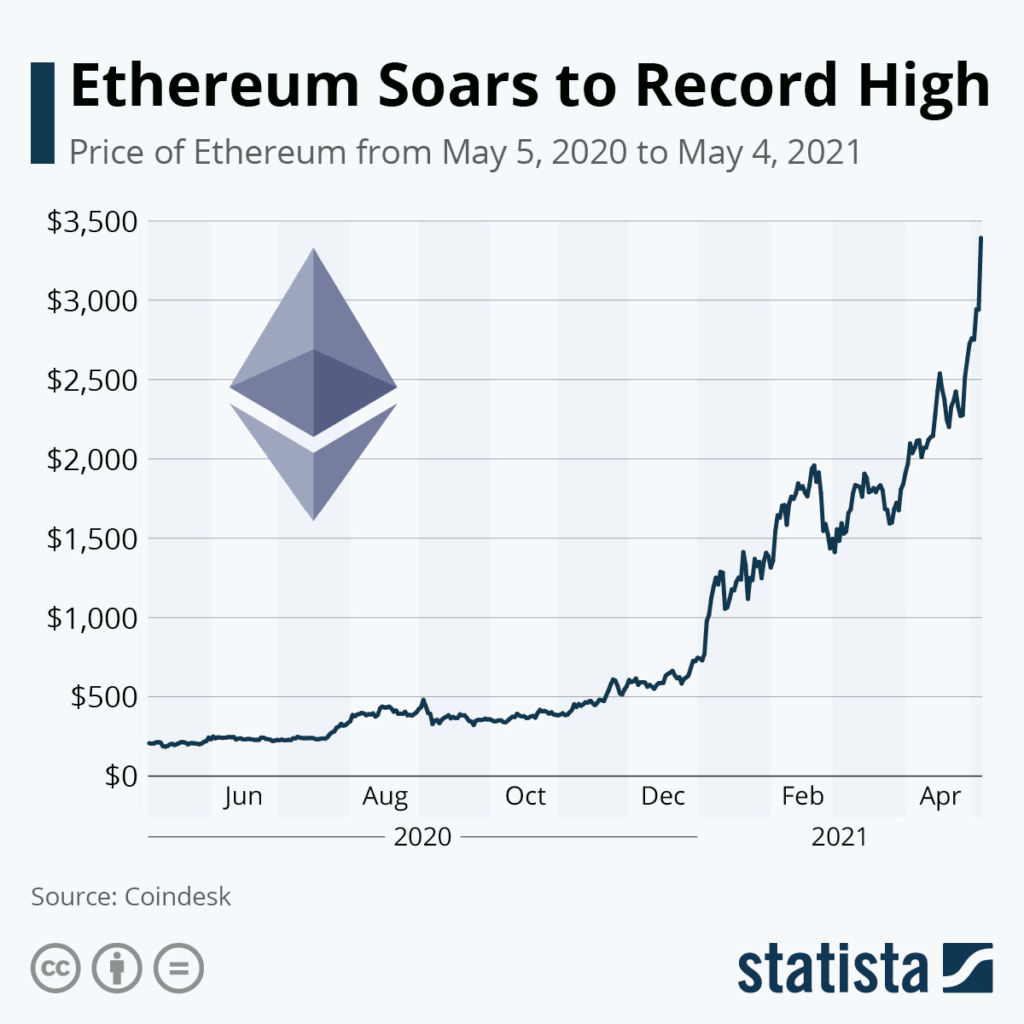

Ethereum price has recently made headlines by surpassing the significant threshold of 3000 USDT, now standing at 3000.43 USDT. This milestone is accompanied by a notable 24-hour increase of 1.79%, capturing the attention of traders and investors alike in the cryptocurrency market. As Ethereum trading continues to gain momentum, many enthusiasts are analyzing potential reasons behind this remarkable surge in ETH price. The current favorable market conditions and growing adoption of blockchain technology contribute to the optimistic outlook for Ethereum’s future. With the USDT value remaining stable, investors are keenly observing how Ethereum will perform in the coming days.

