In recent news, the Ethereum price drop has caught the attention of investors as ETH fell below 2900 USDT, marking a significant decline of 3.3% over the past 24 hours. According to the latest Ethereum market report, this downturn has left many speculating about the future trajectory of Ethereum, especially with strong interest in its projected price for 2025. The OKX ETH data indicates that the cryptocurrency decline is reflective of broader market trends affecting major digital assets. With the latest updates resonating in Ethereum news December 2025, analysts are keenly assessing whether this slump could signal a longer-term bearish trend or simply a passing storm in a volatile market. As traders navigate these developments, understanding the implications of this Ethereum price drop will be key to making informed decisions moving forward.

As the digital currency landscape continues to evolve, recent fluctuations in Ethereum’s value have sparked discussions among cryptocurrency enthusiasts and investors alike. The recent plunge in ETH’s price below the 2900 USDT mark has raised concerns about potential ripples across the digital asset market. With ongoing analysis surrounding the anticipated ETH price for 2025 and the implications of current trends, many are looking to decipher the underlying factors driving this latest cryptocurrency decline. In light of the data presented by OKX regarding Ethereum and the increasing volume of Ethereum news December 2025, it is crucial to stay updated on how such shifts affect overall market sentiment and future investing strategies.

Current Ethereum Price Trends

The Ethereum price fell notably below the 2900 USDT mark, as recent market data has indicated a significant 24-hour decline of 3.3%. This price drop has raised concerns among cryptocurrency investors, prompting discussions about the overall health of the ETH market. As Ethereum continues to grapple with volatility, analysts are keeping a close eye on its price movements and potential turning points that could shape the cryptocurrency’s trajectory in the coming months.

As we approach the end of the year, the fluctuations in ETH’s price capture significant attention from traders and analysts alike. With the latest figure standing at 2899.02 USDT, Ethereum’s market performance suggests that investors should brace for continued fluctuations. Given the historical volatility of cryptocurrencies, understanding these trends is crucial for forecasting potential price movements in 2025.

Factors Contributing to Ethereum’s Decline

Several factors are influencing the current decline in Ethereum’s price, including market sentiment and investor behavior. As seen with the recent drop below 2900 USDT, negative sentiment within the cryptocurrency community may lead to broader sell-offs. Analysts point to external economic pressures and regulatory news as critical components behind this downturn, emphasizing the need for investors to remain vigilant.

Additionally, fluctuations in the overall cryptocurrency market affect Ethereum considerably. The decline in ETH’s price can be linked to broader trends affecting various cryptocurrencies, suggesting that Ethereum’s struggles are reflective of a larger cryptocurrency decline. The investor outlook is growing cautious, emphasizing the importance of following comprehensive market reports to make informed decisions.

Future Outlook for ETH and Price Predictions

Looking ahead, many investors are speculating on ETH’s price performance in 2025. Factors such as technological advancements, regulatory developments, and market adoption rates will play pivotal roles in influencing Ethereum’s trajectory. Price predictions and market sentiment surveys often indicate a potential recovery, with some analysts projecting a return to previously established levels, contingent upon favorable market conditions and investor confidence.

The possibility of an Ethereum price rebound presents an intriguing topic for discussions among cryptocurrency enthusiasts and investors. A substantial recovery could position ETH favorably as it competes with other cryptocurrencies. However, cautious optimism is necessary, as market volatility remains a persistent issue that could thwart these upward trends.

Ethereum News and Market Analysis for December 2025

As we delve into the latest Ethereum news for December 2025, the current market analysis reveals a crucial juncture for ETH. Reports from reliable sources such as Odaily Star Daily and OKX highlight the recent plunge below the 2900 USDT mark. Keeping track of ongoing news is vital for investors seeking to grasp the implications of market sentiment on Ethereum’s future value.

Moreover, understanding Ethereum’s market dynamics will be essential as the year progresses. With comprehensive market reports, investors can glean insights into ETH’s future performance, including anticipated recovery phases in light of recent price changes. Staying informed about Ethereum developments will allow investors to navigate the complex landscape of cryptocurrency investments effectively.

The Role of OKX ETH Data in Market Analysis

The recent data from OKX regarding Ethereum’s performance has been pivotal in the effective analysis of the cryptocurrency market. As reported, ETH’s drop to 2899.02 USDT serves as a critical marker, allowing traders to assess real-time market trends. The role of reliable data sources like OKX cannot be overstated, as they shape investor understanding and decision-making.

