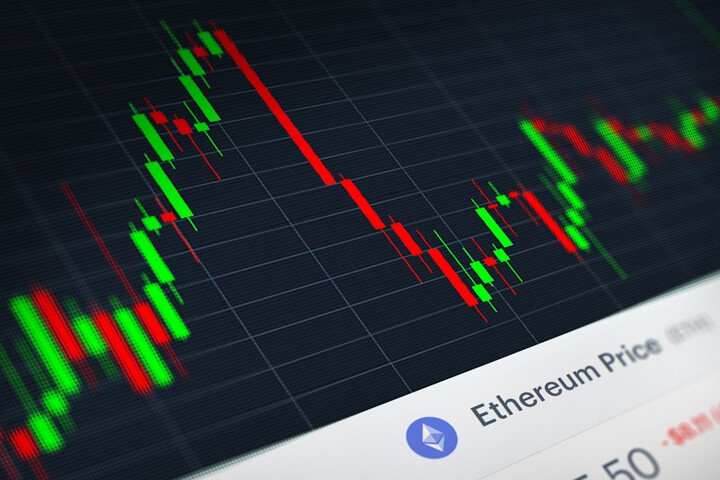

The recent Ethereum price decline is causing waves of concern among investors, particularly in light of the significant amount held by companies like BitMine Immersion. Last week, BitMine announced a substantial acquisition of Ethereum, yet both its stock and the overall market saw a steep 9.7% drop in ETH price within 24 hours. This downturn has prompted many to scrutinize Ethereum market analysis and the broader crypto market trends, with analysts like Tom Lee weighing in on future predictions. As the crypto stock performance continues to fluctuate, the implications of these developments pose intriguing questions about the resilience and trajectory of Ethereum in the coming months. Amidst this backdrop, BitMine’s recent activity underscores both the volatility of the market and the opportunities that still exist for growth in the cryptocurrency space.

The decline in Ethereum’s valuation has sparked noteworthy discussions across the cryptocurrency landscape, particularly concerning the market’s overall health and the costly implications for major stakeholders like BitMine Immersion. While the company’s recent Ethereum purchases were intended to bolster its position, the abrupt market downturn illustrates the unpredictability inherent in digital asset investments. As analysts examine the potential impacts of these trends on Ethereum’s stability, many are turning attention to market indicators and expert forecasts to assess the situation. Tom Lee’s insights into crypto performance and future forecasts are particularly relevant, highlighting the dichotomy between immediate market behavior and long-term investment strategies. As stakeholders navigate these turbulent waters, understanding the factors driving price changes becomes crucial for making informed decisions.

Tom Lee’s BitMine Holdings Surge Despite ETH Price Decline

Amid a turbulent crypto market, Tom Lee’s BitMine Immersion has made significant strides by increasing its Ethereum holdings, amassing over $10 billion in the cryptocurrency. This ambitious investment includes a recent purchase of 96,798 ETH, valued at more than $265 million. However, despite these bold acquisitions, the firm’s stock has recently faced challenges, dropping 12% alongside Ethereum’s price decline, which has fallen to $2,745 after reaching $4,946 just a few months prior. This paradox illustrates the volatility of the crypto market—where even established firms like BitMine face the brunt of wider economic fluctuations.

The decline in ETH’s market price is notable, particularly as it reflects a broader trend affecting the cryptocurrency landscape. While Tom Lee and his team at BitMine remain optimistic, indicating that they perceive positive tailwinds for ETH’s recovery, the immediate market performance paints a different picture. With over 76% of market participants in a recent survey predicting further drops—down to $2,500—it’s clear that uncertainty lingers in the air for Ethereum investors. This situation has compelled not only BitMine but many other investors to reassess their strategies amid the ongoing volatility.

Analyzing Ethereum Market Trends in 2025

The Ethereum market has shown resilience and adaptability, even as prices fluctuate dramatically. Currently trading at $2,745 after a significant peak in the previous months, there is a growing need to analyze the factors driving these trends. Market analysts highlight macroeconomic trends, regulatory changes, and shifts in investor sentiment as critical influences. For instance, the recent market crash in October, which saw a loss exceeding $19 billion in open interest, highlights the fragility of current crypto market structures. As companies like BitMine Immersion expand their holdings, they must navigate these challenges and the possibility of further declines.

Additionally, with crypto stocks reflecting a mixed performance, the need for comprehensive market analysis is more pressing than ever. Tom Lee’s predictions remain cautiously optimistic, suggesting that stabilization may be around the corner due to the natural cycles of the crypto economy. However, the observed scrutiny on crypto treasuries, alongside significant liquidations reported in both Bitcoin and Ethereum, emphasizes a tightening environment for crypto investments. These elements underscore the necessity for investors to stay informed about market fluctuations and the potential impacts on their portfolios.

