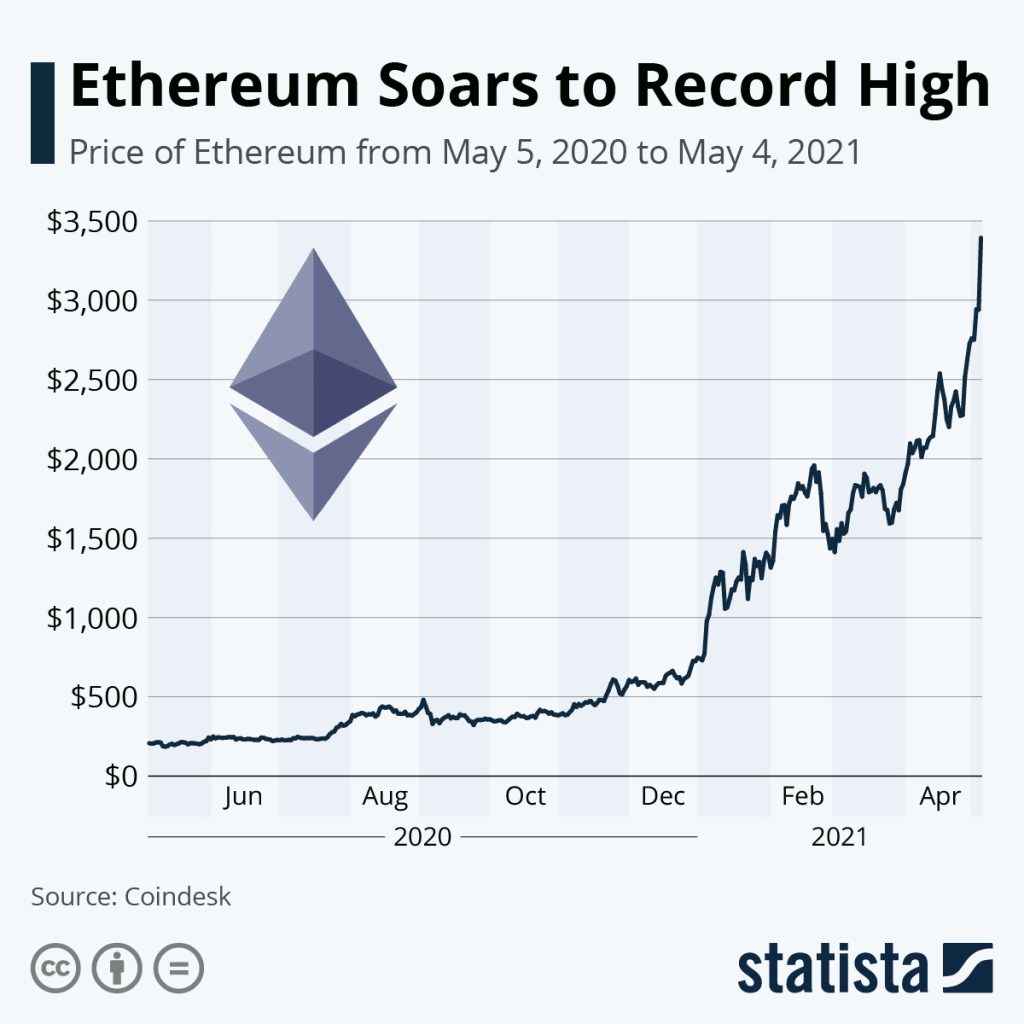

In recent weeks, Ethereum price growth has captured the attention of investors as it rallies towards the $3,500 target, reflecting a positive sentiment across the cryptocurrency market. The Ethereum network’s impressive milestones, particularly the staggering $8 trillion in stablecoin transfer volume, signal robust activity within this blockchain ecosystem. This rise in price is supported by a favorable analysis of the Ethereum token, with experts providing bullish Ethereum price predictions that hint at potential surges to the $4,000 to $4,500 range. As Bitcoin also shows strength, hitting new highs, Ethereum seems poised to follow suit amidst the favorable cryptocurrency market trends. Traders are eagerly watching these developments, making Ethereum’s price movements a focal point for those tracking market dynamics and investing strategies alike.

The upward trajectory of Ethereum has prompted discussions about its growth potential and the underlying factors influencing this shift. Often viewed as a reliable indicator of the broader cryptocurrency landscape, analysts are turning their attention to Ethereum price analyses to gauge its resilience and future performance. Various market conditions alongside increased stablecoin activity on the Ethereum network have contributed to a more optimistic outlook among traders. As Ethereum’s significance in the digital currency space continues to expand, its ability to attract investors highlights emerging trends within the cryptocurrency ecosystem. Observers are particularly focused on how Ethereum’s advancements might impact its token valuation and overall network strength in the coming months.

Ethereum Price Growth: A Bullish Outlook Ahead

Ethereum’s price growth has captured the attention of many investors as it steadily climbs towards the $3,500 target. Analysts are projecting this bullish trajectory, especially in light of the recent surge in cryptocurrency market trends that have positioned Ethereum as a leader among altcoins. The substantial rise in Ethereum’s price has coincided with an impressive milestone for the Ethereum network, which reported a record $8 trillion in stablecoin transfer volume. This substantial network growth indicates that Ethereum is not only maintaining its market presence but also expanding its influence and usability within the blockchain ecosystem.

