Ethereum daily active addresses have seen a remarkable surge, recently surpassing all layer-2 networks, marking a significant trend in Ethereum mainnet activity. This increase has created a notable disparity in daily engagement levels, with Ethereum’s active addresses soaring to about 1.3 million at one point. Analysts, however, caution that part of this growth may stem from address poisoning attacks, where malicious actors mislead users through deceptive transactions. Despite concerns over the authenticity of some activity, the Ethereum network remains a leader in blockchain user engagement, particularly following recent upgrades that have lowered gas fees. This resurgence indicates a potential return to the mainnet, a pivotal development in the ongoing comparison between Ethereum and its layer-2 counterparts.

The recent uptick in overall Ethereum interactions highlights a significant revival in user activity on the Ethereum blockchain. With the daily user count outperforming various layer-2 blockchain solutions, it’s clear that many are returning to this primary network for their transaction needs. While the dramatic rise in daily active addresses might be referenced from recent protocol enhancements, security experts have voiced concerns about the potential influence of malicious tactics, such as misleading transactional behavior. Nevertheless, this behavioral shift underlines Ethereum’s resilience and its prominence as a platform for digital asset management. In a landscape where blockchain user engagement is crucial, Ethereum’s strong performance continues to draw attention.

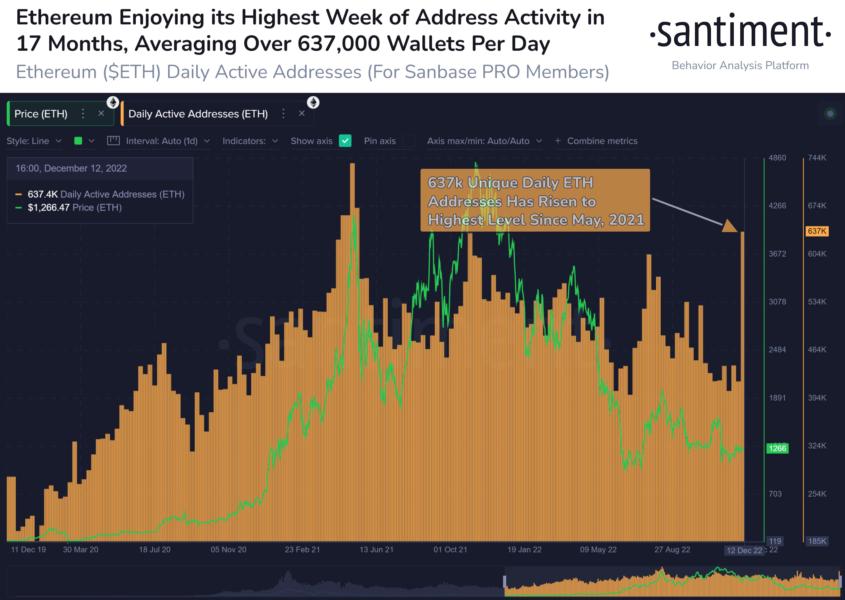

| Key Point | Details |

|---|---|

| Ethereum Daily Active Addresses | Ethereum mainnet’s daily active addresses increased to 945,000, surpassing all layer-2 networks. |

| Recent Increase | A spike in active addresses approaching 1.3 million was reported on January 16, |

| Impact of the Fusaka Upgrade | The December Fusaka upgrade lowered gas fees substantially, contributing to increased activity. |

| Address Poisoning Attacks | Analysts noted that part of the increase may be due to address poisoning scams. |

| Ethereum’s Dominance in Asset Tokenization | Ethereum holds over $400 billion in on-chain assets, controlling major shares in stablecoins. |

Summary

Ethereum daily active addresses have significantly surpassed those of layer-2 networks, marking a pivotal point in the platform’s usage. Despite concerns regarding the legitimacy of some users due to address poisoning attacks, Ethereum’s mainnet remains robust with a substantial active user base. The recent upgrades and lower gas fees further enhance its appeal, solidifying its position as the preferred blockchain for asset tokenization in the evolving digital landscape.

Surge in Ethereum Daily Active Addresses

The recent surge in Ethereum daily active addresses has captured significant attention in the blockchain community. As reported, Ethereum mainnet has outperformed all layer-2 networks, registering an impressive peak of 1.3 million active addresses in mid-January. This resurgence is attributed largely to the Ethereum Fusaka network upgrade that resulted in reduced gas fees, enhancing the overall user experience on the platform. Even after settling to approximately 945,000 active addresses, Ethereum remains the frontrunner in blockchain user engagement, demonstrating a clear preference among users for its mainnet over alternative layer-2 solutions.

