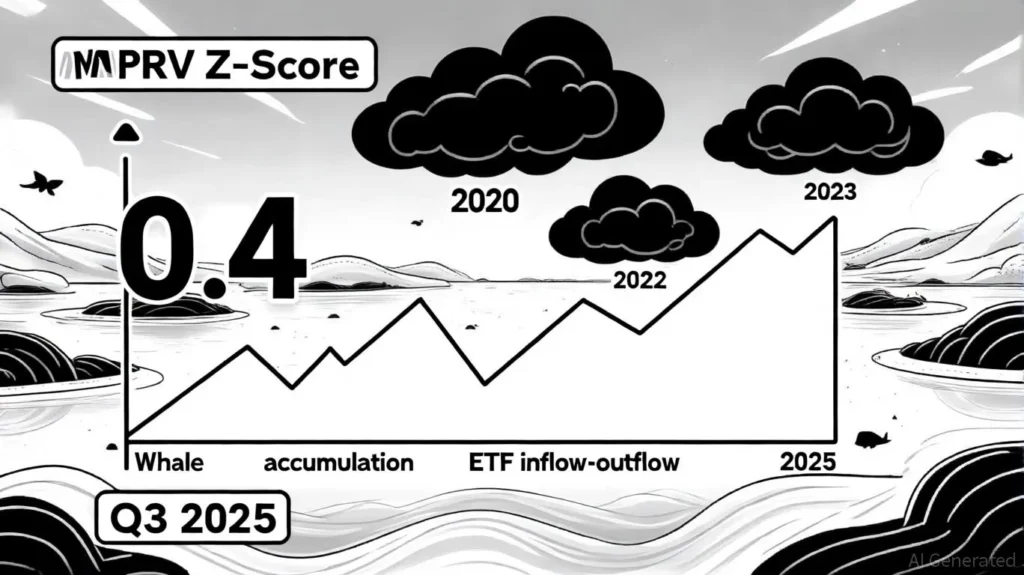

In a significant development for the Ethereum ecosystem, recent reports indicate a net outflow of 10,000 ETH from centralized exchanges (CEXs) within the last 24 hours. This surge in withdrawals highlights a growing trend among investors who are increasingly opting to move their assets off exchanges, potentially in response to market volatility and a desire for greater control over their holdings.

Centralized exchanges have long been a popular choice for trading cryptocurrencies due to their user-friendly interfaces and liquidity. However, as the crypto landscape evolves, many investors are becoming more cautious about leaving their assets on these platforms, which are often targets for hacks and regulatory scrutiny. The recent outflow of ETH could be indicative of a broader shift towards decentralized finance (DeFi) solutions and self-custody wallets, where users maintain direct control over their assets.

This withdrawal acceleration may also reflect a heightened sense of urgency among Ethereum holders as they anticipate potential market movements or changes in regulatory environments. As Ethereum continues to develop its network with upgrades like Ethereum 2.0, investors are likely reassessing their strategies and considering the long-term implications of their asset management choices.

Overall, the 10,000 ETH net outflow from CEXs underscores a pivotal moment in the cryptocurrency market, where security, control, and strategic asset management are becoming paramount for investors navigating this dynamic landscape.