As Ethereum’s market capitalization increases and the bullish outlook gains traction, traders are eagerly watching for signals of an upward movement that may surpass the $3,500 level. With recent data showcasing robust trading volumes and positive market sentiment, these projections hold weight. However, analysts caution that any upward movement must be approached carefully, as profit-taking and market corrections are potential risks that could impact Ethereum’s price trajectory in the near future.

Ethereum Price Predictions: Key Factors to Consider

Investors are keenly interested in Ethereum price predictions as they navigate through the massive fluctuations of the cryptocurrency landscape. Among the factors influencing these predictions are market trends and the adaptive nature of Ethereum itself, enhanced by innovations such as the Ethereum network stablecoin. As the stablecoin transfer volume hit unprecedented levels, market analysts consider how this could stabilize Ethereum’s price amid volatility and enhance its appeal to traders and long-term investors alike.

Analysts are forecasting positive movements for Ethereum’s price based on its fundamental strength and current market dynamics. Several have noted that it could reach targets well above $4,000 if bullish momentum persists. However, analysts are also vigilant about market corrections that could trigger sell-offs. Understanding market trends and leveraging technical analysis is essential for investors looking to make informed decisions in this evolving situation.

Trends in Cryptocurrency Market Affecting Ethereum

The broader cryptocurrency market trends are significantly affecting Ethereum’s price dynamics. Recent increases in Bitcoin’s value to unprecedented levels have created a ripple effect across major altcoins, including Ethereum. As Bitcoin rallies, altcoins often experience increased trading volumes, leading to upward pressure on their prices. The correlation between Ethereum and Bitcoin is strong, and when Bitcoin performs well, it often boosts investor confidence in Ethereum. This phenomenon underscores the importance of analyzing the overall market to understand Ethereum’s potential for growth.

Additionally, the rise of AI tokens and other innovative projects has showcased the evolving landscape of cryptocurrencies, drawing more attention and investment into the sector. The increased competition among cryptocurrencies is also encouraging innovation within the Ethereum network, further setting the stage for sustained price growth. Therefore, investors should remain aware of these trends, as they could have significant implications on Ethereum’s overall market performance and future price trajectories.

Analyzing Ethereum Tokens and Their Future Potential

Understanding Ethereum token analysis is crucial for investors to evaluate their potential in the ever-changing market. Ethereum tokens, particularly those linked to successful decentralized finance (DeFi) projects or stablecoins, have shown resilience against market downturns. As the Ethereum network continues to enhance its infrastructure, the utility of its tokens becomes increasingly attractive, reflecting positive signals for future growth in pricing and acceptance within the larger financial ecosystem.

Furthermore, as institutions begin to recognize the value of Ethereum tokens in various applications, from smart contracts to decentralized applications, these developments could lead to increased demand, further supporting price growth. Keeping a close watch on token performance and market regulations will allow investors to strategize effectively and capitalize on potential investments as these assets gain traction and legitimacy in the global financial market.

Ethereum’s Stablecoin Success: A Market Leader

The success of Ethereum’s stablecoin is a defining factor in its market leadership. As illustrated by the recent milestone of over $8 trillion in transfers, Ethereum is emerging as the go-to network for stablecoin transactions. This dominance highlights Ethereum’s capability to handle high transaction volumes, making it an ideal platform for stablecoin issuance and use. The significance of these transfers often goes beyond speculative trading, as they demonstrate real-world applications that enhance Ethereum’s value proposition.

Moreover, stablecoins serve as a bridge for traditional finance and the crypto ecosystem, drawing more users and liquidity into the Ethereum network. This steady influx can bolster Ethereum’s stability against market volatility, creating a safe haven for investors during uncertain times. With the global shift towards digital assets, the continued growth of stablecoins on the Ethereum network might well secure its place as a critical player in the blockchain landscape for years to come.

Investor Sentiment: Bulls vs Bears on Ethereum’s Future

Investor sentiment in the Ethereum market shows a clear divide between bulls and bears, shaping the outlook for Ethereum’s future price movements. While many bulls are optimistic about a move towards the $3,500 goal, driven by overall cryptocurrency recovery and the allure of competitive market conditions, bears remain cautious. They point to the $63 million short position by a major whale as an indication of underlying fears regarding potential price corrections and the impact of larger market forces.

This tension between bullish optimism and bearish skepticism illustrates the volatile nature of cryptocurrency assets. As traders make their positions, Ethereum’s ability to break above resistance levels becomes crucial. A decisive move past the $3,500 mark could instill further confidence among bulls, potentially leading to a new all-time high. Conversely, any downward pressure or unfavorable news could quickly shift sentiments, leading traders to reconsider their positions and strategies.

