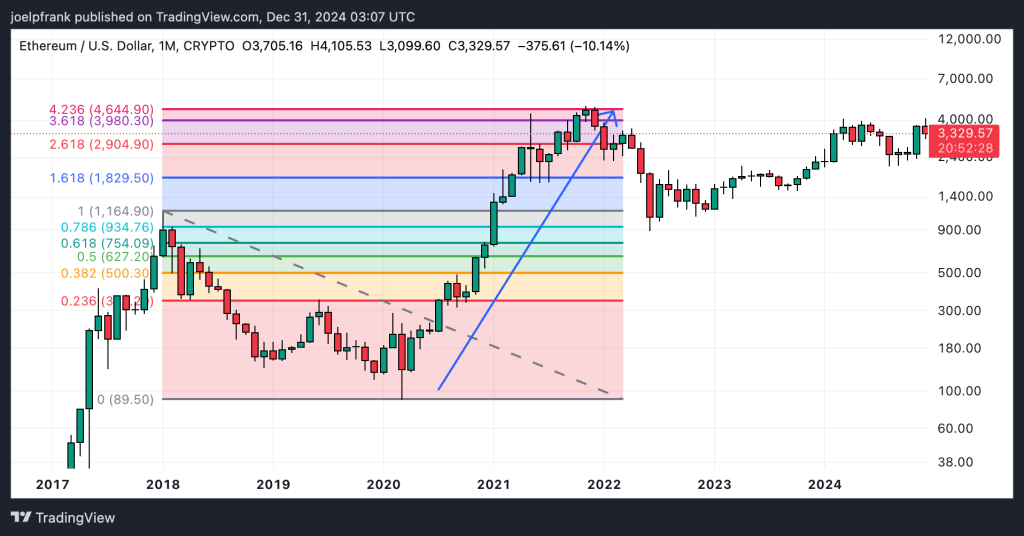

The recent Ethereum price drop has captured the attention of investors and analysts alike, as it reflects significant volatility within the cryptocurrency market. Over the past week, two major ETH whales executed massive liquidations that contributed to a staggering decline of over 20% in Ethereum’s value. This downturn is intricately linked to a series of events involving the liquidation of leveraged positions, particularly from the notorious whale identified as Garrett, which forced the price down toward critical support levels. Such market movements not only impact Ethereum but also have a cascading effect on other cryptocurrencies, pushing BTC down to its previous cycle’s historical support level. A thorough Ethereum market analysis shows this trend is heavily influenced by the Aave liquidation impact and strategies employed by ETH whales to navigate the cryptocurrency price trend.

In the ever-evolving landscape of digital assets, the recent fall in Ethereum’s valuation has sparked widespread discussions among traders and market strategists. The liquidation actions taken by influential holders, often referred to as ETH whales, have led to notable shifts in market dynamics, affecting other cryptocurrencies such as Bitcoin as well. Investors are now monitoring the implications of this drastic reduction in Ethereum’s price, which has heightened interest in understanding the broader cryptocurrency price trend. Analysts suggest that the forces behind this drop, including influential trading patterns on platforms like Aave, could redefine investing strategies in the future. As the market grapples with these challenges, a comprehensive evaluation of Ethereum and its price fluctuations remains crucial for determining potential recovery pathways.

| Key Point | Details |

|---|---|

| ETH Whales Liquidation | Two major ETH whales liquidated most of their leveraged positions, significantly affecting the market. |

| Impact on ETH Prices | ETH dropped by over 20%, influenced by the liquidation of large long positions. |

| Key Whale Involved | The whale known as Garrett, implicated in the ’10·11 insider whale’ event, had a significant long position liquidated. |

| Current Position of Trend Research | Trend Research has liquidated several hundred million dollars and their liquidation price is around $1,600. |

| Future Predictions | Market should recognize the strong technical support, indicating a potential bottom for Ethereum. |

Summary

The recent Ethereum price drop has been triggered by the liquidation of leveraged positions held by major whales in the market. This has led to a significant decline, pushing prices to a point where strong technical support may suggest a forthcoming rebound. As the market stabilizes and the situation improves, it is crucial for investors to stay informed and recognize the opportunities that may arise once Ethereum recovers.

Understanding the Recent Ethereum Price Drop

The recent Ethereum price drop has sent shockwaves through the cryptocurrency market, reflecting a decrease of over 20% in just one week. This downturn was triggered largely by the liquidation of considerable leveraged positions held by two prominent ETH whales, particularly the high-profile case involving Garrett. The forced liquidation of the 200,000 ETH long position has sparked a wider sell-off, forcing the price to retreat to critical support levels that echo previous bearish cycles in Bitcoin.

