As Ethereum continues to carve its niche in the cryptocurrency market, recent trends in its pricing suggest a potential surge of optimism among investors. Experts and analysts have been closely monitoring the coin’s performance, and recent data reveals three key trends that could signal what to expect in the near future. Here’s a closer look at these trends and how they might shape the trajectory of Ethereum’s value.

### 1. Increased Adoption of Ethereum 2.0

One of the most significant developments affecting Ethereum’s price is the ongoing upgrade to Ethereum 2.0, which promises increased efficiency and scalability. This upgrade tackles the well-known issues of high gas fees and slow transaction times. The shift from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism is particularly noteworthy as it aims to decrease the energy consumption of the blockchain by over 99%.

As Ethereum becomes more scalable and environmentally friendly, it’s gaining favor not only among individual investors but also among institutions looking for eco-conscious investment opportunities. This broadening appeal is crucial as it brings stability and growth potential to the cryptocurrency. The actual implementation of these changes in the Ethereum network, particularly the full deployment of sharding expected in later phases, could significantly boost the price as the network’s capacity expands.

### 2. Decentralized Finance (DeFi) Growth

Ethereum’s prominence as the leading platform for DeFi projects remains a major driver of its value. The total value locked in DeFi contracts on Ethereum has been consistently high, indicating steady or increasing trust and utilization of the Ethereum blockchain for financial services. These services include lending, borrowing, and earning interest in a decentralized setting, all of which attract significant capital into the Ethereum ecosystem.

The innovative nature of these projects and the increasing functional utility they provide continue to attract more users to the Ethereum network. As more projects launch and existing ones mature, the intrinsic value of Ethereum is likely to grow, propelled by its strong fundamentals as a host platform for these applications.

### 3. Positive Market Sentiments and Technical Indicators

Analyzing market sentiment and technical indicators also paints a bullish picture for Ethereum. Recent investor behavior demonstrates an accumulation trend, where major holders are either holding onto their Ethereum or acquiring more, suggesting a widespread expectation of future price increases. Additionally, Ethereum has been showing strong recoveries following market pullbacks, indicating resilient demand.

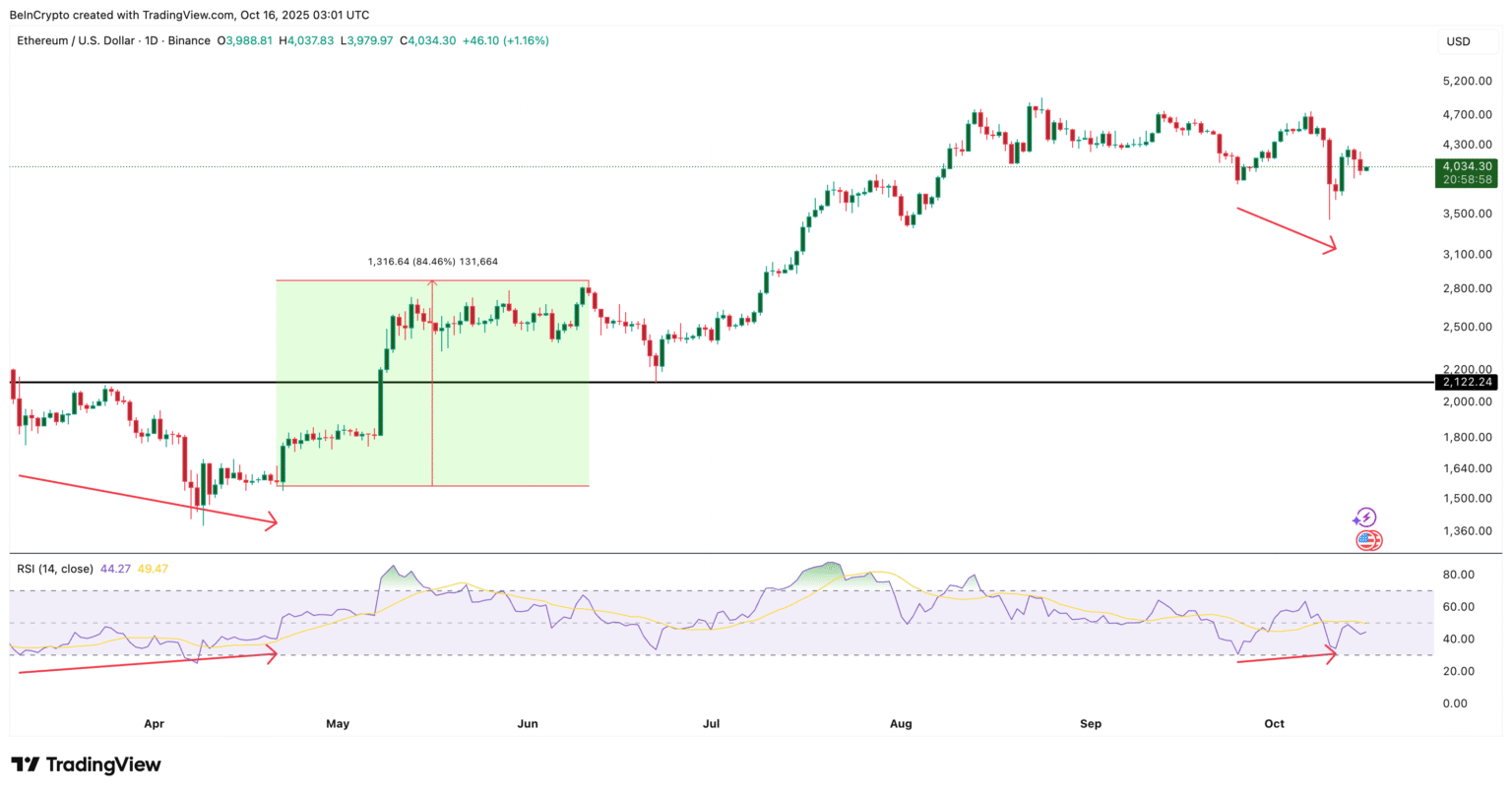

Technical analysis supports these observations, with key indicators such as the moving average convergence divergence (MACD) and the relative strength index (RSI) pointing towards a bullish trend. Moreover, the price of Ethereum has been consolidating above significant support levels, and breakouts in price have been accompanied by increases in trading volume, suggesting robust buying interest.

### What to Expect Next?

Given these optimistic trends, what can Ethereum enthusiasts and potential investors expect moving forward? While the cryptocurrency market is notoriously volatile and influenced by a wide array of factors, the aforementioned trends provide strong reasons to be hopeful about Ethereum’s future.

However, investors should keep an eye on the broader market context, including regulatory developments and macroeconomic factors that could impact the cryptocurrency market. Additionally, the successful implementation of Ethereum 2.0 upgrades, particularly in enhancing network capacity and reducing fees, will be critical in sustaining any upward price momentum.

In conclusion, Ethereum is showing promising trends that should excite existing investors and potentially attract new ones. Its role as a platform for DeFi, the ongoing network upgrades, and positive technical and sentiment indicators all suggest that Ethereum might continue to see considerable growth in the near to mid-term future. As always, prudent investment decisions should be based on comprehensive research and consideration of market risks.