| Key Point | Details |

|---|---|

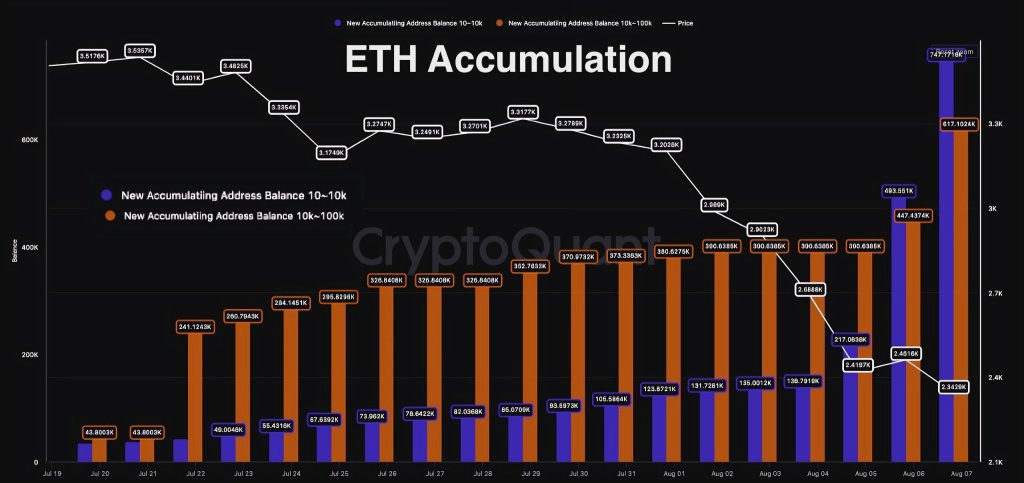

| Recent Ethereum Accumulation | Accumulation is primarily driven by spot buying, not leveraged funds. |

| Technical Indicators | Despite recent rebounds, the mid-term allocation logic for ETH remains supportive with improving indicators. |

| Market Activity | The ETH options market is dominated by selling call options while spot buying is prevalent and strategic. |

| Impact of Accumulation | This accumulation phase provides stronger support for price recovery and reduces short-term downward pressures. |

Summary

Ethereum accumulation is a significant trend driven by spot buying rather than leveraging activities. This strategic movement in the market indicates a growing confidence in ETH’s potential, with technical indicators supporting the notion of a sustained recovery. As market participants continue to engage in spot buying and selling call options, Ethereum’s price could further stabilize, creating a favorable environment for investors looking to accumulate.

Ethereum accumulation is a significant trend within the crypto landscape, showcasing a robust interest from investors navigating the ETH market. Recently documented by Matrixport, this accumulation is largely influenced by spot trading, which emphasizes cash transactions over leveraged speculation. As traders seek Ethereum trading insights, it becomes evident that the underlying technical analysis reflects a positive shift with improving indicators and a resurgence in on-chain activity. Furthermore, as ETH market trends evolve, there is less downward pressure on Ethereum’s price owing to a collective easing of pessimism among market participants. Notably, in tandem with the trends seen in the Ethereum options market, this strategic buying approach signals a deliberate position by long-term holders aimed at maximizing potential returns without succumbing to market volatility.

The movement known as Ethereum accumulation reflects a growing appetite for ETH among traders focused on secure investments. This strategy distills the essence of savvy trading, where market participants lean towards direct purchasing rather than engaging in leveraged trades. In the realm of digital currencies, recognizing the importance of spot purchases plays a pivotal role in crafting successful trading strategies. Moreover, analyzing the dynamic shifts within the Ethereum ecosystem provides critical insights into prevailing financial behaviors and market sentiment. As traders continue to explore these dimensions, discussions surrounding Ethereum’s progressive accumulation intertwine with broader themes of strategic investing and market resilience.

Understanding Ethereum Accumulation Trends

Recent reports indicate a significant trend in Ethereum accumulation, primarily fueled by spot trading activities. Investors are strategically purchasing ETH, reflecting a cautious yet optimistic approach towards the cryptocurrency market. This shift from leveraged trading to spot trading is notable as it underscores a deliberate effort by investors to accumulate assets without the risk associated with margin trading. The current market conditions, characterized by improved technical indicators, on-chain data recovery, and reduced pessimism, contribute to this growing interest in Ethereum accumulation.

As Ethereum continues to gain traction among both retail and institutional investors, the accumulation trend appears to be strategically aligned with mid-term market forecasts. Investors are focusing on long-term positioning rather than immediate gains, which suggests a conscious decision to build their cryptocurrency portfolios steadily. This approach is further supported by the decreasing short-term downward pressure on prices, highlighting a potential turning point for ETH as it transitions into a more bullish phase.