The Impact of Macro-Economic Factors on Crypto Assets

Crypto assets are becoming increasingly intertwined with broader macroeconomic factors, shaping their performance and influencing investor behavior. As seen in recent declines across cryptocurrencies and stocks alike, financial shifts such as inflation rates, interest rate changes, and geopolitical tensions can create a ripple effect that impacts market sentiment. Investors are now more cautious, reacting to downward trends that have led to considerable liquidations. The interplay between these global factors and crypto-specific events necessitates a keen understanding of market dynamics.

As crypto markets adjust to these changes, companies like BitMine must be vigilant. Their strategic decisions, including significant investments in Ethereum, are directly affected by these macroeconomic trends. Tom Lee’s acknowledgment of the market’s attempts at stabilization indicates a crafty assessment of short-term volatility against a backdrop of potential long-term gains. However, while his outlook on Ethereum suggests recovery, the undeniable reality remains that macro-economic uncertainties could foster continued volatility in crypto prices.

Tom Lee’s Predictions for Ethereum’s Future

Tom Lee, co-founder of Fundstrat Global Advisors and a recognized voice in the cryptocurrency space, has offered insight into the future trajectory of Ethereum. Despite the recent downturn in prices, Lee remains optimistic, believing that the fundamentals surrounding Ethereum support a potential recovery. His bullish stance indicates that further integrations and technological advancements within the Ethereum network could drive price appreciation, leading to renewed investor interest and market confidence. His assertion for a shift towards the $4,000 mark hinges on a combination of bullish market sentiment and innovative progress.

The sentiments expressed by Lee reflect a growing faction of crypto analysts who see Ethereum as a vital player in the evolving landscape of digital assets. Yet, skepticism prevails among others, particularly those observing the immediate price drops and increasing scrutiny surrounding crypto treasuries. In this climate, the balance between expert predictions and market realities remains a tug-of-war, creating a complex backdrop for investors. As Lee’s predictions continue to circulate within the crypto community, the divergence in opinions only emphasizes the unpredictable nature of Ethereum’s future amidst a backdrop of volatile market conditions.

BitMine’s Strategic Approach Amidst Falling Stock Prices

BitMine Immersion’s strategy in building its crypto treasury reflects a careful and calculated approach to navigating today’s tumultuous market. Following its latest purchase of Ethereum, the firm’s leadership has made it clear that their investment decisions are rooted in long-term objectives, not just immediate performance. With over 301% growth this year despite recent declines, BitMine’s stock performance illustrates resilience, positioning itself to capitalize on eventual market recovery. Their approach emphasizes a focus on solid liquidity positions—keeping in mind the stability of resources, including a cash reserve of nearly $882 million.

Moreover, as BitMine continues to expand its holdings in Ethereum and Bitcoin, the company also faces the challenge of showcasing value to its shareholders amid volatile market fluctuations. As the stock fell 12% concomitant with ETH’s price declines, investor confidence may be fragile, prompting the necessity for transparency and strategic communication. With Tom Lee’s predictions for the crypto market as a guiding principle, BitMine’s leadership is likely to reinforce its commitment to navigating market challenges and ensuring that strategic investments align with long-term goals.

Understanding Crypto Stock Performance in Volatile Markets

The performance of crypto-related stocks, like BitMine Immersion, can mirror the volatility observed within cryptocurrencies themselves. In recent trends, significant price swings have drawn a necessary correlation between traditional equity markets and emerging digital asset markets. For investors, monitoring the performance of these stocks has become crucial—especially given that companies involved in cryptocurrency, like mining firms, can showcase robust returns even when the underlying cryptocurrencies may falter. With a 301% increase year-to-date, BitMine stands as a prime example of a company reaping benefits from careful investments amid fluctuating market conditions.

However, with the recent downturn affecting both crypto prices and associated stocks, investors are reevaluating strategies and approaches. Falling prices can invoke a ‘risk-off’ mentality, where investors withdraw from high-volatility assets, leading to declines in stock prices for firms tied to cryptocurrency markets. Tom Lee’s insights thus extend not only to predicting Ethereum recovery but also to understanding how the fluctuations of crypto influence stock performance. This connection is vital—prompting stakeholders to adopt multifaceted investment strategies that take into consideration both crypto and its associated stocks.

The Future of Ethereum Amidst Skepticism and Optimism

As Ethereum navigates through peaks and valleys of market volatility, the prevailing sentiment encompasses both optimism and skepticism from various market analysts and investors. While Tom Lee’s predictions for Ethereum’s recovery towards $4,000 inspire hope among supporters, the reality of recurrent price dips—such as that recently witnessed, where ETH fell almost 10%—continues to cast a shadow of doubt. The debates surrounding regulatory policies, market stabilization, and overall economic conditions amplify the complexity of forecasting Ethereum’s path forward.

