The Ethereum Layer 2 network is quickly emerging as a transformative force within the blockchain landscape, particularly with Robinhood Crypto at the forefront of this evolution. Recently, Johann Kerbrat revealed exciting insights about their Layer 2 expansion during an interview, highlighting the focus on tokenized stocks and advanced staking services. By integrating within the Ethereum ecosystem, Robinhood harnesses the power of enhanced security and liquidity that this established network provides. This strategic choice allows them to concentrate on meaningful innovations, such as scaling their offerings—from initially supporting 200 tokenized stocks to now exceeding 2,000. As the crypto developments continue, the implications of this Layer 2 network could significantly reshape how we view investments in both traditional and digital assets.

The Layer 2 solution on Ethereum is becoming increasingly significant, particularly for platforms like Robinhood Crypto, which are innovating within the digital asset landscape. This network not only enhances transaction efficiency but also supports exciting projects like fractional stock ownership and staking solutions. By aligning with the Ethereum infrastructure, Robinhood ensures robust security and access to a broad range of liquidity pools. As anticipation builds for the public phase of this development, stakeholders eagerly await the expansion into new assets, encompassing areas such as private equity and real estate. With the rapid progression of blockchain technology, the role of Layer 2 solutions promises to be pivotal in the future of finance.

Exploring Robinhood Crypto’s Innovations

Robinhood Crypto is making significant strides in the digital assets space as it expands its offerings to include innovative projects in tokenized stocks and staking services. The recent comments from Johann Kerbrat highlight Robinhood’s commitment to leveraging the Ethereum ecosystem, especially through its upcoming Ethereum Layer 2 network. This network not only aims to facilitate faster transactions but also enables Robinhood to create a more seamless experience for users wishing to engage in tokenized stock trading. The focus on innovation within Robinhood signifies a response to the increasing demands of retail investors who are keen on accessing diverse financial products in a decentralized environment.

With a vast network and growing user base, Robinhood is poised to impact the crypto landscape significantly. As the company integrates staking services into its platform, users will have the opportunity to earn rewards on their crypto holdings, further enhancing their investment strategy. This aligns with the increasing trend of investors seeking yield-generating opportunities amidst the evolving regulatory landscape. By focusing on tokenized stocks and staking, Robinhood aims to solidify its position as a leader in the intersection of traditional finance and the crypto world, highlighting its adaptability and forward-thinking approach.

The Importance of Ethereum Layer 2 Networks

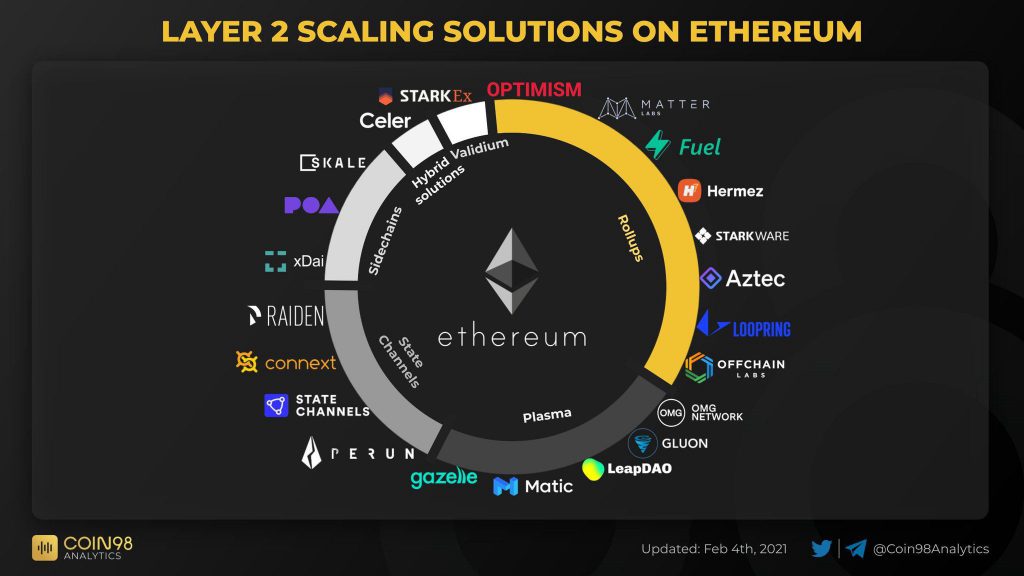

Ethereum Layer 2 networks have become crucial in solving scalability issues that plague the Ethereum blockchain. By choosing to build its Layer 2 network within the Ethereum ecosystem, Robinhood can harness the decentralized, secure, and liquidity-rich environment of Ethereum while avoiding the complexities of establishing a standalone infrastructure. Layer 2 solutions like those being developed by Robinhood allow for faster transaction confirmation times and lower fees, which are essential for creating a robust trading environment for tokenized stocks.