As Ethereum struggles to stabilize, market analysts are closely watching its behavior at historical support levels that have previously served as bastions of recovery for BTC. The pattern of whale liquidations, like those linked to Aave’s leveraged trading, not only affects ETH but sends ripples across the entire cryptocurrency landscape. Understanding the mechanics behind these price movements can aid investors in navigating the current market volatility and making informed decisions.

The Impact of ETH Whales’ Liquidation on the Market

The recent liquidation by ETH whales has brought to light the intricate dynamics of leverage in cryptocurrency trading. Garrett’s significant sell-off of around $300 million in ETH has not only impacted the price but has instigated a chain reaction leading to broader fears of a market downturn. This creates an atmosphere of uncertainty among retail investors who might follow suit, amplifying the bearish sentiment. Such movements also enable discerning market analysts to identify trends and potential entry points based on historical data.

Furthermore, the cascading effect of these liquidations often results in heightened volatility, causing prices to approach the liquidation points previously set by traders on platforms like Aave. The broader Ethereum market analysis reveals a depth of complexity where whale activity shapes price trends significantly. Investors must keep a keen eye on whale movements and factors influencing these trends to strategize their investments more effectively.

BTC’s Response to the Ethereum Price Movement

As Ethereum faces significant price pressure, Bitcoin has also felt the impact, retreating to previously established historical support levels. This relationship between the two cryptocurrencies highlights the interconnectedness of the market, where the actions of ETH whales can influence BTC’s stability. Investors often view Bitcoin’s historical support as a measure of confidence—the lower BTC falls, the more speculation surrounds its ability to bounce back.

The interplay between Ethereum’s price dynamics and Bitcoin’s historical support levels suggests critical junctures for traders. For instance, should Bitcoin successfully hold above key support levels, it may serve as a launching pad for Ethereum’s recovery. Thus, while Bitcoin’s recent performance is tied to its foundational benchmarks, investors in ETH are watching to see how BTC’s recovery might signal a turnaround for Ethereum as the market seeks equilibrium.

Aave’s Role in Ethereum’s Liquidation Story

Aave’s liquidation mechanisms have been highlighted in the recent wave of ETH sell-offs. This decentralized protocol plays a crucial role in lending and borrowing in the crypto space, and its implications for liquidations are significant. With the liquidation price for some positions now nearing $1,600, Aave’s infrastructure has become a focal point for both traders and analysts alike, as these prices can dictate buying and selling strategies in this volatile market.

The ongoing situation emphasizes the importance of understanding Ethereum’s position within the Aave framework. The repaying activities amounting to hundreds of millions indicate that many traders are either cashing out or being forced to liquidate their positions. The ripples of this activity underscore how quickly fortunes can shift in a market characterized by rapid price movements, compelling investors to stay informed on Aave’s strategic influence regarding Ethereum’s price trend.

Technical Support Levels Indicating Potential Recovery

Amidst the pessimism surrounding the Ethereum price drop, technical analysis points to several support levels that could indicate a forthcoming rebound. The projection that Ethereum will find support around $1,600—approximately 24% below its current rate—provides a crucial threshold for market participants to consider. An established technical support level often serves as a psychological barrier for traders, leading to increased buying pressure as price approaches it.

Technical analysts argue that the current bearish trend may soon reverse, propelled by optimistic signals from technical indicators. With strong support levels identified, now may be an ideal time for astute investors to accumulate ETH at lower prices, anticipating a bounce-back. Thus, while the immediate market sentiment may skew negative, the underlying technical structures offer hope for a turnaround that traders must be prepared to capitalize on.

Market Sentiment and Future Ethereum Predictions

Given the recent turmoil, market sentiment around Ethereum has understandably shifted. Negative investor psychology, spurred by the whale liquidations, has led many to question the viability of ETH’s recovery in the short term. However, as with any bull-bear cycle in cryptocurrency, periods of pessimism can frequently turn around as market participants reassess their positions. The collective belief is that the market eventually corrects itself, potentially leading ETH to stages of recovery that were previously unanticipated.

Looking forward, analysts stress the significance of compiling comprehensive research on Ethereum’s market indicators, alongside monitoring BTC performance. Future predictions hinge not only on the recovery of ETH but also on macroeconomic factors affecting cryptocurrencies globally. By utilizing tools like Ethereum market analysis, traders can position themselves better to take advantage of potential upward trends.