Despite these challenges, the core technological advancements tied to Ethereum’s success cannot be ignored. Innovations in smart contracts, decentralized finance, and emerging applications position Ethereum as a powerhouse within the crypto space. As stakeholders weigh the prospects amid skepticism, the larger narrative includes addressing the concerns surrounding liquidations and market manipulations. This multifaceted perspective fosters discussions about resilience and recovery, crucial elements that will define Ethereum’s future in a competitive and ever-evolving market landscape.

The Role of Crypto Market Analytics in Investment Decisions

In the multifarious world of cryptocurrency investment, sound market analytics plays a critical role in shaping decision-making processes. Investors must navigate through detailed data points and forecasts, decoding market signals that indicate potential shifts in price and trading patterns. The extensive analysis conducted by firms like Fundstrat not only elevates Tom Lee’s insights but also allows for a deeper understanding of market currents—particularly during turbulent times where price fluctuations can catch many off guard. Engaging with analytical tools and market reports can support informed strategies that mitigate risks amid the unpredictability of Ethereum and other altcoins.

As crypto asset volatility continues, the need for robust analytical frameworks to predict market trends becomes essential. Data-driven insights inform investor expectations and allow for reactionary measures in times of market distress. Investors must thus remain proactive, equipped with comprehensive research and analytics that encompass both historical performance and future forecasts. By adhering to an analytic-driven paradigm, crypto investors can cultivate greater situational awareness and prepare for potential downturns, such as the recent widespread price declines that have impacted both Ethereum and associated stocks.

Frequently Asked Questions

What factors are contributing to the Ethereum price decline?

The recent Ethereum price decline can be attributed to a variety of factors including market volatility, sharp declines in Bitcoin prices, and overall crypto market trends that create investor uncertainty. According to Tom Lee, recent events led to a liquidation shock in October that significantly impacted crypto assets like ETH.

How does BitMine Immersion’s Ethereum acquisition relate to the current price decline?

Despite BitMine Immersion’s recent acquisition of over $265 million in Ethereum, the price of ETH has still faced a decline. This contradiction highlights the challenges in the crypto market, where even large institutional purchases may not prevent price downturns due to broader market sentiments and declining crypto stock performance.

What does Tom Lee predict for Ethereum prices following the recent dip?

Tom Lee predicts that Ethereum could see positive movements, citing market stabilization after the earlier sharp decline. He claims that recent factors are acting as tailwinds for ETH prices, suggesting potential recovery despite the current decline.

How significant is the impact of Bitcoin’s price on Ethereum’s performance?

The impact of Bitcoin’s price on Ethereum’s performance is significant. As Bitcoin prices decline, Ethereum and other altcoins often follow suit, reflecting the interconnectedness of the crypto market. Recent reports indicate that BTC’s decline caused substantial liquidations throughout the crypto space, including Ethereum.

What does the future hold for Ethereum considering the current market trends?

Future predictions for Ethereum, following the current market trends, remain mixed. While a Myriad prediction market suggests that over 76% of respondents see ETH dropping to $2,500, the resilient long-term outlook and Tom Lee’s favorable predictions indicate potential for recovery as market conditions change.

Are there any indicators that Ethereum will recover after this price decline?

Yes, there are indicators suggesting that Ethereum could recover from its current price decline. Tom Lee points out that stabilization following significant downturns, increased institutional purchases, and long-term bullish sentiments might eventually lead to a rebound in ETH prices.

| Key Points | Details |

|---|---|

| Tom Lee’s BitMine Purchases | Previously acquired over $265 million in Ethereum, totaling 96,798 ETH. |

| Current Holdings | BitMine holds 3,726,499 ETH valued at $10.1 billion, and 192 Bitcoin worth $16 million. |

| Recent Stock Performance | BitMine’s stock fell 12% during Ethereum price decline but is still up 301% year-to-date. |

| Ethereum Price Decline | ETH’s price fell by 9.7% to $2,745, significantly below its peak of $4,946. |

| Market Predictions | 76% of Myriad respondents predict ETH will drop to $2,500. |

Summary

The Ethereum price decline has had a significant impact on the market, as evidenced by BitMine’s recent stock drop despite its large acquisition of Ethereum. Currently, Ethereum is trading at $2,745, which is a notable decrease from its previous highs, indicating that market sentiment remains cautious amid ongoing volatility. The overall state of the cryptocurrency market suggests that while some are bullish on ETH’s recovery, others are preparing for further declines.

Related: More from Ethereum News | Vitalik Buterin Shares Vision for Ethereum Scaling Solution | Tether Freezes Over $4B Linked to Crime in Three Years in Ethereum