The recent performance of Ethereum has attracted considerable interest as it climbs above 3000 USDT, marking a significant moment for crypto investors. This digital asset, known for its smart contract functionality, has shown an impressive uptick, raising questions about the dynamics within the digital currency landscape. Investors and traders are keenly exploring the implications of this price increase, particularly in the context of Ethereum trading strategies. As the cryptocurrency market evolves, the relationship between Ethereum’s value and stablecoins like USDT becomes increasingly relevant. With each surge, analysts are left to speculate on the future trajectory of this leading altcoin.

Understanding the Current Ethereum Price Surge

Ethereum has recently crossed the significant threshold of 3000 USDT, reaching a current valuation of 3000.43 USDT. This notable surge of 1.79% over the last 24 hours indicates a robust movement in the cryptocurrency market, reflecting the heightened interest and enhanced trading activity surrounding ETH. Investors and traders are keenly monitoring these developments to identify potential buying opportunities amid the fluctuating trading patterns.

The latest surge in Ethereum price can be attributed to several factors including increased adoption, enhancements in DeFi technologies, and broader market enthusiasm for cryptocurrencies. People are now looking at the potential of Ethereum beyond just a digital currency, recognizing its capabilities in powering smart contracts and decentralized applications. As ETH continues to rise, it will likely attract more institutional investments, which could further bolster its value in the cryptocurrency trading landscape.

The Impact of Ethereum on Cryptocurrency Trading

Ethereum’s recent price boost has caused ripples throughout the cryptocurrency market, influencing various trading strategies amongst investors. With many traders focusing on ETH price movements, the implications for trading strategies have significantly evolved. The rise in Ethereum’s value often leads traders to shift their attention towards other altcoins, potentially enriching their trading portfolios as they leverage the increased liquidity flowing towards Ethereum.

Moreover, as Ethereum continues to gain momentum, it fosters confidence among new traders entering the cryptocurrency market. This influx is vital for the overall health of the market, as a diverse array of trading options fosters more dynamic market behavior. Tools and resources aimed at educating traders about Ethereum trading are becoming increasingly popular, reinforcing the importance of understanding market trends and price actions.

The correlation between Ethereum and USDT value cannot be overlooked. As ETH price rises, the demand for stablecoins like USDT may also see an increase, with traders using these stable currencies to manage risk amidst volatility. Observing the interplay between Ethereum and USDT can provide insightful perspectives on market tendencies and investment strategies.

Factors Influencing ETH Price Movement

Ethereum’s price is influenced by a multitude of factors ranging from market sentiment to technological advancements. Recent upgrades, such as Ethereum 2.0 and the transition to a proof-of-stake consensus mechanism, are directly affecting ETH’s valuation. These changes aim to enhance scalability and sustainability, which are crucial aspects for long-term investors looking for stability in the cryptocurrency market.

In addition, macroeconomic factors also play a significant role in influencing ETH price. Global financial conditions, regulatory announcements, and trends in traditional markets can drive investors toward or away from cryptocurrencies. Understanding these influences allows traders to make informed decisions, helping them navigate the complexities of Ethereum trading.

Analyzing the 24-Hour ETH Price Trends

The recent data showing a 1.79% increase in ETH over the last 24 hours is a positive indicator for traders and investors alike. Analyzing short-term price trends is essential for those looking to capitalize on quick trades, as fluctuations within such a brief span can lead to significant gains. This increase suggests a growing bullish sentiment, which can be a driving force behind further investment and trading activity in the cryptocurrency market.

However, it is important for traders to approach these 24-hour trends with caution. Cryptocurrencies are notoriously volatile, and what appears to be a surge could quickly reverse. Utilizing tools like technical analysis and market indicators can help traders make more informed predictions on future price movements of ETH and other cryptocurrencies.

Ethereum Trading Strategies in a Volatile Market

As Ethereum price continues to show upward momentum, traders are drafting new strategies to navigate the volatile landscape of cryptocurrency trading. Many are employing a mix of swing trading and day trading techniques to optimize their positions. This approach allows traders to capture smaller price movements that can accumulate to substantial gains over time, especially as ETH price fluctuates during high market activity.

Moreover, it’s advisable for traders to diversify their portfolios, not just focusing solely on Ethereum but also exploring altcoins that may correlate with ETH price movements. By keeping an eye on the entire spectrum of the cryptocurrency market, traders can better understand the overall trends and implications on their trading plans.