Data points such as these provide essential insights into trade volumes, market sentiment, and investor behavior. By utilizing comprehensive analytics from platforms like OKX, investors can better anticipate potential reversals in ETH’s price and make more informed trading decisions. Such data is indispensable for those looking to navigate the complex world of cryptocurrency trading.

Impact of Market Sentiment on Ethereum’s Performance

Market sentiment heavily influences Ethereum’s price and can often lead to drastic market movements, as evidenced by the current 3.3% decline. As traders react to news and events surrounding ETH, sentiment can shift rapidly, causing prices to fluctuate. Understanding these dynamics is crucial for investors looking to capitalize on potential price swings.

Moreover, emotional response to market news contributes to the volatility seen in Ethereum’s trading behavior. Investors must recognize the power of market sentiment in shaping the price trends and prepare to adapt to sudden changes. By maintaining an awareness of market sentiment, traders can better position themselves amidst Ethereum’s ups and downs.

The Crucial Role of Technical Analysis for Ethereum Traders

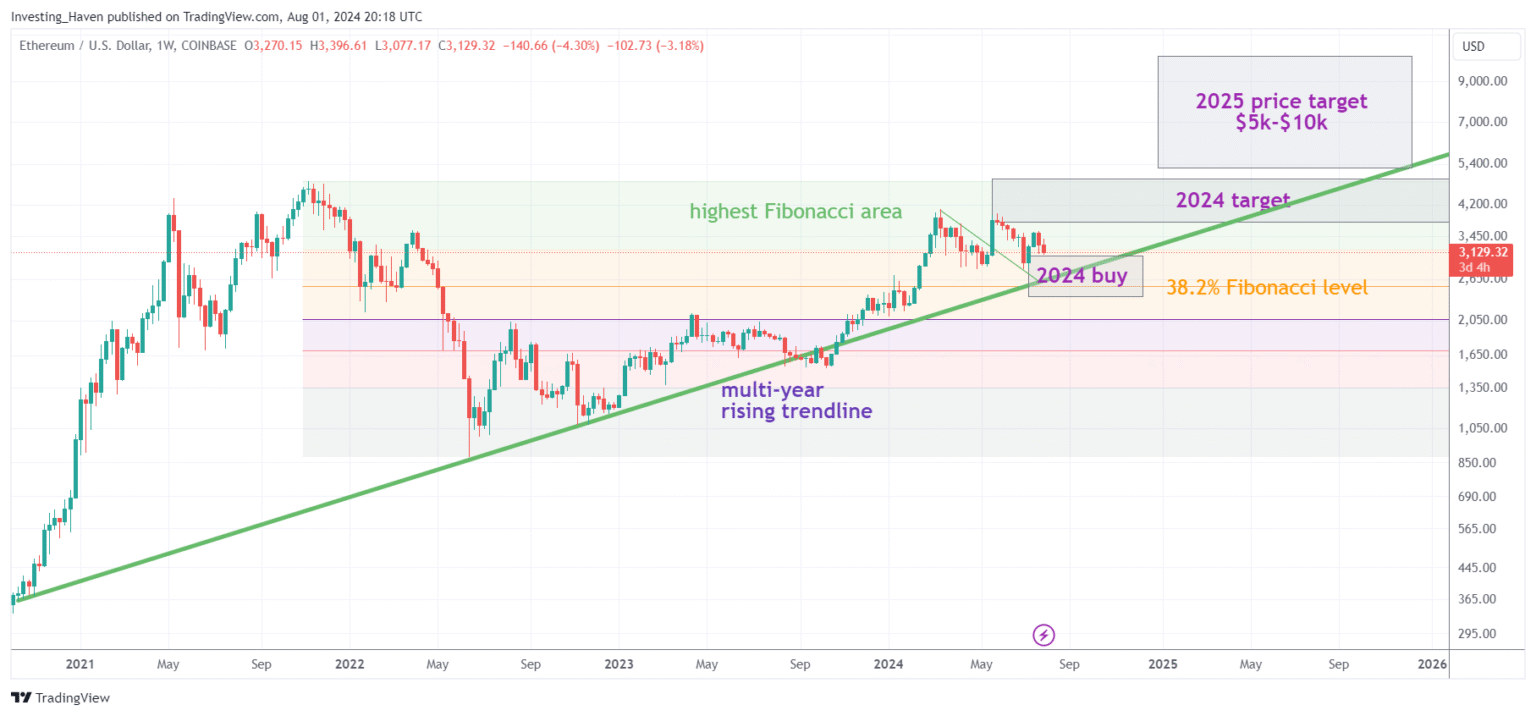

For Ethereum traders, technical analysis serves as a valuable tool in predicting price movements and identifying entry and exit points. By examining historical price patterns and market data, including recent drops below 2900 USDT, traders can develop strategies to navigate turbulent market conditions effectively. Technical indicators are essential in assessing whether Ethereum’s price is poised to recover or face further declines.