Investment Strategies During Cryptocurrency Downturns

In light of the recent Ethereum price drop, investors may need to revisit their strategies for handling the downturn. For many, this could be an opportune moment to employ accumulation tactics, purchasing ETH at reduced costs while observing technical indicators for a potential rebound. This approach can mitigate some risks to capitalize on future recovery as the market conditions stabilize. Additionally, diversifying portfolios with stablecoins or BTC can offer a buffer during such highly volatile conditions.

Moreover, understanding liquidity trends can be critical during downturns. Keeping abreast of significant whale activities and analyzing their liquidation impacts could provide insights into potential upcoming market shifts, helping retail traders make strategic decisions. As history has shown time and time again, every dip in cryptocurrency can lead to long-term gains if approached with calculated caution.

The Role of Investor Sentiment in Price Recovery

Investor sentiment plays a vital role in shaping the price trajectory of Ethereum, especially during turbulent times marked by significant sell-offs. The collective mood can lead to panic selling and a rush towards liquidations, as demonstrated by recent events. However, positive sentiment and confidence often lead to rallies that can turn around market losses. Traders should be acutely aware of how feelings of fear or greed can dramatically influence trading patterns.

Monitoring social sentiment around Ethereum through platforms like X, alongside traditional market analysis, provides strategic insights. If sentiment begins to shift favorably despite current price pressures, it could signal an imminent recovery phase, encouraging investors to buy into ETH. In this environment, confidence can be as important as technical indicators in guiding investment decisions.

Preparing for the Next Bull Cycle after the Bear Market

As Ethereum and the broader cryptocurrency market navigate through this bearish cycle, preparing for a future bull market becomes paramount. Understanding the factors that sparked the recent price drop, including the influence of ETH whales, helps investors assess opportunities for future investments. It’s essential to reflect on the dynamics of the market and recognize when to enter positions that can potentially lead to significant gains during the next upturn.

In addition, aligning investment strategies with market cycles can aid in taking advantage of bullish trends. Observing historical data, including past recoveries and notable price rebounds for ETH, can aid in forecasting potential future performance. With strong support levels likely paving the way for recovery, the right preparation now could enhance the likelihood of capitalizing on the next bull cycle when it arrives.

Frequently Asked Questions

What caused the recent Ethereum price drop related to ETH whales liquidation?

The recent Ethereum price drop, which saw a decline of over 20%, was primarily triggered by the liquidation of leveraged positions held by major ETH whales. Specifically, a whale known as Garrett, who previously held a 200,000 ETH perpetual long position, faced forced liquidation over the weekend. This event was exacerbated by the liquidation actions fromTrend Research, which has significantly impacted the Ethereum market.

How does ETH whales liquidation affect Ethereum market analysis?

ETH whales liquidation has a profound impact on Ethereum market analysis. The forced liquidation of major holdings contributes to increased selling pressure, leading to substantial price declines. In Garrett’s case, the liquidation merged with declining confidence in the market. Analysts are now closely monitoring how the reduced whale participation and the current price levels influence market fundamentals and upcoming price trends.

What is the correlation between Ethereum price drop and cryptocurrency price trend?

The Ethereum price drop is closely linked to broader cryptocurrency price trends. As ETH experienced a significant decline due to whale liquidations, Bitcoin (BTC) also fell, reaching its historical support level. This correlation highlights how movements of large asset holders in Ethereum can influence overall market sentiment and the price dynamics across the entire cryptocurrency landscape.

What was the impact of Aave liquidation on the Ethereum price drop?

The Aave liquidation impacted the Ethereum price drop significantly by creating a feedback loop of selling pressure. As Trend Research’s positions were liquidated, it placed additional downward pressure on ETH prices, causing panic selling and further declines. The current liquidation price around $1,600 indicates how sensitive Ethereum is to these liquidations and reinforces the need for a strong rebound to restore market confidence.

What is the historical support level for BTC in relation to the Ethereum price drop?

The recent Ethereum price drop has led BTC to revert to its previous cycle’s historical support level, showcasing the interconnectedness of these cryptocurrencies. As ETH declined over 20%, BTC followed suit, reflecting the influence of liquidated positions in Ethereum on Bitcoin’s stability. This historical support level is key for traders to watch, as it may signal potential recovery points for both cryptocurrencies.