However, it is essential to consider the factors contributing to this spike in activity. Security researchers have raised concerns regarding potential address poisoning attacks, wherein attackers send small transactions to wallets that resemble legitimate user wallets. Such tactics could mislead unsuspecting users and artificially inflate the displayed activity on the network. As the conversation around network integrity continues, the actual user base may be less than what the numbers suggest, warranting a closer examination of blockchain user behavior in the Ethereum ecosystem.

Impact of Ethereum Network Upgrades

Ethereum’s recent network upgrades, particularly the Fusaka upgrade, have been pivotal in maintaining its position in the blockchain sphere. This upgrade significantly lowered gas fees, thus encouraging more users to engage with the Ethereum mainnet. Consequently, the lowering of transaction costs contributed to a notable increase in daily active addresses, leading Ethereum to surpass all leading layer-2 networks. This trend highlights the importance of efficient network operation, as lower costs equate to higher participation from genuine users and investors alike.

Despite the benefits of such upgrades, the rise in activity levels poses questions regarding the authenticity of user engagement. Security analysts have noted the rise in address poisoning tactics, which exploit the very upgrades meant to enhance user experience. These attacks not only affect user confidence but could skew analytics regarding genuine interaction on the Ethereum blockchain. Therefore, while upgrades play a crucial role in driving Ethereum’s adoption, they also necessitate enhanced security measures to protect user integrity and trust.

Ethereum vs. Layer-2 Networks: A Comparative Analysis

The ongoing debate over Ethereum’s mainnet and its layer-2 counterparts has intensified as Ethereum continues to lead in daily active addresses. With Ethereum recently surpassing all layer-2 networks, it’s vital to understand what this signifies for both networks. Layer-2 solutions like Arbitrum and Base Chain provide scalability benefits, yet they fall short when it comes to user engagement compared to the Ethereum mainnet. By analyzing the metrics, it becomes evident that while layer-2 networks can manage transactions faster and cheaper, their adoption lacks the organic growth seen in Ethereum’s mainnet activity.

Critically, while layer-2 networks offer viable alternatives for transactions, Ethereum’s mainnet retains its dominance due to its established reputation and infrastructure. Additionally, security concerns around some layer-2 solutions cannot be overlooked. Issues such as scalability, potential exploits, and the risk of fraudulent activity contribute to hesitance among users. For now, Ethereum’s resilience and recent enhancements position it as the leader in blockchain technology, with layer-2 networks playing a complementary role rather than a competing one.

Address Poisoning and Its Implications

Address poisoning has emerged as a critical issue within the Ethereum blockchain landscape, warranting further discourse among security analysts and users. This deceptive practice involves attackers sending tiny amounts of cryptocurrency to addresses intended to mimic legitimate users. As the Ethereum network continues to attract attention, the tactics employed by cybercriminals have evolved, with the recent surge in network activity directly linked to these address poisoning efforts. Analysts contend that this technique has become economically viable due to lower gas fees, allowing attackers to implement their strategies without incurring significant costs.

The implications of these attacks extend beyond immediate financial consequences; they threaten to undermine user trust in the Ethereum ecosystem. As reported, security firms have indicated that such campaigns could correlate strongly with the inflated transaction volumes observed on the network. It raises concerns regarding data integrity and the ability to accurately assess Ethereum’s success in user engagement. Therefore, ongoing vigilance and improved security measures are imperative for maintaining the credibility of the Ethereum blockchain and ensuring that users can engage without fear of compromising their financial safety.

The Future of Tokenization on Ethereum

Ethereum continues to lead the charge in the realm of asset tokenization, boasting a staggering $400 billion in on-chain assets. With a significant share of stablecoins and real-world asset tokenization, Ethereum has positioned itself as the preferred blockchain for businesses and individuals looking to leverage the benefits of decentralized finance. The global market for tokenized assets is expected to exceed $11 trillion by 2030, and Ethereum’s foundational infrastructure is likely to play a crucial role in this burgeoning industry. Thus, it’s becoming increasingly clear that the future of tokenization is intrinsically linked to Ethereum’s continued evolution.

Looking ahead, the prospects for tokenization on Ethereum appear remarkably bullish. As adoption continues to grow, investments in infrastructure improvements and network security will become paramount to handle increasing transaction volumes and maintain user engagement. Moreover, Ethereum’s strong foundation, coupled with innovative layer-2 solutions, could propel the framework for tokenization forward, presenting new opportunities for developers and investors alike in a rapidly shifting financial landscape.