Spot Trading Ethereum: The New Norm

Spot trading has emerged as the dominant force in the Ethereum market, overshadowing more traditional leveraged trading methods. The recent analysis from Matrixport emphasizes that this shift is not just a passing trend; rather, it reflects a fundamental change in investor psychology. Spot buying allows participants to own Ethereum directly, providing them with tangible assets that can appreciate over time without the complexities associated with leverage. This favorable trading environment has led to a more robust accumulation pattern seen in recent weeks.

Moreover, the focus on spot trading has enabled investors to navigate the Ethereum market more strategically. By engaging in non-leveraged activities, traders can mitigate the risks often associated with high volatility periods. This cautious approach enhances their ability to capture ETH market trends effectively while ensuring they remain poised for potential rebounds. As a result, spot trading is becoming the preferred method for both newcomers and seasoned traders, reflecting an evolution in how the community interacts with Ethereum.

Analyzing Ethereum Technical Performance

The technical performance of Ethereum reveals a noteworthy improvement in the cryptocurrency’s price action. Recent analyses highlight a rebound in ETH’s price, backed by positive technical indicators that suggest an impending bullish trend. As investors utilize tools like Fibonacci retracements and moving averages, the clarity in Ethereum’s technical landscape offers insights into potential entry and exit points for traders. Technical analysis is becoming an essential element for those engaging in spot trading and aiming to build their positions amidst ongoing market fluctuations.

Additionally, the constructive technical performance correlates with a broader recovery in the cryptocurrency market, with Ethereum leading the charge. Traders are observing key levels of support that have emerged, bolstered by the recent accumulation trends. This blend of technical analysis and strategic accumulation places Ethereum in a favorable position as investors become more confident in its long-term prospects. Overall, the combination of positive indicators and a healthy spot trading environment points towards a promising outlook for ETH.

ETH Market Trends: Navigating through Changes

Current trends in the Ethereum market demonstrate a gradual shift towards stability following a period of turbulence. The accumulation phase has been marked by increased spot buying, which serves as a foundation for a more bullish outlook. Data from recent trades indicate that investors are closely watching market signals, taking advantage of lower price levels rather than participating in speculative trading. This shift reinforces the idea that ETH’s market trends are being shaped by long-term strategic planning rather than short-term volatility.

Moreover, ongoing developments in the Ethereum ecosystem, including upgrades and network improvements, are influencing market dynamics. As traders navigate these changes, the focus on retaining positions through spot trading becomes more pronounced. The collective behaviors of investors indicate a growing understanding of how to leverage ETH’s capabilities effectively while minimizing risks associated with market fluctuations. Such insights into ETH market trends are crucial for both existing and new participants in the cryptocurrency landscape.

The Role of Ethereum Options Market

The Ethereum options market has seen a strategic tilt towards selling call options as spot trading continues to dominate. This inclination towards utilitarian strategies allows traders to capitalize on volatility while retaining their ownership of Ethereum as an asset. Selling call options can act as a buffer against short-term downturns, generating premiums while still being exposed to potential price upside. This trend signals a shift in how traders perceive risk and opportunity within the Ethereum ecosystem, highlighting a more intuitive trading environment.

Additionally, the dynamic between call options and spot trading indicates a complex interplay of market strategies among Ethereum participants. By leveraging options, traders can maintain a closer connection to market movements without overcommitting to leverage risks. This balanced approach reflects the broader understanding within the Ethereum community of volatility and the importance of strategic accumulation. As the Ethereum options market evolves, coupled with spot market dynamics, it reinforces the adaptability of traders in this rapidly changing landscape.

Ethereum’s Accumulation Strategy in 2023

The accumulation strategy adopted by Ethereum investors in 2023 has been critical in shaping its market narrative. As evidenced by the sustained interest in spot trading, investors are focusing on building their Ethereum holdings incrementally while awaiting favorable price movements. This approach signifies a shift in mentality, as the market seems to favor long-term growth prospects over short-term gains. The ability to accumulate ETH during favorable market conditions suggests a well-thought-out strategy by participants who understand the potential of the cryptocurrency’s underlying technology.

Furthermore, this accumulation strategy is reinforced by a backdrop of increasingly favorable market indicators and trends. As Ethereum positions itself for future upgrades, such as improvements in scalability and the transition towards a more energy-efficient consensus model, investors are keen to secure their positions ahead of anticipated developments. This collective effort to accumulate Ethereum indicates strong belief among traders in the asset’s potential to outperform in the coming months.