Ethereum and Market Corrections: A Balancing Act

As Ethereum approaches critical price levels, the possibility of market corrections looms large, highlighting the delicate balance that exists in cryptocurrency trading. Historical data suggests that after significant rallies, corrections are natural, and the current market dynamics indicate that Ethereum could hit a rebound point. Understanding these market cycles is essential for traders who aim to navigate risk effectively and capitalize on the volatility that often accompanies the cryptocurrency landscape.

Traders need to prepare for potential reversals, especially as competition heats up between Ethereum and other altcoins. The presence of short positions in the market could also signal impending corrections, encouraging cautious approaches among speculative investors. Being aware of Ethereum’s market context allows investors to make more informed decisions, minimizing risks while seeking potential rewards.

The Role of AI and Innovations in Ethereum’s Ecosystem

The integration of AI and technological innovations into the Ethereum ecosystem is paving the way for unprecedented developments. From automated trading strategies to advanced decentralized applications, these innovations are set to redefine how value is exchanged on Ethereum. As more projects leverage AI to enhance user experiences and streamline transactions, the network’s appeal continues to grow among developers and users alike, with implications for price trends and stability.

Moreover, the adoption of AI technologies could position Ethereum at the forefront of the next wave of digital transformation. As developers explore AI’s potential in smart contracts and data analysis, the Ethereum network may further solidify its role as a leading blockchain platform for innovation. This forward movement may inspire increased investment, propelling Ethereum’s price growth and stabilizing it amid market fluctuations.

Building a Long-Term Strategy for Ethereum Investment

Investing in Ethereum requires a well-thought-out long-term strategy, especially given the market’s unpredictable nature. Investors should focus on comprehensive research that encompasses market trends, token analysis, and potential innovations in the Ethereum ecosystem. Building a diversified portfolio that includes Ethereum and other promising cryptocurrencies can provide balance and reduce exposure to volatility. Alongside traditional investment principles, adapting to the dynamism of the crypto space is essential for success.

Additionally, staying informed on regulatory changes, technological advancements, and macroeconomic factors will aid investors in making timely decisions. With Ethereum poised to lead the way in several sectors, particularly as it relates to stablecoin transactions, understanding the interplay of these elements will be critical for maximizing returns. Investors who remain proactive and adaptable are more likely to navigate the complexities of the cryptocurrency market effectively.

Frequently Asked Questions

What are the key factors driving Ethereum price growth?

Ethereum price growth is primarily driven by significant stablecoin transfer volumes on the network, recently hitting an $8 trillion milestone. Additionally, bullish sentiments in the wider cryptocurrency market, alongside Ethereum’s ability to attract investor capital through innovations and network upgrades, contribute to its price movement.

How is the Ethereum price prediction influenced by market trends?

Ethereum price predictions are significantly influenced by overall cryptocurrency market trends. With Bitcoin’s recent surge to around $93,000, Ethereum has benefited from this bullish environment, suggesting a positive outlook for Ethereum price growth. Analysts are eyeing the $3,500 mark as a potential resistance level before targeting $4,000.

What role does the Ethereum network play in stablecoin transactions?

The Ethereum network serves as a primary hub for stablecoin transactions, with transfer volumes exceeding $8 trillion. This increased activity in stablecoin transactions supports Ethereum’s price growth, as more real-world payment use cases emerge alongside speculative trading.

What is the bullish outlook for Ethereum price growth in the near term?

Analysts have a bullish outlook for Ethereum price growth, especially as bulls target breaking the $3,500 resistance level. Should Ethereum surpass this point, it might push towards $4,000, driven by the overall positive sentiment in the cryptocurrency market and significant daily trading volumes.

How does Ethereum token analysis impact investor decisions?

Ethereum token analysis, which includes examining price patterns and market sentiment, impacts investor decisions by providing insights into potential price movements. Current analysis suggests a bullish trajectory, while caution is advised due to significant short positions held by major investors.

What are the potential risks to Ethereum’s price growth?

The potential risks to Ethereum’s price growth include profit-taking by traders after significant rises, macroeconomic factors affecting wider risk assets, and substantial short positions by large investors. A downturn in Bitcoin’s performance could also negatively impact Ethereum’s price trajectory.

| Key Point | Details |

|---|---|

| Ethereum Price Growth | Ethereum’s price is on an upward trend, currently at $3,171, with bulls targeting a push towards $3,500. |

| Network Growth | The Ethereum network has reached a remarkable $8 trillion in stablecoin transfer volume, marking a significant increase. |

| Market Conditions | The broader cryptocurrency market has shown positive movements, particularly with Bitcoin reaching $93,000, which has buoyed Ethereum prices. |

| Resistance Levels | Ethereum recently retested the $3,200 resistance level after previously reaching $3,211, indicating potential bullish strength despite earlier drops. |

| Analyst Sentiment | Analysts suggest that breaking past the $3,500 level could pave the way for prices to reach $4,000, but caution is noted due to a significant short position held by a whale. |

Summary

Ethereum price growth is showing strong momentum as the cryptocurrency aims for a $3,500 target amid rising market optimism. With the Ethereum network achieving an extraordinary milestone of $8 trillion in stablecoin transfers, the future looks promising. However, traders remain vigilant due to potential profit-taking and the looming presence of a major short position in the market, which could influence price dynamics.