Economic Viability of Layer-2 Solutions

While Ethereum mainnet leads in daily active addresses, the economic viability of layer-2 solutions remains a topic of great interest. Layer-2 platforms like Arbitrum and Optimism offer cheaper transaction fees and faster processing times. However, their position is influenced by how well they can attract and retain users over time. As Ethereum continues to innovate and roll out upgrades—like its recent Fusaka upgrade—layer 2 solutions must find unique value propositions to differentiate themselves. Without genuine user commitment, the sustainability of these platforms could be jeopardized.

Additionally, the current landscape indicates that many users may gravitate back to the Ethereum mainnet for their transactions due to the inherent values of security and trustworthiness associated with Ethereum. Layer-2 networks, while providing advantages in cost and speed, could falter if they don’t reinforce their security measures against address poisoning and other threats. It will be essential for layer-2 solutions to continue evolving, focusing on seamless integration with the Ethereum ecosystem while building robust defenses against potential vulnerabilities.

Addressing Blockchain User Engagement

The phenomenon of Ethereum’s robust user engagement is a topic of keen analysis in blockchain platforms. With daily active addresses reaching impressive numbers, it raises questions about what drives users to prefer Ethereum over its layer-2 counterparts. Factors such as user interface simplicity, the security of transactions, and the larger ecosystem surrounding Ethereum contribute positively to user participation. With the ongoing developments within the Ethereum community, user engagement metrics provide insights into user behavior and preferences, proving vital for future blockchain strategies.

However, increasing user engagement must come alongside adequate safeguards against security risk. The occurrence of address poisoning attacks reminds stakeholders that while active users are essential for network health, the authenticity of user interaction directly affects the sustainability of the ecosystem. Therefore, increasing efforts towards education regarding secure transaction practices and enhanced wallet security features will be vital in safeguarding users, thereby ensuring that Ethereum maintains its reputation as a leading blockchain platform for legitimate activity.

The Role of Ethereum in DeFi

Ethereum’s ecosystem has truly become synonymous with decentralized finance (DeFi), leading the sector in total value locked (TVL) and innovative financial products. This ecosystem’s growth is reflected in Ethereum’s active users, as individuals, as well as institutional players, flock to take advantage of decentralized protocols for lending, staking, and trading. With Ethereum dominating the DeFi landscape, it underscores the network’s robust technological framework and the community’s trust in its decentralized nature.

As DeFi continues to innovate and expand, Ethereum’s role will likely evolve in unison. New enhancements in functionality and security will be critical to addressing the growing user demands while maintaining a frictionless experience. By providing infrastructure for DeFi, Ethereum positions itself not only as a leader in blockchain technology but as a pivotal force in the future of finance, capable of adapting to market needs and ensuring that users are engaged across its platforms.

Frequently Asked Questions

What is the significance of Ethereum daily active addresses compared to layer-2 networks?

Ethereum daily active addresses are significant as they demonstrate the level of engagement on the Ethereum mainnet. In January 2023, Ethereum’s daily active addresses surpassed those of all major layer-2 networks, indicating a strong return to the mainnet and suggesting a rebound in user activity, particularly with gas fees being lower following the Fusaka upgrade.

How do Ethereum daily active addresses relate to address poisoning attacks?

Ethereum daily active addresses have seen fluctuations partly attributed to address poisoning attacks. These are tactics where scammers send small transactions from fake wallet addresses, which may mislead users. This activity artificially inflates the transaction volume, impacting the perceived legitimate engagement on the Ethereum network.

What changes occurred in Ethereum’s daily active addresses after recent upgrades?

After the recent Ethereum network upgrade, specifically the Fusaka upgrade, daily active addresses on the Ethereum mainnet increased significantly due to lower gas fees. This has led to around 945,000 daily active addresses, surpassing the activity seen on layer-2 networks, though some of this activity may be related to less organic user engagement.

Why are Ethereum daily active addresses important for blockchain user engagement?

Ethereum daily active addresses are a critical metric for blockchain user engagement as they reflect the number of unique users interacting with the Ethereum mainnet. Higher daily active addresses signal a vibrant ecosystem, essential for developers, investors, and analysts evaluating the overall health and usage of Ethereum compared to layer-2 solutions.

Can the increase in Ethereum’s daily active addresses be fully trusted?

While the increase in Ethereum’s daily active addresses suggests growing network activity, it is essential to approach these figures with caution. Security analysts have indicated that part of this increase may stem from address poisoning attacks, which could misrepresent actual user engagement on the Ethereum network.