s price may support more informed trading strategies as the landscape adapts to fluctuating investor attitudes.

The Role of Investor Confidence in Ethereum

Investor confidence plays a pivotal role in the trajectory of Ethereum, acting as both a driver for price increases and a deterrent during downturns. As noted by various analysts, the community’s prevailing sentiment can create an environment conducive to bullish activity if confidence remains high. As Ethereum witnessed fluctuations and a significant correction, maintaining confidence among investors becomes a focal point for future growth. Positive discourse surrounding Ethereum’s innovative developments can help inspire confidence, drawing more investors into the market.

Moreover, with the Ethereum community actively engaging in discussions on social media, the perceptions formed can greatly influence market behavior. When stakeholders express optimism about Ethereum’s potential, often reflected in social media sentiment, it can create a domino effect that enhances market confidence among traders and investors alike. Conversely, negative sentiment may lead to a lack of enthusiasm, highlighting the importance of building and sustaining a supportive atmosphere around Ethereum to promote stability and potential growth.

Comparative Analysis of Ethereum and Bitcoin

A comparative analysis between Ethereum and Bitcoin reveals distinct characteristics that shape investor decisions within the crypto market. While Bitcoin continues to hold the title of a digital store of value, Ethereum’s multifunctional platform attracts users through its smart contracts and innovations in decentralized applications. This divergence highlights the different type of investor sentiment that often accompanies the two assets, influencing how Ethereum is perceived among those with varying risk appetites and investment strategies. A favorable Ethereum social media sentiment can draw attention away from Bitcoin, indicating a competitive landscape.

Ethos surrounding Ethereum is crucial, especially as it competes for market share against Bitcoin. Bitcoin’s original premise is often viewed as a safe haven during market volatility, while Ethereum’s vast utility and market potential can enhance its attraction in opportunistic trading environments. As both assets continue to mature, the comparative sentiment analysis can provide valuable insights into patterns of investor behavior and preferences, driving potential shifts in market dynamics that could alter Ethereum’s future path.

Navigating Ethereum’s Investment Landscape

Navigating the investment landscape of Ethereum requires a delicate balance of fundamental analysis and market sentiment awareness. Investors are advised to consider not only Ethereum’s historical pricing patterns but also the current market environment influenced by broader economic factors and social media sentiment. Understanding how Ethereum is perceived in the eyes of both retail and institutional investors can play an integral role in shaping trading strategies that align with market movements. The emphasis on well-informed decision-making underscores the necessity for investors to remain educated on evolving trends and developments.

Moreover, as market behavior fluctuates, maintaining an adaptive approach becomes key to capitalizing on Ethereum’s potential. Investors are encouraged to engage with relevant news and updates that impact Ethereum, whether it’s network upgrades or shifts in social sentiment. As the digital landscape of crypto trading remains dynamic and affected by various external factors, those who stay attuned to Ethereum’s investment landscape stand to benefit from potential opportunities that align with favorable market conditions.

Frequently Asked Questions

What does the current Ethereum social media sentiment suggest about its price analysis?

According to recent observations, the current Ethereum social media sentiment indicates a resemblance to levels seen prior to significant price rallies in the past. This suggests that the market may be primed for a potential surge similar to previous times, providing a hint for Ethereum price analysis.

How do Ethereum market trends correlate with social media sentiment?

Ethereum market trends appear closely linked to social media sentiment. Current decline in social media discussion mirrors past behaviors preceding substantial price increases, hinting at a potential turnaround in Ethereum’s market behavior.

What is the impact of social media sentiment on Ethereum price prediction?

The social media sentiment surrounding Ethereum plays a critical role in price prediction. Analyst observations suggest that declining sentiment could signal a bottoming out phase, indicating potential for future rebounds, aligning with historical price movements.

What role does crypto sentiment analysis play in understanding Ethereum’s future outlook?

Crypto sentiment analysis, particularly regarding Ethereum, helps investors gauge market psychology. The current sentiment, reflecting low optimism, is pivotal in shaping Ethereum’s future outlook, potentially signaling shifts in investor interest and subsequent price movements.

Can Ethereum social media sentiment influence its price during market downturns?

Yes, Ethereum social media sentiment can significantly influence its price during downturns. As observed, the sentiment can drop to levels that historically precede price recoveries, indicating that broader market emotions can contribute to Ethereum’s price resilience.

How has Ethereum’s price been affected by changes in social media sentiment recently?

Recent changes in Ethereum’s social media sentiment show a decline, which aligns with observable price drops. However, analysts suggest that this could set the stage for potential recovery, drawing parallels with earlier market patterns.

What indicators should be considered alongside Ethereum social media sentiment for comprehensive price analysis?

In addition to social media sentiment, factors like trading volume, on-chain metrics, market capitalization, and broader crypto market trends should be considered for a comprehensive Ethereum price analysis.

Is the current social media sentiment around Ethereum reflective of potential long-term growth?

The current social media sentiment around Ethereum, although low, may indicate a potential for long-term growth. Historical patterns suggest that periods of diminished hype often precede significant price recoveries.

How does Ethereum’s social media sentiment compare to other cryptocurrencies?

Ethereum’s social media sentiment often reflects its unique positioning in the market, frequently viewed as the second-largest cryptocurrency. Compared to others, its discussions are influenced by its network developments and staking news, while Bitcoin dominates market sentiment.

What strategies can investors use to interpret Ethereum social media sentiment for trading?

Investors can interpret Ethereum social media sentiment by monitoring trends in discussions, gauging market emotions, and correlating social signals with market data to inform trading decisions, ultimately enhancing their strategies.

| Key Point | Details |

|---|---|

| Current Sentiment | Ethereum’s social media sentiment reflects a trend similar to that observed before its last significant price surge. |

| Analyst Insight | Santiment analyst Brian Quinlivan states that Ethereum’s sentiment is low but does not suggest further declines. |

| Price History | Ethereum hit an all-time high of $4,878 on August 23, 2025, after a significant price rally. |

| Market Reaction | Following a $19 billion crypto market liquidation on October 10, Ethereum’s price fell by 36% from its all-time high. |

| Investor Outlook | Despite recent declines, Ethereum is still viewed positively in the market, ranked as the second most valuable asset. |

| Network Growth | Ethereum’s network growth is strong, fueled by interest in staking. |

| Market Sentiment | Overall crypto sentiment is low, with a current fear score of 29. |

| Altcoin vs Bitcoin Season | Currently, the market is in a ‘Bitcoin Season’ as shown by an index score of 34 out of 100. |

Summary

Ethereum social media sentiment appears to be at a pivotal point, reminiscent of sentiments preceding significant price increases. With analysts noting a recent dip in enthusiasm corresponding to a broader market decline, Ethereum continues to hold its place as a key player in the crypto landscape. Despite facing fluctuations in price and sentiment, the continued interest in Ethereum, particularly regarding staking, points to its potential for recovery and growth. Investors maintain a focus on Ethereum as a strong second choice after Bitcoin, reflecting an underlying optimism about its future performance.

Related: More from Ethereum News | Google Cloud, MoneyGram Join New Privacy Network Bank Initiative | Ethereum Network Transactions Hit New Record: What It Means for You