The Ethereum Layer 2 network that Robinhood is rolling out plays a vital role in enhancing the user experience. As more users transition towards crypto investments, efficiency becomes paramount. By backing its innovations on the established Ethereum blockchain, Robinhood not only benefits from its network effects but also contributes to the growing ecosystem of decentralized finance (DeFi). Layer 2 networks help in streamlining transactions across various financial products, including staking services, thus promoting broader adoption among investors looking to capitalize on the burgeoning opportunities in crypto developments.

Tokenized Stocks: Revolutionizing Investment Opportunities

Tokenized stocks represent a paradigm shift in how investors can access traditional equity markets. By digitizing ownership of stock shares, Robinhood is making it easier for investors to diversify their portfolios without the constraints typically associated with traditional brokerage accounts. Johann Kerbrat’s insights reveal that Robinhood has successfully expanded its offering from 200 to over 2,000 tokenized stocks, allowing users to invest in fractional shares and gain exposure to a broader array of asset classes. This not only democratizes access to investing but also enhances liquidity in the market.

As Robinhood continues to innovate in the tokenized stock sector, it opens up new avenues for investment, particularly in private equity and real estate. This diversification aligns with the growing trend of investors seeking alternative assets, allowing them to hedge against market volatility. With the backing of a powerful Layer 2 network, these tokenized stocks could ensure faster transactions and lower fees, creating a more attractive landscape for both new and experienced investors within the dynamic Ethereum ecosystem.

Staking Services: A New Frontier for Retail Investors

With the launch of its staking services, Robinhood provides retail investors with an opportunity to earn rewards on their crypto holdings, effectively turning passive investors into active participants in the crypto space. Staking, a process that involves locking up cryptocurrencies to support blockchain operations, allows users to generate income without the need for intensive trading strategies. Given the increasing interest in earning yield through staking, Robinhood’s move signifies its alignment with current trends in the cryptocurrency market.

The implementation of staking services by Robinhood not only benefits users but also strengthens the network’s security and efficiency. As more investors participate, the overall health and stability of the blockchain increase. Moreover, the integration of these services into Robinhood’s offerings enhances its competitive edge, positioning the platform as a comprehensive financial hub. As staking continues to gain traction, Robinhood’s strategic focus on this service underscores its commitment to fostering user engagement and driving innovation in the evolving cryptocurrency landscape.

Navigating Regulatory Changes in the Crypto Space

As Robinhood expands its offerings, staying compliant with evolving regulations is paramount. The recent updates in SEC policies have allowed the company to launch its staking services across most areas in the U.S., demonstrating the importance of regulatory agility in the crypto market. By aligning its practices with the latest regulatory guidelines, Robinhood not only safeguards its operations but also builds user trust, essential for long-term growth in the highly volatile and scrutinized crypto environment.

Navigating regulatory frameworks is challenging but necessary for companies like Robinhood looking to innovate. The seamless introduction of staking services following regulatory updates illustrates Robinhood’s proactive approach to compliance and its dedication to creating a secure environment for users. As other companies look to emulate Robinhood’s strategy, understanding and adapting to regulatory changes will remain critical in fostering a responsible and thriving cryptocurrency ecosystem.

The Future of Cryptocurrency Investments with Robinhood

The future of cryptocurrency investments is rapidly evolving, particularly with platforms like Robinhood leading the charge. By integrating features such as tokenized stocks, staking, and a Layer 2 solution, Robinhood is setting itself apart as a forward-thinking brokerage that caters to modern investors. The overall trend indicates that retail investors are becoming more engaged in digital assets and seeking innovative ways to diversify their portfolios.

With each development, including the imminent public release of the Ethereum Layer 2 network and expanded tokenized stock offerings, Robinhood is reinforcing its commitment to making investment accessible and efficient. The company’s strategies align closely with emerging crypto developments and the increasing demand for user-friendly solutions in finance. As Robinhood continues to innovate, it is likely to play a pivotal role in shaping the future landscape of investment through technology-driven initiatives.

Embracing the Ethereum Ecosystem for Enhanced Security

The decision to anchor Robinhood’s Layer 2 network within the Ethereum ecosystem is a strategic move that emphasizes the importance of security in the growing crypto sector. Leveraging Ethereum’s robust security architecture allows Robinhood to provide a reliable platform for trading and engaging with digital assets. This reliance on Ethereum not only enhances security for users but also extends the credibility of Robinhood’s financial products, such as tokenized stocks.

By embedding itself within the Ethereum ecosystem, Robinhood can tap into existing liquidity and a well-established user base, facilitating a break from the challenges faced by fledgling chains. As security remains a paramount concern in digital finance, Robinhood’s focus on a Layer 2 solution within Ethereum provides an assurance to investors. The integration ensures that users can trade and stake with confidence, knowing their investments are safeguarded by a trusted and decentralized network.