The Significance of ETH in the Cryptocurrency Market

Ethereum has established itself as a cornerstone in the cryptocurrency market, not only due to its market capitalization but also thanks to its functionality. Unlike Bitcoin, which primarily serves as a store of value, ETH powers a plethora of applications, driving its demand. This uniqueness has positioned Ethereum as an essential asset in diversifying investment portfolios within the crypto space.

The significance of ETH is further underscored by its use in various decentralized finance (DeFi) products. As more projects develop on the Ethereum platform, the demand for ETH increases, bringing more liquidity and stability to the market. This interconnectivity within the cryptocurrency ecosystem demonstrates how crucial Ethereum is to the broader market health and investment potential.

Understanding the Role of USDT in Ethereum Trading

USDT, or Tether, plays a crucial role in the trading dynamics of Ethereum and other cryptocurrencies. It serves as a stablecoin, providing traders with a way to hedge against volatility while maintaining liquidity. As Ethereum price rises, the demand for USDT may increase, allowing traders to quickly convert their profits without facing drastic price corrections.

Furthermore, pairing Ethereum with USDT in trading pairs has become commonplace, enhancing accessibility for traders and making it easier to execute trades in a rapidly changing market. This pairing allows for quicker transaction times and greater exit strategies—an essential factor for success in cryptocurrency trading.

Future Projections for Ethereum Price

Market analysts are optimistic about future projections for the Ethereum price if current trends continue. The increase in adoption and development of Ethereum’s ecosystem suggests that ETH will continue to appreciate, providing lucrative opportunities for traders and investors. As Ethereum improves its scalability and functionality through ongoing upgrades, the potential for price enhancement becomes increasingly viable.

However, it’s crucial for investors to remain vigilant and informed of any regulatory changes or market shifts that could impact ETH’s performance. Employing careful monitoring of market dynamics and adopting a long-term view may prove beneficial for those looking to get involved with Ethereum in the coming months and years.

Leveraging Market News for Ethereum Trading

Staying updated with the latest market news is essential for successful Ethereum trading. Investors who leverage current events—such as technological updates, partnerships, or regulatory changes—can make more informed decisions that may positively affect their trading activities. For instance, positive news regarding Ethereum upgrades often leads to bullish trends in ETH price, creating optimal trading opportunities.

Additionally, subscribing to cryptocurrency news outlets and following industry leaders on social media can provide insights that help traders anticipate market movement. An informed trader is better equipped to make timely buy or sell decisions, optimizing their gains during moments of market volatility.

Frequently Asked Questions

What is the current ETH price and its recent performance?

As of now, the Ethereum price stands at 3000.43 USDT, reflecting a 24-hour increase of 1.79%. This surge showcases the robust nature of Ethereum trading in the current cryptocurrency market.

How does the current Ethereum price affect trading strategies?

The current ETH price of 3000.43 USDT can significantly influence trading strategies. With a recent surge, traders might consider entering positions, anticipating further growth in the cryptocurrency market.

What factors contribute to the recent Ethereum surge?

The recent surge in Ethereum price to 3000.43 USDT can be attributed to various factors including increased market sentiment, institutional investments, and overall positive trends in the cryptocurrency market.

How closely is the ETH price related to USDT value fluctuations?

The ETH price, currently at 3000.43 USDT, is closely linked to USDT value fluctuations since USDT is a stablecoin. Traders often compare ETH to USDT to gauge market momentum and cryptocurrency trading strategies.

What trends should I watch for concerning Ethereum price in the upcoming days?

Watching the Ethereum price trend, currently at 3000.43 USDT, is crucial. Key indicators such as trading volume and market sentiment will provide insights into potential future surges or dips in the cryptocurrency market.

| Key Points |

|---|

| Ethereum price has surpassed 3000 USDT, currently at 3000.43 USDT. |

| There is a 24-hour increase of 1.79% in Ethereum price. |

Summary

The Ethereum price has seen significant growth as it surpasses the 3000 USDT mark, currently standing at 3000.43 USDT. This positive trend indicates a 24-hour increase of 1.79%, reflecting the growing interest and confidence in Ethereum within the cryptocurrency market. As investors continue to monitor fluctuations, the upward trajectory of the Ethereum price is certainly worth noting.