Furthermore, the integration of technical analysis with fundamental factors helps traders formulate comprehensive trading strategies. While Ethereum’s recent performance reflects a bearish trend, combining these insights with technical charts can provide a clearer picture of potential market reversals. This approach underscores the importance of remaining informed and adaptable as market conditions evolve.

Ethereum’s Comparative Performance Against Other Cryptocurrencies

In the context of the broader cryptocurrency market, Ethereum’s recent fall raises questions about its performance compared to its competitors. While Bitcoin continues to retain dominance, Ethereum’s fluctuations signify its unique challenges and opportunities. Assessing ETH’s price drop alongside other cryptocurrencies can offer valuable insights into the market dynamics at play.

Understanding these comparative performances is essential for informed decision-making within the cryptocurrency space. Investors should be cognizant of how Ethereum’s price movements interrelate with those of other cryptocurrencies, thereby gaining a broader perspective on potential trends and recovery patterns. This comparative analysis will be key in shaping strategies moving into 2025 and beyond.

Long-term Strategies for Investing in Ethereum

Given the current volatility and recent price drops, formulating long-term strategies for investing in Ethereum is more critical than ever. Investors are encouraged to take a measured approach, focusing not only on short-term fluctuations but also on the overall potential for growth in the long run. By considering ETH’s position within the broader cryptocurrency ecosystem, investors can develop strategies that align with their financial goals.

Moreover, diversification remains a cornerstone of effective investing. By spreading investments across various cryptocurrencies and asset classes, investors can mitigate risks presented by sudden price changes, such as the recent drop below the 2900 USDT mark. Long-term holders of Ethereum should stay informed about market trends and technological advancements that can shape the cryptocurrency landscape moving forward.

Frequently Asked Questions

What is causing the Ethereum price drop to below 2900 USDT?

The recent Ethereum price drop, moving below 2900 USDT, is attributed to various market factors, including overall cryptocurrency decline trends and investor sentiment. Reports indicate that as of December 1, 2025, ETH is quoted at 2899.02 USDT, reflective of a 3.3% decline over the last 24 hours, as reported by OKX market data.

How will the Ethereum price drop affect ETH price predictions for 2025?

The current Ethereum price drop could influence ETH price predictions for 2025. Analysts often adjust their forecasts based on market performance, and with ETH falling below 2900 USDT, there may be a temporary reconsideration of bullish predictions. Ongoing analysis in Ethereum market reports will provide clearer insights in the coming months.

What is the significance of the Ethereum price drop reported in the latest Ethereum news?

The Ethereum price drop to below 2900 USDT is significant as it reflects current market trends and investor reactions. As noted in Ethereum news from December 2025, this decline of 3.3% over the last 24 hours highlights potential volatility in the cryptocurrency market, which could impact future trading strategies.

How does the Ethereum market report detail the recent price drop?

According to the recent Ethereum market report from December 1, 2025, ETH dropped below 2900 USDT, currently trading at 2899.02 USDT with a 24H decline of 3.3%. This report aggregates data from multiple sources, including OKX ETH data, to deliver a comprehensive perspective on the market’s performance.

What implications does the Ethereum drop have on the broader cryptocurrency market decline?

The Ethereum drop below 2900 USDT serves as an indicator of the broader cryptocurrency decline currently affecting the market. When leading cryptocurrencies like Ethereum experience price drops, it often signals changing investor sentiment and can lead to further volatility across various crypto assets.

| Key Points |

|---|

| Ethereum (ETH) Price Drop Details. |

| ETH fell below 2900 USDT |

| Current price: 2899.02 USDT |

| 24-hour decline of 3.3% |

| Reports sourced from OKX market data |

Summary

The recent Ethereum price drop saw ETH fall below 2900 USDT, marking a significant decline of 3.3% within 24 hours. This decline indicates a sensitive market response, reflecting broader trends that could impact investor sentiment. The current price is reported at 2899.02 USDT, showcasing the volatility of cryptocurrencies. As the market continues to fluctuate, keeping an eye on Ethereum price trends is crucial for traders and investors alike.

Related: More from Ethereum News | Vitalik Buterin Shares Vision for Ethereum Scaling Solution | Tether Freezes Over $4B Linked to Crime in Three Years in Ethereum