Enhancing User Experience through Technology-driven Solutions

In today’s digital landscape, the user experience is a critical component for technology-driven financial platforms. Robinhood’s focus on enhancing user experience through its Layer 2 network, alongside initiatives like tokenized stocks and staking, indicates a clear understanding of modern investor needs. By utilizing advanced technology to streamline transactions and reduce costs, Robinhood is positioning itself as a user-centric platform in the highly competitive crypto market.

Optimizing the trading experience requires continuous innovation, which Robinhood is clearly demonstrating. With plans for further expansion into varied sectors such as real estate and artworks via tokenization, the company showcases its commitment to adapting to market trends and consumer preferences. As Robinhood continues to refine its offerings and leverage technology, user engagement and satisfaction are likely to soar, reinforcing its mission to make investing accessible for everyone.

Frequently Asked Questions

What is the Ethereum Layer 2 network being developed by Robinhood Crypto?

The Ethereum Layer 2 network being developed by Robinhood Crypto is a scaled solution designed to enhance transaction efficiency and lower costs while leveraging the security of the Ethereum ecosystem. By building on Layer 2, Robinhood aims to improve user experience and integrate its services such as tokenized stocks and staking.

How does Robinhood Crypto’s Ethereum Layer 2 network support tokenized stocks?

Robinhood Crypto’s Ethereum Layer 2 network supports tokenized stocks by providing a robust infrastructure that allows for seamless trading and ownership of tokenized stock assets. This integration has allowed Robinhood to expand its offerings from 200 to over 2,000 stocks on platforms such as Arbitrum One.

What benefits does Robinhood gain by using the Ethereum ecosystem for its Layer 2 network?

By utilizing the Ethereum ecosystem for its Layer 2 network, Robinhood gains access to mature security protocols, decentralized features, and substantial liquidity. This choice allows Robinhood to focus more on enhancing its core functionalities, such as developing tokenization services and staking options.

What are the current features of Robinhood’s Ethereum Layer 2 network?

Currently, Robinhood’s Ethereum Layer 2 network is in a private testnet phase and focuses on features such as tokenized stocks and potential staking services. While a public release timeline is not confirmed, the network aims to streamline crypto transactions within the Ethereum ecosystem.

What are staking services offered by Robinhood on the Ethereum Layer 2 network?

Robinhood offers staking services on its Ethereum Layer 2 network as part of its expansion into crypto developments. These services allow users to earn rewards by locking their cryptocurrencies within the platform, complementing Robinhood’s advances in tokenized stocks and other blockchain technologies.

What future plans does Robinhood have for its Ethereum Layer 2 network?

Robinhood plans to expand its Ethereum Layer 2 network to include more tokenization services, potentially venturing into private equity, real estate, and artworks. This strategic direction aims to enhance the user experience and broaden investment opportunities within the Ethereum ecosystem.

How does Robinhood’s Layer 2 network benefit users engaged in the Ethereum ecosystem?

Users in the Ethereum ecosystem benefit from Robinhood’s Layer 2 network through lower transaction costs, faster processing times, and enhanced security features. This network enables access to a wide range of crypto assets, including diverse tokenized stocks and staking options.

When will the public have access to Robinhood’s Ethereum Layer 2 network?

As of now, Robinhood has not announced a specific timeline for public access to its Ethereum Layer 2 network, which is currently in the private testnet phase. Updates regarding its release and available features will be communicated by Robinhood as they progress.

| Key Points |

|---|

| Robinhood Crypto, led by Johann Kerbrat, is developing an Ethereum Layer 2 network. |

| The decision for a Layer 2 over a standalone Layer 1 is based on security and concentration in the Ethereum ecosystem. |

| Robinhood’s Layer 2 network is currently in a private testnet phase with no public release date announced. |

| The company has expanded its tokenized stocks from 200 to over 2,000 on Arbitrum One since last July. |

| Future expansions may include tokenization services for private equity, real estate, and artworks. |

| Robinhood’s staking services launched in most of the U.S. in June after regulatory updates from the SEC. |

Summary

The Ethereum Layer 2 network developed by Robinhood Crypto represents a significant advancement in the company’s strategy to enhance cryptocurrency services. By leveraging the established Ethereum ecosystem, Robinhood aims to offer secure and robust functionalities, such as stock tokenization and staking services. With current operations in a private testnet phase and a focus on expanding tokenized stocks, the future looks promising as Robinhood continues to innovate within the Ethereum Layer 2 framework.

Related: More from Ethereum News | Google Cloud, MoneyGram Join New Privacy Network Bank Initiative | Ethereum Network Transactions Hit New Record: What It Means for You