Spot Trading vs. Leveraged Trading in Ethereum

The debate between spot trading and leveraged trading in the Ethereum market has significant implications for investors. Spot trading allows for direct ownership and control of assets, thereby eliminating the additional risks that come with margin positions. With the renewed emphasis on accumulating Ethereum through spot purchases, traders are shifting towards a more calculated approach to their investments, as seen in recent trends. This method of trading fosters greater market stability and lessens the impact of sudden price swings.

On the other hand, leveraged trading, while offering the potential for higher returns, exposes investors to amplified risks. As market sentiment shifts, many traders are reconsidering their positions, particularly in light of the ongoing accumulation phase. The growing preference for spot trading underscores a desire for sustainable investment strategies that prioritize asset growth without incurring debilitating losses. This movement away from leverage highlights a maturation in how Ethereum traders are approaching their investment strategies.

Impacts of Market Sentiment on Ethereum Trading

Market sentiment plays a crucial role in shaping trading behaviors in the Ethereum ecosystem. As investor confidence fluctuates, it directly influences the liquidity and price action of ETH. The recent analysis from Matrixport suggests that current changes in market sentiment are fostering a more bullish environment for Ethereum, fueling ongoing spot accumulation. This positive sentiment can lead to increased buying pressure, reinforcing the notion that how investors feel about the market significantly affects trading decisions.

Moreover, the relationship between market sentiment and trading volume is intertwined. Higher sentiment typically correlates with increased trading activity, as evidenced by the uptick in spot trading in Ethereum. Traders are increasingly reliant on market sentiment indicators to inform their strategies, which can result in additional volatility but also present opportunities for proactive participants. Understanding these dynamics is essential for any trader looking to navigate the complexities of the Ethereum market effectively.

The Future of Ethereum: Insights and Predictions

Looking ahead, the future of Ethereum appears promising as continued accumulation efforts and favorable market conditions converge. Analysts are projecting that if the momentum generated by spot trading remains strong, we may witness a significant price rally in the months to come. Factors such as technological advancements, improved scalability, and growing institutional interest all serve to bolster the case for Ethereum as a leading cryptocurrency. As such, investors should stay informed about these developments, as they will greatly influence trading strategies and market dynamics.

Furthermore, predicting Ethereum’s price movements requires a comprehensive understanding of ongoing developments both on-chain and off-chain. As market fundamentals shift, those involved in Ethereum should remain agile, modifying their strategies as necessary to adapt to new market conditions. The interplay of spot trading, technical analysis, and market sentiment will play a pivotal role in determining Ethereum’s trajectory in the near future. For investors willing to navigate these waters, the potential for substantial returns remains.

Frequently Asked Questions

What are the key factors driving Ethereum accumulation in the current market?

Ethereum accumulation is being primarily driven by spot trading rather than leveraged activities. Recent analysis indicates that a shift towards spot buying, along with improving technical indicators and on-chain metrics, is supporting the accumulation of ETH. This trend suggests that investors are seeking stability and growth opportunities in the Ethereum market.

How does spot trading affect Ethereum accumulation and market trends?

Spot trading plays a crucial role in Ethereum accumulation as it facilitates direct purchases of ETH without leveraging. This creates a stable demand, contributing to stronger support for price rebounds. The current trend indicates that large-scale spot buying is overshadowing leveraged trading, which positively influences ETH market trends and reduces short-term bearish pressures.

What insights can we gain from Ethereum technical analysis regarding accumulation patterns?

Ethereum technical analysis reveals that despite recent price fluctuations, the mid-term outlook for ETH remains promising. Key indicators show recovery trends, suggesting that current accumulation patterns are likely to sustain positive long-term price movements. This analysis highlights the importance of understanding market dynamics and investor sentiment in the accumulation phase.

How does the Ethereum options market relate to the current accumulation trends?

Currently, the Ethereum options market is characterized by a predominance of sold call options, indicating a strategy of strategic accumulation rather than aggressive buying. By selling call options, traders can capitalize on premiums while maintaining exposure to potential price increases. This strategy complements the ongoing spot buying trend, reinforcing the accumulation of Ethereum.

What does the latest analysis say about ETH market trends and accumulation?

Recent analyses by Matrixport highlight that Ethereum market trends are leaning towards accumulation driven by spot trading. With diminished short-term downward pressure and improving technical conditions, the overall sentiment around ETH is shifting towards optimism, suggesting a healthy accumulation environment for long-term investors.